Introduction

What does the company do?

Rogers Communications, Inc. is one of the best communications and Media Company in Canada. The company was founded in the year 1920 and it stands in Toronto, Canada. The Company gives their services through three different system, they are Wireless, Cable, and Media. One of the first sections to be mentioned is all about the Wireless segment that contains wireless voice and services which promote communication of different data.

It controls an inclusive structure for mobile communications and common small package radio service network. Fido is considered to be one of the brand names which promote such services the way Rogers Communications do it. The second section cable provides cable television, cable telephony, and high-speed Internet access. Its cable element too supervises the company’s Internet and countrywide customary with computer telephony services.

Used for local and long-distance telephone, better voice and data services, and IP contact Rogers Company give good offers. This segment activates cable services, digital and Internet equipment, more than and over supply digital video recording and video game sales and rentals. This company is the biggest television firm in Canada; it acquired the shares did not already hold of Rogers Sports net Inc. In the Media section, activates radio and television stations, which holds just about half part of the ownership in a mobile production and the company brings content and conducts ecommerce during the Internet and possess a sports and activity site.

Where does it stand in its industry?

In other areas the company is not yet able to consistently measure the impact to the consolidated financial statements for these differences. These quantifications will be completed throughout 2010. The Company’s current accounting policy is to measure the defined benefit obligation. The impact of this difference has not been finalized, but is expected to further reduce the pension asset. The Company designated the accounting policy option to cost these expenses as acquired. In the Rogers Company publicized the opening of a latest wireless brand name is chart, the first is prepaid unlimited talk and text group to tender clients the reach and consistency of a confirmed system.

Sales and marketing operating expenses are greater than before slightly for the three months. Evaluate to the correspondent stage, payable to modest increased payments on publicity and endorsement costs for latest advertising movements, counterbalance by investments resulting from cost reduction initiatives. The Sales and marketing expenses reduces evaluates to the matching stage, due to lesser sales volumes with savings resulting as of cost reduction plans.

Main Body

Income statement, balance sheet, cash flow statement

The evaluation of the significant factors which predetermine the work of Rogers Communications is considered to be a helpful step to analyze the achievements of the company. In the tables (Table 1, 2, and 3) which are given in Appendix, it is possible to observe the numbers and define the nature of income statement, comprehend the development of balance sheet, and understand the progress of cash flow statement.

Income statement helps to measure Rogers Communications financial performance in the period of 2006-2008. Balance sheet of Rogers Communications introduces the summary of financial balances of 2006-2008 considering company’s assets, liabilities, and stockholders’ equity. And cash flow analyzes the movements of cash within the chosen business from 2006 to 2008. The numbers which are provided in tables prove that Rogers Communications is one of the companies which depend on a number of outside factors. For example, the results in 2006, 2007, and 2008 are not characterized by some kind of gradual transition.

So, it seems to be rather interesting and educative to touch upon different years and define the reasons of why net income that is applicable to common shares is the highest in 2007, and cash flow reaches its high points in 2006. In Table 1, it is possible to observe the development of cash flow and analyze the differences which were inherent for 2006, 2007, and 2008. In Table 2, the analysis of income statement is given. And the Table 3 represents the balance sheet of the company.

The key areas analyzed

Here include in the analysis part financial analysis. In this there mainly discussed present financial condition of Rogers Company. With the help of ratio analysis there discussed what are the main financial effect in the Rogers Company, that happens due to the present financial policies. Ratios analyses are simply uses in accounting to express the relationship in mathematical terms between two related figures in the financial statement. Ratios can be expressed in three ways as the quotient of one none divided by other. So time, percentage and proportion are the three ways of expressing ratio.

Financial analysis including, profitability, liquidity and solvency (provide complete calculations for all ratios)

This analysis is carried out by using three types of financial ratios including Profitability ratios, Liquidity ratio, and solvency ratio. These ratios are used broadly in financial analysis.

Profitability ratio

Profit making is considered as the primary objective of every business organization. The profitability of a firm can be easily measured by its profitability ratios. Profitability ratios measure the capacity of the firm to make an sufficient return on sales, whole assets and invested capital. Profitability ratios should be usually calculated by means of evaluation the sales or investments which are inherent to the company chosen.

This paper focuses on some popular ratios only to evaluate the achievements of the company and properly define its peculiarities and possibilities considering the current conditions under which the representatives of the Rogers Communication have to work and express their thoughts and ideas.

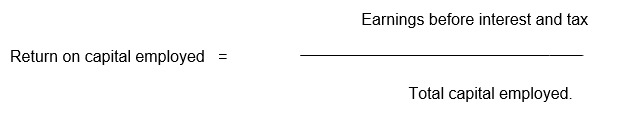

Return on capital employed (ROCE)

This ratio expresses the relationship between the net profit make during a period and the average long-term capital invested in the business during that period. It is computed as follows.

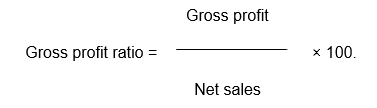

Gross profit ratio

Gross profit shows the relationship between gross profit and net sales. It is usually expressed as percentage. It is computed as follows.

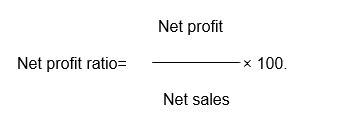

Net profit ratio

Net profit ratio shows the relationship between net profit and net sales. It is also known as net profit margin. It is calculated as follows

In the year 2006 to 2007 based on Returns on capital employed shows that performance of the company was rather steady and comparatively good performance. ROCE increased gradually over the period of 2 years with net profit margin from 464.28 to 431.6. In 2008 ROCE shows poor performance. In 2008 net profit margin fell from 431.6 to (869.6).

Liquidity ratio

Liquidity refers to the firm’s facility to convene its current liabilities beyond the current assets when they become owed. Liquidity ratios are procession or short term financial procession of a firm. This ratio reflects the short term short term solvency of a business.

Some definitions of ratios used during the analysis of the organization chosen:

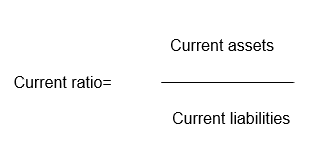

Current ratio

Current ratio is defined as ratio of current assets to current liabilities. As a rule, this kind of ratio aims at demonstrating the relation of total current assets with a number of current liabilities. It is computed as follows.

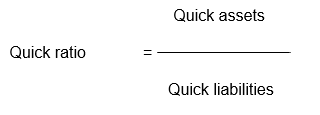

Quick ratio

Quick ratio is a type of indicator that evaluates quick assets of the company and its quick liabilities. It forms the connection between quick assets by quick liabilities. It is also called liquid ratio or acid test ratio. It is computed as follows.

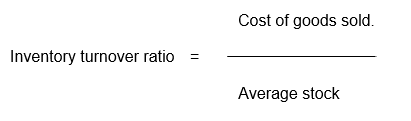

Inventory turnover ratio

Inventory turnover ratio is another type of that is also identified as stock turnover ratio in the sphere of finance. As a rule, it aims at establishing proper relations which have to be developed between costs of goods sold and average stock. This ratio indicates how many times during the period the firm has during the inventory. It is computed as follows.

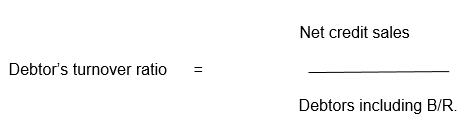

Debtors turnover ratio

Debtor’s turnover ratio is also called receivable turnover ratio. It relates net credit sales to sundry debtors. It measures how fast debtors are collected. It is calculated as follows.

In 2007 Rogers company showed higher performance of current ratio. In 2006 and 2008 comparatively lower performance shows Rogers Company in current ratio. It shows particular when 2007 was the only year the concern had cash at bank and cash in hand instead of bank overdraft as common. In the year 2007 current ratio is comparatively high ie, 5.361. In case of quick ratio in the year 2006 the performance is comparatively high i.e., 52.997. Debtors days and stock days are decreasing reduce the continuously.

Solvency ratio

Solvency ratios are used to analyze long term financial procession or long term solvency of a firm. These ratios are also used to analyze the capital structure of a company. The term solvency generally refers to the firm’s ability to pay the interest regularly and repay the principal amount of debt on due date. The important solvency ratios are debt equity ratios, proprietary ratio, and capital gearing ratio

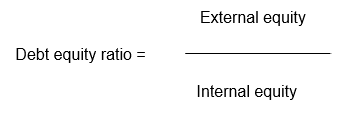

Debt equity ratio

Debt equity ratio shows the relationship between total debts and owned capital. It is the ratio of the amount invested by outsiders to the amount invested by the shareholders. This ratio reflects the relative claim of share holders and creditors against the assets of a company. It may be expressed as follows.

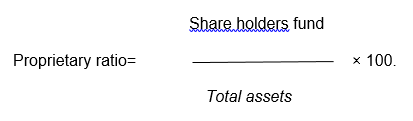

Proprietary ratio

This kind of ratio is based on the relations which are usually developed between shareholders funds and all those total assets inherent to the company. It indicates the proportion of total assets financed by share holders. It is computed as follows.

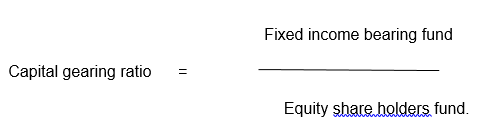

Capital gearing ratio

This is one of the important ratios used to analyze the capital structure of a company. The term capital gearing of leverage refers to the proportion between fixed income bearing funds and equity share holder’s fund.

Debt equity ratio did not practically adjust obvious over 3 years other than the tendency to fluctuate over the value in 2006 35.779 and it fluctuating 20.568 and 55.229 in the year 2007, 2008 respectively. Though, Proprietary ratio shows higher performance of the year 2006 but in the 2007 and 2008 the ratio is very low. Capital gearing ratio shows as 22.097 in the year 2006 but gradually the level of ratio decreasing to 1.676 and 1.944 in the year 2007 and 2008 respectively.

Summary and Discussion

An assessment of the relative strengths and weaknesses of the company, including supporting exhibit and other influential factors inherent to the organization

The SWOT analysis will help to recognize the deep business outline of the Rogers communication company Inc. The profile has been carry together by Global Data to bring a clear and an impartial view of the company’s answer for strengths and weaknesses and the potential opportunities and threats. SWOT analysis will help to understand what the original position of the company is. Rogers Communications Inc. (RCI) is a communications and media company which is in Canada. A considerable portion of work has to be done to evaluate the strong and weak sides of the company.

This is why it is better to start analyzing their strengths and then be able to define the weak points which prevent achieving the desirable success. Recent developments in the company covered will help the company from the present condition to higher position. Email surveys, direct mail surveys-these tools are the best way to get customer feedback on company strengths and weaknesses. Rogers Company has good innovative capacity as they have good R&D department and they should improve their marketing level and they should improve the promotional activities which will improve the companies share capital also. Through this there can improve the whole level of the company.thus SWOT analysis will help to attain the higher position and maintain the market value of the company.

Evaluation of each company as a candidate for 1- investment and 2- credit

The whole condition is very suitable to the company as make or improve it in to the public limited company there reveal in the ratio analysis that there can suggest for this company as to improve the promotional activity and if there get the financial support for this activity it will improve the companies market share to an extant. Rogers’s communication Inc is the one of the most famous communication limited in Canada through this analysis there revealed the financial condition of the company.

From a journal there come to know that In February 2010 there can find an increase in the annual dividend. The new annual dividend will be paid in quarterly. There the company announced that the Toronto Stock Exchange allowed the restoration of the Company’s normal course issuer bid program for the repurchase of up to the smaller. Within the year 2010 these shares that can be repurchased below the NCIB for a collective purchase price of during the next twelve months.

In the Year 2010, Cable obtain 100% of the exceptional ordinary shares of Blink connections Inc a totally own extra of Oakville Hydro Corporation. The Rogers’s communication is reported second quarter income share and The Company controls in the wireless, cable and media industries. The revenue segment of Wireless is 55%, cable is 32% and media is 13%. In the year of 2009 there can be launched the next generation HSPA plus network and offering customers wireless speeds. The Managing costs and operating efficiently turn into essential. In the year 2009, there the company took important steps to rearranging the cost structure.

The important ideas incorporated outsourcing the common of physical IT infrastructure to IBM to make significant capital outlay efficiencies. Also the company considerably streamlined the organization structure to improve the operating effectiveness and to position Rogers successfully for the varying industry setting. The company can on a pathway to repeatedly drive efficiencies, preserve strong profit margins and carry on to develop cash flow.

Evaluation of the financial information in terms of providing the necessary information for making decisions and analyzing the adequacy of the information provided for the decision making process offered

A thing to make an accounting policy choice regarding the treatment of actuarial gains and losses has to be considered. The Company means to accept the choice allowing the immediate recognition of actuarial gains and losses directly in equity with no impact on profit or loss. The impact of this policy choice will be to further reduce the Company’s pension asset by the amount of any unamortized net actuarial losses and unrecognized transitional assets that exist at the date of transition.

The Company will be necessary to take in its test the threat that the parties to the prevarication tool will non-payment by worsening to make payment. According Canadian GAAP the Company chosen not to contain credit risk in the hedge efficiency tests. the Company intends to continue to apply hedge accounting to all its hedging arrangements to which Canadian GAAP hedge accounting is applied and which meet the IFRS hedge accounting criteria, including passing the revised effectiveness tests.

The defined advantage obligation and plan assets are calculated at the balance sheet date while Canadian GAAP permit the dimension date of the definite benefit compulsion and plan assets to be up to three months prior to the date of the financial statements. The Company’s current accounting policy is to measure the defined benefit obligation and plan assets at September 30, 2009. The impact of this difference has not been finalized, but is expected to further reduce the pension asset.

While the decision to use the equity method will not be finally confirmed until the new standard is issued, the impact of using the equity method is predictable to result in decrease of the opening balances for Current Assets, Property, Plant & Equipment, Intangible Assets and Current Liabilities with an offsetting increase in Investments.