Introduction

The skill of interpreting financial statements is just as important as preparing them. Accounting is a language used to describe the economic activity of a business unit. Many questions have been asked as to whether or not the best way of describing economic performance is to use figures in a statement. When non-accountants seek advice from an accountant on whether or not to invest in a company, the advice is usually given in a prose-style report instead of the seemingly daunting arrays of rows and columns of figures. Interpretation of accounts as an art and science of translating accounting figures in a manner that reveals the financial strength and weakness of a business and the causes which have contributed thereto is a major way in giving meaning to accounting information. (Spicer and Peglers, 1978, p265)

In this report, a critical analysis is made of the financial statements of the British Airways Group for the period February 28, 2008, to March 31, 2009, which was presented to the annual general meeting of the members and the general public on Tuesday 17th July 2009. These users of this financial statement include shareholders, governmental/para-governmental agencies, suppliers, creditors, debtors, employees, financial or investment analysts, and of course the management of the airline.

The information needs of these categories are diverse and this presentation does not purport to cover the entirety of their information need but presents a snapshot of the general economic health of the entity as submitted in the annual financial statements. These include a critical analysis of the profitability trends, gearing, and shareholder investment risk. This analysis also makes use of the available industrial performance indicators and other information sourced from the records of the Alitalia Airline, the Royal Dutch Airline (KLM), and the South African Airline. Another source of information alluded to in this analysis is also appropriately disclosed for ease of reference.

Company Profile

The British Airways group is made up of about twenty-one separate business entities. The area of operation is largely focused on the air transport industry but some of its subsidiaries including Speedbird Insurance Company Speedbird Cash Management Ltd and BA Cash Management Ltd are involved in insurance and financial investments as their names suggest. As the flag carrier airline of the United Kingdom with its headquarters in Watershed, its history dates back to the 1st of September 1974 through the amalgamation of four major airlines namely the North East Airlines, British European Airways, British Overseas Airways Corporation, and the Cambrian Airways which were nationalized by the then Labour Party in government. (Official Corporate website)

As a full-service global airline, it operates colossal fleets of both Airbus and Boeing aircraft offering year-round low fares with an extensive global route network to centrally located airports from its two major bases of Gatwick and Heathrow all in London. British Airways is a listed member of the prestigious London Stock Exchange and the FTSE 100 Index. The airline is currently merging with the Iberia Airline to create the world’s third-largest airline in terms of revenue. (Wikipaedia, 2010)

The company also operates a worldwide air cargo business through the instrumentality of the scheduled passenger services. According to its annual report for the year ended March 31, 2009, its main source of business is by making important routes available for trade and investment while providing leisure travel opportunities for individuals and groups. The company’s current report suggests that it earned a whopping amount of nine billion Pounds Sterling in revenue which was a 2.7 percent improvement on the figure for the 2008/2007 financial year. It further revealed that passenger traffic accounted for 87.1 percent of its business income while the rest was earned from other sources including cargo services. The total number of aircraft at of end of March 2009 stood at 245. (Corporate Report, 2009, p4)

Profitability

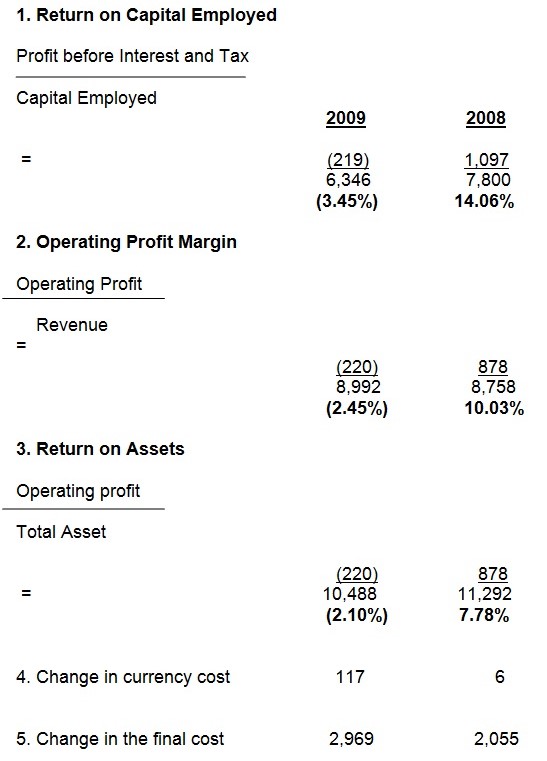

The profitability analysis was carried out using the Return on Capital Employed Ratio, Return on Assets ratio, operating profit margin, and the net profit margin. On the whole, the group’s profitability is not appreciable as compared to the previous year. Management efficiency in generating profits from the entrusted resource is questionable considering the negative value of the Return On Capital Employed ratio which also suggests that the business has a relatively stable level of capital employed (notwithstanding the 18.46% decrease in value from last year), This position is confirmed by the declining asset turnover, operating profit margin, and the net profit margin despite the minimal increase in revenue over the period.

A key factor that is identified to be a cause of the declining profit level is the rapid increase in the operating cost of the group. The current operating cost appreciated by almost 19% with a chunk of this figure emanating from drastic increases in the fuel and tax expenses and the “adverse currency movement’. The chairman acknowledges this fact in his report to the shareholders and further asserts that their analysis suggests that the company lost out on some of their premium traffic destinations. The chairman’s report also claims that the downturn or economic slowdown was anticipated but its pace took the Group by surprise. It will be necessary to verify the budget statement for the same period as this will validate or invalidate this claim.

Investment Risk

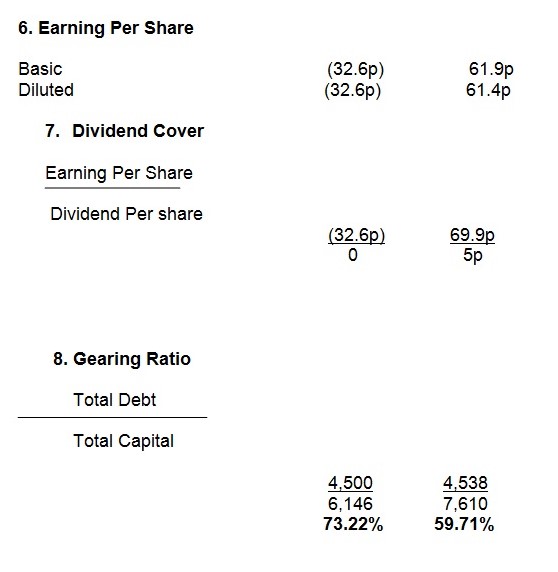

Shareholders who invest in an organization do not only look out for the returns but are interested in the risk associated with their investment. The shareholder is a gambler to a large extent and as such is concerned about the safety of his resources. As far as the period 2009/2008 is concerned, the group’s (British Airways) financial statement does not present the company as a very safe investment destination. The inability of the group to pay dividends to shareholders calls for concern. This is because the last declared dividend was paid as far four months after the declaration. In the 2008/2007 report of the company, similar trends were identified by the companies own analysis (Corporate Report 2008/2007, p4)

Dividends are the direct form of benefits that an investor can enjoy from the shares apart from the usual gains made in share price appreciation. It will be very important to investigate if the group had a measure of appreciation in its share price to compensate for the unavailable dividends. As a reresultf the losses suffered, the earning per share (basic and diluted) has also declined drastically the result of this is also shown by a declined dividend cover explaining why the company cannot maintain the payment of dividends.

The current market price per share is important information that needs to be sought since it did not find space in a comprehensive corporate report such as this. When compared with the earning per share, it will disclose the dividend yield and provide a reflection on the extent of the market view of the group. The group’s level of gearing or leverage is also very crucial as it quantifies the degree of risk involved in holding equity shares in the company. The analysis suggests that debt-equity has grown higher than the previous year by about 40%. This explains the increases in the already high finance cost. It should be noted that the cash position from the cash flow statement does not also give a contrary view. The current cash balance is lower than that of the previous year while cash generated from operating activities is also on the decline.

General Financial Position

The balance sheet is the most important information management tool for assessing the financial position of an entity. An additional look at the working capital analysis will put this presentation in a better perspective. As already shown the rate at which the group can respond to issues of liquidity can not be said to be safe. The declining current and acid test ratio is enough indication that the group will have problems with its ability to meet all of its debts that are due.

The above information supports the argument that the financial performance of the British Airways group is on a decline.

It is worth noting that management in its attached report does not pretend to be unaware of the challenges confronting it. This analysis while putting the British Airways group into perspective has also made use of data from three very important airlines namely KLM, Alitalia, and South Africa Airline a critical look at the trend in their annual report ending 2009 suggest that there was a general astronomic increase in fuel prices and a reduction in the air traveling during the period. According to the Chief Executive Officer of the South African Airline, this drastic downturn can only be compared to the challenges the airline industry faced between 2002 and 2003 following the September 11, bombing of the world trade center. (South African Airline, 2010, p2), (Alitalia Airline 2009, p12), (KLM, 2009, p7)

Conclusion

In effect, although the financial report does not show any sign of a good job then, it has to be looked at within the limiting factors in which the airline operated. The global effects of the economic crunch which saw the collapse of many airlines and other industries, the resurgence of terrorism that is affecting interest in air transport, and the record hikes in fuel prices is worth acknowledging. Based on that, I am tempted to share the sentiments of the Chief Executive Officer of the group when he ended his report in these words “The airline industry is enduring the toughest time in its history and we expect more pain before things improve. We are taking the right short term action to survive the downturn”. (Corporate Report, 2009, p3) I think this statement needs our careful consideration.

References

Alitalia Airline (2009) Corporate Report Alitalia Airline Milan, Italy

British Airways (2009) Corporate. Web.

British Airways (2010) Profile of British Airways, Official UK Website.

KLM, (2009) Excerpts of Corporate Report, Onboard Bulletin.

South African Airways (2009), Excerpts of Corporate Report, On-board Bulletin SAA.

Spicer and Peglers, (1978) Advance Accounting, University Press, Ottawa, Canada

Wikipaedia (2010) Profile of British Airways.

Appendix