Introduction

All organizations invest in items like land machinery and other assets as a part of conducting business and for further expansion and increasing profitability and efficiency. The process of deciding which asset to buy or whether to buy it or not is usually referred to as capital investment decisions. Most organizations treat this area with care mainly because capital investments tend to be large amounts, and a wrong decision might result in serious consequences for it. “Capital investment decisions that involve the purchase of items such as land, machinery, buildings, or equipment are among the most important decisions undertaken by the business manager.” (Boehlje and Ehmke, p. 1).

Once a decision has been made, the next step is to finance the operation. This paper will discuss different methods by which managers can come to a capital investment decision and also about financing the business operations.

Investment decisions

The paper mentioned in the previous section further adds that two factors are important, and they have to be considered when making such decisions, especially if the investment is large. They are economic profitability and the time value of money. Any investment should remain as such, and this will happen only if it generates adequate returns. This is what is meant by economic profitability. The time value of money refers to the reduction in the value of money in the long run.

For example, if a hundred pounds can buy a certain quantity or a particular item at present, it will not be able to buy the same quantity after a period of five years. A certain amount of inflation and other factors will see to it that only a lower quantity of the same item can be bought five years later. Capital investments will recoup their value only in the long run, so this factor is very important when making decisions.

Methods

There are several methods that will help managers make capital investment decisions. These will be discussed here with reference to the Thai-Lay Fashion Company Ltd. The company is a garment manufacturer and exporter with its main markets situated across stores in Europe. The company has a turnover of HKD 10 million and employs about 250 workers. The company makes a variety of garments for men, women, and children.

The company has a finance department headed by a qualified accounting manager. The methods by which managers can take a correct investment decision are the Accounting Rate of Return (ARR), Pay Back Period (PP), Net Present Value (NPV), and the Internal Rate of Return (IRR). The first two are classified as non-discounted cash flow methods, and the last two are classified as discounted cash flow methods. (Methods of Ranking Investment Proposals).

Accounting Rate of Return (ARR): The ARR method calculates the return by dividing average net profit by average investment on machinery and is shown as a percentage. This rate of return should be bigger than the cost of holding capital in the company.

ARR = Average annual profit/Average investment X 100

Average annual profit is profit generated by the asset after deducting average depreciation over a period of the life of the asset. Average investment is the cost of the asset plus its disposal value divided by the number of years of the life of the asset. Thai-Lay Fashion regularly uses this method among others to come to a decision. The company has decided to purchase a new machine using this method along with PP and NPV. The cost of the machine is 50,000 HKD and its disposal value is 5,500 HKD with a life of five years. Hence the average investment will be

(50,000 + 5,500)/5 x 100 = 11,100

The average profits from the asset is calculated HKD 250,000 per year. So the ARR will be 250,000/11,000 x 1 = 22.52% which is a satisfactory return as far as the company is concerned. There are certain drawbacks in using this method. Only net income is considered and not the cash flow generated by the asset. The time value of money which will inevitably change is not taken into consideration. Thirdly, the income from the asset will fluctuate and this is not taken into consideration also. (Lesson 27: Annual Rate of Return Method. 2000).

PP =Total investment/Net cash flow x 100

The Payback period: This is the period within which the investment will be recouped from the cash flows generated out to the asset.

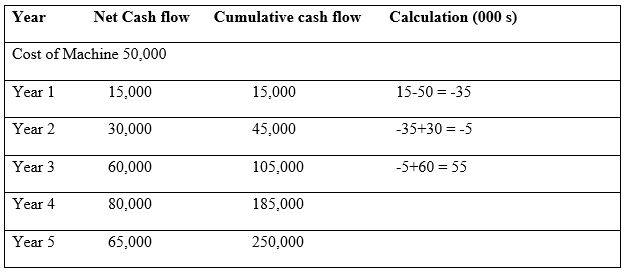

The cost of the machine as stated earlier is 50,000 and the total return or cash flow by the end of the five year period is 250,000.

The figure in the calculation column becomes positive by the third year and hence the payback will happen sometime in the third year. By using the formula we get

PP =50,000/5,000 x 100= 2.5 years

This method also has some drawbacks which is given here. Like ARR this method also ignores the time value of money. Secondly, it does not take into consideration the incomes which follows the payback period. (Payback Period: Limitations of Payback Period). Due to the drawbacks of the above two methods, Thai-Lay Fashion always combines them with NPV in arriving at large investment decisions.

The Net Present Value (NPV)

Net Present Value can be considered to be a more realistic value of cash flow since it takes into account the time value of money caused by inflation and other factors like risk and alternative interest rates. This is essential since the life of an asset will run into several years and the value of money will definitely decrease in value during the period. “The NPV indicates an investment’s net value of in today’s dollars. All costs and benefits are adjusted to “present value” by using discount factors to account for the time value of money.” (Net Present Value (NPV)). This is precisely why this method like IRR is called discounted cash flows.

So it takes into consideration the benefit derived from an investment in today’s prices. For example, investing 10,000 pounds in an investment which gives a return of 20% would result in the investor getting 2000 pounds as interest. The total amount he would get would be 22,000. With NPV the value of this amount one year later and its present value is compared. If the value derived is a negative one then it is assumed that the investment is not worth it.

A realistic interest rate will also be considered because financial institutions would have taken into account factors like risk and inflation when fixing interest rates. There are three factors that contribute to the value of money over different periods of time. They are interest rates, risk and inflation. Interest is seen in the way income that is lost due to choosing one method of investment over another.

So, if a certain amount of money is invested in a bank deposit that money cannot be used elsewhere and the benefit from the alternative investment will not be received by the investor. He will have to choose either one and he may end up earning less money in the present investment. This cost is referred to as opportunity cost. “The difference in return between a chosen investment and one that is necessarily passed up.” (Opportunity Cost. 2008). Risks are what all firms face in the course of their business. Expected sales may not materialise or a machine may not be able to produce the required number of products. All these factors are considered in the calculation of NPV.

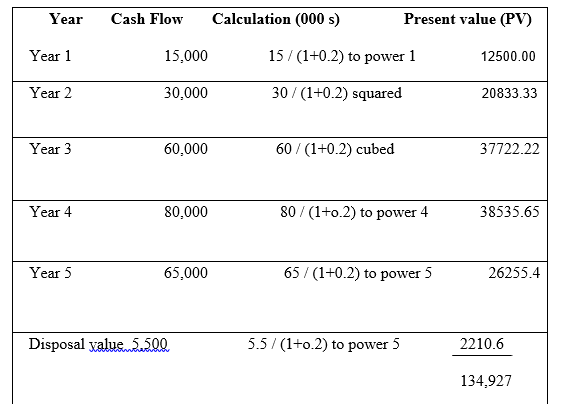

The NPV for the machine to be purchased by Thai-Lay Fashion is given below with interest rate at 20%.

Investing in a 20% per annum deposit would only yield approximately 80,000 pounds. Hence the decision to purchase the machine from the results of all the three methods namely ARR, PP and NPV will be beneficial to the company. In this context it would be ideal to use a discount table which would make calculations easier for both NPV and IRR. (Coulthurst 1998).

Internal Rate of Return (IRR)

Another popular and realistic approach is to use the Internal Rate of Return. “The Internal Rate of Return (IRR) is the discount rate that results in a net present value of zero for a series of future cash flows. It is an Discounted Cash Flow (DCF) approach to valuation and investing just as Net Present Value (NPV). Both IRR and NPV are widely used to decide which investments to undertake and which investments not to make.” (Internal Rage of Return – IRR. (2008). The Thai-Lay Fashion Company does not follow this method for making investment decisions.

Financing the business

Another important factor that managements have to overcome is finding finance for their business start up and future investments. Financing can be classified on the basis of source of funds and period of financing. The former can be classified as internal finance or external finance and the latter can be classified as long term and short term finance. Internal financing entail using the company’s own resources like profits and reserves instead of depending on an outside entity. Availing of internal finance only needs the approval of the board of directors. Companies can raise internal financing by using company reserves, working capital, profits etc.

Reducing the sock of inventory, reducing credit sales, delaying payments to creditors, restructuring repayment of loans, sub-letting unused premises, leasing instead of purchasing etc. are some of the other methods by which internal funds can be raised. (Internal Financing. 2007). But it is not always advisable to use the interest free internal finances to obtain funds. In most cases investing such internal funds in profitable investment would be better and funds be obtained through external financing.

The tools mentioned in the previous section can be used to see whether resorting to external financing would be better for the company. Moreover there could be limitations to the extent of money that could be raised through this method without compromising day to day operations of the company. Resorting to external finance could be a better option in many cases. The amount of money raised could also be larger in this instance. Sources of external finance includes money obtained from financial institutions, issue of shares (ordinary and preference shares), private loans, hire purchase agreements, leases, issue of debentures and bonds, etc.

Whatever may be the case, Thai-Lay Fashion has taken care to see that it’s financing is well geared. Financial gearing refers to keeping an ideal balancing between the company’s capital and external debt. “The most common use of the term ‘gearing’ is to describe the level of a company’s debt compared with its equity capital, and usually it is expressed as a percentage. So a company with gearing of 60 per cent has levels of debt which are 60 per cent of its equity capital.” (Gearing: Definition (UK specific). 2008).

Thai-Lay Fashion has managed to keep the gearing ratio to under 25% which is quite healthy for a company of its size. With regard to shares, the company has only ordinary shares. There are no plans at present to raise capital through a new issue. The company is also not listed in the stock exchange. The company plans to buy the new machinery required through a bank loan and preliminary talks with a bank in the city is well under way.

Thai-Lay Fashion raises short term external finance through bank overdrafts and discounting of invoices. The latter is a good source since the company is an exporter and has a lot of invoices that can be used for this purpose. The company does not resort to debt factoring.

Conclusion

Two major chapters in finance management with reference to Thai-Lay Fashion Company Ltd. have bee reviewed here. They are capital investment decisions and financing. In both instances, the company is maintaining healthy practices. The company makes use of ARR, PP and NPV is making capital investment decisions. Financing is done through external sources and to a certain extent from the company’s own resources. It can be concluded that the managing of finances in the company is performed in an efficient manner.

Bibliography

BOEHLJE, Michael., and EHMKE, Cole. Capital Investment Analysis and Project Assessment. AICC – Agriculture Information and Commercialization Centre. P. 1. Web.

Methods of Ranking Investment Proposals, Session 2: Project Evaluation and Selection Analysis Techniques. NetTel.

Lesson 27: Annual Rate of Return Method. (2000). Web.

Payback Period: Limitations of Payback Period. 12MANAGE, The Executive Fast Track. Web.

Net Present Value (NPV). Web.

Opportunity Cost. (2008). Investopedia – A Forbes Digital Company. Web.

COULTHURST, Nigel. (1998). Discounting the Interest in Money: Discounting. ACCA – The Global Body for Professional Accountants. Web.

Internal Rage of Return – IRR. (2008). Value Based Managemtne. Web.

Internal Financing. (2007). Queensland ICT, Information Industries Bureau, Queensland Government. Web.

Gearing: Definition (UK specific). (2008). Global Investor, Glossary. Web.