Structure of the UK Sneaker/Sports Trainer Market

The UK sneaker trainer market is one of the world’s biggest footwear industries. It has a large population of 65.64 million people who provide a ready market for the sports trainer. According to Baena, the marketing of trainer shoes has gone global and the consumers are aware of product quality and brand (86). The UK sneaker industry has a clued up customer base and the international market is aware of the quality of their products. With such a global ambition on how to sell the sneakers, they have been able to change the entire continent shop for their products over the years; thus, establishing a bigger business empire.

Dimensions and Segmentation

The UK sneaker trainer industry is divided into three competitive segments that are fairly competitive both locally and internationally. The first segment of the market is athleisure sports footwear (Laitasalo 34). The shoes in this division are used for both leisure and athletic purposes. Such foot gears are important to consumers who love to follow the latest fashion and sporty looking trends in the market. The most prominent athleisure footwears are the sports or casual shoes. Running shoes make the second segment of the UK sneaker trainer market. Growing consciousness of healthier lifestyle has increased demands for running shoes in the developing markets (Schamp 155).

The rising participation in the physical fitness activities among various consumers has also served to the advantage of the market. Court game shoes comprise the third segment of the sneaker trainer market segment in the UK (Schamp 155). These footwears include shoes for court games such as squash, badminton, and basketball. Such games require that the footwears have different design and soles to enhance performance.

Key Players involved in the UK Sneaker Market

The major companies involved in the UK sneaker/sport trainer dealings are C&J Clark Limited, Office Holdings, and Schuh Limited.

C&J Clark LTD

This firm operates both as a wholesaler and a retailer in sneaker trainer market. The retail sales of the company account for approximately 35.0% of group revenue (Hart 154). To distinguish itself from the discount stores that have flooded the market, C&J Clack LTD has established a niche as a specialist. It is the country’s dominant retail store. Because the UK market has remained static, the international market has steadily become relevant; hence, posing threats to the company (Hart 154).

This company has remained steadfast in its mission and policy of maintaining a strong brand position and a substantial retail presence. Nevertheless, the tough industrial conditions have affected sales due to the fact that consumers have reduced their expenditure on footwear. External retailers have offered stiff competition owing to their cheaper prices on the sneaker trainers.

Office Holdings

This store is one of the biggest retail chains in the UK dealing in footwear and sneakers. This company is unique because it operates subsidiary retail stores. Offspring, which was launched in 1996, sells fashionable sneakers while Poste is an upmarket boutique that deals in designer men’s shoes (Williams 84). This concept was launched in the year 2000 and was closely followed by Poste Mistress that trades designer women’s footwear including sneaker trainers. The company operates more than 80 standalone outlets in the UK including Offspring, Poste, and Poste Mistress. It also sells through concessions in the departmental stores.

Schuh LTD

This entity runs more than 90 sneaker stores all over the country. It is reported that the company intends to open more stores, refurbish the existing stores, and improve its internet services with a view of promoting its business. The success of every business squarely lies in its organisation (Williams 83). Therefore, by improving the quality of its footwear products, it will sell more.

Factors driving Demand in the UK Sneaker Market

Various factors including fashion, a large number of consumers, physical fitness, and technology drive demand for sneaker footwear in both the UK market.

Fashion

There have been increasingly sophisticated styles and colour combinations from different sneaker trainer brands. This trend has been combined with the influence of premier fashion brands such as Dior. This position has attracted a lot of women who are lured by fashion. As a result, there is an increased sale of the sneakers. Many women buy the shoes filling their wardrobes with sneakers (Lewis and Dart 32). Men in the UK have also been reported to develop an interest in fashion trends. According to Lewis and Dart, a broader collection of sneaker shoes are not only reaching out to the innumerable female consumers but also to their male counterparts (32).

Large Number of Consumers

The UK has a large population of over 65.64 million people who provide a ready market to the sneaker trainer industry. The international community is also aware that the country produces quality sneakers; hence, many people are willing to buy the products (Lewis and Dart 32). This state of affairs has been facilitated by the ability of the companies to advertise their products broadly.

Income Level of the Consumers

Most families in the UK belong to the middle class. Therefore, they can afford sneakers for their consumers. The sneaker industries also sell their products at affordable prices.

Need for Physical Body Fitness

Due to the increasing awareness of the importance of physical health, many people are buying the sports sneakers to use during exercises (Williams 81). The urge to maintain physical fitness has contributed immensely to the expansion of the sports trainer market.

Advanced Technology

With the advancement in the methods of advertisement such as television broadcasting and social media (such as Facebook and Twitter), many potential customers receive real-time information about new trends in the market.

Future of the UK Sneaker/Sports Trainer Market

The future of the UK sneaker trainer market is bright because of the unique strategies that have been put in place to reach the consumers. With the trend well maintained, the UK sneaker industry will dominate the world market in the next ten years.

Appendix

The table shows the trend in marketing value of Sneaker sports trainer in the UK between the years 2015 and 2016.

- Years: 2015 2016 % change.

- Women’s 4130 4246 16.5.

- Men’s 2451 2598 22.0.

- Children’s 1454 1546 7.2.

- Total 8035 8392 16.2.

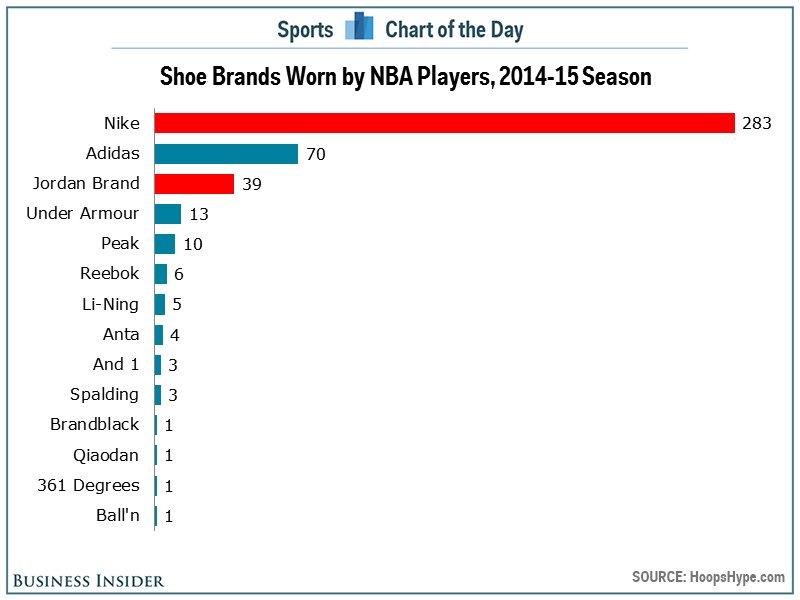

The graph below shows the competitiveness amongst sneaker brands in the UK market.

Works Cited

Baena, Verónica. “The Next Revolution in Mass Customisation: An Insight into the Sneaker Market.” International Journal of Marketing, Communication and New Media, vol. 4, no. 6, 2016, pp. 87-106

Hart, Rachel. “Sneakers: Fashion, Gender, and Subculture, Yuniya Kawamura (2016).” Critical Studies in Men’s Fashion, vol. 3, no. 2, 2016, pp. 150-154.

Laitasalo, Riku. Sneakerheads: Influencers of Industry or Insignificant Insiders? A business History on the Collectible Sneaker Market, 2016. Web.

Lewis, Robin, and Michael Dart. The New Rules of Retail: Competing in the World’s Toughest Marketplace. St. Martin’s Press, 2014.

Schamp, Eike W. “Fashion Industries on the Move: Spatial Restructuring of the Footwear Sector in the enlarged European Union.” Zeitschrift für Wirtschaftsgeographie, vol. 60, no. 4, 2016, pp. 155-170.

Williams, Jean. “Given the Boot: Reading the Ambiguities of British and Continental Football Boot Design.” Sport in History, vol. 35, no. 1, 2015, pp. 81-107.