Introduction

Technology has played a critical role in advancing financial inclusion globally. According to Boitan and Marchewka-Bartkowiak (2021), millions of people who previously lacked access to financial products, such as savings accounts, investment accounts, and loan products, can now obtain them through emerging technologies. Financial technology, often referred to as “FinTech,” has introduced a wide range of financial products to people who previously lacked access to conventional bank accounts and products.

Cryptocurrency has also emerged as a financial product deeply rooted in technology. It makes financial investment easily accessible to people who cannot understand or have access to various financial investment products (Sahay, 2020). This study will be grounded in the topic of financial technology and its role in enabling millions of people worldwide to access financial products and services. The researcher will focus on studies that have examined the impact of financial technology on the accessibility of financial products to the general public worldwide. Upon reviewing the preliminary literature, it became apparent that cryptocurrency is gaining popularity as a financial investment product worldwide (Sahay, 2020).

However, there is a knowledge gap about the stability and future of this financial product. Addressing this gap is important because it will help determine whether this product is worth investing in, especially when compared with traditional financial investment products such as mutual funds, fixed deposits, bonds, stocks, and equities. It will also make a significant contribution to the literature and practice in this field, as it will enable individuals to make informed decisions when investing in cryptocurrency. The researcher seeks to answer the following question through this study: “How stable is cryptocurrency as a financial investment product relative to traditional investment products?”

Methodology

The role of technology in enhancing financial inclusion has been a topic of growing interest among scholars for several years. Technology has become a critical tool in the field of finance. In this section, the focus is on discussing the method that will be used to conduct the study. The overall research methodology to be applied is explained, along with the research methods employed within it. This section also outlines the approach to data analysis that will be employed and the methodology for the write-up. This study also includes a detailed discussion of ethical considerations.

Defining the overall research methodology helps readers understand how the study applied specific research principles to achieve its primary goals and answer the research questions. It defines the primary assumptions and the pattern used to arrive at the study’s conclusion. It includes research philosophy and research approach.

Research Philosophy

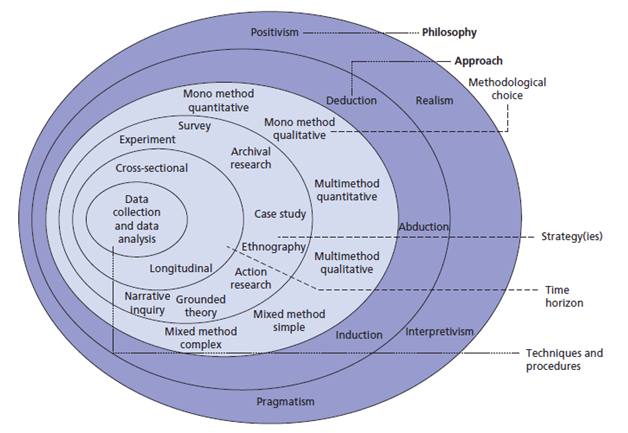

When planning to conduct research, defining the philosophy is one of the first steps that should be taken. Research philosophy involves defining the epistemology, ontology, and axiology of the study. According to Eisend and Kuss (2019), research philosophy refers to a set of beliefs and assumptions that one embraces in the development of knowledge. The selected philosophy will define the method that the researcher takes to collect and process data from various sources. A researcher can employ positivism, interpretivism, realism, or pragmatism, as illustrated in Figure 1, depending on the study’s aim and objectives. The researcher chose pragmatism as the most preferable research philosophy in this study.

Pragmatism is one of the most popularly used research philosophies in the social sciences. Pragmatism holds the belief that a concept is true and relevant only if it can be applied to support action. Aityan (2022, p. 26) explains that pragmatists “recognize that there are many different ways of interpreting the world and undertaking research, that no single point of view can ever give the entire picture and that there may be multiple realities.”

Instead of strictly limiting a researcher to a specific method of doing the research, it allows one to use various methods, as long as the knowledge developed is actionable. It means that when one applies this philosophy, one can employ qualitative, quantitative, or mixed-methods research. Scholars have published literature explaining the superiority of this philosophy over others in the context of social science research. Machado and Davim (2020) explain that one of the main strengths of this method is that it does not limit a researcher to a specific data analysis strategy. Instead, it allows one the flexibility of collecting and processing data from various sources. It also allows the use of mixed-method research when conducting analysis.

However, the main weakness of the method is that the time required to collect and process data may be longer than when using other philosophies. Positivism will not be employed because it restricts the researcher to quantitative methods of data analysis (Eisend & Kuss, 2019). Similarly, interpretivism is not suitable because it limits the analysis of data to qualitative methods. Realism will not be employed because it is only appropriate when conducting a pure science study, often in a laboratory setting.

Research Approach

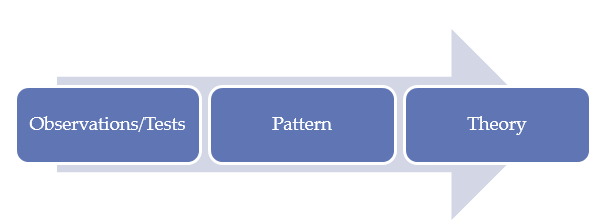

When research philosophy has been defined, the next step is to determine the research approach. The underpinning principles and assumptions of the chosen research philosophy should support the selected research approach. As Eden et al. (2019) observe, the term refers to the general procedure and plan used to conduct a study. It is the process that is used to develop new knowledge. One can use deductive, inductive, or abductive approaches to develop new knowledge. The researcher considered inductive methods as the most appropriate research philosophy.

The inductive approach is one of the most widely used methods for developing new knowledge. It does not require the development of a hypothesis based upon a specific theory as the foundation of the investigation. Instead, it requires a researcher to start with a research question and to stipulate the aim and objectives of the study.

As shown in Figure 2, once the question is set, a researcher must make observations by collecting data from specific sources. The observation would then lead to the development of patterns, which would ultimately culminate in a new theory or body of knowledge. The deductive method will not be used because the researcher had no intention of developing a hypothesis to define the development of knowledge.

Research Methods

Once the research philosophy and approaches are established, a researcher must select a method capable of collecting the specific data necessary to answer the primary question (Esteban-Bravo & Sanz, 2021). This study utilized mixed research methods, drawing on secondary data, observation, and interviews to collect the required information from the participants.

Secondary data will be instrumental in informing this study since it enables researchers to understand what other scholars have discovered in a specific field (Machado & Davim, 2020). Through a review of literature, one can avoid the mistake of duplicating already existing information. The review also enables an understanding of the knowledge gaps that need to be addressed. The researcher will also be able to develop a background for this study based on the secondary data that will be collected. The literature review chapter of the document will be based solely on data collected from secondary sources.

An interview is another method that will be considered instrumental in collecting the data needed for the study. Bougie and Sekaran (2020) argue that once a literature review is completed and knowledge gaps are identified, a researcher needs to collect primary data to address the gaps. One of the most effective ways to address knowledge gaps is to conduct an interview.

Having a face-to-face interview is often one of the best ways of collecting primary data (Eden et al., 2019). It enables the collection of necessary information directly from individuals who are believed to possess the desired knowledge due to their level of education and experience. Alternatively, one can conduct an online interview with the sampled participants in cases where a face-to-face interview is not possible (Eisend & Kuss, 2019). A phone interview is an effective method of gathering the needed data.

The researcher considered observation as another effective tool for collecting primary data. The number of mobile money transactions in India is skyrocketing. It is now possible for individuals to send and receive money, as well as make payments, using their mobile phones in India.

Cryptocurrency is also gaining popularity in the country, especially among young and techno-savvy citizens. It is easy to observe how people make various transactions using technology. It is also easy to observe how technology has made various financial products, such as loans and savings products, more accessible. Mobile applications have become massively popular in the country. Through observations, it will be possible to respond to the primary research question of the study.

The researcher was unable to utilize all possible methods of data collection. For instance, it will not be possible to use experiments when collecting data for the study. Bougie and Sekaran (2020) argue that an experiment should ideally be conducted in a controlled environment, such as a laboratory.

In this social study, it will not be possible to control the subjects. The role of the researcher was limited to the collection and analysis of data. The researcher was able to observe the trends and interview participants without attempting to influence their actions in any way.

Data Analysis

Once data has been collected, the next step is to analyze it to address specific research questions. As mentioned above, the researcher opted to use a mixed-methods research design as the most appropriate approach. Thematic analysis is one of the methods that will be used to process primary data.

Thematic analysis is a qualitative approach to processing data (Bougie & Sekaran, 2020). It involves examining transcripts or interviews to identify common themes that emerge. In this case, it involved identifying how people who previously had no access to financial products in the conventional banking system are now using technology to access them. The thematic analysis helped to identify how products such as mobile loan apps, mobile money transfers, mobile money payments, and cryptocurrency are rapidly gaining popularity in India and around the world.

Correlation analysis is also considered another important method of processing primary data. The use of statistical methods enables the determination of a relationship between two or more variables (Machado & Davim, 2020). In this case, it will be possible to determine whether technology has indeed influenced global financial inclusivity.

Using correlation analysis, it is possible to determine the impact of technology on financial inclusivity. The analysis enables an understanding of the degree of the relationship. The selected mixed-methods approach is considered effective in providing a comprehensive analysis of the primary data collected from the field.

Presentation Approaches

The final stage is to present the findings derived from the analysis of data from various sources in a manner that addresses the research questions. It has been explained that data will be analyzed both qualitatively and quantitatively. The presentation had to take the two approaches used to process data.

Thematic analysis of the data will be presented in the form of themes, along with a detailed explanation of each. For instance, when a mobile loan app was identified as one of the financial products made available to the masses with the help of technology, the researcher had to explain the same. It started with the direct quotes from the respondents, which led to the development of patterns. The patterns identified from the respondents’ statements were then used to develop themes that directly explained how technology has helped advance financial inclusion globally.

The statistical analysis will be presented in the form of charts, graphs, and figures. When statistical tools such as Microsoft Excel spreadsheets or Statistical Package for the Social Sciences (SPSS) are used, the outcome of the analysis is often presented in appropriate figures. The outcome helps to confirm or reject the existence of a relationship between the analyzed variables. It also helps in determining the degree of the relationship between the variables being analyzed. Each figure presented will be explained in detail to help readers understand the concept being explained.

Ethical Considerations

When conducting research, one is expected to be aware of and address ethical issues at various stages of the report’s development. One of the ethical requirements, as Esteban-Bravo and Sanz (2021) explain, is to get consent when collecting data from an institution. The consent protocol employed in this study will be two-fold.

The first step will be to get consent from the institution whose employees will participate in the study. A formal letter will be written to management explaining the nature and relevance of the study, as well as the reason why the institution was chosen. The employees were contacted only when consent had been obtained.

The second step will be to get consent from the individual participants in the study. The researcher contacted the participants and explained the study’s goal and the rationale behind their selection. They were reminded that their participation in the study is voluntary. Any question or concern that any of them had will be adequately addressed.

The protection of participants is another primary ethical consideration that researchers must observe. Eden et al. (2019) explain that individuals may sometimes be victimized or even attacked when they hold an opinion contrary to that of the majority or those in positions of power. To avoid exposing the participants to such threats, their identities remained anonymous. Instead of using their actual names, participants will be assigned numbers (Participant 1, Participant 2, Participant 3, etc.) for identification purposes. They will be informed that their identity will remain anonymous to ensure they do not fear participating in this study.

Data storage, usage, and disposal are also critical ethical issues that require definition. Once responses were obtained from the respondents, they will be processed to help respond to the research questions. Once these questions have been answered satisfactorily, the materials from the respondents will be destroyed. This step is designed to further minimize the possibility of third parties gaining access to data that could help identify the participants. Processed data that cannot be used to identify the respondents will be included in the report.

Once the report is written and proofread, it will be delivered to the instructor according to the guidelines provided by the school. The researcher will retain a copy of the report that has been delivered to the instructor. As an academic report, it will be ethically important to avoid all forms of plagiarism. As such, the report will be written from scratch based on data obtained from secondary and primary sources.

Conclusion

The preliminary review of the literature indicates that technology has played a crucial role in advancing financial inclusion worldwide. Various financial products that were previously unavailable to the masses who lacked bank accounts have become accessible through mobile phones. In this report, the researcher focused on explaining how data will be collected and processed to determine how technology has helped advance financial inclusivity globally. The paper also explains how the data will be processed, interpreted, and presented to facilitate easy understanding of the findings by readers. Data in this study will be obtained from both primary and secondary sources.

The researcher considered pragmatism to be the most appropriate research philosophy that would underpin the principles and assumptions made in the study. An inductive approach was also selected as the most suitable method for developing new knowledge. These paradigms enabled the processing of primary data both qualitatively and quantitatively. The study aims to provide a detailed explanation of how technology is transforming the financial sector, with a specific focus on making financial products accessible to the masses.

The study aims to explain how financial institutions have responded to the changes brought about by technology over the past few decades. Based on the findings of the study, future scholars should focus on understanding the dangers that technology poses to users, especially the vulnerable and low-income segment of customers who previously had limited access to financial products in commercial banks.

References

Aityan, S. K. (2022). Business research methodology: Research process and methods. Springer.

Boitan, A., & Marchewka-Bartkowiak, K. (2021). Fostering innovation and competitiveness with fintech, regtech, and suptech. IGI Global.

Bougie, R., & Sekaran, U. (2020). Research methods for business: A skill-building approach. John Wiley & Sons.

Eden, L., Nielsen, B., & Verbeke, A. (2019). Research methods in international business. Palgrave Macmillan.

Eisend, M., & Kuss, A. (2019). Research methodology in marketing: Theory development, empirical approaches and philosophy of science considerations. Springer.

Esteban-Bravo, M., & Sanz, J. (2021). Marketing research methods: Quantitative and qualitative approaches. Cambridge University Press.

Machado, C., & Davim, J. P. (2020). Research methodology in management and industrial engineering. Springer.

Sahay, R. (2020). The promise of fintech: Financial inclusion in the post COVID-19 era. International Monetary Fund.