Trends in Accounts Receivable

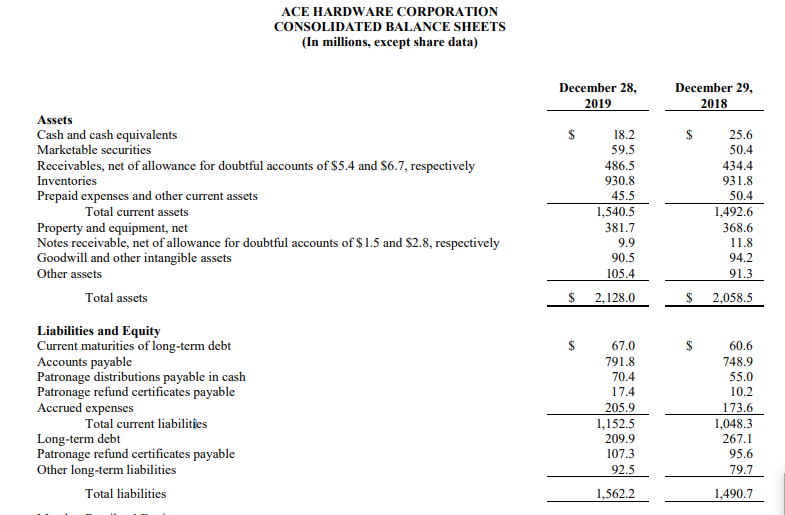

Notably, Ace’s accounts receivable hiked by $100,000 from 2018 to the year 2019. The increase exemplifies that more customers are paying their balances. The Organization’s sales on credit accounts are the primary factor behind the increasing trend of accounts receivables, reflecting the Company’s receivable turnover ratio. Argumentatively, the accounts receivable ratio denounces how an organization effectively collects payments from clients.

According to Kozarevic et al. (2019), receivables are the actual amount that clients owe the Company, considering that they buy items and service them on credit. Statistically, the accounts receivable turnover ratio is obtained by distributing the net sales for the reporting period by the actual average of the commencing and ending balance of the accounts receivables for the specific time. The accounts receivable determines the average time length to reconcile a credit account by dividing 365 days by the company ratio. The proportions in 2018 and 2019 are 4.68 and 5.06 times, respectively, for Ace Company. Thus, the average duration for Ace to reconcile these accounts is 78 and 72 days for 2018 and 2019, respectively. Presumably, Ace Company will increase its cash on hand following this trend.

Inventory Ratio

According to Kumar et al. (2018), the inventory ratio describes the actual rate an organization has sold and eventually replaced the exact sold products within a fixed period. The inventory ratio helps in determining the length that a company takes to sell throughout the reporting period. The balance of inventory is calculated by dividing the actual costs of products sold during the specified period by the average inventory costs. Furthermore, when the reporting days are divided by the ratio, the average time that a product can be in stock becomes evident.

The average RSC service fill rates of 96.2 in 2017, and 96.3 in 2019 demonstrate improved turnover (Ace & Company, 2020). The inventory turnover is 1.83 and 1.94 for 2019 and 2018, respectively, while the industry average was ten for the same years. Using the inventory ratio, an understanding is obtained that Ace makes a sale of 200.5 and 188 days in the year 2019 and 2018, respectively, while 36.5 days was the industry average. Holistically, this decline is a massive concern for the Company as it reveals deprived inventory management and sales.

Credit Worthiness

To comprehend the Ace company’s creditworthiness, understanding how the Company was handling debt previously is paramount. Comparably, the 2018 and 2019 current ratios are 1.54 and 1.81, respectively. The recent ratio increase denotes that Ace Company has tremendously improved in paying short-term expenses or liabilities with the existing assets. Moreover, considering the document provided, it is evident that the Organization’s total debt to equity has critically decreased from 3.78 and 2.49 times in the year 2018 and 2019, respectively.

Here, Ace Company owes less to its creditors. On the same note, the Company’s interest increased from 8 times in 2018 to 10.2 times in 2019. As such, the interest amount increases signify that the Company is on the right path to success. The ace organization is becoming better regarding meeting the interest payments.

Recommendation

Holistically, after reviewing Ace Company’s financial data critically, I feel assured that we can confidently request and process their ten-year loan of $3 million. The Company has significantly shown its creditworthiness because of its fewer current liabilities and debts that exist. Moreover, Ace organization has exemplified an increase in the receivable inventory turnover rate and general growth per their net income and total assets. Ace’s decrease in the inventory turnover rate forms the basis of dissatisfaction.

However, it cannot be a critical concern since the Organization is consistently making huge revenue income, indicating that the Company is utilizing its excess inventory. Therefore, Ace Corporation has vividly shown its creditworthiness, and the loan lender should be confident in its potential to repay the loan.

References

Ace & Company. (2020). Finances Annual Report of 2019.

Kozarevic, E., Delic, A., & Omerovic, M. (2019). The role of controlling credit sales and receivables in the wood processing companies of Tuzla Canton, Bosnia, and Herzegovina. International Journal of Industrial Engineering and Management (IJIEM), 10(1), 93-103.

Kumar, D. S. L., Nallusamy, S., & Ramakrishnan, V. (2018). Proposed inventory management model to improve the supply chain efficiency and surplus in the textile industry. Technology, 9(5), 675-686.