Abstract

Banks and other financial institutions forming part of the financial system contribute greatly to the development of any economy. Business and industrial enterprises look for increased financial support from these institutions, since they can develop and introduce innovative financial products and services. Because of the nature of products and services handled by the financial institutions, they are exposed to different types of financial risks. There has been increased exposure of financial institutions to various risks before and during the recent financial crisis.

In this context, this research extends to the examination of risk management under conditions of the financial crisis. The study covers the classification of risks and the salient aspects of risk management. Different risk assessment models and their deficiencies are also focused. The research engages qualitative case studies of the risk management failures in Lehman Brothers and 2007/2008 subprime financing to report on the implications of risk management on the financial institutions. Suggestions on concrete measures for improving risk management in financial institutions are not included in the scope of this study.

Introduction

The word risk originates from the Italian word risicare meaning ‘to dare’. Webster’s Dictionary (1989) defines the word risk to mean

- expose to the chance of injury or loss

- a hazard or dangerous chance

- the hazard or chance of loss

- the degree of probability of such loss

The understanding of risk, measuring it and analyzing its consequences has made risk-taking as one of the drivers of the modern Western industrial development. Economic growth, improved quality of life and technological advancements – all have been the positive outcomes of risk-taking. In the traditional setting, codes, predetermined standards, and fixed hardware requirements guided the carrying out of hazardous activities. In the modern world, there is a complete change in the focus were with the functional orientation what is interesting is the result to achieve, rather than the solutions or guidelines to achieve the desired end. In such a functional system, the ability to address risk becomes the key element. Therefore identifying and categorizing risks is of critical importance for providing decision support for making suitable choices of arrangements and measures to achieve what is planned.

Risk Management – An Overview

While risk is the potential loss that occurs because of natural or human activities, the potential losses are “the adverse consequences of such activities in the form of loss of human life, adverse health effects, loss of property, and damage to the natural environment” (Modarres, 2006). Risk analysis, therefore, is a process, which characterizes, manages and informs others about the existence, nature, magnitude, and prevalence of potential losses in any situation. The process also describes and cautions on the contributing factors and uncertainties connected with such potential losses.

In engineering systems comprising of hardware, software, and human organizations potential losses due to the associated risks may arise externally to the system or losses caused by the system to the humans, organization, assets and/or environment. The loss may also occur internally resulting in damages to the system only. From an engineering perspective, the risk or potential loss results in exposure of recipients to hazards and such hazards normally extend to “injury or loss of life, reconstruction cost, loss of economic activity and environmental losses”. In engineering systems, risk analysis is undertaken to measure the extent of the potential loss as well as to identify the elements of the system, which are most responsible for causing such losses.

The risk management system thus signifies the ability to define the probable future course of events, making closer to a realistic assessment of the associated risks and uncertainties and to enable decision-making among the available alternatives. Risk management extends the decision-making ability to several varied social, economic, business and political issues. Based on an evaluation of several quantitative and qualitative factors interconnected with the issues under consideration, the best alternative giving the highest probability needs to be selected in any decision-making process. In business situations, choosing a specific alternative depends on the consideration of associated costs and other key performance measures as well as a careful assessment of risk and uncertainties to ensure positive outcomes. However, it cannot be ruled out that there might also result in some negative outcomes; but positive outcomes should be visualized as the overall outcomes. This is the essence of risk assessment and the process of risk management.

Risk analysis has its intellectual roots traced back to a hundred years, yet this discipline is developed into an organized body of knowledge only within the past two decades. Risk analysis is undertaken to serve several purposes such as determination of environmental and health hazards associated with several activities or substances or for comparing new and existing technologies or for determining the effectiveness of different control and mitigation techniques designed to reduce risks (Cohrssen & Covello, 1999). Risk analysis is also undertaken to set the priorities of the management in choosing one among several activities for regulatory or corrective action.

Risk assessment, on the other hand, is the technical assessment of the nature and magnitude of risk. Both the terms risk analysis and risk assessment are mostly used synonymously. Risk management uses information and data gathered from risk assessment and analysis and assimilate such information with information on technical resources, social, economic and political values for choosing the control or response options. Risk management is resorted to determine means of reducing the risk or getting rid of the risk. The difference between risk management and risk assessment is subject to wider debates and is not within the purview of this report. However, risk perceptions have a large influence on both risk management and risk assessment.

People have different perceptions about risks and such perceptions are affected by different elements such as the persons or things likely to be affected, nature, familiarity and magnitude of perceived effects. The perceptions often also based on the likely benefits to accrue from acceptance of the risks. Because risk is ubiquitous, risk analysis techniques are used to analyze several phenomena having different magnitudes. Risk analysis makes use of a wide variety of techniques, which are used in situations where the solutions are not explicitly available and where the information on the potential losses is ambiguous and uncertain. Risk analysis uses various disciplines like science, engineering, and statistics for analyzing the risk-related information and for making estimation and evaluation of the probability and magnitude of the associated risks.

Problem Definition

In any economy, business houses and industrial enterprises depend on the financial institutions for their financial support, as these institutions develop and provide innovative financial products and services. Given the nature of products being dealt with by the banks and financial institutions as also the nature of transactions the institutions are exposed to different kinds of risks. Some activities carry risks of complex nature like the case of illiquid and proprietary assets being held by the banks (Santomero & Trester, 1997).

Financial institutions need to adopt systems for identification; assessment and management of risks to their operations and these risks may arise because of the influence of external and internal factors. These risk mitigation initiatives are considered important to enhance the ability of the financial institutions to respond to movements in the financial markets, which are quick and unexpected. The efficiency of risk management of a financial institution depends partly on the effectiveness of corporate governance practices of the institution, which focus on risk mitigation across the institution. There are different types of risks faced by financial institutions, which influence their risk management practices.

The risk management in the financial institutions centers around two basic issues as to the impact of risk on the functioning of the financial institutions and how the institutions can work to mitigate the potential risks involved which form an integral part of the products of the financial institutions (Stulz, 1984). The available literature points out four distinct reasons for practicing risk management in any financial institution. They are (a) self-interest of the managerial people involved in the business processes of the financial institutions, (b) impact of taxation, (c) the cost of financial distress and the resultant economic losses and (d) capital market imperfections (Santomero, 1995). In each of the above instances, the profits are volatile, which may result in a reduction of the firm’s value to some of the stakeholders. Anyone of the above reasons would have the effect of motivating the management to make a careful assessment of the risks associated with the different products and techniques for risk mitigation.

Risk management in the financial service industry has assumed greater importance in the wake of a balanced economic development of the nation. An intrusive risk management system is considered very much essential given the concern about the safety and soundness of the financial service industry. However, the advancement in the information and communication technology, the enlargement in the financial services industry, the ambiguity in the distinction of banking and non-banking financial institutions and the creation and offering of numerous financial service products have put the banking system in a state of perpetual change and instability. Thus, the transformation of the industry into a highly competitive and dynamic environment has made the system incompatible with traditional risk management systems. The key question remains that whether at all it is possible to adopt appropriate risk management systems meeting the needs of the increasingly competitive environment of the banking systems.

In the years leading up to the recent financial crisis, some of the authorities have recognized that and intimated several investment banks, that they have not implemented efficient risk mitigation initiatives. Despite the advice from the regulators, these institutions have not taken any steps to remove these weaknesses in their risk management systems such as making changes in the system of risk assessments, until the crisis occurred. This is because these institutions reported a strong financial position. Based on such reporting, the senior management had presented the plans for change in their risk management plans. In some instances, the authorities themselves were not convinced about the existence of deficiencies in the risk management until such time the institutions were affected financially by a lack of proper risk mitigating plans because of the recent financial crisis. Authorities have accepted their heavy reliance on the risk reports of the top management of investment banks. This makes the necessity of the senior management of the financial institutions especially the commercial banks understanding the risk assessment and management under the financial crisis an important and significant task. This thesis studies the issue of risk management under conditions of financial crisis and challenges faced by the financial institutions to mitigate risks, which will add to the existing knowledge on risk management of financial institutions.

Research Objective

Examining risk management under conditions of the financial crisis and the challenges faced by financial institutions is the central aim of this study. In achieving this central aim, the stud attempts to achieve the following other objectives.

- To study and make an in-depth report on the concept of risk, the rationale for risk management risks faced by the financial institutions and methods of measuring risk

- To make an in-depth study of the deficiencies in risk management by financial institutions during the recent financial crisis

- To report on the effects of the deficiencies in managing risk effectively

The study will achieve other objectives incidental to the above objectives.

Research Questions

Based on the theoretical observations from case studies, the research will find answers to the following research questions.

- What are the salient aspects of risk management by financial institutions under conditions of the financial crisis?

- What are the deficiencies in the risk assessment and risk management techniques followed by the financial institutions during the recent financial crisis?

- What are the effects of the deficiencies in managing risks effectively by the financial institutions?

Research Methodology

This research has been undertaken to examine the salient aspects of risk management under conditions of the financial crisis and the challenge of financial institutions functioning in the United States in this respect.

Denzin and Lincoln (1998) state the researcher is independent to engage any research approach, so long as the method engaged enables him to complete the research and achieve its objectives. To achieve its objectives, this research proposes to use the deductive or qualitative approach. The qualitative research method is also referred to as ‘naturalistic’ research (Bogdan and Biklen (1982); Lincoln and Guba (1985); Patton (1990); Eisner (1991). According to Marshall and Rossman (1995), qualitative research is based on the collection of data from different sources and the data already collected forms the basis for reporting the findings of the study and making recommendations. Yin (1984) identified different sources like “archival records, direct observations, interviews, and observation of the participants,” for data collection to conduct qualitative research.

The research design of the case study was adopted for the study. Case study design can be considered as the appropriate one, as this method allows an examination in depth (Burns, 2000 p. 461). According to Burns (2000), using a case study method, the researcher will be able to undertake an intensive analysis of the research topic to get deep insights on the subject studied (p. 461). Punch (1998) observes that the case study allows for a variety of research questions and purposes, which enables the researcher to gather a full understanding of the case to the extent possible, (p.150). However, the case study may be considered as more subjective. Burns (2000) points out that the case study may turn the researcher to be selective in interpreting the results. This makes the observations and interpretations devoid of easy checking or verification. The case study allows an opportunity for the researcher to advance personal causes (Burns, 2000, p 474). The research will use secondary data for researching literature review and case studies.

Collection of Secondary Data

According to Al-Mashari, Zahir & Zairi (2001), because of “a lack of methodological research constructs” it becomes important that an in-depth review of the relevant literature is undertaken. Therefore, an extensive literature review will be attempted using professional journals and other research publications containing articles on risk management by financial institutions and factors affecting risk mitigation. The research will review the theoretical contributions of several research scholars and practitioners to form the theoretical base for the research.

Data Analysis Method

Since the information gathered is qualitative, there will be no statistical methods used to analyze the data collected. An in-depth analysis of the factors and their comparison with the oretical findings will be undertaken to achieve the research objectives.

One of the serious limitations of this research is the smaller number of samples that will be selected for the case study. Generalization of the deficiencies in managing risk effectively during the financial crisis, based on the findings of this research, using the case study of Lehman Brothers and 2007/2008 subprime mortgage, may not be possible and to this extent, this study suffers a serious limitation. Another limitation of the study was the availability of an abundance of literature on the topic of risk management by financial institutions. Considerable time has to be spent on reviewing the available literature and extracting the relevant ideas for inclusion in the thesis. This has impeded the progress of the research to some extent.

The case study will cover the failure of effective risk management in Lehman Brothers and 2007/2008 subprime mortgage, to assess and report on risk management during times of financial crisis. Secondary research was used to collect information on risk management under the circumstances of the financial crisis. The scope of the current research is limited to assess the deficiencies in risk management by financial institutions in the context of the United States and has not been extended to suggesting ways of improving risk management by financial institutions during the financial crisis.

Thesis Structure

To make a comprehensive presentation, this thesis is structured to have five chapters. This Chapter, while presenting a background of the research issue, also laid the objectives of the study as well as the research method, aims, and structure of the thesis. Chapter Two presents a review of the recent literature on risk management to add to the existing knowledge on the effect of deficiencies of managing risk effectively by the financial institutions during the financial crisis. Chapter Three provides a brief description of the research method followed for the research. Chapter Four contains case studies on risk management practices of Lehman Brothers and 2007/2008 Subprime mortgage and a discussion on the findings of the case studies. Chapter Five is the concluding chapter, which contains a summary of the most important findings of the research and answers to the research questions. This chapter also contains a few recommendations for further research in the field.

Literature Review

The objective of this chapter is to present an analytical discussion of the relevant prior research work in the area of risk management by financial institutions to add to the current knowledge on the research topic. The added knowledge will enable an in-depth understanding of the implications of the findings of the current research.

Financial Service Industry

Risk management in the financial service industry has assumed greater importance in the wake of a balanced economic development of the nation. Efficient risk management is considered very much essential because of the concern about the safety and soundness of the financial service industry. However, the advancement in the information and communication technology, the enlargement in the financial services industry, the ambiguity in the distinction of banking and non-banking financial institutions and the creation and offering of numerous financial service products have put the financial system in a state of perpetual change and instability.

Thus, the transformation of the industry into a highly competitive and dynamic environment has made the system incompatible with the traditional risk management models and their application to the industry. The key question remains that whether at all it is possible to adopt a risk management model mitigating all types of risks associated with the operations of financial institutions in the increasingly competitive environment of the financial system. This review examines different aspects of risks faced by banking and other financial institutions.

In the present day business environment to enhance the competitive strength, the firms constantly look for information and knowledge relating to the shift in the market conditions and also enabled services for putting forth the financial and other transactions. In this sphere, the services by the financial services organizations are extremely important and necessary for the business houses to accomplish their financial objectives. However, the products and services being dealt with by the financial service organizations are so vulnerable that these firms are exposed to different kinds of risks while operating in the market. Hence, the firms in the financial services industry attach more importance to risk management in their organizations. Risk management in the financial services organizations is necessitated due to various reasons.

The most important reason is the potential economic losses to which the firms will be exposed in case they had to meet with some unforeseen risk and it may erode the entire capital of the firm. There are other reasons for undertaking risk management in these firms like the tax implications of the transactions, movement in the capital and stock markets and the persistent fear of the people managing the financial services businesses that their decisions may be proved wrong by the course of business events. In any risk, being faced by the financial service firm there is the potential danger of the firm losing profits, which in turn would result in the decline of the firm value for some of the stakeholders. Similarly, all or any of these reasons for managing the risk may force the management of the firm to make an assessment of the risks involved and take necessary corrective or preventive action to protect the firm against the risks identified. In this article, the different kinds of risks to which the financial institutions are exposed and how the firms can protect them against these risks are discussed.

Methods to Protect Against Risks

The financial institutions adopt several ways of protecting them against the risks associated with their businesses. In general, the organizations can find out the best business practices in the industry concerning risk management and adopt them in their organizations. Alternatively, the organizations can find convenient ways of transferring the risks to other players in the market or the organizations can employ specialized risk management programs at their organizational level to protect them against any financial loss resulting from the risks.

The best practices in the industry are the normally adopted risk management procedure by most of the organizations in which the organizations take actions like underwriting and reinsurance of risk so that the risks will be spread among the operators which have the effect of reducing the risks of apparent risks associated with the business. Also, the financial institutions may undertake hedging of their balance sheet items to protect any possible financial risks due to change in interest rates or exchange rates if the assets and liabilities are held in foreign companies. The basic objective behind these measures can be seen from the fact that the organizations do not want to carry the risks, which are part of the businesses undertaken by them and to maintain the level of total risks under controllable levels.

There are systemic risks that can be eliminated by a proper assessment of the risks and taking risk protection programs to safeguard the financial interests of the organizations. Similarly, in the case of risks that the organizations may face due to the frauds committed by the staff and employees, losses arising out of oversights and mistakes of the employees due to limited control by senior-level management – known as operational risks – the organizations can find suitable ways to minimize these risks. In any case, it must be noted that the organizations would suffer from possible erosion of profits due to excessive protective measures being taken by them to control the risks. However, it may be possible for the organizations to make a cost justification for the extended risk management measures and communicate them to the stakeholders to make them agree for the reduced earnings.

A significant part of the risks of the financial institutions is getting transferred to other willing counterparts by a method called ‘Risk transfer’ where the assets created by the financial institutions are transferred to other business counterparts on a fair market value mutually agreed by both the parties.

Such transfers are commonly accepted by the organizations if they find that keeping the assets may not bring any additional financial advantage to them rather than increasing the associated risks. There are specialized markets and players to deal with such claims issued or other financial assets created by the organizations. Individuals and organizations acquire such kind of assets as a part of diversification programs of their portfolios.

Yet another bundle of risks connected with the business of the financial institutions, which have the characteristic feature of being inherently associated with the transactions and which need constant monitoring and control by the institutions. There is no other alternative available to the organizations to shirk away from the responsibility for these risks except to take and provide for the losses arising out of these risks. However, the organizations can employ aggressive techniques of risk management, which may entail additional resources for engaging such risk management techniques. These risks in a way are out of the ordinary and carry certain special features, which make them distinct requiring special attention from the organizations to control the damage on their account.

- As found in the case of some defined pension and other retirement benefits schemes, there are some equity claims in respect of which the financial institutions are accountable for a fiduciary liability where it is not possible to trade in or hedge against the specific claims even if the investors would like to do so. In these cases, the organization should take adequate precautions and protective measures to minimize their risk exposure on these accounts.

- The other areas where such kinds of risks operate are the illiquid and proprietary assets being owned by financial institutions like banks. Such risks are very complex demanding aggressive risk management techniques to be employed by the organizations.

- There are transactions where there are elements of moral hazard forcing the financial institutions to undertake strong measures of risk management to protect the interests of the stakeholders. The application of such risk management techniques forms part of the operating procedures of the organizations and all the risk management programs are considered an integral part of the business of the financial institutions.

What Are Financial Services?

The basic functions of banks, stockbrokers, insurance companies and other financial service providers comprise of services relating to:

- Collecting the savings of the people to provide them compensation in the form of interest for foregoing the current utility of those savings and

- Providing fiancé to those people, firms and even governments who have the intention of investing the finance so provided which will enable them to pay back the institutions the financing and other service charges in the future.

Another service provided by the financial institutions is the use of money or other financial instruments to realize the payments due on purchases of goods and services on behalf of the customers. To perform this function efficiently the banks and the financial institutions have developed instruments like checks, wire transfers, credit and debit cards including smart cards and a host of other instruments which are known as the payment mechanism of the economy.

Yet another addition to the financial services includes the provision of guidance to the potential savers on how effectively use their savings to reap a good return on their investment which service is recognized as asset management and treasury management. (The Environment)

The financial services have taken the provision of a fifth service, which is the risk management to both the investors and savers. Risk management in its traditional form covered only the insurance of buildings, workers’ lives, and property. However, the present-day concept of insurance has extended its horizon to cover a wide range of activities including financial derivatives to manage “price, interest rate, exchange rate, and even credit risks apart from covering the property, accidents, and self. Thus, financial services encompass the following mechanisms:

- Mechanisms or instruments that enable the potential savers to park their savings safely and profitably

- Mechanisms which provide the needy investors or borrowers the required funds to fund their projects

- Mechanisms that govern the payments on behalf of the customers and

- Provision of advice to the savers as to the manner of dealing with their financial needs, as well as managing the assets of the investors and savers and

- Mechanisms to protect and manage the life, property, and finances of the constituents

The Environment

The US financial system consists of an array of financial institutions that provide any of the abovementioned financial services. Despite being the most developed and extensive in the world, financial service institutions face several risks in providing the above services. This review will cover risk management from the perspective of financial institutions providing all the above services and products.

Concept of Risk

This section elaborates on the concept of risk as it is applied in the context of financial institutions. The word ‘concept’ is considered appropriate because the risk is not a directly observable and objective phenomenon of the natural world. The greatest challenge of risk management is that risk is to be construed by the people directly affected by the phenomenon.

Although the studies relating to risk are, varied and wide still there has not been evolved a comprehensive definition that covers all the aspects of risk. Quite often risk is perceived as incidents or happenings which have unwanted or unfavorable consequences. But such a definition results in accepting misleading concepts of risk being viewed as having negative and positive consequences alike and secondly risk not only covers single events but also relates itself to the future project directions. There are chances that the project conditions may change in a favorable or unfavorable direction. The point here is that it is difficult to predict the course of the future project direction at the beginning of the project life cycle. Moreover, there are plenty of chances that the prevailing conditions change during the period at which the project progresses. The risk here is that the conditions are diverse and might be potentially severe far more than the estimations.

It so happens in the investment management process the risks that are already identified as certain and definite are only analyzed to prevent the impact of such risks hampering the returns from such investments. Risks follow the path of either that they will happen or they may not happen and the impact of the risk is largely influenced by the conditions prevalent at the time of the happening of the risk. (Ward and Chapman, 2003; Artto, and Kähkönen, 2000) The quality of the analysis of risk depends on the variability and the degree of uncertainty connected with future scenarios. (Turner, 1999) This is the reason that there has been a recommendation by many researchers that the term ‘risk’ needs to be replaced by the term ‘uncertainty’ which has more neutral quality as compared to ‘risk’. The term ‘uncertainty’ also has a larger scope than that is covered by ‘risk’. The term ‘uncertainty’ has more capabilities to replace the term risk as the variability and ambiguity connected with risk can be accommodated in uncertainty (Ward and Chapman, 2003).

Artto and Kähkönen (2000) point out the risk has a dimensional perception which implies that risk could be adverse and significant for the same may turn out to be an opportunity or less significant for someone else (Artto, and Kähkönen 2000). Risk perception is regarded as one of the major development in the area of risk management practices. Kahkonen identifies that it is possible to localize the definition of risk in a way that it could define the risk more precisely in individual cases. (Kähkönen, K. in Artto, K., Kähkönen (2000)

It is possible that the risks can be categorized in several ways based on the degree of details involved or based on a particular viewpoint selected for the purpose. The risk categorizations may take the form of a risk list or it may as well present the sources of risks, which depend on the phase or the type of the project. A typical risk categorization may take the following form as advocated by Artto and Kähkönen (2000):

- Pure Risks are the ones, which are caused by factors like natural calamities or weather conditions;

- Financial Risks take the form of either difficult cash flow situations or credit risks and the like;

- Business Risks encompass any kind of risks that may affect the progress of the project,

- Political Risks are identified as the one which covers extreme political situations like war which has a serious impact on the project process.

Turner (1999) suggested the categorization of risks as business risks, insurable risks, external risks, and internal risks depending on the impact of the risks of the location of the control over the risks. Bad weather may be cited as an example of the external risk on which the project manager does not have any control. Similarly, the business risks are those risks, which generally have to be faced by any venture to take advantage of a likely opportunity, which can be a positive outcome of business risk.

Approaches to Risk Mitigation

There are there general methods of mitigating the risks in financial institutions:

- The firms can employ simple business practices which have the capabilities of eliminating or avoiding risks

- The firms can try to transfer the risks to other market participants and

- There can be an active risk management programs at the firm level

In the first of the above three methods, the practice of risk avoidance reduces the chances of the firms accumulating losses by the elimination of risks which are superfluous to the business processes. The financial institutions follow actions like underwriting standards, hedging to match the assets and liabilities, reinsurance or syndication to spread the risks and due diligence investigation. In these actions, the main objective is to make the firm get rid of the risks that are not part of the financial services provided or to absorb only an optimum level of a particular risk.

In the case of systematic risks, it is possible to reduce the risks that are not required to continue to do the business by avoiding them altogether. Similarly, in the case of operational risks, the firms can adopt different ways to reduce the different kinds of risks including fraud, oversight failure, lack of control and managerial limitations. However, it must be noted that aggressive risk avoidance measures in these areas may result in lowering the profitability to some extent but enough cost justification can be communicated to the shareholders for the reduction in the earning.

Risk transfer is another method of mitigating a substantial part of the risks. Risk transfer is achieved by the firms by transferring the assets created by the financial institutions at fair market value at the open market. The firms undertake the transfer of these assets if they find no incremental benefit in providing for the mitigation of risks associated with the keeping of such assets. Usually, there exists a market for the claims issued and are assets created by many of the financial institutions and there are individual market participants who undertake to acquire these assets for diversification of portfolios.

There is another set of risks, which are inbuilt in the operations of the financial institutions and the firms themselves must absorb these risks. In these cases, the firms should practice aggressive risk management techniques and the firms are expected to employ additional resources for managing these risks. These risks possess certain special characteristics:

- There are the stakeholders for whom the institutions own financial responsibility. The claims of these people cannot be treated otherwise even by the people who have invested in financial institutions. Example in this connection is the defined pension plans schemes.

- Some activities carry risks of complex nature like the case of illiquid and proprietary assets being held by the banks (Santomero and Trester, 1997).

- The existence of moral hazard in which the stakeholders’ interests need to be protected by adopting different risk management techniques as part of the operating procedures.

- Any risk management process is central to business purposes.

Risks Associated with Financial Services Products

Before an analysis of the risks associated with the financial services products and the ways of mitigating them, it becomes important that an overview of the financial services being provided by the financial institutions is undertaken. The financial services provided by the institutions can be categorized under the following groups (Merton 1995; Merton and Bodie, 1995):

- Origination – involving location, evaluation, and creation of new financial claims issued by the institutions’ clients. The originator depending on his plans to retain the ownership of the new asset or sell the product he takes the position of the principal while retaining the ownership and an agent while trying to sell the asset. An example of the originating function is that of the mortgage banker.

- Distribution – represents the act of selling newly originated products to different customers who can finance them. The institution may act as a broker or as a principal. In this case, the financial institutions do not take ownership of these assets but act to place the assets in the portfolio of the potential investors.

- Servicing – facilitates the collecting the payments due from the issuers and settling the claimants. The service provider in this process maintains records of payments, monitors the financial contracts, and takes necessary action in case of defaults. This kind of activity is more prominent in developed nations. In this case, the same institution holds most of the assets.

- Packaging – is of recent origin and involves the collection of individual financial assets into common pools, and then is repackaged to increase the liquidity or meet the cash flow requirements of specific customers.

- Intermediating – is the most popular financial service undertaken by the institutions, which involves the practice of issuing and purchasing of different financial claims to a single financial entity. There are three different kinds of financial intermediating that are common; they are (i) insurance underwriting (ii) loan underwriting and (iii) security underwriting which involves the acquiring of securities as principal to distribute to different investors.

- Market Making – is an activity where a dealer buys and sells identical financial instruments. However, the market maker does not become the principal in the transactions. A market maker becomes an intermediary when it finances the transactions by issuing its claims and acquires financial assets.

In all the above transactions, a distinction must be made between the “principal and agency activities”. This is because the accompanying “risks and incentives” vary from each other for the two positions. While a principal commits a capital risk in terms of both time and money, the agent works for someone and hence there is the risk of time only. In the agency business, the capital investment is modest whereas in the case of the principal activity there is a heavy investment of capital outlay. Since the principal owns a portfolio there is the systematic and idiosyncratic risk. In the case of an agency, there is only the idiosyncratic risk.

Risk Management by Financial Institutions

Any financial institution is subject to risks. Managing risks is a complex proposition for any financial institution. Risk management has become an increasingly important phenomenon, in the current global economic scenario where there is a close link among the financial systems of different economies. Effective risk management has been prescribed by the global financial institutions and banking regulators, as an important element in the long-term success of the financial institutions. The management of financial institutions and regulators focus on improving the ability of the organizations to manage future risks instead of evaluating the current or historical financial performance. Risk management in the case of financial institutions takes the following form.

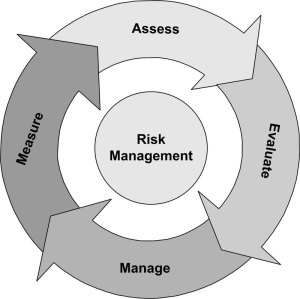

From the above figure, it may be observed that the risk management framework in the financial institutions includes assessing, evaluating, managing and measuring risks to which the institutions are exposed. Risk management must be a continuous process providing the feedback to the management on the potential losses that are likely to occur because of the exposure to different types of risks.

The management and regulators consider the management of future risks as the best predictor of long-term success. The financial institutions, receive several benefits out of efficient risk management.

- The foremost advantage of risk management is that it serves as an early warning for potential problems of financial institutions. With a systematic process of evaluation and measurement of risks, the financial institutions will be able to identify the problems at an earlier stage, before these problems become larger and affect the efficiency in the performance of the financial institutions. An early warning signal prevents the drain of the management time and resources of the financial institutions. When the financial institutions can identify the problems earlier they have to spend only lesser time fixing problems and they can spend more time productively on their growth.

- With an efficient risk management plan in place, the financial institutions will be able to allocate their resources more efficiently. The resources here represent the cash and capital available with the financial institutions. “A good risk management framework allows management to quantitatively measure risk and fine-tune capital allocation and liquidity needs to match the on and off-balance sheet risks faced by the institutions and to evaluate the impact of potential shocks to the financial system or institution” (GTZ, 2000). The financial institutions must engage effective treasury management, as the primary objective of the financial institutions is to maximize the earnings by channelizing their investments in portfolios having the minimum risk of loss.

- A risk management system, when it functions efficiently within a financial institution, can provide to the institution better and quality information on potential consequences, which may be both positive and negative. Effective risk management can establish a proactive and forward-thinking organizational culture within a financial institution. It also helps managers in identifying and assessing new market opportunities and it enhances the ability of the managers to foster continuous improvement of existing operations of the financial institutions, resulting in the effective alignment of performance incentives with the strategic goals of the organization.

In the case of financial institutions, better risk management yields similar benefits, as they do in the case of traditional banking institutions. With the continuous growth and expansion of the financial institutions, they have to serve more customers and attract mainstream investment capital and funds for their successful operation. For achieving this, the financial institutions have to strengthen their internal capabilities to identify and anticipate potential risks. This ability will enable the financial institutions to avoid the unexpected drain of their resources and there may not be any surprises or shocks to the organization.

Creating an efficient risk management framework within the organization has to be the priority of the financial institutions; once they can identify the individual risks such as credit risk, market risk, and liquidity risk, (following sections discuss different types of risks faced by financial institutions). Financial institutions should also have clarity about the roles and responsibilities of managers and board members, concerning the risk management of the institution, which will enable the organization, build stronger organizations. “A comprehensive approach to risk management reduces the risk of loss, builds credibility in the market place and creates new opportunities for growth,” (GTZ, 2000 p. 5).

A risk management framework for a financial institution represents a consciously designed system implemented to protect the organization from unexpected and undesirable surprises (there are denoted as downside risks) and enables the organization to derive the advantages of opportunities available to the organization. The following are the potential advantages of an effective risk management framework as it applies to a financial institution. Since effective risk management will avoid most of the delinquencies in the financial institutions, a discussion on the risk management for the financial institutions becomes important.

Effective Risk Management Can:

- Integrate the operations of the financial institutions into a set of systematic processes. This systematic process enables the identification, measurement, and monitoring of different types of risks faced by the financial institutions by helping the management to have a close watch on the organizational functions in a global way

- Provide continuous feedback between measuring and monitoring and between internal controls and reporting. Such a framework also provides for an active oversight by the senior leaders of the organization and the directors on the operations of the financial institution. This also enables the organization and its top management to respond swiftly to changes in internal and external environments of the financial institution

- Provide an overview of the situations in which the management can have an overview, where different risks interact with each other and they can exacerbate one another in adverse situations.

- Allocate the responsibility for risk management and organizational preparedness to the domain of the senior management and that of the board

- Promote efficient use of resources and decision-making in the most cost-effective way

- Create an internal organizational culture in which there is a possibility of ‘self-supervision’, which will be able to identify and monitor risks much before the outside stakeholders or regulators could identify them.

Importance of Risk Management to Financial Institutions

Some reasons make a more sophisticated risk management framework and improved approaches are important to financial institutions. In the present day context, the financial institutions have grown to larger proportions, serving a large number of customers and broader geographic areas. They offer a wide range of financial services and products. In practice, the internal risk management of the financial institutions is found to be a step or two behind the scale and scope of their operations. This makes an effective risk management an important factor to sustain their growth. Secondly, for meeting the requirements of enlarged lending activities, financial institutions have to rely increasingly on market-driven sources of funds.

The funds are generally drawn from external investors or as deposits from the savings of clients. If the financial institutions have to preserve the access to such funding sources it requires the maintenance of good financial performance and avoid unexpected losses. Third, the organizational structures and operating environments pose exclusive problems to the management. “They may be very decentralized or too centralized (both can be a risk), tend to be labor and transaction-intensive have concentration risk in certain regions or sectors (e.g. agriculture) due to their mission and often operate in volatile and less mature financial markets.” Finally, financial institutions have to establish financial viability through operations, which are efficient and cost-effective. This calls for effective risk management to achieve better resource management without exposing the institution to undue risk.

Rationale for Risk Management

The importance of risk analysis can be found in dealing with increasingly complex financial transactions. For example in derivative transactions, several innovative products and services have developed over the period, which enlarges the risk of the financial institutions in these fields. The complexity is enhanced as a natural evolution process, although it is not a universal phenomenon. For instance, with sophisticated information and communication techniques number of people dealing with the financial institutions from different geographical locations increase, which also enhances the risk element for the financial institutions. As a concurrent development, with the increase in information and knowledge of the public, there is the demand and need for higher levels of service quality and the risk increases because of the increased complexity of the systems. Therefore, it becomes important for financial institutions to understand and meet the investors’ demand by making their policies consistent with such demands. In recent periods risk analysis is one important and powerful tool to address risk management issues by the financial institutions and to develop sound and safety policies and design strategies.

Thus, economic challenges, market uncertainties, and difficult value trade-offs among competing goals have made it difficult to arrive at a consensus on the policies to be followed to manage the potential hazards, dangers and losses to financial institutions. However, suitable policies must be developed and implemented to achieve the desired outcomes in the matter of protecting the interest of the financial institutions. It is therefore important that the use of risk analysis to improve risk management decisions and policies resorts.

The demand for risk analysis can be seen from the significance of eliminating all risks associated with an activity. Risks must be weighed in terms of (i) risks of alternative activities to that which is being considered and (ii) trade-offs between the benefits likely to accrue from the incremental efforts taken to mitigate the particular risks and the cost of such efforts in getting the resultant benefits. Here lies the demand for risk analysis. Risk analysis provides the information needed to weigh the alternatives and analyzing the tradeoffs between costs and benefits. This is more so when there is ambiguity surrounding the available information and the information is uncertain and not obvious to make a decision. Risk assessment techniques become handy in providing a means of presenting the relevant information in an organized way and estimating the impact of adverse consequences.

However, the analysis conducted using risk assessment techniques may be able to provide precision to the information only to a certain degree, because of the tentative nature of the underlying assumptions and uncertainties, which are inherent in the risk assessment. In such cases, there is the demand for risk analysis and efforts may be taken to arrive at a balance by considering what constitutes acceptable risk by using any risk assessment tools. Thus to meet the demand for risk analysis, individuals and corporate decision-makers identify levels of risk which are within the tolerance limit in the light of several other factors like cost of risk reduction, perceived risks and benefits of the technology applied, activity, or substance that poses the risk and the available alternatives for the activity or substance, (Covello et al 1988; Travis et al 1987; Travis and Hattermer-Frey, 1988).

Classification and Measurement of Risk

To manage their risks, financial institutions must have complete knowledge about the risks affecting their operations. Acquiring the knowledge about the risks involves assigning the methodologies to measure them based on a perceived and classified expression of risks. Thus, there are different steps involved in the process of identifying and measuring the risks. They are: (i) classification of risks into meaningful and observable types of risks, (ii) selection of an appropriate model-based methodology for measuring the risks belonging to the individual classification made and finally, (iii) use of the selected methodology to generate a measurement of the specific risks affecting the financial institutions. Once the financial institutions acquire the knowledge relating to the risks affecting their operations, the management can start applying various policies to assess, mitigate or transfer the risks identified by them. This section provides a review of the commonly used classification of the risks and the fundamental current risk management and measurement methods.

Out of the above classification of the financial institutions, the originators, distributors, service providers, and packagers can be considered as having the agency characteristics and the intermediaries and market makers represent principal business makers. The agency services act to provide market access to the buyers and sellers of financial instruments and hence expose the service provider to a minimum of risks. The businesses where the service providers act as principals place a significant amount of capital on the interaction between the buyers and sellers.

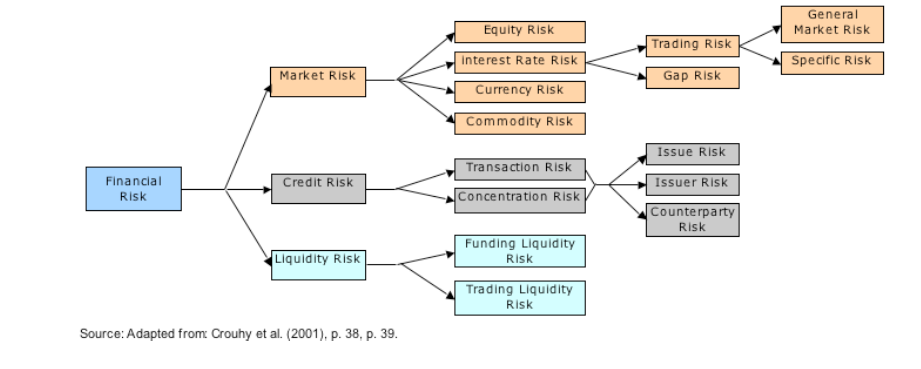

In fact in these areas that the financial institutions expose themselves to major risks and hence there is the need for an effective risk management program. Both the intermediary and the market maker are not covered entirely for the risks associated with their activities and hence it may be necessary that its investors may have to bear some part of the risks associated with the activities of these financial institutions. The risks borne by these institutions can be broken down into three general categories of risks, which are (i) market risk, (ii) credit risk and (iii) liquidity risk. Apart from these risks, there is a liquidity risk, which is often mentioned as a major separate risk category. There are other non-financial risks, which includes strategic and business risk, which also needs consideration by the financial institutions.

The three main categories of financial risk can be subdivided into other subcategories as depicted in the above figure. However, there may be varying classifications of the risks facing financial institutions in the literature. Since the financial institutions must have a thorough knowledge of the major risks affecting their financial standing and profitability, studying the classification becomes important and it also helps them to design and apply appropriate risk management policies to overcome the potential losses arising from the risks.

Market Risks

Market risks have a financial orientation and these risks arise because of frequent changes in the domestic financial system. The disparity in values of properties and claims against a financial institution can lead to the facing of market risk by the financial institutions. Market risks are likely to become more pertinent when the financial institutions become larger in size and operations and complex in terms of assets and liabilities possessed by them. The varying proportions of properties and claims of the financial institutions pose challenges of market risk to the financial institutions because fluctuations in the market, which affect the value of such properties and claims.

Changes in conditions of the market, in which the financial institutions are operating, though may be external to the financial institutions influence the functioning of the financial institutions favorably or unfavorably. Therefore, these are considered as market risks for financial institutions. There are three important market risks for the financial institutions and the following sections deal with these different types of market risks. Market risk can be subdivided into “equity risk, interest rate risk, currency risk, and commodity risk.”

Interest Rate Risk

Interest rate risk can be defined as the current or prospective changes in the earnings and capital caused by periodic movements in the interest rates. “Depending on the interest rate risk profile of banks, such as the extent to which individual banks are net lenders or net borrowers in the interbank market, their profitability will be affected to different degrees” (Yam, 2006). The major risk being faced by the banks and the financial institutions is the risk posed by the change in the interest rates. The interest rate risk for the financial institutions emanates from the financial intermediation services being undertaken by them.

The risk is caused by the difference in the maturity values of the assets and liabilities of the banks. The interest rate sensitivity differences often expose the equity of the banks and other institutions to changes in the interest rates, which ultimately affects the profitability of the institutions. The unexpected changes in the interest rates make the balance sheet hedging activity of the bank, which is normally undertaken based on the maturities of assets and liabilities at the expected maturity values shown in the balance sheets of the firms. When there are changes in the interest, which affect the valuation of assets and liabilities negatively the banks and other institutions are bound to get a beating of the earnings. The other forms of interest rate risks are the refinancing risk and reinvestment risks.

Techniques Used to Protect Against Interest Rate Risk

A forward contract with the interest rate changes as the base is known as ‘forward rate agreement’ (FRA). The FRA consists of an inter-bank traded contract to buy or sell interest payments on a future date and the interest is to be calculated on a notional principal. Under the forward trade agreement, the buyer gets a right to specify a certain rate of interest for an agreed term, which is set to start on a future date. The interest amount will be arrived based on an assumed principal amount. Similar to the currency forward contracts, the FRAs also are entered into with maturity periods of 1,3,6,9 and 12-month periods.

Interest rate futures, on the other hand, are largely used by the finance and treasury managers of non-financial companies in contrast to the currency futures (Bodnar & Gebhardt, 1999; Eiteman et al., 2000). The enhanced usage may be because interest rate futures are having relatively high liquidity, are simple to use and the interest rate exposures of the firms are standardized. However, Phillips, (1995) and Mallin et al., (2001) are of the view that the interest rate futures are not popular among firms to manage their interest rate risks.

The interest rate swap is a dealing between two entities wherein one party settles interest to the other on fixed dates, but with varying interest calculations. ‘Plain Vanilla’ is the common arrangement where one part of the payments is set and the other part of the payment is maintained at varying rates. This type of swap contracts has become the most popular financial arrangement in the global context.

Interest rate options are just like forward rate agreements. In the interest rate options, instead of being bound by a firm commitment to receive interest at one rate and make payment of the interest on another, a right is given to the holder to receive interest at one rate and make payment of the interest on another.

Currency Risk

Currency risk or foreign exchange risk is a natural consequence of international business dealings, where the value of the currency of one country moves up and down against that of another. International firms usually enter into some contracts that require payment in different currencies. This risk arises because of a change in the domestic currency value of a firm’s assets and liabilities caused by the changes in the rates at which the currencies of different countries are counted. The exchange rate exposure may be positive or negative (Banking and Finance, 2000).

Firms that deal in currencies of different countries face the risk of gaining or losing in the value of assets and liabilities or respect of their revenue or outflows because of sudden unanticipated changes in currency exchange rates (Sivakumar & Sarkar, 2007). Economic globalization has made the business organizations spread their wings across the geographical locations and use low-cost locations for improving their profitability and sales growth. This has necessitated the movement of foreign exchange from one country to another in the form of capital movements and the profits repatriated to the country of origin. However, due to frequent and major changes in the domestic and international financial markets, the firms have been exposed to two kinds of foreign exchange risks. These are exchange rate risks and interest rate risks. The firms adopt several measures to protect against currency fluctuations.

Techniques Used to Manage Currency Risks

One of the earliest methods adopted without involving any derivative instrument is the forward contracts in foreign currencies in which they are dealing it. However, this method of mitigating the foreign exchange risks did not prove to be effective whenever there was a favorable movement of the foreign currency and the firms are often exposed to loss of profits, which they would have otherwise earned had they not entered into the forward contracts. After the introduction of the various forms of financial derivatives, they started covering their foreign exchange exposure by resorting to financial derivatives.

Using Derivatives for Managing the Currency Risks

Out of the above methods of mitigating the foreign exchange risk, the forward contract is the oldest and most popular one used by the business firms to manage the financial risks. A forward contract is “a cash market transaction in which delivery of the commodity is deferred until after the contract has been made. Although the delivery is made in the future, the price is determined on the initial trade date.” (Investopedia, 2009) Under the forward contract, the firm agrees to buy and deliver a certain amount of a specified foreign currency at a future date. The rate at which the currency is to be delivered is decided at the present point of time. If the actual currency value on the date the amount is due is more, the firm makes a profit out of the deal and if the currency value is less than the contracted value a loss results out of the deal.

A futures contract is defined as “A standardized, transferable, exchange-traded contract that requires delivery of a commodity, bond, currency, or stock index, at a specified price, on a specified future date.” (Investor Words, n.d.) Under the futures contract, the firm is obligated to buy certain specified currencies at specified exercise exchange rates. In this type of contract, the risk to the holder of the instrument is rather high and unlimited as there is always used to exist an asymmetry in the payment pattern. The risk of the seller is unlimited as well.

Under the currency swap contract, the buyer and seller or the other parties involved in the contract are obligated to provide for predefined remittances at the appointed payment dates. A swap contract comprises a series of forwarding contracts put together for covering the foreign exchange risks. Under this system, the parties provide each other with the difference in the interest payments covering the amount contracted in the different currencies. An option “Like other options, an option on a futures contract is the right but not the obligation, to buy or sell a particular futures contract at a specific price on or before a certain expiration date. These grant the right to enter into a futures contract at a fixed price,” (Investopedia, 2010c).

Credit Risks

Generally “Credit risk is the risk that a change in the credit quality of a counterparty will affect the value of a bank’s [or other financial institution’s; note of the author] position,” (Crouhy et al. 2001). Credit risks arise due to the non-performance of a debtor and these risks usually arise either the debtor is unwilling or unable to perform according to the already committed contract terms. This has its effect on the lender who underwrote the loan, other people who advanced money to the creditor as well as the shareholders of the debtor himself. A major part of credit risk is the culmination of the systematic risks and the unusual losses associated with these risks pose a problem for the creditors despite the benefits of diversification from the whole uncertainty. This applies especially to the creditors who advance amounts in the local market against the security of the illiquid assets (Morsman, 1993).

Credit risk has a close association with the lending of the financial institutions and is an important risk that any financial institution could face. Whenever a financial institution lends money to a borrower, there is an inherent risk that the borrower may commit default in repaying the amounts to the institutions. Where there is a potential chance that the borrower fails to pay back the borrowed amount the situation is known as the credit risk. “Credit risk is simply the possibility of the adverse condition in which the clients do not pay back the loan amount” (India Microfinance News, 2010). This type of risk is the popular one among the financial institutions. Credit risk becomes important for the financial institutions, as these institutions have a diverse clientele. Financial institutions derive their funds and fund their portfolio through external borrowings or deposits from the public and by subscribing to their capital. Advancing a loan by the financial institutions also puts these sources of funds under risk.

Credit risk is inbuilt to the transactions undertaken by any investment or commercial bank. It is a fact that financial institutions can neither are too conservative in their approach towards lending, (as this approach would be a deterrent on their growth) nor can they act over-enthusiastically. If they act in an over-enthusiastic manner, the organization may face the danger of incurring potential losses. Therefore, it becomes essential that the financial institutions have to institute appropriate risk-mitigating initiatives, to ensure sustained profitability avoiding the negative impact of different risks affecting the business beyond reasonable levels. Credit risk arises because of elements affecting the operations present both within and outside the financial institution.

There are different forms of credit risk and the subcategories include the sovereign, political and country risks. All these categories include exposures to losses because of cross-border business connected with decisions of foreign governments and regulatory bodies. Settlement risk is another category of credit risk, where there is a failure of a two-way payment transaction. Settlement risk occurs when one of the persons dealing under a transaction defaults after the other party has performed his part in the transaction.

Managing credit risk form a major responsibility for the banks, as lending is the core business for the banks. Banks mainly adopt (i) portfolio diversity, (ii) conservative underwriting and account management and (iii) aggressive collection procedures as the techniques to mitigate credit risk (Dorsey, 2007). The best way banks manage their credit risk is by dividing their total amount of lending by companies, industries or geographical locations. This enables the banks to have a cushioning effect in the matter of credit risk management. If the bank experiences a higher credit risk exposure in one of the geographical locations, it will be offset by the safe lending in other areas. This way the banks can spread their credit risk over different portfolios of lending.

When the banks lend to firms in any sector, they can protect themselves against credit risk by evolving efficient procedures for risk mitigation. The focus of risk management in respect of credit risk lies in avoiding writing bad loans. If a loan appears to be doubtful, the banks take all possible efforts to realize the loan. The banks, which develop the skills for better managing credit risk, can have a higher competitive ability than the others are. Establishment of sound credit approval systems and processes supplement this ability of the banks to mitigate the credit risk more efficiently.

Since lending becomes the major activity for the banks, they establish detailed systems and procedures for assessing the risks and rewards of its credit risk settlement activities. An efficient credit analysis would help banks to mitigate their credit risk largely. This way the banks would be able to eliminate credit risk without lowering their level of activities in credit trading by making their settlement practices more efficient. The trading patterns of the banks also have an impact on the mitigation of their credit risk largely.

Liquidity Risk

Asset liability management is important for any organization, especially for financial institutions. “Asset liability management is, therefore, a process through which an organization has to match maturing of its assets (that is when they can be turned into cash) with maturing of its liabilities (that when they are falling due for poor payments)” (India Microfinance News, 2006).

“If an organization does not have sufficient assets maturing to fulfill its liabilities falling due then there is a risk that the organization may not be able to honor its committed obligation and this risk is called Liquidity Risk. Assets, maturing within one year period are termed as Current Assets, while liabilities which are falling due within one year period are called Current Liabilities,” (India Microfinance News, 2006).

“Liquidity management is, therefore, basically managing current assets and currents liabilities. If an organization’s current liabilities are more than current assets than such an organization has an immediate liquidity risk. Liquidity risk in financial institutions is considered to be one of the most sensitive issues and a risk of high priority,” (India Microfinance News, 2006).

“As liquidity problem can result in a financial institution failing to honor its obligations, it can result in loss of reputation, loss of credibility among lenders and depositors and has the potential to snowball into a big crisis” (India Microfinance News, 2006). If a financial institution is unable “to pay back savings of depositors when they come for withdrawal because they do not have enough cash then it can immediately give the wrong signal in the market,” (India Microfinance News, 2006). The news will flow in the market that either financial institution does not intend to repay the depositors or the institution is insolvent and unable to meet its financial commitments. “Spread of this news with other depositors can result in the panic situation who may also come for withdrawal and this could lead to a situation called to run on savings, where everyone wants to withdraw their savings compounding the entire problem,” (India Microfinance News, 2006). Also, defaults committed by the financial institution in making repayments to its lenders will lead to reduced confidence not only of the present lending agencies but also other prospective lending agencies. Because of this, the credit rating of the financial institution will fall, making any further rising of funds difficult for the institution.

It is also not advisable that the financial institution always keeps high liquidity with sufficient cash at all times to face emergencies. It is important to understand that liquidity entails a cost on the organization and if the financial institution decides to maintain all of its assets as a liquid, it may not be possible for it to earn any fee or interest. It is always in the interest of the organization to avoid idle assets. Since the income of the financial institution arises from lending the money, it will fail to earn the interest income if it maintains all its assets in cash form with it. Additionally, the financial institution “has to pay interest on its borrowing as well as deposits irrespective of the fact that they are deployed in loans or not,” (India Microfinance News, 2006). Therefore, “while high liquidity brings the profitability and sustainability of a financial institution down, insufficient liquidity results in the risk of defaulting on obligations” (India Microfinance News, 2006). The financial institutions must institute appropriate risk mitigation plans, within the financial institution to enable the organization to conduct its business transactions smoothly.

Operational Risk

The operational risks take the form of errors in record keeping, computing errors in calculating the payments, processing system failures and non-compliance with some regulatory requirements. The operational risks result in issues relating to processing, settling and providing, and securing delivery of trades in exchange for cash. Thus through individual operating issues pose smaller risks to the well-managed organizations, they may sometimes expose these firms to larger exposure of economic losses.

Operational risks arise from human or computer error. These risks may arise when the financial institution serves the clients during its business. Operational risks may be found in any division or product of the financial institution. “This risk includes the potential that inadequate technology and information systems, operational problems, insufficient human resources or breaches of integrity (i.e. fraud) will result in unexpected losses,” (GTZ, 2000).

Traditionally any other uncertainty, which could not be classified into the ambit of another major risk group, was included in the group of operational risk. However, the Basel Committee on Banking Supervision has provided a new definition of operational risk. This definition includes any loss occurring to the financial institution from a lack of internal control or inefficiency of systems and procedures. It also includes loss arising from the operation of external events. This definition has provided for a different category of risks connected with the operations of the financial institutions, which is the “strategic risk”.

There has been increased importance attached to operational risk in recent years, because of the proliferation of information and communication technology usage in the financial institutions and because of the recognition of the increased role of human resources in the operation of these institutions. Another feature of operational risk is that it can emerge in all the departments across the institution because of the presence of human resources and technology in all the functional areas of the financial institutions.

In the present day’s context, the financial markets and banking institutions and system has changed dramatically with the increased use of technologies. Also, enterprises across the globe have recognized the importance of human resources. Financial institutions have also adopted these larger changes and the operations of the financial institutions are carried out using modern-day technological measures. This has given rise to several operational risks to which the financial institutions are exposed. “Strong internal processes, systems, good human resource and preparedness against external events are needed for managing the operational risk. Operational risk is enhanced by increased dependence on technology, low human and business ethics, competition, weak internal systems in particular weak internal controls,” (India Microfinance News, 2006a).

The operational risks to which a financial institution is exposed can be grouped under five different categories –

- human risks including errors, frauds, collections, and animosity,

- Process risks including lack of clear procedures on operating such as disbursements, repayments, day-to-day operations, accounting, data recording and reporting, cash handling and auditing,

- system and technology risks like a failure of software, computers and power failures,

- relationship risks like client dissatisfaction, dropouts, loss to competition and poor products and

- asset loss and operational failure due to external events, loss of property and other assets or loss of work due to natural disasters, fires, robberies, thefts, riots.

Other Categories of Risk

There are some other categories of risk, which can be listed including reputational risk and strategic risk. Reputational impairment to the financial institution causes reputational risk.

“Perceived incompetence, negligence or misconduct of the institution” is the major cause of reputational risk. Strategic risk arises because of the strategic choices of top management. The following sections discuss other categories of risk.

Systematic Risks

Systematic risk is the risk of changes in the asset values, which are the result of systemic factors. The institutions can at best hedge against most of these risks but cannot completely do away with them. The systematic risks are faced by the institutions because of the impact of the economic conditions on the values of assets owned or claims issued by the institutions. The best example of the systematic risk is the difference occurred in the worth of properties and claims because of the changes in the interest rates. Due to fluctuations in the market rate of interests, unpredictable differences occur in the worth of properties and claims. Similarly, large-scale changes in weather may influence the value of real estate assets.