Causes of Subprime crisis

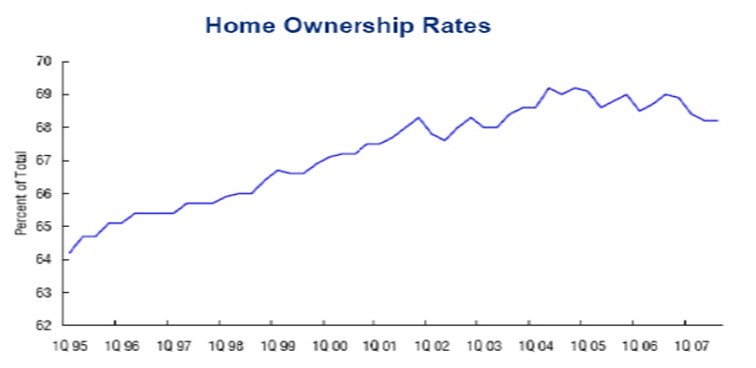

The federal reserves in the year 2001 started reducing the interest rates for federal funds, which went as low as 1% by the year 2003. When the interest rates went down, it was a chance for investors to borrow money at a low cost so that they invest and make big profits. Investors viewed this opportunity as a perfect vehicle in Collateralized Debt Obligations (CDOs) investment. The CDOs were to be backed by subprime mortgages. In addition, these CDOs had several tranches all of which had different levels of risks. Senior tranches were rated with triple- A (Jansen 2008).

The standards of underwriting subprime mortgages went down. Mortgage brokers lent money to even households who had inadequate income or assets top service the loans. In fact, the income documentation was insufficient. Most of the people who were borrowing loans were anticipating to buy properties which they could then sell afterwards and make good profits (Muolo and Padilla 2008). The subprime mortgages were now packaged into CDOs by investment banks and then sold to investors. Most of the investors took the senior tranches with triple- A rating. Some banks such as the Citigroup had formed off balance sheet entities to hold CDOs. The entities were referred to as the Structured Investment Vehicles (SIVs). For the SIVs, CDOs were long term assets. The SIVs were financing their purchases with borrowed funds, whereby the borrowed funds were in the form of short term maturity and were backed by commercial paper (Tsanis 2010).

The financial crisis started in the year 2007, and those who had invested in commercial paper demanded to be paid in cash. The banks, which had the SIVs, were now forced to put assets into their own balance sheet, and this put so much pressure on them (Kolb 2011). The United States housing bubble also contributed to the financial crisis. As the cost of borrowing went down, too many people borrowed mortgages to build homes for resale. This resulted to inflation of assets in the US. The valuation of houses decreased due to more houses for sale in the market. The owners of the houses are left with left with little wealth to repay the loans. The owners of the houses are also left with less spending power. This lend to a slow economic growth in the US. Since there were investors from outside the US who had borrowed the mortgages, the housing bubble also spread to other parts of the world such as in Europe (Hu 2011).

The consequences of subprime

The subprime crisis of the United States had many effects to the economic growth and the general economic status. The first consequence that it had was the spread to the rest of the globe affecting the economy of other nations (Conrad, 2010). Among the factors that contributed to its spread are globalisation and securitisation. The risks that were posed by the mortgage securities in the US were spread around the globe. This spread the impact of the crisis globally. The mortgage securities in the US were sold to other nations in the globe hence causing the crisis to elsewhere. Investors from outside US found the opportunity where they could get loans at a much lower cost. They bought the mortgages and built houses in their countries for sale at higher costs in the future with the aim of reaping high profits. When the situation changed in the US, and the mortgages were affected, the investors could not get enough wealth to repay the loans. The prices of houses went down, and it became hard to sell houses. Their spending power declined, and this lend to a slow economic growth. This is what caused the spread of the subprime crisis and the global crisis consequently. The crisis made it difficult for investors to sell houses (Grant and Wilson 2012).

Lessons learn from subprime crisis

Governance in banks

Governance in the banks should be improved in the future so as to avoid such occurrences. For instance, the regulatory over the CDOs and creation of other financial instruments should be observed in the future. The costs of mortgages went too low, and the banks, in turn, started packaging the mortgages into CDOs and sell them to investors. They sold the mortgages even to people who did not have enough income and assets to repay the loans (DiMartino and Duca, 2007). The banks were also looking to make profits out of the situation. In fact, some of them created SIVs which were not included in the balance sheet. This put too much pressure to the banks when the housing bubbles burst. The governance of the banks should, therefore, be improved so as avoid them from lending money even to unqualified people and creating financial instruments, which could be a problem to them in the future. It is argued that the subprime crisis resulted from individual incentives as well as lack of accountability (Kolb 2010).

Risk allocation does not eliminate risk

Banks should also learn that by spreading the risk, it does not completely eliminate the risk. The banks of the US spread the risk by lending mortgages to many people even from outside the nation. These lend to spread of the risk even to the outside world and to the globe. It made it difficult to assess the effects of the loss as a result of the crisis and the situation became difficult to control (Chandran 2008).

References

Chandran, P. 2008, Lessons from the Sub-prime Meltdown, Web.

Conrad, C. A. 2010, Morality and economic crisis: Enron, Subprime & Co. Hamburg: Disserta-Verl.

DiMartino, D. and Duca, J. V. 2007, The Rise and Fall of Subprime Mortgages, Federal Reserve Bank of Dallas Economic Letter 2(11).

Grant, W., and Wilson, G. K. 2012, The consequences of the global financial crisis: The rhetoric of reform and regulation. Oxford, UK: Oxford University Press.

Hu, J. 2011, Asset securitization: Theory and practice. Singapore: John Wiley & Sons (Asia.

Jansen, L. H., Beulig, N., and Linsmann, K. 2008, US subprime and financial crisis – to what extent can you safeguard financial system risks?: [research paper]. München ;Ravensburg: Grinverl.

Kolb, R. W. 2011, The financial crisis of our time. New York: Oxford University Press.

Kolb, R. W. 2010, Lessons from the financial crisis: Causes, consequences, and our economic future. Hoboken, N.J: Wiley

Muolo, P. and Padilla, M. 2008, Chain of Blame: How Wall Street Caused the Mortgage and Credit Crisis. Hoboken, NJ: John Wiley and Sons.

Tsanis, K. 2010, The impact of the 2007-2009 subprime mortgage crisis in the integrated oil and gas industry. München: GRIN Verlag.