Introduction

The Kingdom of Saudi Arabia is commonly known for producing and exporting oil. It is the largest county in the Arab world, covering a land area of about 2.15 million square kilometers and approximately 28 million inhabitants. The country’s capital and financial center is Riyadh city, in the middle of the an-Nafud desert. Saudi Arabia gained official recognition in 1932 following a constant push by Abdul-Aziz bin Saud.

Even as the country enjoys a diverse geography, with grasslands, deserts, forests, and mountain ranges, Saudi Arabia is predominantly characterized by desert conditions. It is ruled by an Islamic Monarch that has been criticized for its tough stance, and global shifts and climatic dynamics threaten the dependence on oil. The challenges pose an opportunity for Saudi Arabia to institute reforms and make considerable investments to attract visitors and promote family-friendly tourism to support the country’s economy.

Challenges Facing the Country

Saudi Arabia has enjoyed favorable and robust economic prospects for a long time. It is the leading oil and gas producer and exporter globally. Despite the vast fortunes brought by immense oil and gas deposits, the main threat to the country is that the sector accounts for around 90 percent of the total earnings (Abouelhana & Elbeheiry, 2022). Therefore, Saudi Arabia predominantly relies on fossil fuel energy currently threatened by global and climatic shifts. Climate change remains a significant point of discussion in global conversations as countries pledge to seek and utilize more renewable sources of energy, such as wind, solar, and clean electricity. The dependence on a single commodity further exposes the Arabic nation to unpredictable fluctuations in oil prices.

Even though Saudi Arabia has a vast land area, it is a desert country with brutal climatic conditions. The country has limited arable land and freshwater sources, which can not sufficiently cater to the population. It also faces natural disasters such as sandstorms and flash floods and has to depend heavily on food imports.

Besides consumer spending, Saudi Arabia spends vast resources financing massive projects and provides numerous subsidies that challenge its fiscal sustainability. For instance, in 2021, Saudi Arabia spent almost a quarter of its GDP compared to a global average of about 17 percent (Poncet, n.d.). Such spending does not invigorate economic prosperity for its population, with reports of income inequality and increasing levels of unemployment, especially among the youth, who comprise over 50 percent of the Saudi people (Abouelhana & Elbeheiry, 2022).

Many youngsters have endeavored to enter the labor force in recent years, but they have to contend with foreign migrant workers historically inclined to work for lower wages. The locals are, however, conditioned to a higher standard of living. The government has attempted to protect its labor market, but the improvement has yet to be realized despite threatening the Kingdom’s stability.

Furthermore, Saudi Arabia is an absolute monarchy with an intricate power structure. A significant influence is exercised by the royal family, religious leaders, and the government. Large and well-connected business families have become rooted within the Saudi economy. They run large state-owned enterprises, which are dogged by a lack of innovation and corruption. Saudi Arabia has recently made several well-publicized and somewhat successful attempts to crack down on corruption, with the example of the Ritz-Carlton case.

However, corruption still prevails, mainly within the military and civil contracts. The problem is promoted by political connections of business people to the government, who are extremely hard to dislodge or compete against. State-run monopolies also operate inefficiently and serve as a barrier to economic liberalization. The country has restricted political freedom and civil rights, and heresy is not accepted. The country further comes across security threats from terrorist groups such as ISIS and Al-Qaeda that threaten its peace and stability.

Foreseeable Fiscal Plan: Enhancing Tourism and the Vision 2030 Plan

Saudi Arabia has set out to find ways to diversify the economy to help create jobs for the youth and growing population. The Royal Family has been at the forefront of finding possible solutions to diversify the economy and ease solitary and unsustainable dependence solely on oil. The efforts are captured by Saudi Arabia’s Vision 2030 plan, which describes the country’s aim for social and economic development in the next seven years. The program launched by Crown Prince Mohammad bin Salman over a decade ago supports the need to cut Saudi Arabia’s dependence on oil revenues, increase employment opportunities for Saudis, and improve citizens’ overall quality of life.

Abouelhana and Elbeheiry (2022) state that one of the critical pillars of the plan is to turn Saudi Arabia into a more enterprising and globally influential country, partly supported by the development of tourism. The sector currently contributes a small proportion to Saudi Arabia’s gross domestic product (GDP), which is still below the targeted 10 percent. Figure 1 below shows the trend of tourism’s contribution to Saudi Arabia’s GDP, which declined in 2020 as the world struggled with the coronavirus pandemic, which resulted in travel restrictions.

Historically, tourism in Saudi Arabia has primarily been associated with the Muslim pilgrimage. The country hosts the Makkah and Madinah Muslim activities that attract millions of people worldwide who come to perform Hajji and Umrah yearly. Abouelhana and Elbeheiry (2022) state that religious tourism remains a significant contributor to Saudi Arabia’s economy, accounting for 56 percent of total inbound tourism based on 2019 figures. The remaining 44 percent was shared between business and conference (18) and visiting family and friends (15) (Abouelhana & Elbeheiry, 2022).

In 2020 and 2021, the figures were suppressed following the coronavirus pandemic. There is a need for the government to continually expand the tourism industry beyond the hajj. The government should continue diversifying inbound travel into Saudi Arabia, and measures such as granting pilgrims visas to travel to other destinations in the Kingdom are welcome.

Additionally, Saudi Arabia should continue to review its legal framework to attract more visitors. The country prohibited visitors by only processing visas for religious pilgrims, expatriate workers, and business people. The government has taken significant steps to enhance the processing of tourist visas. According to Poncet (n.d.), the decision to allow tourists with U.K., U.S., and Schengen passports direct entry into the country in 2020 caused the tourism GDP contribution to rise slightly to 9.3 percent. The government should remain focused on boosting the number of international tourists visiting the country to become among the top five destinations in the world by 2030 by improving the issuing of visas.

Improving tourism is expected to contribute to economic growth and development. Abouelhana and Elbeheiry (2022) state that by 2030, Saudi Arabia hopes the sector will earn the country over SAR 635 billion, which will be well over the set target of 10 percent. It will support the energy sector by creating more than one million opportunities. It is in line with these improvements that the World Travel & Tourism Council (WTTC) the nation’s tourism sector to grow by an average of 11 percent every year over the next decade (Abouelhana & Elbeheiry, 2022). It is expected to be the fastest-growing tourism market in the Middle East region.

Comparative Advantage of Tourism in Saudi Arabia

Saudi Arabia is surrounded by countries embracing tourism as an essential contributor to economic growth and development. The UAE’s closest rival has been highly liberal in accepting visitors worldwide. Qatar has chosen to attract visitors through improved infrastructure and telecommunications. Bahrain gained the stature of a Sin City of the Gulf by embracing visitors of all kinds.

Saudi Arabia has largely been restrictive and prohibitive to visitors, but the country’s route of being a family-friendly destination is distinctive. The approach affords the Kingdom a comparative advantage in the region by drawing upon visitors in the form of families. Several attractions have been developed for this purpose, especially along the coastal seafront in the western (Jeddah) and eastern (Damman) regions. The destination has excellent aesthetics and entertainment attractions that are expected to promote and develop tourism in line with the country’s vision.

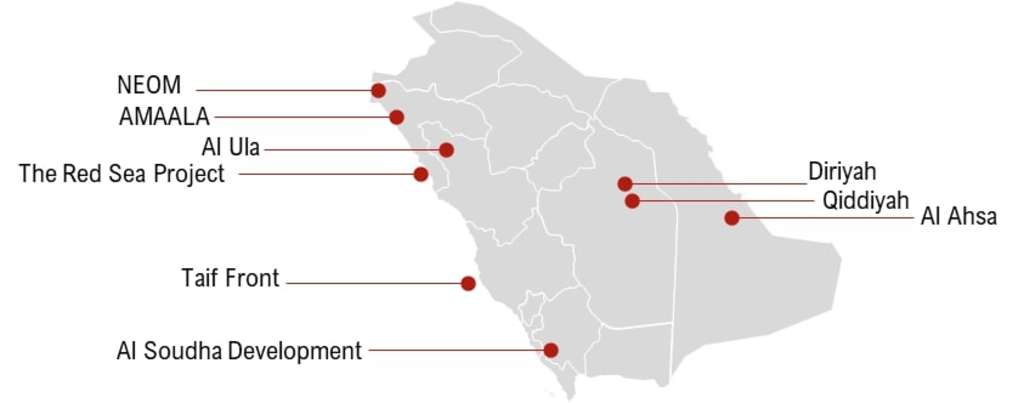

Saudi Arabia has further embraced mega-projects to attract more visitors for business or friends and family. The government expects to spend over $133 billion by 2030 to build its tourism sector, while related activities will cost upwards of $810 billion (Poncet, n.d.). The main project earmarked for development includes the Red Sea, NEOM, AMAALA, Qiddiyah, and King Salman Park, projects among many others, as shown in figure 2 and 3 below.

Each of the projects uniquely and powerfully reflects the country’s concept and is counted on to change the Kingdom’s tourism and overall economic landscape. The Red Sea is at the core of promoting tourism by creating a luxurious and hospitality destination. According to Poncet (n.d.), the NOEM project entails a $500 billion futuristic city project covering the northwest part of the Kingdom. It is centered on sustainability, clean energy, and enhanced transportation and is intended to compete with similar projects in Doha and Dubai.

Furthermore, the Green Riyadh project is intended to improve the urban architectural overlook of Riyadh city by rehabilitating the environment through planting trees, developing attractive parks, and restoration of valleys and tributaries. Arabian Business (2023) states that Qiddiya and King Salman Park project aims to enhance the outlook of Riyadh city and support tourism through innovation and the development of culture, arts, sports, and entertainment. According to Arabian Business (2023), AMAALA, or the “Middle East Riviera,” aims to create a world-class facility that will attract tourists and enable the Kingdom to compete effectively. Corder (2023) also indicates that the government has made the International Academy for Hospitality and Tourism an essential pillar of Vision 2030. The academy’s mandate includes developing talent and empowering Saudi nationals to be equipped to lead the hospitality industry.

The projects will be financed predominantly by Saudi Arabia’s Public Investment Fund. The sovereign wealth fund is regarded as one of the biggest in the world. The Kingdom also seeks to engage the private sector and foreign players and provide subsidies. Tax relief to support developments of tourist infrastructure, including new tourist destinations, massive shopping malls, and theme parks, are expected to rival similar attractions in top destinations such as California or Florida in the U.S. By financing the projects, the Saudi government aims to satisfy local and foreign tourist preferences.

Furthermore, the Saudi government has prioritized the construction and expansion of airports. The aim is to have big and modern airports in Riyadh and other cities that can efficiently handle more passengers by 2030 (France 24, 2023). According to Abouelhana and Elbeheiry (2022), Saudi Arabia’s General Authority of Civil Aviation (GACA) aims to invest over $100 billion into the aviation sector. The outlay will increase the number of destinations served from 100 to over 250 to boost passenger traffic (Abouelhana & Elbeheiry, 2022). According to an article by the Arab News (2023a), the airports will be served by a modern fleet of aircraft following a 37 billion deal crafted with Boeing. Investments in ground transportation systems have further supported the initiatives.

The Saudi government recently launched the first phase of the Riyadh bus service, which is expected to ease transport and movement through improved connectivity. The project is part of the King Abdulaziz Project for Riyadh Public Transport, which will introduce over 340 buses on 15 routes (Arab News, 2023b). The project will encompass 86 routes and is expected to have 633 stations and stops within the Riyadh Buses network (Arab News, 2023b). It is expected to be completed in 2024, and the entire five phases will cover about 1,900 kilometers and contain over 2900 stations and 800 buses (Arab News, 2023b).

The rail and metro system integration will span 176 kilometers and cover six tracks containing 85 stations (Arab News, 2023b). The project is projected to cost $22.5 billion and promote tourism by reducing the number of car trips made by nearly 250,000 (Arab News, 2023b). The combined Saudi government initiatives will further attract private investments in entertainment venues, such as cinemas, that have been legalized. The country recently permitted families to attend soccer games, part of the new measures to promote family-friendly tourism.

The third pillar of the 2030 vision plan is to create a vibrant society with strong values, culture, and social norms. It is centered on empowering and engaging young people, stimulating social participation, and enhancing the recreation and sports sectors. Abouelhana and Elbeheiry (2022) state that the country launched the Saudi Seasons initiative in 2019, covering 11 annual tourist seasons spread across the country. Since the 2018 lifting of the ban on movie screening, over 50 cinemas have been opened across Saudi Arabia (Abouelhana & Elbeheiry, 2022). In this regard, Saudi Arabia should continue to improve on successes that have already been achieved.

Since establishing the tourist e-visa system a few years ago, the Kingdom has also successfully hosted major sporting events, such as the Formula One (F1) Grand Prix. The country has further placed bids for the 2026 Women’s Asian Cup and 2027 Asian Cup (Abouelhana & Elbeheiry, 2022). The Formula One and football events are expected to elevate the legacy of Saudi Arabia and support the family-friendly tourism agenda. For instance, F1 attracts colossal international consumer interest, with sports fanatics drawn from all worldwide. The event enjoys a solid digital presence that continues to grow by attracting fans on leading social media platforms such as Snapchat, Twitter, Instagram, Facebook, YouTube, WeChat, TikTok, Weibo, and Twitch, among others.

The global audience can continue to benefit Saudi Arabia by promoting the destination through urban place marketing schemes. According to Formula One (2021), the Grand Prix races support place marketing so that the host region benefits from becoming first-class multicultural cities. The F1 motorsport further characterizes urban cosmopolitanism that brings together sports entertainment, symbolic capital, and the product’s image being promoted. Using advertising through visual signs encourages global mega-brands to create a specific identity for the host city.

The events give the host destination an opening to promote their culture, which may help Saudi Arabia to clear any illusions people from foreign countries may be harboring regarding the Kingdom. This further supports the cultural and heritage aspect as premeditated under Saudi Arabia’s Vision 2030 plan. Therefore, by hosting the Grand Prix F1 race in 2021, the Kingdom got a good chance to disapprove of unfavorable portrayals of their bad treatment toward people from other regions.

There have been perceptions that the country is particularly hostile to individuals who do not profess the Muslim faith. Saudi people have also been accused of widespread human rights abuses, but sports events are a way of disabling such whims. This is an opening for the country to showcase its strengths and allure people with hostile interpretations of its culture. The Ministry of Culture further enhances the efforts and drives the country’s desire to attract more domestic and international tourists. The ministry is at the center of stimulating foreign tourism by promoting Saudi culture and growing its nascent entertainment industry.

Conclusion and Recommendation

Tourism can be a valuable asset to the Saudi economy, and the Vision 2030 initiatives provide an excellent opportunity for its promotion. The benefits that tourism can bring to the country’s economy primarily involve urban and social developments. The support for family-friendly tourism will spark various social benefits across the country. The influx of visitors and revenue can heavily impact local businesses, creating jobs, new services, and reallocating resources. Increasing consumer spending and infrastructure investment can also open up new regions. At the same time, the preservation and promotion of cultural heritage and historical sites can also profoundly impact the long-term sustainability of tourism in the country.

The main recommendation of the report is for the government to continue supporting tourism. The approach will help the nation to further bring monumental changes to urban development through improved infrastructure, such as roads, airports, and railway systems. It can also contribute to local services and amenities, such as hospitals and schools, and improve clean energy and sustainability. Private and foreign investment will further serve as a strategic investment portfolio to help reshape the urban landscape and create jobs for the Saudi youth.

References

Abouelhana, Z.N. & Elbeheiry, A.Y. (2022). Saudi Arabia’s tourism landscape – Establishing a vision. Hospitality Net. Web.

Arab News. (2023a). Saudi Arabia and Boeing strike $37bn deal for 121 aircraft. Arab News. Web.

Arab News. (2023b). RCRC launches first phase of 1900-km Riyadh bus service network. Arab News. Web.

Arabian Business. (2023). Saudi Arabia megaprojects: 15 massive developments in the making. Construction Week. Web.

Corder, J. (2023). Saudi Arabia announces International Academy for Hospitality and Tourism. Hotelier. Web.

Formula One. (2021). Formula 1 announces TV and Digital audience figures for 2020. Web.

France 24. (2023). Saudi unveils new airline to compete with Gulf rivals. France 24. Web.

Poncet, S. (n.d.). Could Saudi Arabia become the next tourism leader in the Middle East? Hospitalityinsights.ehl.edu. Web.