Introduction

Commodity

Netflix, Inc is a subscription streaming service based in America. It also produces its content and has been operational since 1997. The successful content provider offers customers a library of television series and films using distribution deals and Netflix Originals, the company’s production component. Based on its statistics, Netflix has grown substantially in twelve years and has more than 214 million subscribers worldwide (Stoll, 2021). It has 74 million subscribers in the USA and Canada. The company has 39 million subscribers in Latin America. It also exhibits a 70 million following in Europe, Africa, and the Middle East. Additionally, Netflix boasts 30 million subscriptions in the Asia Pacific (Stoll, 2021). As indicated, the company is a multinational powerhouse integrated into every country save for a few, such as North Korea, Syria, mainland China owing to local restrictions, and Crimea because of US sanctions. The company also plays a significant part in the distribution of independent films.

Popularity Boom

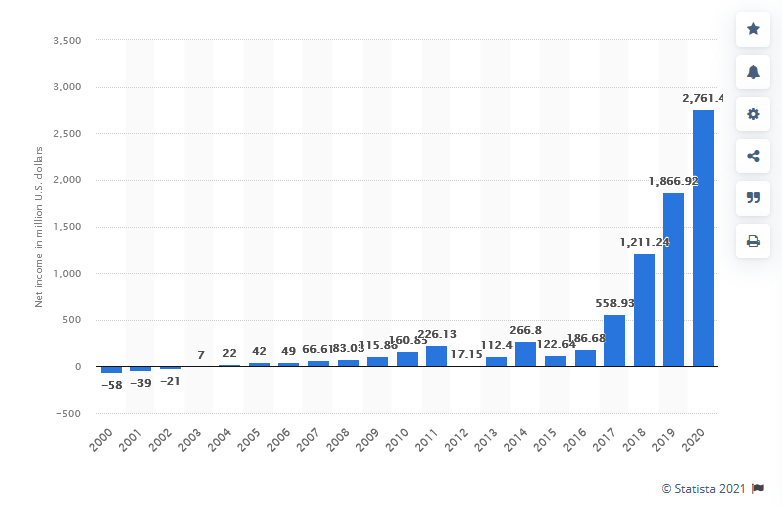

Netflix’s decision to offer its services via DVD instead of Video Cassette tapes was a significant boost for its operations. While it did not have high sales during its initial months, individuals popularly gave DVD players as a gift during the holidays in 2001. Additionally, while VCR sales were reducing, DVD subscriptions were proliferating. Increased sales such as subscriptions allowed Netflix to issue its IPO in 2002, where it sold 5.5 million shares of ordinary shares at US $15.00 per share (BBC, 2020). The company gained its initial profit in 2003, using $272 million to earn $6.5 million in revenues (BBC, 2020). In the subsequent year, the profit rose substantially to $49 million. In 2005, the company sold 1 million DVD copies every day and had 35,000 varying films available to its customers (BBC, 2020).

Factors influencing its Supply and Demand Changes and their effect on its Price

Netflix has experienced several industrial boosts since its inception in the industry in 1997. For instance, the company’s initial growth began with the rise of DVD technology. The company’s well-integrated DVD subscription service provided a convenient way for a growing number of DVD player owners to watch movies. This boost was a lucky break due to a tendency for many individuals to procure DVDs as holiday gifts, promoting the organization’s business.

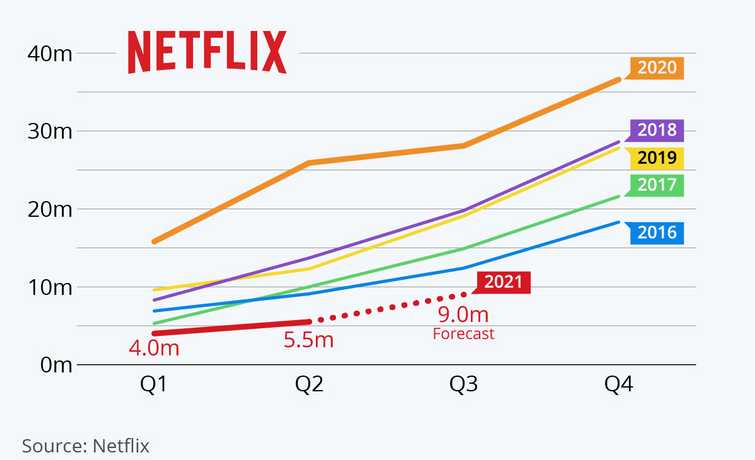

Additionally, Netflix lost and gained demand and supply owing to the COVID-19 pandemic. Many individuals subscribed to the streaming service during this period due to lockdowns which required them to stay within their homes. In 2020, Netflix gained 16 million new subscribers within the US (BBC, 2020). Furthermore, the company’s market share grew rapidly during this period as investors projected it would grow in size as more people were forced to stay within their homes. Nonetheless, Netflix suffered as governments halted film production across the globe. This problem resulted in fewer offerings for a growing number of customers. While Netflix had a more considerable demand, its supply grew smaller.

Changes in Supply and Demand

Netflix’s first demand growth came in late 2001. The company had experienced rapid growth and had 120 employees by this year, prompting Netflix to consider issuing an IPO. However, the 9/11 attacks and the dot-com bubble burst elicited reducing sales as fewer people sought the company’s offerings (McCord, 2014). Netflix put its IPO on hold and laid off almost a third of its employees. Nevertheless, the company would see the unexpected happen when there was a craze or DVD players that Christmas. Netflix found itself with 30% fewer employees than it needed to sustain operations as demand for DVDs rose substantially (McCord, 2014).

Furthermore, Netflix also gained a sizeable subscription market outside the USA in 2020. Subscriptions rose by almost 16 million people within the first three months of that year, exhibiting close to double the sign-ups seen in the final quarter of 2019 (BBC, 2020). Additionally, despite Europe, the Middle East, and Africa accounting for almost 7 million new subscribers, sharp drops in many currencies’ values resulted in reduced revenues (BBC, 2020). New subscriptions were not as valuable during the first quarter of 2020 as they were before the pandemic, reducing its international revenue growth. It is important to note that despite lags within the US and Canada, 2020 resulted in almost 2.3 million new subscriptions (BBC, 2020). This resulted in Netflix experiencing a higher share price as it grew by more than 30% due to investor speculation of its capacity to benefit from people staying indoors (BBC, 2020). The company also boasted a $5.7 billion increase in revenue, exhibiting a 27% growth in 2020 compared to 2019. Additionally, its profits doubled to $709 million, up from $344 million within the same quarter in 2019 (BBC, 2020).

Netflix experienced substantial growth in 2021, illustrating its potential to increase demand for its products and services post-pandemic. Such moves can be attributed to reduced lockdown restrictions that have allowed the creation of more films and different work-life designs that have started promoting home-based working in some institutions. The company illustrated a 4.4 million increase in subscriptions during the third quarter of 2021 (Chan, 2021). This has increased the subscription number to 214 million subscribers (Stoll, 2021). Netflix surpassed its projections for the period as it had sought to boost its paid subscribers by 3.5 million individuals (Chan, 2021). It is important to discern that Netflix’s subscription growth is primarily attributed to the Asia-Pacific region. The area accounted for about half of the quarter’s net subscribers, that is, 2.2 million (Chan, 2021). Furthermore, the company showcased continued high revenues in Europe, the Middle East, and Africa, where Netflix garnered 1.8 million new subscribers from October 2021 (Chan, 2021). Netflix also gained 70,000 new followers within US and Canada and 300,000 subscriptions in Latin America (Chan, 2021). Therefore, Netflix has boosted its demand due to increased supply as it lost 400,000 subscribers in its home country last quarter (Chan, 2021).

Analysis

Netflix’s first boost resulted from three simultaneous issues occurring. There was significant growth in technology, with the inclusion of DVDs within the market. VCR cassettes were bulky and relatively not varied from the newer and sleeker DVDs (McCord, 2014). The latest products were light, posited similar features to VCRs with the benefit of lightness and almost identical prices. Switching from VCRs to DVDs was also prompted by rapid growth in dot-com connotations. The company’s founders developed the business entity at the end of an era as more people switched from older versions of the technology (McCord, 2014). Many individuals had the luxury of acquiring DVD players and promoted Netflix sales in 2001 due to the machine’s relative inexpensiveness compared to VCRs. DVDs boosted the market for DVD providers, a market that Netflix had joined as the first company. Blockbuster, a VCR subscriptions provider, would make an erroneous business decision, refusing to procure Netflix as it was a pioneer in the field (McCord, 2014). This worked to Netflix’s advantage in the log-run as it is the largest streaming service in the world.

Furthermore, Netflix benefitted immensely during the COVID-19 period. While it did not gain a lot of revenues in 2020, it was among a select number of businesses that elicited profit within the period (BBC, 2020). For instance, the airline industry was facing significant losses as a whole and losing market share while individuals were investing in Netflix as it appeared to grow. Therefore, despite making few profits, Netflix boosted its number of new subscribers and reached a broader market beyond the US and Canada. While it did not make a lot of sales during this period, it is crucial to consider that the incident was not isolated and happened to every company in the entertainment industry. The company’s competitors were also adversely affected by their inability to create new content as movie sets were prevented from operating. In this manner, Netflix increased its market share, an issue that would prompt additional sales in the future.

Netflix posited positive results throughout 2021, illustrating its potential to remain relevant after the COVID pandemic. It also gained a sizeable market share after it released a Korean-based film, Squid Game (Chan, 2021). The movie was received remarkably around the world and increased Netflix’s offerings. Its focus on other regions such as Africa and the Middle East could be attributed to favorable internet conditions. The company’s streaming service also coincides with a major boom in technological penetration within other regions such as Asia, enabling Netflix to gain large numbers of subscribers from these regions. Continued integration of Netflix in the global economy is likely to propagate it to higher levels. It is tapping into markets that its competitors, such as Apple TV, are barely trying to penetrate. Increased internet adoption in these areas could see Netflix extensively boost its demand beyond its competition.

Conclusion

Netflix has grown immensely since its creation to become the world’s largest content streaming platform. It has recorded numerous profits since its development and continues to grow rapidly. Netflix has significant demand and has formed many partnerships and created its production company to increase its supply of products. The company’s 214 million paid subscribers attest to its capacity to provide entertaining content to its viewers. It is also relatively inexpensive, prompting many individuals to remain loyal once they subscribe to its offerings. Nonetheless, Netflix sees the potential for video games, a market that has been growing substantially. This is a good business decision as it would enter another lucrative business. Its revenues would allow Netflix to weather more prominent players in the gaming industry. If I were to produce Netflix’s commodity, I would offer some games using virtual reality headsets as they are a growing market among gamers in the world. I would also develop an NFL or FIFA-related game as they are among the most widely played games in the world. Netflix would also benefit from another boost in shares from gaming as it would diversify its offerings. Gaming institutions did not experience a significant drop in sales as their film counterparts.

References

BBC. (2020). Netflix gets 16 million new sign-ups thanks to lockdown. BBC News.

Chan, J. C. (2021). Netflix adds 4.4m new subscribers in third quarter, surpassing projections. The Hollywood Reporter.

McCord, P. (2014). How netflix reinvented HR. Harvard Business Review.

Stoll, J. (2021). Netflix. Statista.