Introduction

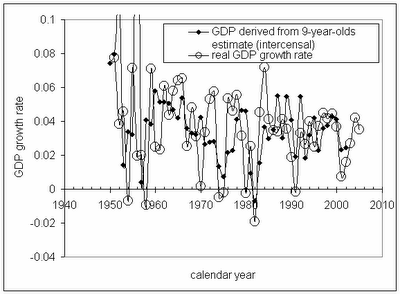

The Gross Domestic Product of a nation is the total value of the goods manufactured and services provided in the nation. As shown in Figure 1, the Real Gross Domestic Product differs from the Nominal Gross Domestic Product, in that the former quantifies the total value in relation to the prices of a particular base year while the latter quantifies the total value based on the current market prices. Real GDP is also quite useful when it comes to predicting changes in the housing industry in the immediate future.

The first source was forecasting the growth in the Real Gross Domestic Product of the U.S. as increasing from 0.6 % to 1 % (Haughey, 2007). The second forecast came from the building team forecasts, they tried to point out the increase in the GDP rate would be in the range of 2% to 2.9%, (Richter, 2008).The former is closer to the actual values because they are taking into consideration the negative aspects that the national housing problem might be causing in the near future. The other forecast was not as pragmatic in their assessment as the final outcome of the sub-prime credit crisis that the rest of the nation has been experiencing.

The Federal Reserve control’s monetary policies have an immediate effect on the housing industry. This is mostly because people take mortgages to purchase houses and the rate of interest at which the borrow money is adjusted by FED. For instance, FED controls the discount rate i.e. the rate at which banks borrow from the Fed and the Fed Funds rate i.e. the rate at which banks borrow from each other. These effect the GDP because the addition cost to the bank trickles down and increases the cost of the commercial bank’s borrowings. Subsequently, a trickle down effect occurs on mortgage rates because banks have raise mortgage rates to contain their costs. This directly dampens housing demands due to higher mortgage rates.

Mortgage Rate

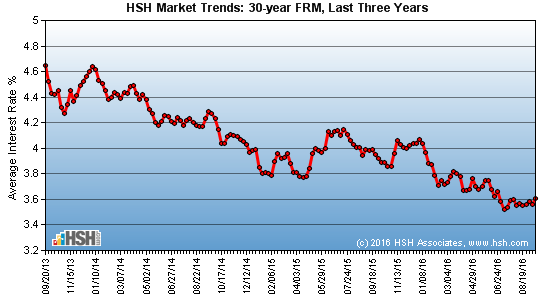

Mortgage is a loan given to an individual or a corporation on the basis of the value of a house, building or any other construction. Mortgage rate is the rate of interest charged on the loan. This could either be a fixed rate, an adjustable rate or a sub-prime mortgage rate depending on the particular housing property and the credit history of the individual in contention. The monthly payment on mortgages “is calculated using the interest rate, the amount of the loan, and the term (length of the loan). While mortgage rates in general can have a say in the economic health of the housing industry, sub-prime mortgages in particular can add an element of volatility to the housing industry, as is evident from the recent sub-prime crisis to hit the American housing markets. According to HSH Associates, 2007, Figure 2 shows a three-year look at how fixed rate mortgages (FRMs) have behaved in the market. In the last seven or eight years, the housing industry in the United States saw a substantial growth as a result of very low interest rates, though this frenetic house building led to the housing bubble (Krugman, 2008).

According to the forecast centre, the rate for the mortgage is basically going to be the same kind as the ones experienced in the year 2007. The forecast made by market vector on the other hand, showed a very dramatic decline in the kind of mortgage rate that the U.S. will be experiencing since the figures shown are way below the 6 % level and there seems to be no end in the kind of decline of the mortgage rates, (Market Vector, 2008). The forecast of the market vector is going to be accurate since the nation has just suffered one of the worst ever kind of real estate market meltdown. Since everybody is incapable of paying off his/her mortgage loans, they all tend to lower down their asking prices in case they need to sell their homes. The big lack of demand for the real estate also makes it very much unattractive for the sellers to demand for higher prices. In order to reverse this and to try to attract more people to buy and acquire real estate again, the resulting mortgage rates are lowered.

Housing Starts

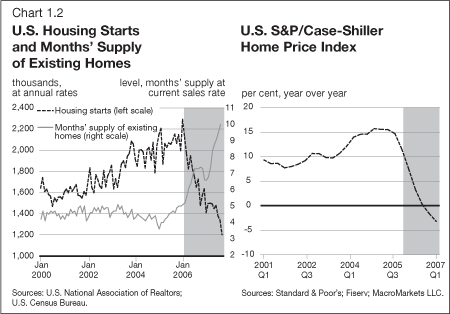

Housing starts are defined as the number of residential units on which construction has started every month. Housing starts are a key economic indicator that determines the health and future direction of the Housing industry. The following chart (Figure 3) published by the U.S. Bureau of the Census(2006) gives a historical perspective of housing starts.

The trend for the housing starts is expected to decline greatly as they are going to be influenced by two major factors. The first factor why there should be a decline in the housing starts is because of the stricter policies of banks when it comes to getting a mortgage loan from them (Housing Starts, 2008). This translates into the lower turn out of people who will be qualified for the banks loan program. The second factor is the recent real estate market bubble wherein there were dozens of other unskilled investors who tried to capitalize on the hot market opportunity at that time. This naturally resulted to the increase in homes that are left by their original purchaser since the ones who originally purchased the real estate is incapable of paying their monthly dues and obligations. As a result of this situation, a huge number of real estate properties that were left for foreclosure and without any owners. In the case of the bank confiscated properties, the investor can be confident that the bank would be willing to give it up for a very low price since they are holding huge numbers of these non-performing assets. In fact, the numbers are so huge that they are the reason why they are threatening the health of the banks themselves. With this kind of backdrop, the investor is faced with a very low prospect of getting the prices and the activities of the real estate market running the way it was years ago.

Keynesian or Classical Economic Theories

The current housing bubble burst has a perfect Keynesian explanation. According to Keynesian theory residential investment is low when mortgage interest rates are high, and it declines in all recession (Dornbusch, Fischer, Startz, 2004). Monetary policy has a strong effect on housing investment. Part of the reason is because houses are purchased with mortgages.

In 1994 due to changes in the monetary policy of Fed commercial lending increased. This was the formative stage of the bubble. Then, from 2001 to 2002 the Federal Reserve Funds Rate was reduced from 6 percent to 1.24 percent, leading to similar cuts adjustable-rate mortgage (ARM) rates. These drastically lowered ARM rates meant that in the United States the monthly cost of a mortgage on a $500,000 home fell to roughly the monthly cost of a mortgage on a $250,000 home purchased two years earlier. Demand surpassed supply. With more credit available than there was housing stock, prices predictably, and rapidly, rose.

During 2005 there was a lower wage situation for consumers which consequently reduced their disposable income. Moreover due to the earlier increased demand, the housing industry came up with increased supply of housing property. This created a surplus supply of houses which actually burst the bubble.

References

Dornbusch, R. , Fischer, S. , Startz, R. (2004), Macroeconomics, New York: McGraw Hill Housing Starts Trends (2008). NBN News Archives. Web.

Market Vector. (2008). Marketvector.com. Web.

Krugman, P. (2008). Editorial, New York Times. Web.

Richter, J. (2008). U.S. initial jobless claims fall from two-year high. Bloomberg.com. Web.

Haughey, J. (2007). U.S. real GDP growth to slow in 2007, but pick up again in 2008 and 2009, building team forecast. Web.