Executive Summary

This paper represents the continuation of a feasibility study directed at determining potential solutions for the line of wearable devices developed by TechSystems. It starts with determining the attractiveness of three options that were suggested to resolve the challenges associated with insufficient sales and product innovativeness. Discontinuing the product line, the first option, was found to be less preferable due to high losses and the cessation of production. The second option, partnership with a sister company, was regarded as the most appropriate solution, as in this case the company preserves its product, brand name, and at least part of the corresponding revenues. As for the last option, selling the product line to an industry giant, it was found that high losses and risks specific to the given company and situation make it an unattractive choice.

The project outcomes were defined for each of the options. If the first and the third cases imply a full transition of the product line to other companies, the second case means the preservation of the brand name and significant revenues. In addition to possible financial advantages, there are also non-monetary benefits. Since the solution involves not only financial issues but also customers, employees, and stakeholders, it was essential to understand how each option would be perceived in terms of these factors. If TechSystems selected the first option, it is likely that 45 percent of users and five percent of stakeholders would be dissatisfied with it. The second option would fit the expectations of all parties who are either directly or indirectly involved in the decision-making process. Ultimately, the third option is likely to be perceived negatively by some stakeholders and the majority of users. Therefore, considering that there are three options to choose from, it is safe to recommend selecting the option of creating a partnership with a sister company.

Attractiveness – Achievability Chart

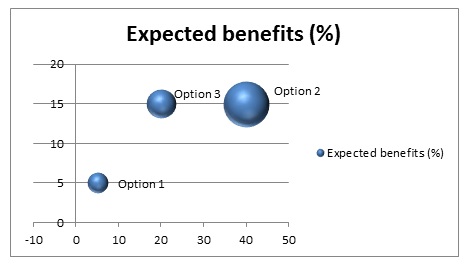

The first option, discontinuing the wearable devices product line, is the least complicated way to resolve the issue of insufficient sales. It implies ceasing production of fitness trackers, while losses would remain uncovered. However, it seems essential to consider both advantages and drawbacks of this option to ensure that the most appropriate decision would be ultimately made. As it can be seen in Chart 1, both expected benefits (revenues) and risks are relatively low. Discontinuing a product means the shutdown of production that is made when the funds invested in the production and marketing of this product can no longer be justified from the point of view of the company. The key issues involve economic reasons (unprofitability), technical and technological reasons (outdated technology), and the absence of necessary resources such as skilled personnel and appropriate distribution channels.

Likewise, the modern world of business frequently encounters the phenomenon of Volatility, Uncertainty, Complexity, and Ambiguity (VUCA). Time has accelerated, changing the market, customers’ preferences, and the organization of companies (Gambles, 2017). There is a direct relationship between the size of a firm and its sensitivity to change. Small businesses like TechSystems today feel much more confident than corporations that are ready to offer budgets, strategies, and support for start-ups with low time-to-market indicators. The main goal of such a partnership is to allow TechSystems to continue the production of fitness trackers and gain experience in fulfilling the needs of customers. As for TechSystems in general, the advantage of a partnership is an individual approach to the formation of pricing policy and loyalty programs, as well as the right to sell the gadgets under a unique brand. For partners, support in negotiations with customers along with technical, marketing, and advertising assistance are guaranteed (Gambles, 2017). Such conditions are likely to make it possible to derive the maximum benefit from sales. As indicated in Chart 1, the expected revenue is 40 percent, and risks are at 15 percent.

The third option presented to address this situation is selling the product line to a large company that is interested in increasing its market share. The market for the purchase and sale of ready-made businesses is growing at a rate of 20-50 percent (Kerzner, 2017). An important condition for conducting a successful transaction is guidance from specialists in this matter who possess relevant knowledge and experience. It is necessary to fairly assess the value of the business and to describe it both in general as well as in detail concerning its economic aspects, technical characteristics, assessment data, expertise, tangible assets, prospects for development, and potential pitfalls. A large team of in-house attorneys and procurement team specialists would lead to additional losses. Therefore it can be expected that selling the product line to an industry giant would be associated with significant financial losses. Chart 1 illustrates that the third option is the second in the range of possible solutions. In particular, while its expected benefits are assessed as 20 percent, potential risks are 15 percent.

Determining Project Outcomes

It is important to determine potential project outcomes for each of the three identified options. Making a decision about discontinuing production is greatly simplified if, at the stage of development planning, quantitative requirements that are to be met by the product line are set with sufficient certainty (Wilson, 2014). In other words, if the product has ceased to correspond to the previously established level of payback, sales, or profit, then the decision to cease manufacturing the goods becomes quite uncomplicated. When making such a decision, two points should be taken into account. First, the wearable products have already consumed significant resources of TechSystems regardless of the phase of its life cycle, including development, market research, marketing, etc. Second, there is a large amount of data about the current situation, creating an opportunity to conduct analysis, the results of which may be used for new product lines (Wilson, 2014). The project outcomes for this option would include focusing on some other new product or redirecting the resources to other products. As a result, the opportunity to enter a relatively new niche of fitness trackers would be lost.

Considering the potential project outcomes of the second option, one should emphasize that the company would preserve its product and brand name. In response, it is expected to return 60 percent of profits to the partner company. This option seems to be quite feasible for the company as it enters into cooperation with a corporation. Furthermore, when interacting with partners, a corporation would pay special attention to guaranteed compliance with their rights and interests as well as information transparency (Ferreira, Proença, Spencer, & Cova, 2013). Maximizing the effectiveness of investments in TechSystems and focusing on achievable and measurable results as well as clear and understandable partnership rules are the key principles of interaction. Any cooperation of the company with business partners would be based on the principles of equality, respect, and compliance with legal and ethical business standards.

The third option foresees the direct sale of the product line to a large company. When choosing possible buyers, it is important to consider the timeline as well as what price each of them can offer. Many leaders pay insufficient attention to what will happen to a business after a sale as they are guided only by the potential monetary reward. However, it is critical to take it into account along with employee and customer motivation. As 15 percent of employees would like to continue working on this product, they are more likely to be dissatisfied with this option. Often managers resort to the help of outside organizations that assist with the entire process of selling a product line. They conduct an analysis of the market, competitors, consumers, the financial condition of the enterprise, and so on (Hill, Jones, & Schilling, 2014). Their services are not cheap, however. Choosing a company with experienced specialists guarantees proper documentation and effective marketing. The third-party companies can help not only to increase the cost of the product line but also to sell it in the most profitable way to the most preferable and reliable buyer. As a result, TechSystems is likely to cover its financial losses on the device, yet also lose its product.

Non-Monetary Benefits

The starting point in decision-making concerning the termination of the wearables product line should be an awareness of the company’s objectives. Another critical point is the attitudes of employees towards the situation. Fifteen percent of TechSystems’ workforce supports the new product. In this case, since the objectives of the enterprise are the development of advanced technologies and access to larger markets, it seems important to select some other option rather than ceasing production. It is appropriate to focus attention on the second option of partnering with a sister company.

There are several factors that make the second option the best solution for the survival and further successful development of the product line. Since 45 percent of users of the product are young experts who also utilize a third of the products from other product lines, there is an evident interest in new devices. Customers want to have innovative gadgets that would be competitive with and more attractive than those of the company’s rivals. The fact that the sister company offers its assistance with updating Bluetooth version and covering manufacturing costs also indicates the relevance of the product. More to the point, employees would benefit from partnership and cooperation with professionals working on other projects. In the framework of cooperation, links may be established with the design studio, technology department, and manufacturing section.

Performance excellence, innovation, and risk management are the key items on the agenda for corporate leaders. Innovative strategy, as a rule, covers such areas as products, structures, processes, business models, communications, interactions with clients, and so on (Huxham & Vangen, 2013). For long-term success, corporate innovators should develop the habit of curiosity, a constant search for additional information, and the involvement of other creative people. Companies like Facebook, Google, and Intel are acquiring startups with well-established venture capital tools since investments in start-up businesses or their acquisition can be a way of obtaining new technologies, knowledge, and expertise. Instead of attracting specialists or other third parties, corporations can immediately interact with small business leaders.

Also, corporations organize various meetings and conferences with specialists all over the world. For example, the annual summits of the Mobile Marketing Association show how Unilever or Mondelez are working with start-ups. In particular, Unilever is calling directly for collaboration at global events (Huxham & Vangen, 2013). Timely reaction and flexibility are two issues that are beneficial both for TechSystems and its potential partner as some of the most important factors for a startup as well as for a corporation. However, and more importantly, the ability to find mutual interests while remaining sensitive to the expectations of customers and market conditions would benefit first from a quick test before moving on to more extensive cooperation through investment, purchase or technological partnership, or partnership on the basis of profit sharing.

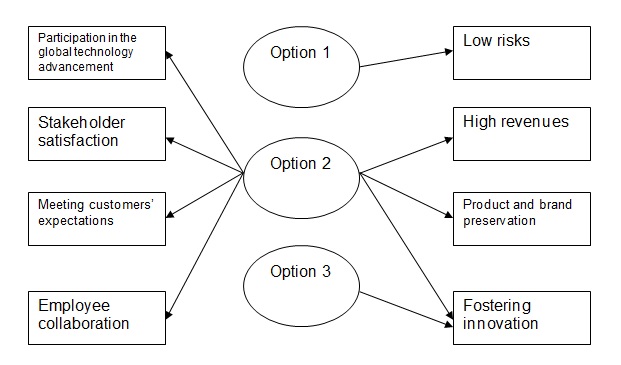

As for the third option, to investigate the potential business acquisition, the duration of the transition period averages approximately a month. In particularly difficult cases, this stage can last from six to twelve months (Hill et al., 2014). During this time, any shortcomings identified during the inspections are eliminated, acquaintance is made with key customers (as well as suppliers, networks, etc.), and contact is made with representatives of controlling and permitting bodies with whom it will be necessary to communicate in the future. An inventory is conducted of accounts payable and receivables, commodity balances, cash balances on accounts and in the cash register, which is more convenient to assign than other procedures. The following Chart 2 summarizes the benefits of the three options:

References

Ferreira, F. N. H., Proença, J. F., Spencer, R., & Cova, B. (2013). The transition from products to solutions: External business model fit and dynamics. Industrial Marketing Management, 42(7), 1093-1101.

Gambles, I. (2017). Making the business case: Proposals that succeed for projects that work. New York, NY: Routledge.

Hill, C. W., Jones, G. R., & Schilling, M. A. (2014). Strategic management: Theory: An integrated approach (11th ed.). Stamford, CT: Cengage Learning.

Huxham, C., & Vangen, S. (2013). Managing to collaborate: The theory and practice of collaborative advantage (2nd ed.). New York, NY: Routledge.

Kerzner, H. (2017). Project management: A systems approach to planning, scheduling, and controlling (12th ed.). Hoboken, NJ: John Wiley & Sons.

Wilson, J. (2014). Essentials of business research: A guide to doing your research project (2nd ed.). Thousand Oaks, CA: Sage.