Introduction

The budget process is a crucial undertaking for every country across the world. It yields an essential economic policy tool that guides all government activities. Apparently, a government cannot raise or spend any funds without a national budget. This requirement makes the national budget pivotal in all government endeavors since no activity can materialize without financial involvement. In the U.S., the budget process often presents the government with a huge dilemma. The American population is unhappy with the growing budget deficit. As a result, it has placed immense pressure on the government to balance the budget. Intriguingly, the same population expects taxes to be kept at the least possible level. This paradox has placed the U.S. government in an awkward position.

Main Body

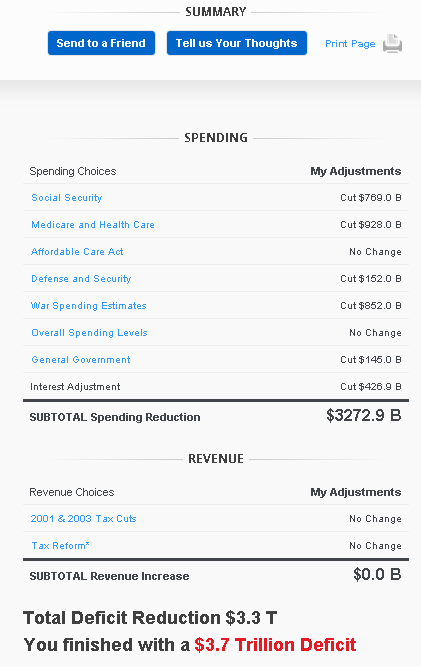

Nonetheless, it is imperative that the U.S. government reduces the budget deficit and maintains a reasonable tax regime. This feat can be achieved by striking a balance between government expenditure and revenue collection. Cutting government expenditure seems more alluring than increasing revenue, but expenditure cuts are not applicable in some areas. My initial approach to dealing with the budget deficit was to reduce government expenditure. This approach was inspired by the assumption that reduced expenditure could easily eliminate the current budget deficit within a span of several years because it circumvents the technicalities involved in planning for additional revenue. In addition, it is likely to be palatable to the American people because they have already voiced complaints that the government is overtaxing them. Therefore, through this approach, the government can maintain the status quo in revenue collection but gradually reduce its expenditure.

A variety of tough decisions had to be made to achieve a judicious reduction of the budget deficit. One of these decisions was to cut the government’s expenditure on social security. It is a sensitive area since it deals with the vulnerable members of society. However, despite its sensitive nature, the consequences of reducing its budgetary allocation cannot compare with the possible ramifications of an out of hand budget deficit. Besides, those who are categorized as vulnerable members of society continue to grow by the day, yet the revenue that the government obtains from this group keeps dwindling. Most importantly, it has been a long time since the government reviewed its social security policy.

Another sensitive area that was affected by the expenditure cut is health care. The U.S. government runs a plethora of health care programs that constitute about a quarter of the national budget. Further, expenditure on health care programs is projected to grow faster than all other programs. These programs mainly target retirees, who keep increasing in numbers without a corresponding increase in revenue collection. Therefore, a reduction in health care expenditure will have a variety of consequences. One of the key consequences of reducing expenditure in health care is the adjustment of the eligibility age of beneficiaries from 65 years to 67 years. However, such consequences may not have any far-reaching effects on the economy.

The defense and security section also underwent an expenditure cut. Redundant programs such as TRICARE can run on a lower budgetary allocation. In addition, the private sector will play a bigger role in equipment maintenance. The U.S. government spends too much money on defense and security, yet there is no immediate threat of a military confrontation. Therefore, a reduction in the budgetary allocation for this area is reasonable.

Expenditure on war is another key consumer of government money. America has a history of engaging in unnecessary military confrontations. This habit leads to the use of large sums of money to facilitate wars instead of using it to fund productive projects. Therefore, a reduction in war expenditure can reduce the budget deficit without adversely affecting the economy.

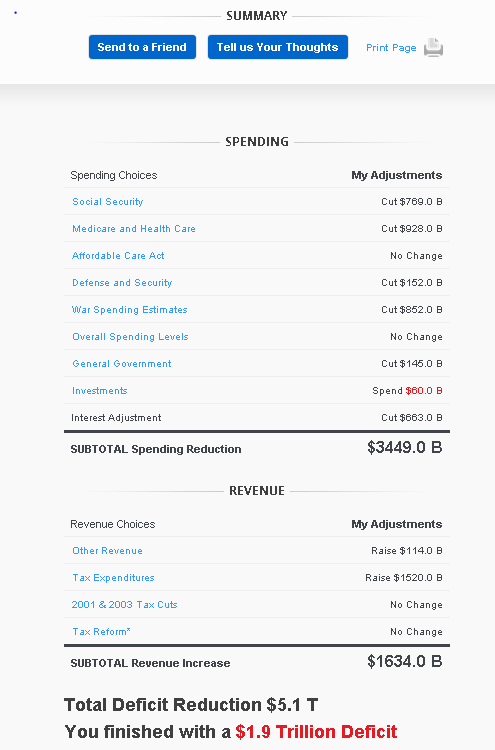

The reduction of government expenditure in the outlined areas did not bring the budget deficit to a sustainable level. Therefore, it occurred to me that there was a need to do more than merely cutting government expenditure. I arrived at the conclusion that it was necessary to increase revenue generation to achieve a significant reduction in the budget deficit. As such, a number of revenue generation measures were taken alongside the expenditure cuts. The measures that were taken to increase revenue include investment in infrastructure and education, taxation of the worldwide income of U.S. corporations, and reduction of tax expenditures. These measures helped to raise a substantial amount of revenue ($1634.0 billion) that reduced the budget deficit further.

Conclusion

This simulation taught me a crucial lesson. It is easy for American citizens to be overly critical of their government due to their spending patterns. However, I now know that the budget process involves striking a delicate balance between fiercely competing national needs. Clearly, the average U.S. citizen has a superficial understanding of matters pertaining to the management of the national budget. Otherwise, they would be a little less judgmental. In this respect, my conclusion is that it is advisable to be critical of situations only if one has a comprehensive understanding of the circumstances surrounding them.

Budget Statements