The Great Recession is fairly described as a horrendous financial collapse that left millions of families with fewer money or even deeply in debt, it also caused multiple companies to go bankrupt. Remarkably, nearly 8 million Americans lost their jobs, 4 million homes were foreclosed, 2.5 million businesses were closed (Cashin et al., 2018). The drastic change of the American socio-economic situation in 2007-2008 has various reasons and interpretations to this day.

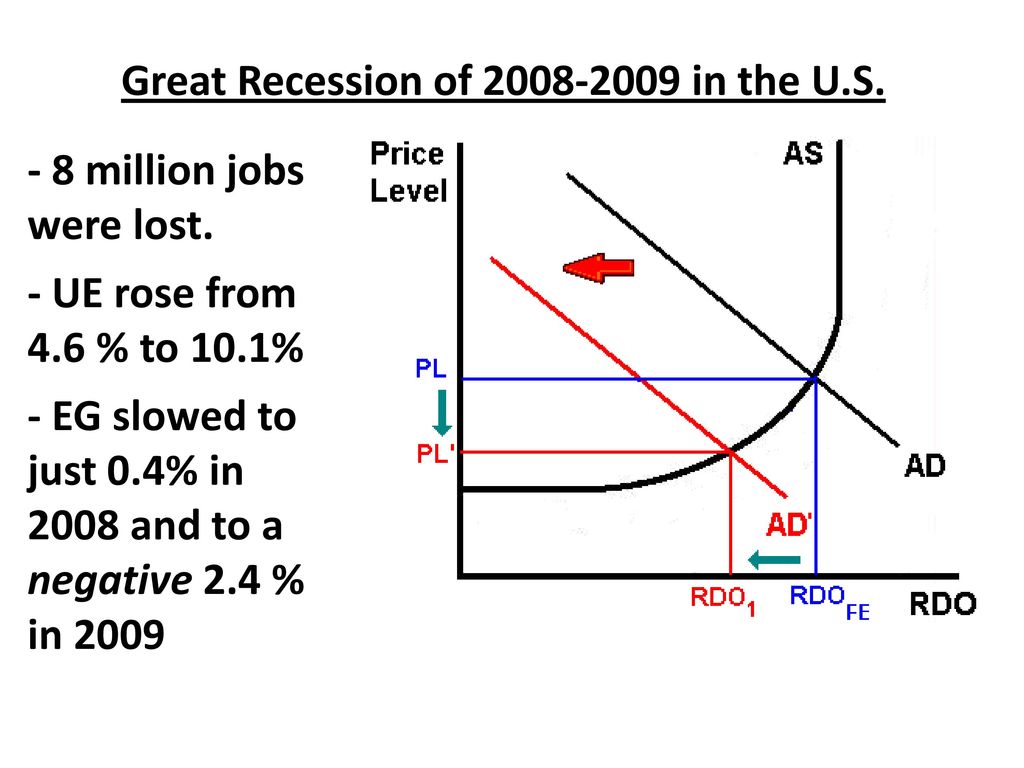

Speaking of the causes of the Great Recession, failures in financial regulation, excessive borrowing by households and Wall Street are the aspects that definitely contributed to this crisis. Moreover, subprime mortgage crisis was the most vivid and obvious reason why the stock market collapsed. The loan that allows people to buy a house in advance became available for the borrowers with extremely low credit ratings; therefore, the housing market was booming for some time. However, these economic conditions made the prices of houses extremely low because the demands started declining; unfortunately, it led to a devastating economic downturn. In addition, financial losses were the reason less money was spend on goods and services which further damaged the economy making a vicious circle of decreasing demands and supplies (look at the aggregate supply and demand model).

Additionally, the well-known statistics of the Gross Monetary Value showed the drastic decrease of people’s demand and how it affected the final value of products and services and the supply declining. Financial firms lost their previous opportunities of lending money to satisfy people’s needs and improve the money flow. Economic studies show that the demands went down, the prices of homes quickly decreased, resulting in a great amount of money loss by financial institutions and homeowners. Below you can find an example of an aggregate demand and aggregate supply (AD/AS) model that illustrates the general trends of the U.S. economy during the Great Recession (Shambers 2021).

References

Cashin, D., Lenney, J., Lutz, B., & Peterman, W. (2018). Fiscal policy and aggregate demand in the USA before, during, and following the Great Recession. International Tax and Public Finance, 25(6), 1519-1558.

Shambers, C. The AD/AS Model: Stabilization Policies. [The image of the aggregate supply and demand model]. Web.