Introduction

Competitive advantage refers to the ability of a company to make profits or returns more than the amount that it should make with regard to its capability and competencies that gives it an edge over its rivals (Kurtako, 2004, p.7). For a company to be said to have a competitive advantage it must be able to sustain its growth and should also be relevant and unique when compared to the other companies in the field. In competitive advantage, scholars and analysts seek to address criticisms that have been brought forward against comparative advantage (Hoecklin, 1994, p.65). The argument behind comparative advantage is that businesses, as well as countries, should only consider strategies and policies that aim at increasing the quality of goods produced and then sell the goods at a high market price (Kurtz, MacKenzie & Snow, 2009, p.34).

On the other hand, competitive advantage argues that an economy can do without natural resources and that labor in itself is somewhat ubiquitous (Dickens, 1992, p.62).

If comparative advantage is followed by companies as well as countries, it might lead to the exportation of primary goods (Bendell, Boulter &Kelly, 1993, p. 6). When a company or country is enjoying a comparative advantage, it is able to outperform all its competitors. This is attained by having an adequate supply of resources at a lower cost and having a highly trained human resource. New and efficient technology can also lead to a competitive advantage (Porter, 1998, p.53). This paper analyzes aero-engine and global retailing markets with the intention of comparing their competitive advantages.

Portfolio 1

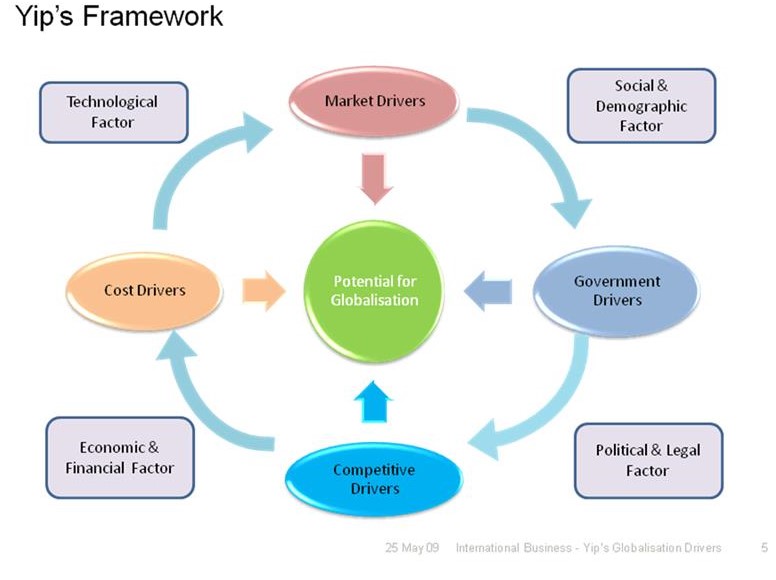

George Yip (1992) identified a four-model approach to drivers of internationalization. Each driver acts in its favorable scale of a market environment created by major enterprises to sustain international trade. Some drivers classify as market-oriented globalization drivers, cost-related globalization drivers, government globalization drivers, and other drivers emanating from competitive trends in international markets (Jessica, 2010, p.1).

While comparing global grocery retailing and civil aerospace engine manufacturing industries, we analyze the strength of each driver in intensifying international strategy. The four factors act in synergy to create strength capable of moving industrial activity in any sector of the economy from the low level of production that meets only the domestic market to that which meets international market demands (Sexana, 2005, P.4). Thus far, technological factors acting in the interface between cost and market drivers’ as well social and economic factors perpetuated by various systems of governments have intensified the growth of airlines.

This segment of strength analysis in airlines forms the basis of analysis in the comparing competitive advantage of aero-engines manufacture and global grocery. While civil aero-engine manufacturers enjoy high levels of competitive advantage in Yip’s model, demographic factors and political/legal restrictions motivated by government and market forces yield minimal advantage for traders in international grocery retailing. Since such enterprises are subject to many social and economic restrictions in international markets, the competitive advantage of global grocers remains in the realm of market drivers and cost-effective means and competitive strategies characterized by financial strengths and technological aspects of the drivers to internationalization.

George Yip’s Model of Drivers to Internationalization

This latter view yields to the notion that aero-engine manufacturers have a more competitive advantage given the developments in automated devices mounted on aerospace engines to help in monitoring faults that may occur in its usage. Similarly, the four-approach model proposed by Yip (1992, p 5) indicates a strong effect on the factors motivating internationalization drivers in civil aero-space than global retail grocers. In sum, the government, market, and cost drivers tend to create a retrogressive effect in the retail groceries’ potential for internationalization. In the government sustained drivers to strengths of competitive advantage of aero-engines and international retail groceries, the massive investments by governments in airline industries by making huge financial outlay in nationalized companies involved in the manufacture of aerospace engines, results in its weak relative potent compared to the global groceries in international production and trade.

Portfolio 2

The Competitive Advantage of the Aero-Engine Market

Of all sealing environments, the aircraft engines stand out to be the most demanding. This is occasioned by the safety requirements that need to be met by those involved in the oil engine business. The designers of these engines must be very careful not to risk component failure. The aero-engine industry has seen huge progress in the last few years which has mainly come about as a result of improvements in technology. Fuel crisis being experienced in the world today has given room for the development of new aircraft that are more fuel-efficient (Nordenstreng, Vincent & Trabert, 1999, p. 81). This has also come as a benefit as this would work very well in dealing with future expansion in the airline business. The industry has seen continuous development of new technologies, airframe seals that provide greater fuel efficiency, reliability, and safety from fire hazards. For example, Trelleborg Sealing Solutions, a company in the aero-engine industry has developed solutions that go along well in matching the specifications by customers in terms of performance and safety standards (TSS, n.d, para 15). Most of the airspace manufacturing takes place in the US, UK, France, Denmark, and Sweden. These innovative sealing options have given the industry and the market a competitive advantage through the improved engine efficiency and the low costs of operating (Sexana, 2005, p. 4).

General Electric, the largest manufacturer of jet engines has developed engine control software. This makes it have an upper hand among its competitors. This gives General Electric a competitive advantage over the other firms in the market. The main competitors for GE are Rolls-Royce and Pratty &Whitney (Rolls-Royce, n.d, para 7). The three companies operate in an oligopolistic environment globally in an industry that requires massive capital to venture into. Any unique development that requires a lot of research and development puts any of the three giants in a position where it enjoys a competitive advantage over the others. This aids in propelling the concept of entrepreneurship (Shane, 2003, p.27).

Portfolio 3

Carrefour and Wal-Mart have continually sought to tap into the Chinese market potential through various expansion strategies. As a typical example of the international retail market, Wal-Mart is involved in a wide-scale franchising and networking business to ensure that its products penetrate the Chinese market. Given its capability and competencies in the national and international grocery trade, the supermarket adopts chain stores in various parts of the world and presumes that the same can create positive feedback in China. Similarly, through franchising and alliances with other chain stores distributors in china, Wal-Mart seeks to initiate a takeover program of Chinese Medium and large-scale enterprises by first tasting the waters while sharing the cost with Chinese holdings in the line of groceries and ender-user consumable products.

Wal-Mart and Carrefour market analysts predict that a significant market share for both corporations has the ability to promote trade of both stores in china albeit minimal competitive advantage in the first stages. In the next subsequent stages of the company’s operations in China, their vast investment coupled with the economic factors dispensable in China would lead to heightened competition with Wal-Mart importing products in the country from other countries while reaping the benefits accruing to such business strategy. Business managers generally admit that the population of china presents a great opportunity for business in terms of its labor and sales market. Large western retailers often suffer major shocks of business drawbacks in the Western markets. Consequently, if a large western retailer such as Wal-Mart, Tesco, Carrefour, and Woolworths chose to stay out of the Chinese market, their ability to sustain risks as a result of global recessionary tendencies would increase (Johnson, Scholes &Whittington, 2006, P.23). On the other hand, venturing into the Chinese market would make them less susceptible to such risks as the giant retailers spread risks to the ventures overseas.

Global Retailing Market

On the other hand, global retailing markets’ success depends on the business as well as the customer’s view of the commodity on offer (Jessica, 2010, p.2). Apparently, most retailers have a clear knowledge and understanding of their customers well. But for the case of a global retailer, this is made impossible by the fact that the customers are a bit much diversified. In this industry, the competitive advantage usually emerges from factors such as information transparency, the need to provide more value at a lesser cost, and the access to good and quality capabilities through the use of specialists (Transtod, 1995, P.6). During the last half of the 20th century, the industry saw the emergence of retail shops such supermarket at a very high rate which has mainly dominated the food industry (Peteraf, 1993, p.3). Shoppers nowadays seek convenience and the development of new tastes. Any supermarket that manages to offer these considerations to the customers wins the competitive advantage over the rivals (Jaynie, 2005, p.7).

Research has shown that the largest 200 global retailers in the world account for more than 30% of demand globally. This comes out of the disposable income of the buyers coupled with the willingness of the buyers to make a purchase. The competitive advantage in the global retail market may also come about as a result of developing good distribution and information systems for the goods and customers respectively (Deloitte, 2003, para 25).

Portfolio 4

This section of the portfolio introduces us to the analysis of information in Tesco’s website about their core purpose and strategy in the light of ideas about vision, mission, and objectives and the link between those and actual strategies pursued by a company. In their presentation, Tesco communicates their intention to create value for its customers so that they can afford their long-term loyalty (Frayling, 2009, p. 4). On their website, they continue to emphasize the significance of their staff and customers in their successes from time to time as a function of the roles these groups of people play in their hyper and supermarkets. Tesco maintains that their progress depends on the interest of their customers and staff in their activities. As embedded in their values, the investment operators express their actual objectives to serve their members and derive the benefits thereof.

On the part of the clients, Tesco claims that it would wish to make shopping an enjoyable experience for customers each time they go shopping in their outlets. Since its endeavors remain at the forefront of meeting a large customer’s needs, it outlines its intentions to treat customers and its pools of stakeholders and suppliers just how they would want to be treated. In essence, it attempts to instill into the customers the opinion that, it is committed to providing the best service with favorable terms and conditions to its customers. In reality, Tesco’s customers testify having enjoyed special treatment in the hands of staff when they shop in various outlets. In addition, Tesco has had a little disagreement with its staff in the last decade as opposed to other giant retailers who have had employee-related suits filed against them. Thus, Tesco’s web content is near near-reality reflection of its actual objectives.

Tesco’s objectives illuminate a suitable strategy for the holding amid its plans to undergo progressive expansion programs. Liberalization policies in international developing markets and new trends in globalization inspire Tesco “to be a successful international retailer” and be a strong provider of both food and non-food items (Baron & David, 2008, p. 4). It also speculates the growth of the UK core business. Moreover, it intends to put the community at the center of its activities. In all its strategies, Tesco aims at expanding its operations in the UK and the rest of the world through a people-oriented strategy. This has a high likelihood of giving Tesco a sustainable growth path while providing a real guarantee for a cost-driven competitive edge ahead of its rivals.

Portfolio 5

Roll Royce is a public limited company that is established within the UK aerospace and defense industry. The firm has been specializing in manufacturing aircraft engines since it was established in 1906. Some of the products that the firm specializes in producing include military and civil aero engines, power generation equipment, and marine propulsion systems. In its operation, the firm has incorporated the concept of internationalization which has enabled it to operate on a global scale. This has been attained by adapting the concept of strategic alliances with its suppliers. The firm’s management team has integrated this strategy within its supply chain. This arises from increased quality consciousness amongst the customers (Monika, 2003, p.54). According to Kaufmann (2009, p. 205), there has been an increment in the rate at which firms are incorporating multi-company alliances in their operation. Roy-Royce Company has formed alliances with a number of companies.

Strategic alliances are not simple or easy to create, develop, and support. According to Monczka, Petersen, Handfield, and Ragatz (1998, p.3), strategic alliance with the suppliers requires a high degree of coordination. The selection of the partner is also important since it contributes towards a high level of efficiency within the alliance (Parmigiani &Will, 2009, p.1065). In addition, the two parties must derive substantial value from the alliance. Monczka (1998, p. 3), posits that there are two criteria through which the success of strategic supplier alliances can be measured. These include soft methods such as supply chain integration and competitive technology. On the other hand, hard strategies include cycle time, cost and quality delivered. There are a number of success factors in the strategic alliance developed between suppliers and buyers (Chen, 1999, p.54). One of these includes commitment. Commitment entails the willingness amongst the two parties to act towards building the relationship. This means that the two parties in the contract have to devote resources either in form of money, time, or human capital towards strengthening the relationship. Strategic supplier relationship is also built under trust and organization. Efficiency in information sharing is also vital. Monczka (1998, p. 3) defines information sharing as the efficiency with which information is transmitted across the two parties’ supply chain. This information may relate to financial health, overhead cost, and ability to grow. This information is important since it enables the two parties to plan on the expected growth. In order for the alliance to be successful, Roy Royce has formulated comprehensive purchasing policies. The core objective is to maintain the quality of the products and services it purchases across the globe.

According to Elimuti and Kathawala (2001, p.206), there are a number of reasons why firms enter into strategic alliances. One of the key reasons is to improve organization’s performance thus enhancing its competitive advantage. Some firms also form strategic partnerships for promotional purposes, gain access to certain markets that prove difficult to penetrate through other strategies such as green investment, obtaining necessary technology, and reducing political and financial risk. Strategic alliances can also improve organizational performance through the attainment of effectiveness and efficiency in the process of research and development via sharing the cost (Peteraf & Barney, 2003, p. 5).

Strategic alliance projects often fail because of tactical errors made by management. This may relate to the poor formulation of goals and objectives, lack of trust, and poor coordination amongst the management teams.

Conclusion

Attaining competitive advantage is paramount in the success of a firm considering the intensity of competition (Brown & McDonald, 1994, p.63). This can be attained through various strategies such as internationalization. Internationalization has not only become a concern for large enterprises but also amongst small and medium enterprises (Alasadi & Abderahim, 2007, p. 130). In addition, firms should formulate effective strategies that act as guidelines in their operation. Through internationalization, a firm is able to attain a relatively high competitive advantage compared to its competitors. This arises from the fact that the firm is able to attain a high profit which enables it to implement its strategies successfully. In selecting the country to venture into, a firm’s management team needs to conduct an assessment of the external environment (Grant, 1948, p.52). Roy Royce Company has managed to venture into the international market successfully. This has made the firm attain a high competitive edge.

There are various ways through which competitive advantage can be attained. One of these ways is through Roy-Royce Company has attained this is via formation of strategic alliances with the suppliers. This alliance enables the firm to supply high-quality products and services resulting in a high level of customer satisfaction. Strategic alliances enable firms to attain effectiveness in venturing markets that would be difficult to enter, attain technological efficiency hence its performance. However, they should be conducted with caution in terms of management to eliminate the chances of failure (Rantanen, 2005).

Reference list

Alasadi, R. & Abderahim, A. 2007. Critical analysis and modeling of small business performance: case study, Syria. Journal of Asia entrepreneurship and sustainability. Vol. 3, issue 2, pp. 1-131. Abu Dhabi: Abu Dhabi University.

Baron, David, P., 2008. Business and the organization. 6th ed. Chester, CT: Peason.

Bendell, T., Boulter L., Kelly, J. 1993. Benchmarking for competitive advantage. London: Pitman.

Brown, L., & McDonald, H.B. 1994. Competitive marketing strategy for Europe: developing, maintaining, and defending competitive advantage. Basingstoke: Macmillan.

Chen, N. 1999. Cx wary of forging alliances. Asia: MCB Publishers.

Deloitte. 2003. Indian food retail sector in the global scenario. [Online].

Dicken. D., 1992. Global shift: the internationalization of economic activity. 2nd ed. London UK: Paul Chapman.

Elmuti, D. & Kathawala, Y.2001. An overview of strategic alliances> Management decision. Vol. 39, issue 3, pp. 205-217. London: MCB University Press.

Frayling, C. 2009. Competitive advantage through design. New York: Design Council.

Grant, Robert M. 1948. Contemporary strategy analysis. 7th ed. Chichester: John Wiley & Sons.

Hoecklin, L. A., 1994. Managing cultural differences: strategies for competitive advantage. Wokingham: Addison-Wesley.

Jaynie, L. S.2005.Creating Competitive Advantage: Give Customers a Reason to Choose You Over Your Competitors. Sydney: Prentice Hall.

Johnson, G., Scholes, K. &Whittington, R. 2006. Exploring corporate strategy: globalization and internationalization. New York: Pearson.

Jessica, E.2010.Middle East challenges and rewards: the future of our business is not only domestic but regional and global. Journal of International Business. Vol. 3, Issue, 2, pp. 1-4. London. Cengage Learning.

Kaufmann, P.J. 2009. Multiunit franchising: growth and management issues. Boston. Elsevier Incorporation.

Kurtako, F.D.2004. Entrepreneurship: theory, process, and practice. New York: Cengage Learning.

Kurtz, D.L., MacKenzie, H.F. & Snow, K. 2009. Contemporary marketing. New York: Cengage Learning.

Monczka, R., Petersen, K., Handfield, R. & Gary, R.1998. Success factors in strategic supplier alliances: The buying company perspective. (Online).

Monika, J.S. 2003. Food quality and consumer value: delivering food that satisfies. [E-Book]. Chicago: Springer.

Parmigiani, A. &Will, M. 2009. Complementarily, capabilities and the boundaries of

the firm: the impact of within-firm and inter-firm expertise on concurrent sourcing of complementary components. Strategic Management Journal. Vol. 30, issue 10, pp. 1065-1091.California: University of California.

Peteraf, M. & Barney J.2003. Unraveling the Resource-Based Tangle: Managerial and Decision Economics 24. California: Cengage Learning.

Peteraf, M. A. 1993. The cornerstones of competitive advantage: a resource-based view. Strategic management journal. Vol. 4, issue 3. Pp. 1-5.

Porter, Michael E. 1998.Competitive advantage: creating and sustaining superior performance. New York: Free Publications.

Transtod, R.1995.Product positioning. (Online).

Trelleborg Sealing Solutions (TSS). n.d. Aero engine & airframe sealing solutions. [Online].

Rantanen, T. (2005). The media and globalization. London: Sage, p.74.

Rolls-Royce. n.d. Competing within a changing world. [Online].

Sexana, R. 2005. Marketing management. Chicago: Tata McGraw-Hill.

Shane, Scott.2003.A general theory of entrepreneurship: the individual-opportunity nexus. (E-book).Northampton: Edward Elgar Publishing Incorporation.

Vincent, R., Nordenstreng, K. and Traber, M. (eds) (1999) Towards Equity in Global Communication: MacBride Update. Cresskill, NJ: Hampton Press.