Introduction

The report elucidates the key business environmental issues of the retail supersector and two companies within its food and wholesale subsector – Tesco and Sainsbury. According to FTSE Russell’s Industry Classification Benchmark, the retail supersector may be segregated into two sectors: food and drugs, and general sectors (FTSE 2012, p. 4). The food and drug sector is further divided into drug retailers, and food retailers and wholesalers. Tesco and Sainsbury are two leading supermarket chains in the UK. They specialize in selling grocery and general merchandise. Both companies belong to “food retailers and wholesaler” subsector. This report presents a comprehensive analysis of the business environment of the retail supersector in the UK and its subsectors, especially Tesco and Sainsbury.

Business Environment

Economic

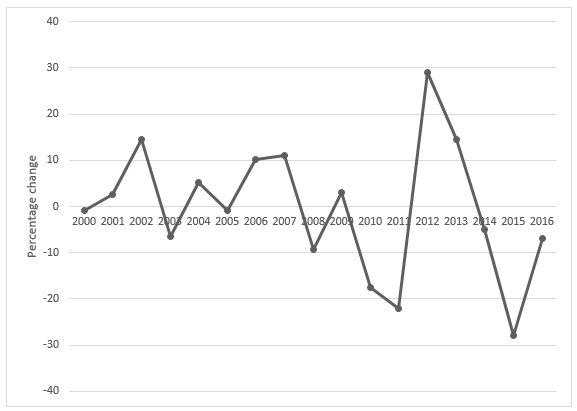

Since 2000, the growth rate has declined considerably in the UK retail supersector. Further, since 2012, the sector has consistently shown a decline in sales (see figure 1). This section provides macro-environmental factors that may have affected the fall in retail supersector sales in the UK.

Economic factors include factors related to the economic environment of the supersector, fiscal and monetary policy that directly or indirectly affects the businesses within the supersector and economic condition of the consumers (Worthington & Britton 2015, p. 83). The problems faced by the retail supersector in the UK are increasing costs and slow economic growth. The global financial crisis has reduced the growth of the overall economy. The economy faces high rates of inflation and unemployment. This reduces disposable income and dampens consumer demand.

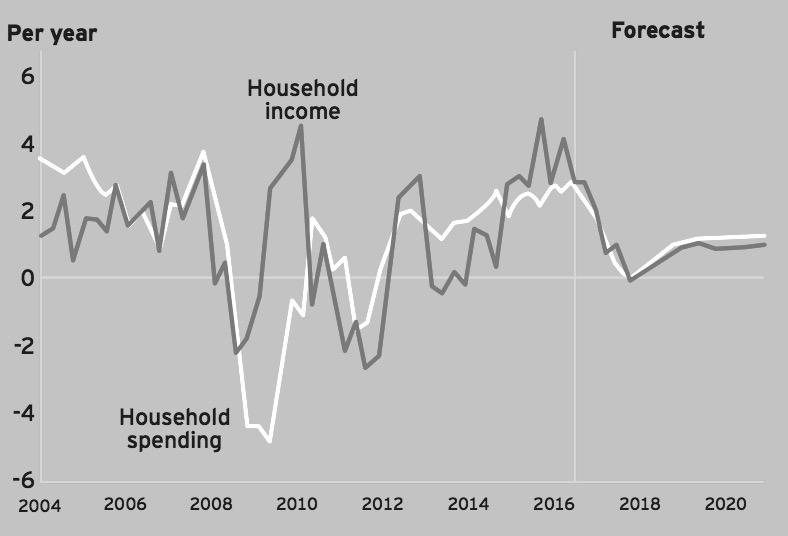

Household disposable income in the UK has reduced considerably, which has lowered household spending. Disposable income has fallen by 0.3%, resulting in a drop in consumer spending from 2.8% in 2016 to 1.7% in 2017 (EY 2017, p. 2). Figure 2 shows the yearly movement of household income and spending in the UK. It shows that the household income and spending have been decreasing and are expected to fall further.

Political

Political environment has a strong influence on retail business (Worthington & Britton 2015, p. 46). General elections held for Brexit and continued negation in this regard have created an environment of political and economic uncertainty. Brexit has also raised operational and supply chain difficulties. This has forced the supersector to pass some of its increased cost to the consumers, which has augmented retail prices. Further, the depreciation of the UK pound has created greater pressure. The rise in the cost of fuel and other commodities has also affected the supersector adversely.

Social

Changes in consumer preference towards online and mobile retail have strongly affected the retail supersector. E-retailers like Amazon are expanding aggressively in the UK market that reduced the market share of many of the retailers like Tesco and Sainsbury by 1.8% (PWC 2017, para. 5).

Legal

Many changes have been incorporated in the employment law of the UK in the retail sector due to Brexit. All retailers have to make a gender pay gap report. A new apprenticeship levy has been implemented in 2017. There has been change in the minimum wage since 2017. Further, employers who hire foreign nationals have to pay an annual charge.

Labour Market

The UK labour market has undergone a slowdown as unemployment rose in 2017 and wage growth fell from 2.9% to 2.8% (Inman & Monaghan 2017, para. 2). As there are more unemployed labours available in the market, the retailers have higher power to bargain for lower wages.

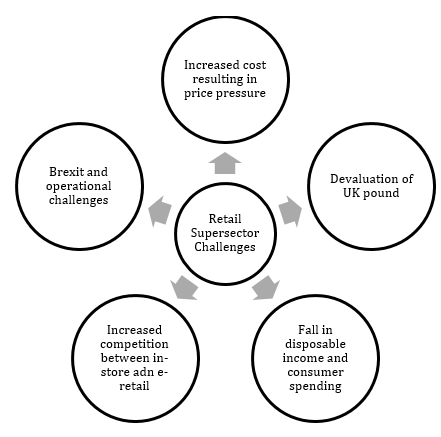

The overall challenges faced by the retail subsector from the macro-environment can be summarized as shown in figure 3.

Impacts on Food Retailer & Wholesalers Subsector

Brief Background

The food retailer and wholesale subsector include retail sales in all kinds of food products (packaged and non-packed), beverages (alcoholic and non-alcoholic), tobacco, and household products (MarketLine 2016). The food retailer and wholesale is one of the most important subsectors of the retail supersector. This subsector has been experiencing decelerating growth for the last few years. The subsector posted a compound annual growth rate (CAGR) of 2.1% between 2011 and 2015 (MarketLine 2016). The packaged food section of the subsector had the largest share in the total revenue of the subsector (43.1% of the total sales of the subsector).

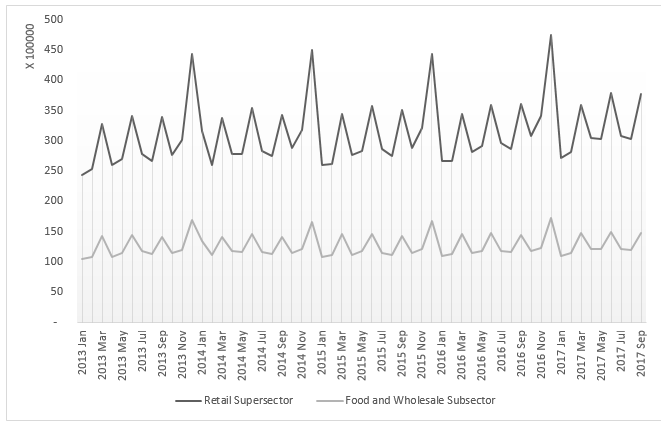

The UK food retail and wholesale subsector is one of the most advanced subsectors worldwide. Figure 4 shows that the food retailer and wholesale subsector have the largest share in total retail supersector sales since 2013 through 2016 after non-food subsector sales. The numbers in the table demonstrate the declining share of food retailer and wholesale subsector and a constant increase in the sales of the online retailer.

The table clearly shows that the food retailer and wholesale subsector is facing stiff competition from the online retailers who have shown a 42% increase in online sales while that of the food retail and wholesale sector has increased just by 2.92%. This establishes that the food retailer and wholesale subsector in the UK is struggling in the face of technological advancement and the advent of online retailing.

Figure 4: Percentage share of the subsectors in total sales of the retail Supersector in the UK (Office for National Statistics 2017).

Figure 5 below shows that the overall monthly sales in the UK of the retail supersector and that of the food and wholesale subsector have shown similar trend. The sales figure for the supersector and the subsector rise and fall almost simultaneously indicating that the macro-environmental factors that affect the former, also influence the latter. Hence, it can be intuitively inferred that the food and wholesale subsector have also faced similar challenges, as has the retail supersector in the UK.

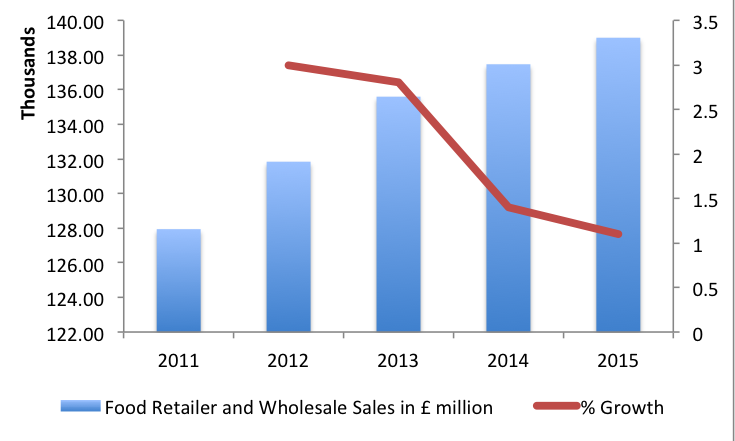

Figure 6 shows that the sales of food retailer and wholesale subsector have been increasing consistently. However, there has been a fall in the percentage growth rate, indicating that the subsector was not performing very well.

Sainsbury

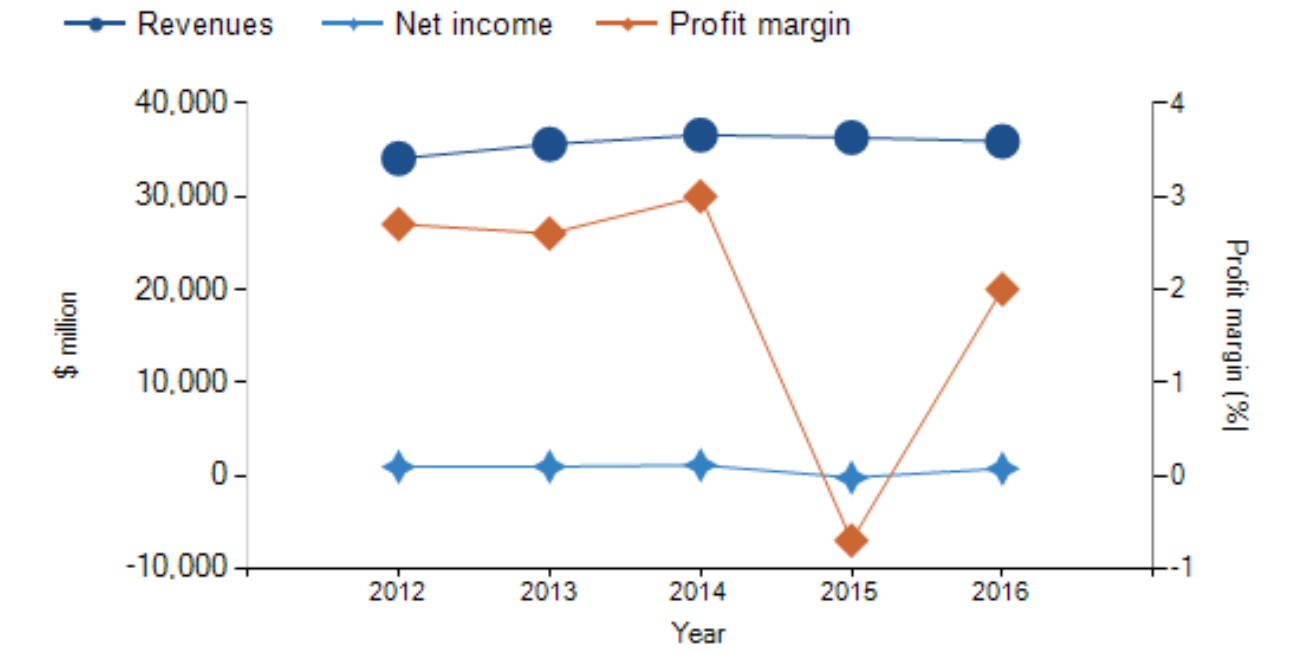

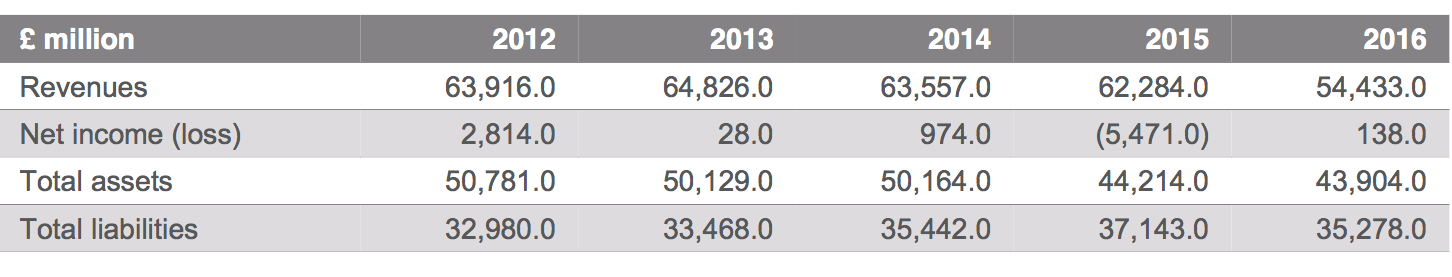

Two of the leading companies in this subsector are Tesco and Sainsbury. Sainsbury is a UK based food and non-food retailer that operates in the UK. It has 592 supermarkets, 1203 stores, and 24 million customers (MarketLine 2016, p. 20). Sainsbury recorded total revenue of £23,506 in 2016. The company incurred a loss of £471. The company posted a profit margin of 2% in 2016 which is much lower than 3% profit posted in 2014, but higher than 2015 when its profit margin fell to -0.7%. Sainsbury has faced a slowdown since 2015. Revenue growth fell to -0.7% in 2015 and reduced further to 1.1% in 2016. This shows that the company’s performance had been dwindling since 2015 (see figure 7).

Tesco

Tesco sells grocery, general merchandise, and non-food items. The company operates in the UK, other European countries, and Asia. Tesco had 3485 stores in 2015 in the UK (MarketLine 2016, p. 24). Tesco too faced a decline in its CAGR by 12.6% in 2016. Figure 8 show that the company has shown a marked decline in tis revenue from 2015 to 2016. Revenue growth fell from 8.6% in 2012 to -2% in 2015 and -12.6% in 2016.

The financial condition of the company indicates that the company has been facing financial troubles since 2015 as its revenue had gown down considerably. The company’s profit margin also declined from 4.4% in 2012 to -8.8% in 2015 and 0.3% in 2016. This had forced the company to reduce its employee strength by 2.1% in 2016 (MarketLine 2016, p. 24). Thus, the financial slowdown of the economy and the other economic factors adversely affected Tesco’s operations resulting in its dismal financial performance.

Impact of the Environment on the Subsector

The micro factors that affected the subsector the most are competition from the existing players, competition from substitutes (online retailers), change in consumer preference, and rise in cost. Macro level factors that affect the subsector are low household income, low consumer spending, economic slowdown, and Brexit. The micro level factors that affect the subsector are derived from the macro factors discussed earlier.

Competitors

The subsector has become fiercely competitive with new entrants and small retailers entering the market. Further, the UK subsector also faces intense competition from American retailers like Wal-Mart that has slowly entered the UK market. As buyers have a lot of options with no switching cost, the fight for market share has become intense. Though larger companies like Tesco, Sainsbury, Asda and Morrisons hold majority share of the market, intense price competition and new entrants has made operations difficult. Further, price sensitive consumers and heavy discounts as a means to lure customers has made the subsector very competitive, which has reduced its profitability.

Economic

Global financial crisis has made operations more difficult for the retailers in this subsector. Financial crisis has reduced disposable income of the consumers. High inflation rates and low income has resulted in low consumer spending. Fewer purchases have reduced the revenue and profit of the companies in the food retailer and wholesaler subsector. Low consumer demand has forced the retailers to take drastic measure of discounting in order to attract buyers, which has proven counterproductive, as it has reduced their revenue.

Legal and Political

Brexit too had a strong effect on the performance of the subsector. This stopped all free trade relations between the UK and the other European Union countries. This increased the cost of operation of the subsector. The retailers had to look for other suppliers or pay more to purchase the same products. This increased the cost of operation.

Social

Expansion of the online retailers entering the food retail and wholesale subsector have created immense problem for the in-store operators like Tesco and Sainsbury. Online retail market has shown an increase in sales since 2014, when the in-store retailers in the subsector have faced decline in growth. This has brought up the necessity to expand operations not only geographically but also in the digital space.

Reflections

The retail supersector has been undergoing deceleration for the past few years. The reasons for the supersector’s lacklustre performance are global economic slowdown, changing consumer preference towards online retailing, low consumer income and spending, and Brexit. These macro factors in turn affect the micro factors that affect the subsector’s performance. The food retail and wholesale subsector have posted a decline in sales and so has the two major retail supermarkets in the UK, Tesco and Sainsbury. These macro factors has led to the intensification of competition within the subsector, has caused labour market problems, supply chain issues and competition from substitutes (e.g. online retailers). Thus, the macro factors affecting the supersector infiltrates as micro factors and creates similar affect on the subsector.

Conclusion

Business environment has a strong influence on the performance of the supersector and the subsector. Some macro-level issues even affect the micro factors that affect the operations of the companies operating within the subsector. The report shows that the bad performance of Tesco and Sainsbury was a direct result of the macro-level factors affecting the retail supersector.

Reference List

EY 2017, UK retail sector: trading in 2017. Web.

FTSE 2012, Industry classification benchmark.

Inman, P & Monaghan, A 2017, UK labour market shows signs of slowing.

MarketLine 2016, Food & grocery retail in the United Kingdom.

Office for National Statistics 2017, Retail industry.

PWC 2017, Total retail 2017. Web.

Worthington, I & Britton, C 2015, The business environment, Prentice Hall, Harlow.