Executive Summary

Thai-Lay Fashion Company is an existing garment manufacturing company in the UK having the business mission of achieving market leadership in the garment industry on a global basis with its well-designed and qualified garment products. The company’s objective is to get market acceptability through the production and marketing of both indigenous and export garment products. To achieve its market plan, the company has to overview financial sections, break-even analysis, and forecasting of sales and expenses. These techniques are useful for the company for identifying the financial performance over different production processes and segments.

Topical headings

In this discussion, the topics analyzed are financial sections overview, break-even analysis, sales forecasting, and expense forecasting. These are the relevant steps in preparing a marketing plan.

Financial sections overview

A properly prepared financial plan will act as a critical yardstick to measure the performance of business enterprises among different customer segments. “The purpose of the financial section is to formulate a credible, comprehensive set of projections reflecting company’s anticipated financial performance.” (Ernst et al 2004, p.406).

The financial objective of the company to maintain the optimum level of financial resources at the entire production and marketing level can be established through proper financial planning. For this, the company will have to use different budgets relating to different areas such as sales budget, production budget, performance budget, etc. This will act as the scale for measuring the performance of the company over different production stages. By preparing an income statement and balance sheet company will be able to analyze its financial performance and position over different periods.

A strategic marketing plan would help achieve the market goals within the time and cost constraints.

By preparing financial statements such as income statements and balance sheets periodically, the company analyses its financial performance over the past period. Financial objectives of securing adequate funds and avoiding surplus can be met through proper financial planning and its overview. It is an effective tool for finding improvements and defaults in the financial performance of the company over the years. Financial planning is a part of the market plan in which the strategy for acquiring necessary financial resources from the cheapest source and its effective management over different business functions is effectively carried out. Managing the funds without affecting the regular working of the enterprise is the basic function of financial planning.

By comparing the actual data with the projected data, it is found that the actual financial performance of the company for the half-year ended September 2008 is in tune with the projected performance. The projected performance of the company for the year 2008 is $ 84000 in which the segments of T- Shirts= 34000, Tank tops=14000, Sports/ swim wears= 11000, Jeans and Bermudas= 15000, Miscellaneous =10000, were included. The actual performance data for the half-year ended September 2008, is as follows: T- Shirts= 22000, Tank Tops= 6000, Sports/swimwears = 4000, Jeans and Bermudas= 10500, Miscellaneous= 6500.

The result shows that segments of T-shirts, Jeans& Bermudas and miscellaneous are showing above-average performance in sales revenue whereas the other sections of tank tops and sports/swimwear are showing below-average sales revenue. When analyzing the factors of financial performance it reveals that improvement in advertising and promotional activities must be employed for getting the projected market in product segments of the below-average performance.

Break-Even Analysis

Break-even analysis helps find out the minimum rate of return required to meet the cost of production. There are two types of cost, fixed and variable. Variable costs are changing with changes in the volume of production whereas fixed costs remain fixed. In order to find out the lowest sales revenue for covering the cost of production, variable costs and fixed costs are compared with this. “A break-even point defines when an investment will generate a positive return. It is the point where sales or revenue equal expenses.” (Break even point, 2008).

Calculation of Break-even sales of Thai lay

“Contribution = sales – Marginal cost or fixed cost + profit

P/V Ratio = Contribution / sales

Sales at BEP = Fixed cost / P/ V Ratio.” (Chapter 3 – Break even Analysis).

Fixed cost

Rent and rates = $10000, Depreciation = $2000, Research and development= $2000

Administration costs = $5000, Total fixed cost = $19000

Variable costs

Cost of Raw materials = $15000, Salaries and Wages = $10000

Maintenance cost =$2000, Fuel = $17750, Commission = $4000

Total variable cost=$48750

Contribution= Sales – marginal cost = $84000 – $48750 = $35250

PV ratio = contribution/ sales =35250/ 84000 =0. 42

Sales at BEP = Fixed cost / PV ratio = 19000 /0.42 = $45238

The minimum sales required for meeting the cost of production for the company is $ 45238. By fixing the target sales higher than the break-even sales, the company is able to attain profitability from the first year itself.

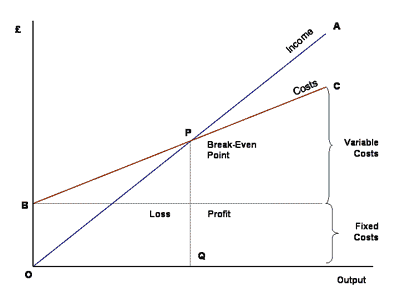

Break-even Chart

A Break-even chart is the graphical representation of costs at various levels of the production process. Break-even point is the point where there is no profit or loss.

Sales Forecast

Sales forecasting is necessary for business firms to measure their actual sales performance. By fixing targets the for sales, the company can identify the necessary steps for meeting their business goals within the fixed time. For adopting the correct sales promotional strategy, sales forecasting is a necessary factor. Sales forecasting involves the process of organizing and analyzing information to find out the sales target that can be and will be achieved by the firm within the specific time period (Sales forecasting, 2007).

Table 1. Sales forecasts. The forecasting sales of Thai-Lay for the years commencing from 2008 to 2011 is given below:

Expense Forecast

Expense forecasting will help firms to identify the necessary expenses that will be incurred for generating revenue. During the working of the business firm, many kinds of expenses will be incurred. Proper expense forecasting will help the company to find out the necessary financial resources for meeting these expenses timely (Profit and loss projection).

Expected total expenses to be incurred on different product segments of Thai-Lay for the years commencing from 2008 to 2011 is given below.

Table 2. Total expenses expected on different product segments

Conclusion

By following the techniques of financial sections overview, break-even analysis, and forecasting of expenses and sales periodically, Thai –Lay Company will be able to achieve their financial and marketing objectives successfully.

Bibliography

Breakeven Point Break- Even Analysis: Calculation of the Pont at Which the Gain Equals the Losses Explanation of Break-Even Point Analysis. (2008). [online]. 12 Manage: The Executive Fast Track.

Breakeven Analysis: Marginal Cost Equation and Breakeven Analysis. (2008). [online].Globusz Publishing. Web.

ERNST., et al. (2004). Financial Plan. [online]. Ernst & Young’s Personal Financial Planning Guide. 406.

Introduction to Break-Even Analysis: The Break-Even Chart. [online]. Tutor2u. Web.

Profit- and- Loss Projection. [online]. Inc.com: The Daily Resources for Entrepreneurs. Web.

Sales Forecasting. (2007). [online]. Canada Business: Online Small Business Workshop.