Introduction

International trade stimulates the development of the world economy. It also contributes to expanding global employment, providing countries with a greater variety of goods, and raising living standards. The challenge that international trade poses are the inability of countries to produce the goods and services that their people need. They cannot manufacture all the products and services required for the economy to function. In addition, international trade reduces the cost of bilateral negotiations between countries. Moreover, globalization has facilitated the commercialization of goods and services by diminishing border barriers. International trade has created a whole specialized system of commodity transportation. Although, with the rapid promotion of international trade, issues related to unfair competition have emerged.

It is worth noting that corruption is a global security problem. It has long been considered a challenge and has finally been recognized as a primary threat to international security (Gezikol and Tunahan, 2018). Many people consider corruption a victimless crime and bribery an alternative method of conducting business. Nowadays, there is widespread agreement that corruption violates the fundamental human right to equality. Across the world, large-scale cases of corruption have been reported (Ali and Gasmi, 2017). Current research provides an essential key to understanding the relationship between transnational organized crime and corruption. It is viewed as a significant threat to political stability, human security, democracy, and economic progress. Corruption occurs in numerous different forms and expressions. Bribery, embezzlement, fraud, extortion, cronyism, and monopoly are some of them (Beverelli et al., 2018). Examples of corruption include bribes paid by an international company suspected of having connections to criminal institutions in order to receive a government contract.

It is significant to mention that offering and accepting bribes is a common practice not only on the scale of individual national economies but also in international trade. Corruption exists in one form or another around the world, in both developed and emerging economies. It impedes trade activities but, at the same time, is often generated by the trade itself. There is also a correlation between trade liberalization and corruption. The latter negatively affects trade freedom, but at the same time, liberalization can contribute to the effort to fight corruption. For instance, obliging traders and creating more open and transparent international trade procedures can help combat corruption. However, there are many opportunities in the global economy for corrupt practices to expand, which can be used at several stages of a single trade transaction.

Thus, international trade can facilitate the development of bribery, which was initially committed only within national administrative structures. Nevertheless, it is widely acknowledged that corruption harms national and global economies. Within the framework of the World Trade Organization (WTO), the leading institution in the field of international trade, there is still no universally accepted agreement devoted entirely to regulating this phenomenon (Wilkins, 2021). Nevertheless, there are options within, and beyond the WTO that states can adopt to combat corruption as a trade barrier.

Studies of the impact of corruption on international trade are complicated by the many indicators that should be considered in such analyses. These include language barriers, geographic length, export and import patterns, trade barriers, and many other factors. However, corruption has also proven to be a cause of barriers to trade and, in particular, leads to a significant increase and variety of tariff rates on imported goods (Boudreaux, Nikolaev and Holcombe, 2018). The high diversity of import duties increases the opportunity for customs officials to make corrupt profits by manipulating classification.

The aim of the study is to assess the effects of corruption on international trade through reliable sources and analysis of contributing factors. This is because some states can benefit from the existence of corruption schemes. This is especially true for Third World states with a shortage of reliable legislation (Sharma and Paramati, 2021). Therefore, trade within a state and its entrance into the international arena is preferable to corruption but negatively affects the development of overall international trade. Hence, the influence of corruption on international trade has not been investigated, and no clear framework separating positive factors from adverse ones has been established. Nevertheless, there is currently a gap in the literature that deals with combating corrupt schemes on an international scale.

Thus, the following research questions need to be answered:

- What is the meaning of the term corruption and their prevalence in the international dimension?

- What are the causes of corruption in international trade?

- What is the level of correlation between corruption and the level of international trade?

- What are the positive and negative effects of bribery?

- What are the methods and proposals for combating corruption?

Meanwhile, establishing the influence of corruption on international trade can be expected to identify effective methods of combating it. Therefore, the objectives of the research are:

- Define the meaning of the term corruption.

- Identify the cause of corruption in international trade.

- Establish the level of corruption in international trade.

- Identify the correlation between corruption and the level of international trade.

- Determine the positive and negative effects of bribery.

- Analyze the methods that exist in international trade and that are aimed at combating corruption.

- Provide suggestions aimed at combating corruption in international trade.

Hence, first, the leading causes of corruption will be examined, and their definitions will be established. Based on this theoretical framework and literature review, correlations can be made between corruption and the level of international trade. The essential negatives and positives of corruption implicated in global trade will then be identified. This analysis will establish the methods to be used to combat corruption. It will also provide suggestions related to the results of the study of this issue. Accordingly, a clear and comprehensive understanding of the phenomenon of corruption and its causes will establish the influence of corruption on international trade and propose methods to combat it.

Methodology

The research design is a combination of requirements concerning the collection and analysis of data necessary to achieve the objectives of the study. It is essential to recognize that the study of the impact of corpus on international trade is based on secondary research (Snyder, 2019). Thus, existing data, such as books or scholarly articles, are used to answer the questions posed. However, secondary research is also used as a means of further validating the information from the studies and creating a more substantial general design. Definitely, the most critical benefit is its economic effectiveness. Collecting primary data is the most expensive stage of the study. It is possible to save not only money but also time and human resources when processing secondary data, referring to the already collected array research (Snyder, 2019). In addition, the use of secondary data is often the only method to make large-scale comparisons and examine global trends in time and spatial coverage. This provides a kind of guarantee for the reliability and validity of the data provided by the archives.

In addition, the study establishes a sample of significant nations, specifically Sweden, Denmark, Switzerland, France, the United Kingdom, the United States, Russia, Ukraine, Afghanistan, and others. This enables the establishment and empirical evidence of hypotheses about the existence of a correlation between corruption and socio-economic indicators. These phenomena include GDP per capita, access to information, and foreign direct investment inflows (Epaphra and Massawe, 2017). As a consequence, empirical research and statistical analysis allow the correlation between the level of corruption and conditions for international trade in different countries to be established (Gupta and Gupta, 2022). For this purpose, the Corruption Perception Index of Transparency International and the Corruption Deterrent Index is used.

Meanwhile, the research will apply theories of international relations to explain the impact of corruption on international trade. Accordingly, to basic economic principles and with the analysis of the literature, the study can establish the main areas of influence of corruption on international trade. Moreover, the analysis of international instruments will establish the existing methods of combating corruption schemes at the global and national levels. Furthermore, selecting already available practices to combat corrupt activities affecting international trade will allow the identification of new methods to prevent corruption (Patel and Patel, 2019). Nevertheless, a limitation of the research is the absence of primary data collection required for the analysis of the international market situation.

The Concept and Causes of Corruption in International Trade

It is relevant to emphasize that the traditional and most developed form of international economic relations is world trade. It represents the totality of foreign trade of all countries of the world (Van Marrewijk, 2017). That is, it is a form of international economic relations that involves the movement of goods and services beyond state boundaries. International trade occupies a special place in the complex system of world economic relations (Van Marrewijk, 2017). Even in current conditions, it has been superseded by global investment as the primary form of international economic relations. Still, international trade remains crucially valuable in terms of its scale and functions. It mediates almost all types of international cooperation, including joint production activities of multinational entities and international technology transfer (Ali and Gasmi, 2017). International trade is an effective stimulus for the development and efficiency of each country’s production. This is because it is the means by which countries can develop a specialization, enhance the productivity of their resources and thereby increase their overall output.

The importance of the existence of transparent and non-corrupt international trade determines the theory of absolute advantage, the creator of which was Smith. According to this theory, it is advantageous for a country to import those goods for which its costs of production are higher than in foreign countries (Chow and Schoenbaum, 2022). It is also possible for a state to export those goods for which its costs are lower than those abroad; that is, an absolute advantage. In contrast to the mercantilists, Smith advocated freedom of competition both domestically and on the world market (Rose, 2018). The primary weakness of this theory is that it leaves no place in international trade for those countries where goods are produced without absolute advantages over other countries. Ricardo’s theory of comparative advantage overcomes this disadvantage of the approach of absolute benefits (Chow and Schoenbaum, 2022). According to it, a nation should specialize in the production and export of those goods which it can produce at relatively lower costs than other countries and import those goods which it has at relatively higher prices. This conventional principle makes foreign trade mutually beneficial to all nations.

Consequently, international trade should be conducted in a way that serves the interests of all market participants. When destabilizing factors, such as corruption, emerge and spread, international trade undergoes changes that disrupt the international allocation of resources (Gründler and Potrafke, 2019). At the same time, the emergence of such factors in states leads to their exclusion from the global network of international trade. Scientists have proved that effective and sustainable business environment development depends on factors such as deregulation, access to financial resources, and the absence of corruption (Gardiner, 2017). Meanwhile, according to experts, corruption is the most significant factor that is an obstacle to economic growth.

Corruption is defined as the criminal activity of using opportunities of power by officials for personal enrichment. The definition of corruption in Roman law was understood as “to destroy, to break, to bribe” and was an illegal act against officials (Gezikol and Tunahan, 2018). This term referred to the collaboration of several participants whose purpose was to unduly influence, for example, the judicial process and to disrupt the ordinary course of the management of public affairs. A characteristic feature of corruption is the conflict between the actions of an official and the interests. The term corruption was expanded at the International Interregional Seminar on Corruption in Havana (Awan et al., 2018). Corruption was defined as the abuse of office for personal or group gain and unlawful receipt by a public official for the benefit of their position and authority.

Many types of corruption are similar to fraud committed by a public official and fall under the category of crimes against state power. Corruption can involve any official who has discretionary authority to distribute any non-proprietary resources at their discretion (Agyei, 2021). The primary incentive for corruption is the possibility of economic profit associated with the use of power, and the principal deterrent is the risk of exposure and punishment. According to macroeconomic and political economy studies, corruption is the most critical obstacle to economic growth and development, which can endanger any transformation (Ghaniy and Hastiadi, 2017). In most European countries, corruption is subject to criminal penalties.

Corruption in international economic cooperation takes place during the creation of enterprises with the participation of foreign capital. It also occurs in the implementation of investment projects and privatization of state property, in solving the problems of market sharing for marketing products and other forms (Epaphra and Massawe, 2017). Economic corruption means bribery, receiving, promising, offering, providing, or extorting a bribe. It also includes any other illegal use by a person of their public status for profit. It is notable that the United Nations considers corruption to be a “complex social, cultural and economic phenomenon that affects all countries,” without explaining the term in more detail (Ghaniy and Hastiadi, 2017). It is noteworthy that even the text of the UN Convention against Corruption (UNCAC) does not contain a definition of what countries are supposed to combat (Sumah, 2018). This is because the phenomenon of corruption is too complex and multifaceted to provide a comprehensive yet sufficiently detailed explanation.

It is essential to emphasize that corruption can also manifest itself at the interstate level. In today’s world, connected by a single information network, transport communications, and a virtually unified system of monetary institutions, there is a considerable place for corruption to emerge. Economic, social, and political processes in different parts of the world and different states are interdependent and mutually influenced (Dimant and Tosato, 2018). In these conditions, corruption becomes a factor of global significance with a negative impact on global processes. Thus, due to its intrinsic properties and the complex structure of its consequences, corruption has the most serious impact on global strategies, making it possible to consider its international nature.

It is also relevant to recognize that corruption has acquired a new dimension in the modern context and is conducive to its globalization. Widespread corruption further deepens the gap between the level of economic development of developed countries and the third world (Ibodullaevich and Kizi, 2021). There is evidence of the embezzlement of funds allocated by the International Monetary Fund and the World Bank as part of financial assistance to developing countries by corrupt officials in African countries. Corruption on a global scale can have a harmful influence on the sustainability of the global financial system.

It is significant to highlight the reasons for the growth of corruption, that is, the opportunities and low probability of exposure. People are susceptible to corruption when the system is not working efficiently, and they need to find a method to achieve their own goals without regard to the existing order and laws (Fisman and Golden, 2017). At the same time, the next reason is the low probability of exposure discretion (Agyei, 2021). Lack of accountability is primarily a consequence of the absence of transparency and weak law enforcement.

A prerequisite for the development of corporations at the state level is the lack of transparency in the current system of formal rules. This prerequisite reflects the possibility of adopting and operating legal regulations that contribute to the emergence or expansion of potential rents, which entrepreneurs can obtain by paying for the “services” of corrupt officials (Fisman and Golden, 2017). Such rules include all kinds of unjustified prohibitions and restrictions on business activities and laws regulating ineffective procedures for controlling the activities of business structures. They are also vaguely formulated provisions that executive officials can interpret at their own discretion (Fisman and Golden, 2017). Accordingly, improved transparency of the system of formal rules and the creation of simple and reasonable mechanisms for adopting practices should contribute to a reduction in the size of potential rents. Consequently, it should also decrease the scale of discrimination and corruption (Fisman and Golden, 2017). In this way, corporations engaged in international trade will also be capable of investigating the powers and duties of officials. This will establish the acts of civil servants as unlawful.

One of the more controversial issues is the role of state regulation of markets and the country as a monopolist. Free market advocates suggest that the reduced role of countries and increased competition reduce corruption in the international market (Mashayekhi, Sepehri and Aghamiri, 2022). This decreases the amount of discretionary power required and diminishes the ability to gain market power through protectionist regulation and, thus, the potential for rent-seeking. Indeed, all countries with low corruption are characterized by a relatively free economy (Carr and Stone, 2017). In contrast, a planned economy, characterized by the monopoly power of officials and keeping prices below market levels, generates incentives for bribery to obtain scarce goods and services.

There are also a number of objections to this argument. First, the private sector cannot always offer satisfactory solutions to problems; in such cases, most people consider the intervention of states or organizations justified. This, in turn, makes preconditions for unfair oversight and rent collection discretion (Agyei, 2021). Hence, it proves impossible to get rid of corruption completely, even in an open economy. Second, the process of economic liberalization is carried out by the government and is, therefore, also inherently an active intervention in the economy.

The following causes of corruption in international trade are related to bribery in trade, black market operations, and illegal financial and property transactions. At the same time, the emergence of corruption also encourages tax evasion and forgery of financial documents (Zhang et al., 2017). This is because some states have adopted laws that regulate financial transactions much more than others. Additionally, the tax system requires the accountability of all companies and organizations that conduct economic activities within the state. Including, in other states, as a rule, less developed companies can hide part of the profits, respectively, pay less taxes (Zhang et al., 2017). Consequently, this contributes to the flourishing of corruption schemes involving contractors from different states.

The next reason is the patronage system, which generally arises when the implementation of illegal transactions is consolidated in the hands of a limited number of individuals or organizations. Actors controlling patronage systems attempt to monopolize power to the point of establishing complete control over the activities of a legitimate government (Enste and Heldman, 2017). Then an unfavorable mode of operation of enterprises arises. This provokes a lack of transparency in many economic processes, which increases the level of corruption (Yahya Khan, Razzaq and Mehboob, 2019). Globalization is also one of the reasons for the development of corruption in an international organization. This is because companies in individual states depend on supplies of specific components for their functioning from abroad (Carr and Stone, 2017). Thus, increasing contact with contingents from different countries encourages corporations to enter foreign markets. Most companies attempt to do this instead at a lower cost than others in order to have a competitive advantage in the market (Sharma, 2017). Accordingly, they choose corruption schemes as a means of achieving their own goals.

Level of Corruption in International Trade

It is essential to note that expanding an international business requires corporations to obtain permits, licenses, and other documents to support their authorized activities. At the same time, a company’s entry into the international marketplace sometimes needs to change policies to accommodate international regulations in a particular area (Chang and Hao, 2017). Thus, companies cannot immediately begin legal operations, which is why they resort to certain arrangements with foreign policymakers. Accordingly, governing corporations often offer officials financial benefits for helping to support business activity (Atsir and Sunaryati, 2018). It should also be mentioned that certain economic influence is not a bribe but has a legitimate basis. For instance, business investment in local infrastructure or environmental development is a legitimate way to demonstrate to officials the importance of allowing businesses to operate in their territory (Feige and Ott, 2019). In international trade, though, straightforward bribery is one of the most frequent instances of corruption.

Despite the fact that corruption in international trade has a number of drawbacks, it has been on the rise in recent decades. First, the phenomenon is illegal because there are laws around the world that regulate government officials and prohibit them from accepting bribes (Saputra, 2019). Accordingly, a foreign corporation instigating an illegal situation risks its business reputation and creates legal risks for the company’s principals (Kellenberg and Levinson, 2019). Moreover, when corporations cannot obtain permits to operate in certain territories, it is due to the incompatibility of their activities with the social, environmental, and other interests of the community. Thus, entering the market through corrupt schemes can be dangerous and blow local businesses significantly. Another negative factor in the use of corruption schemes is the possibility of their discovery (Esteve-Pérez et al., 2021). Therefore, businesses incur legal, financial, and reputational damage.

Although the existence of risk factors does not reduce the general level of corruption in international trade. It is significant to mention that Transparency International (TI) assessed that one in four people around the world offered a bribe in 2009 (Borlea, Achim and Miron, 2017). Moreover, they found that the total number of bribes continues to grow every year. Another confirmation of this position is the calculation of the World Economic Forum (Zimelis, 2020). Accordingly, global corruption in 2016 amounted to more than 6% of the world’s GDP (Nguedie, 2018, p. 63). At the same time, more than $1 trillion is paid in bribes each year in international trade. This has led global organizations and governments to elevate the fight against corruption as one of their most important policies (Aqeel, Zahid and Ejaz, 2022). Despite the fact that almost all multinational companies have adopted anti-corruption policies, there is some evidence that this has not been sufficiently effective.

In order to accurately validate the level of corruption in international trade, Transparency International’s Corruption Perceptions Index (CPI) classifies countries and regions according to the level of corruption in the public sector. In this way, the overall index provides information on the violation of anti-corruption laws and reviews the level of corruption by country (Brada et al., 2019). The CPI confirms that corruption remains a global problem, even in the wealthiest countries.

It is significant to highlight examples of studies that have attempted to determine the level of corruption in the global economy. A 2012 study by Austrian economist Friedrich Schneider found that 250 billion euros did not reach the German budget as a result of corruption schemes (Brada et al., 2019, p. 42). Additionally, a 2015 Dow Jones anti-corruption study found that more than 57 percent of businesses reconsidered their terms of cooperation with counteragents because they might violate anti-corruption laws. Furthermore, the Dow Jones study, which is conducted every two years, found that nearly 43 percent of business owners believe they have problems in the marketplace because of unethical activities of competitors related to corruption (Thach, Duong and Oanh, 2017, p. 791). Thus, these figures indicate that the level of corruption in international trade is significant.

It is significant to address known cases of detection of corruption in international business. The activities of the international company, Walmart in Mexico, are associated with a corruption case. That is because the Mexican Employers Association has conducted research and established that companies that rule in the state spend at least 10 percent of their own profits on fraud and bribery (Shabbir et al., 2019). One of the most prominent issues was the Walmart outbreak, which came to light as a result of a $4.5 billion drop in the corporate stock price. After investigations, it was found that the company’s management allocated more than 24 million dollars to installing corrupt schemes (Shabbir et al., 2019). They were supposed to enhance the corporation’s position in the Mexican market. Accordingly, the corporate encouraged the construction of Walmart stores throughout Mexico as a bribe. It is important to emphasize that the corrupt schemes used by Walmart in Mexico involved high-level officials at the highest levels.

Another case of bribery related to international trade occurred in China. A pharmaceutical manufacturer paid bribes sponsored by parent company GlaxoSmithKline. Thus, this case was investigated in 2013 after Chinese anti-corruption laws were amended. Accordingly, this is an instance for other foreign corporations to use honest and transparent means of introducing international trade (Policardo and Carrera, 2018). The case of Alcatel, which paid $10 million to Costa Rica as compensation for social damage caused by bribery, can also be cited. It is relevant to note that this case is essential because of the application of the concept of social harm and the corresponding compensation order to Costa Rican citizens (Kim and Youn, 2020). Therefore, the case of Alcatel meets the foundations of the theory of social conflicts.

Correlation between Corruption and the Level of International Trade

In the past few decades, countries have made significant progress in lowering trade tariffs and eliminating quota systems. International trade has expanded and become more global, and emerging, and transition economies have access to supply chains (Shirazi, 2020). The global separation of production cycles, combined with just-in-time logistics and the emergence of e-business, has made goods’ efficient, fast and reliable movement more critical to companies (Scholl and Schermuly, 2020). This course of events has made the need for effective trade transaction management a necessity.

Absence of transparency regarding rules and regulations, redundant and time-consuming customs clearance processes, and a multitude of documentary requirements in various formats and with different data elements. These obstacles are now considered more significant barriers to trade than those related to tariffs and quotas (Shirazi, 2020). Thus, it is now more crucial than ever to reach trade facilitation. In order to enhance administrative efficiency and effectiveness, reduce costs and shorten the time from the start of a product’s development to its entry into the market, and enhance the predictability of world trade (Baum et al., 2017). Otherwise, the development of international trade encourages the owners of large corporations to enter into corrupt schemes to reduce bureaucratic procedures.

In this context, corruption has an impact on macroeconomic policy options. An expansion of crime reduces the budget revenues of a country because, on the one hand, corruption has a disincentive effect on the economic activity of individuals (Aderounmu, Ayoade and Oni, 2022). On the other hand, high levels of corruption in fiscal authorities contribute to the reduction of tax payments collected. Corruption has a negative effect on the so-called value-added tax productivity coefficient, the ratio of the share of collected value-added tax (VAT) in GDP to the standard VAT rate.

It is clear that theoretically, in the absence of corruption in the tax authorities and, accordingly, mass evasion of this tax, these two indicators should be equal to each other. However, in practice, the correlation coefficient between the level of corruption and the VAT productivity coefficient is -0.34 (Choudhury, 2019). Statistical analysis confirms that corruption is correlated with the means of managing capital flows. There are two causes for this: first, the more corrupt a country is, the lower its ability to collect taxes; the marginal cost of tax collection increases sharply with increasing corruption (Reinecke and Schmerer, 2018). Second, foreign direct investment accounts for a relatively lower share of capital imports in corrupt countries than in countries with less corruption (Esteve-Pérez et al., 2021). Corrupt countries have a more volatile savings portfolio, which in turn, reduces the capacity for macroeconomic management.

In order to establish a correlation between the scale and the level of corruption, it is essential to examine the correlation between individual variables. Specifically, it is GDP per capita, inflows of foreign direct investment, access to information, and the level of corruption for a sample of countries (Gani, 2017). The Corruption Perceptions Index, compiled by Transparency International, should be used as an indicator of the level of corruption. It will measure the level of perception of corruption in the public sector of a country. The index is based on data from expert and business surveys. It ranks 176 countries on a scale from 0 to 100, with 0 indicating the highest grade of perception of crime and 100 the lowest. A corruption deterrence index should also be used. This is the index used in the World Bank’s Governance Quality Study, which is based on several hundred variables from various sources, specifically nongovernmental organizations (Aïssaoui and Fabian, 2022). It varies from 0 to 100, where 0 means high corruption and 100 means low corruption. Therefore, it is possible to make several hypotheses, which empirical data can confirm.

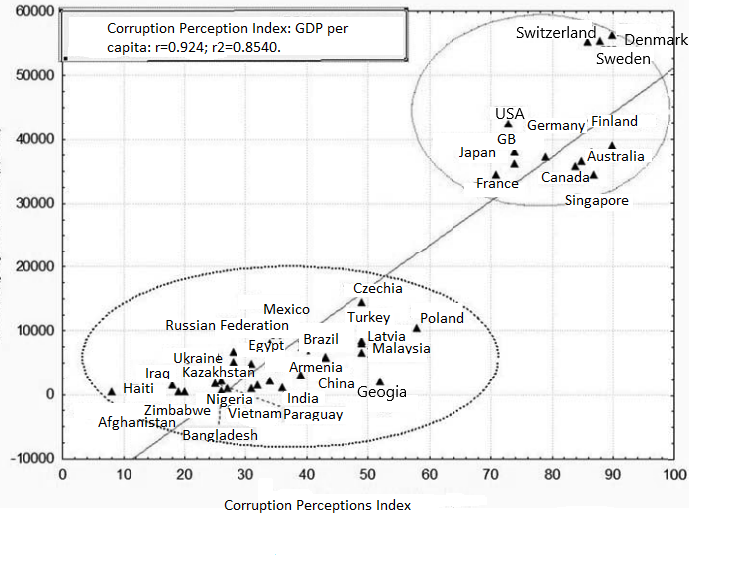

- Hypothesis 1: Corruption is less developed in countries with a higher standard of living. Figure 1 clearly highlights 2 sectors for the group of countries with a high level of corruption and a low standard of living. Conversely, it should be noted that the correlation coefficient 2 R between GDP per capita and the corruption perception index is 0.85. This suggests a close relationship between the indicators.

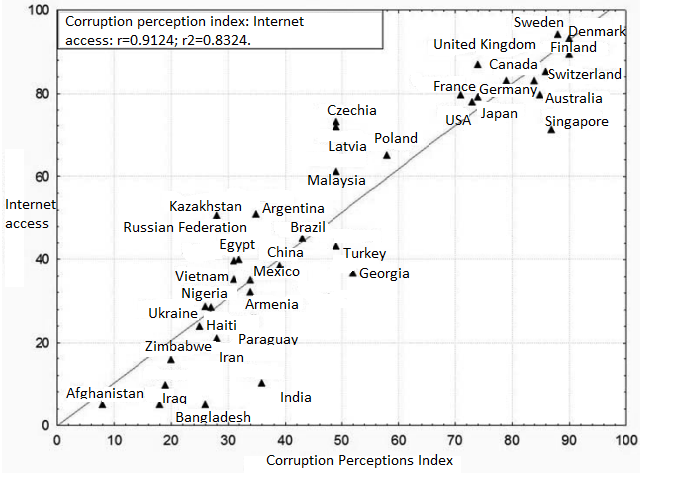

- Hypothesis 2. Access to information significantly reduces the level of corruption. Figure 2 demonstrates a high positive correlation of 2 R 0.83 between the Corruption Perception Index and public access to the Internet.

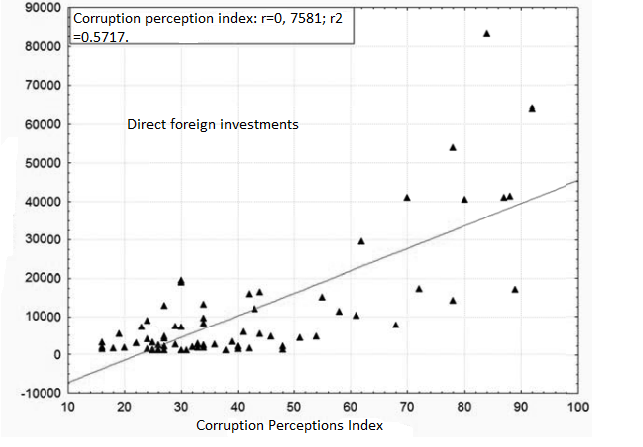

- Hypothesis 3. A low level of corruption is the most crucial factor for attracting foreign direct investment. The correlation coefficient in Chart 3 is not high enough. However, it is imperative to consider that not all countries want to attract foreign direct investment, and many are net investors in the global market.

Thus, there is an inverse connection between the level of income of the population and the level of corruption in these countries. Consequently, a higher level of corruption is characteristic of poorer countries. In addition, countries with high levels of corruption are less attractive to foreign investors (Zhu, 2017). Accordingly, these countries lose one of the sources of economic growth. At the same time, the openness of information and access of citizens to it also reduces the level of corruption. Therefore, the state’s task is to ensure that citizens are aware of their rights and obligations (Bahoo, Alon and Floreani, 2022). This stimulates the development of the economy and the entry of national companies into the international market. On the contrary, states become open to attracting new business from other states (Narayan and Bui, 2021). Hence the correlation of corruption demonstrates that the growth of corruption has a negative influence on economic growth. That is because states with high levels of corruption tend to use a bureaucratic system of governance.

In this way, they provoke the practice of corrupt links; as a consequence, it makes it challenging for the company to open, register or close a business. Furthermore, procedures such as obtaining a loan or purchasing a building plot of land are burdened with bureaucratic processes (Mukherjee, 2018). Accordingly, corporate owners intend to use bribes to solve such cases more quickly. Therefore, strengthening the control of corruption is a prerequisite for attracting international business to various states.

The Positive and Negative Impact of Corruption

It is crucial to emphasize that the phenomenon of corruption has a significant impact on economic activity. Indeed, corruption is identified as a major obstacle to the functioning and growth of firms in developing countries (Lisciandra and Millemaci, 2017). This conclusion is justified according to a study of the global business environment and the level of corruption as a function of state development. As one would expect, according to the majority of scientists, corruption has the most adverse effect on the economy of a country (Cooray et al., 2020). This is confirmed by numerous theoretical as well as empirical studies. In particular, Vito Tanzi suggests the following economic and political consequences of corruption. First, corruption has a negative impact on the ability of the state to regulate the private sector of the economy in order to counteract market failures (Ozturk, Al-Mulali and Solarin, 2019). Second, corruption adversely affects the incentives of economic agents, effectively forcing individuals to spend resources on bribes and rent-seeking. Third, corruption imposes an additional tax on business people, paid to government regulators in the form of bribes.

However, fourth, corruption undermines the ability of the state to exercise its functions related to the specification and protection of property rights, which is an essential condition for attracting foreign investment. Fifth, corruption reduces public confidence in the market economy and democracy and stimulates income distribution and poverty inequality among the general population (Cooray, Dzhumashev and Schneider, 2017). Thus, the principal socio-economic consequences of corruption in international trade can be divided into four large groups. The first group is the effect of corruption on the economic activity of individuals. The second category is the effect of corruption on public money. The third group is the effect that corruption has on income distribution (the level of inequality in society) and human development. There are four main ways in which corruption affects the economic activity of individuals: first, corruption increases the return on investment aimed at finding rents. In addition, corruption has a disincentive effect on small and medium-sized businesses and makes businessmen less sympathetic to innovative activities (Cooray et al., 2020). Meanwhile, the high level of corruption reduces the amount of foreign direct investment.

The explanation of how corruption stimulates clients’ behavior in economic agents follows directly from the famous theoretical model of Andvig – Moen. Consequently, an increase in the number of corrupt officials reduces the probability of exposing a corrupt deal and the transaction costs of finding a counterparty for potential bribers (Gil-Pareja et al., 2019). This promotes an enhancement of the attractiveness of rent-seeking investments for the latter. Obviously, resources spent on the search for rent cannot be spent already in any other effective for society (Van et al., 2018). Therefore, by stimulating rent-seeking behavior, corruption has an adverse effect on the investment activity of entrepreneurs.

In many countries of the Third World, it is typical that entrepreneurs, the leading representatives of small and medium-sized businesses, are forced to pay money to representatives of various government agencies in addition to taxes to the budget. These payments can be presented as charges for some dubious services rendered specifically by these state structures (Bardhan, 2017). The reason for this phenomenon is the weakness of state power and the ineffectiveness of the existing public administration system. It is evident that the increase of corruption burden on small and medium businesses should theoretically lead to its reduction. Therefore it leads to the growth of unemployment and an increase in inequality in society. Secondly, the size of the illegal sector of the economy is expanded. The latter is empirically confirmed by Graycar and Jancsics (2017). It demonstrates that the growth of corruption, in contrast, with the increase of official tax rates, contributes to the expansion of the illegal component of the economy. Thus, states in which companies have to contribute such double payments cannot become full participants in international trade.

Another reason for the negative influence of corruption on the economic activity of individuals and, consequently, on economic development indicators is that it undermines entrepreneurs’ incentives to innovate. Without this factor, companies do not have a competitive advantage in the international marketplace. First, if the level of corruption in the state is high, innovators have to spend extra money to obtain permits, licenses, and the like from the corrupt government (Graycar and Jancsics, 2017). Second, the individual entrepreneur who innovates often has a considerable amount of human capital but lacks funds and cannot obtain the necessary access to credit.

The innovator simply does not have enough money to pay for the bureaucratic services of officials.Thus, foreign commissions do not want to invest in such a state, and national corporations cannot enter the international market (Erum and Hussain, 2019). Therefore, such states are excluded from the system of international trade. At the same time, innovative projects require long-term investments, and with the weak specification and protection of property rights inherent in a corrupt system, such investments lose their reliability.

Moreover, as many empirical research studies demonstrate, the higher the level of corruption of officials in a state, the less attractive this country is for foreign investors. This is because the bribes that foreign investors are forced to provide to corrupt officials are equivalent to additional taxes that deter potential investors from investing in the economy of a particular country. At the same time, as technology becomes more complex, the transaction costs of specifying property rights increase (Nemec et al., 2021). If this property is co-owned, investors with advanced, and therefore complex, technology are less interested in co-ownership of property because of the danger of losing it (Karim, Karim and Nasharuddin, 2019). Therefore, corruption has an additional negative influence on innovation and economic growth.

The primary assumption that foreign direct investment is more susceptible to the level of corruption in a state is the inherent high level of uncertainty in a corrupt system. On the other hand, the governments of many developing countries guarantee, explicitly or implicitly, the repayment of debts to foreign banks. Therefore, this form of investment in a country’s economy with a high level of corruption among government officials is more attractive to foreign investors (Lazhar, Ridha and Imen, 2021). Concerning portfolio investments, in the examined context, they represent an intermediate form of monetary investment between direct investments and loans.

Furthermore, the composition of the flow of foreign capital, characteristic of countries with a high level of government corruption, is a negative phenomenon. Correspondingly, the high level of uncertainty makes the economies of such countries less resilient to possible financial shocks (Imran, Rehman and Khan, 2020). This means that loans and portfolio investments are more fluid, and their fluctuations have a more pro-cyclical amplitude in comparison with direct investments. Hence, the high level of corruption contributes to the growing instability of the financial system and the systematic occurrence of financial crises in the economy of this country (Imran, Rehman and Khan, 2020). Thus, it negatively affects the image of the state and creates an isolationist policy by corporations from states with low levels of corruption.

It is significant that corruption affects trade negotiations between countries and impedes the liberalization of international trade. For example, it prevents the free movement of products through additional inspections on the ground of countries and vaguely defined requirements and procedures and increases the price of international transactions (Imran, Rehman and Khan, 2020). Corruption can also seriously damage global trade. Individual countries introduce various tools to fight international crime, but these measures also obstruct international trade.

It is significant to emphasize that trade barriers restrict the flow of goods and the involvement of the state administration. This immediately indicates their adverse effects on international trade (Lazhar, Ridha and Imen, 2021). It is often the case that domestic producers are forced to offer bribes in the same way as foreign producers if corrupt practices are common in the nation. Therefore, the protectionist effect, which is key to understanding the term trade barriers, is absent. In practice, corruption in a developing country may facilitate greater penetration of foreign goods into the domestic market (Lazhar, Ridha and Imen, 2021). First, if the standard of living in the importing country is much higher, the amounts of bribes may be insignificant for foreign corporations. Second, the attitude towards foreigners is often more tolerant. Thus, according to the theory of international relations, this does not allow the application of the economic principle of protectionism (Lazhar, Ridha and Imen, 2021). As a consequence, domestic enterprises make less profit or declare bankruptcy altogether.

Moreover, bribes have a similar effect on international trade as the tariff. A surcharge on the cost of goods and services leads to an improvement in their prices and a decrease in sales profitability (Nemec et al., 2021). This forces producers out of the market and prevents foreign suppliers from entering the market. Offering and accepting bribes are part of customs regulations and state internal practices. They often contain certain cultural norms, which have a protectionist effect (Nemec et al., 2021). Thus, corruption is a trade barrier that inhibits the growth of international trade and reduces its positive influence on the welfare of states involved in such exchanges of goods and services.

Furthermore, corrupt practices can be part of non-tariff barriers to international trade, as noted by Transparency International, a nongovernmental international anti-corruption organization. Although they are supposed to protect domestic producers, corruption prevents the principle of protectionism from being applied. The World Bank estimates that trade in goods accounted for 48.3 percent of global GDP in 2017 (Nemec et al., 2021, p. 9). This share rose steadily from 2002 to 2008 and reached its highest value during that period, 53.3%; in 2009, it dropped significantly to 43.6% but then began to rise again. Trade in services represents a smaller but still significant portion of GDP (Nemec et al., 2021, p. 9). In 2018, the share of trade in services was 13.2% of the global GDP. Overall, trade in products and services is responsible for 59.3% of global GDP; in other words, more than half of that figure (Nemec et al., 2021, p. 11). This is why it is such an essential priority to combat corruption in international trade effectively.

The negative impact of corrupt practices as a trade barrier manifests itself in four dimensions. The first relates to the fact that corruption reduces the willingness of companies to accomplish business in a country where it is standard practice. The importance of developing competition is enhancing both the economy’s flexibility and the international competitiveness of domestic goods, stimulating innovative development (Erum and Hussain, 2019). Thus, corruption schemes have a negative impact not only on the economy but also on the political and social factors in states. Accordingly, corruption hinders the modernization of states, and the spread of corruption schemes is associated with the reduction of public welfare (Erum and Hussain, 2019). The second aspect connects to the fact that corruption contributes to a decrease in the quality of products and in the confidence of buyers in the quality of the products they consume. Accordingly, corruption eliminates healthy competition between producers. As a consequence, corruption makes it difficult to enter the market.

The impact of corruption on public expenditures also has a harmful influence. Thus, high levels of corruption distort the decision-making process associated with public investment projects (Erum and Hussain, 2019). The preference for large capital-intensive projects at the expense of small social infrastructure projects provides those who allocate resources with more opportunities for illicit enrichment. At the same time, the efficiency of public expenditures and, in particular, of spending on education falls as the level of corruption in the country increases (Erum and Hussain, 2019). Thus, this leads to states gradually acquiring characteristics of backwardness; accordingly, many corporations do not invest in them.

The illegal business in wildlife and forest resources is often associated with corruption. Environmental crimes ranging from poaching to illegal trade in wildlife and valuable timber to the smuggling of hazardous waste, are a serious growing trans-border problem (Ivory, 2017). Combating these types of organized crime requires a cooperative effort. Thus, officials and criminals create whole networks for illegal activities. They damage the environment in multiple directions at once. They poach and smuggle wild animals and sea creatures, do unlawful logging and illegal mining, and the dumping of hazardous waste and toxic substances (Ivory, 2017). These environmental crimes are often connected to other criminal activities, such as drug trafficking or money laundering. Thus, the development of corruption schemes contributes to the emergence of illicit trade on the international market (Ivory, 2017). This can potentially lead to ecological disasters or the destruction of specific animal or plant species.

The primary positive effect of corruption is considered the reduction of bureaucracy, which prevents the passage of trade flows. However, in the long run, the government loses more than it gains. The reason is that government corruption damages millions of people once a day. It prevents roads and bridges, hospitals, and schools from being built (Spyromitros and Panagiotidis, 2022). It keeps water and electricity from reaching the homes of the neediest humans on the planet. It destroys the idea of receiving for hard work and perseverance and takes away people’s hope. Thus, offering and accepting bribes in international trade proves to be contrary to ethics and morality and appears to be a rather unprofitable enterprise in the long run (Spyromitros and Panagiotidis, 2022). The bribe is an additional surcharge on the cost of the transaction and ultimately brings losses to the country itself and its citizens.

In general, the argument in favor of corruption can be reduced to the following two statements. First, in a situation when a corrupt official who is maximizing their wealth is involved in the distribution of some public funds (Spyromitros and Panagiotidis, 2022). For example, if a civil servant places an order for the production of something for the needs of the state for a bribe or performs public procurement of goods, the rent accrues to the one who is most willing to pay for it. Therefore, the efficiency conditions are met, even when the bribe-giver does not have full information about the expected level of costs (Spyromitros and Panagiotidis, 2022). Consequently, and the maximum amount of bribes that competitors can offer to the official, the winner in this corruption auction will be the company that can provide the appropriate benefit with the minimum public cost. In other words, the allocation of resources will be Pareto efficient.

Second, in exchange for the bribe, a service is provided that is not illegal and involves deceiving the principal. For instance, exemption from payment of customs duty for a bribe, but the provision of some legal service by the appropriate bureau is expedited (Spyromitros and Panagiotidis, 2022). That is, the societal cost of waiting is minimized, given the difference in the opportunity cost of spending time, which is also a Pareto-effective result.

Government procurement accounts for a significant portion of total international trade, which suggests that foreign suppliers can use corrupt practices to compete for lucrative contracts. After the contract has been signed, the exporter needs to prepare a considerable number of accompanying documents necessary to pass customs procedures in both the exporting and importing country. The World Bank estimates that about 6.5 papers are required on average for exporting products and 7.4 for importing (Ozturk, Al-Mulali and Solarin, 2019, p.17277). In other words, about 14 documents altogether. When the customs services of the exporting and importing country clear or review each of them, a hitch can be resolved by the payment of a bribe. However, the possibility of corrupt practices remains even if all documentation is executed correctly (Ozturk, Al-Mulali and Solarin, 2019). Nevertheless, there are still corrupt practices even if all the documentation is properly completed.

The possibility of a requirement to take remains even after the imported goods have been cleared. For example, there may be requirements on the weight or space occupied by the products during transportation. Article VI of the General Agreement on Trade in Products allows WTO members to impose duties to compensate for losses from dumping. A special commission is appointed to investigate the impact of each specific case of possible dumping on the national economy. According to Transparency International, in 10% of cases, representatives of such commissions received bribes (Ozturk, Al-Mulali and Solarin, 2019, p. 17280). Since corruption has such a negative impact on international trade, there are a number of international agreements, conventions, and declarations that aim to address this challenge.

Methods to Combat Corruption

The volume of global trade is increasing, and so are the risks of cross-border corruption. A new report from Transparency International (TI) states that little progress has been made in enforcing measures against bribery in interstate commerce in the last three years. Thus, due to insufficient law enforcement efforts, the principal goal of creating a corruption-free environment in international trade has not been achieved (Bahoo, Alon and Paltrinieri, 2020). Corruption and illegal money flows are serious problems in many states. The reduced tax base and the restrictions on public and private investment associated with it are leaving society with vital resources. That is necessary for the structural transformation, economic growth, and sustainable development of states (Bahoo, Alon and Paltrinieri, 2020). In this way, they jeopardize people’s ability to exercise human rights, including their right to development and international trade.

On a positive note, in recent years, the effectiveness of efforts to locate, freeze, or confiscate stolen assets in various countries has increased significantly. Between 2017 and 2021, there has been a significant increase in the recovery of funds stolen as a result of corruption. In addition, more countries are recovering funds cross-border in corruption cases (Dobrowolski, 2017, p. 4). Since 2010, $9.7 billion in proceeds of corruption have been frozen, seized, or confiscated in the destination government or returned to the country where they were stolen (Brock, 2018, p. 103). Thus, efforts to combat corruption must be strengthened. Corruption and the financial flows associated with it not only reduce the state’s ability to mobilize resources to finance sustainable development and ensure human rights (Hofmann, Osnago and Ruta, 2019). They weaken state institutions, undermine the rule of law and undermine the functioning of the criminal justice system. Consequently, it is advisable to consider methods of combating corruption that exist at the international level and positively influence the development of international trade.

Accordingly, international cooperation in the field of combating corruption is an objectively conditioned process of interaction between the relevant authorized bodies, organizations, and institutions. There are many international governmental and nongovernmental associations and interstate and transnational organizations (Hofmann, Osnago and Ruta, 2019). Their status, goals, and objectives are defined as the main directions of activity and means of implementing the plan. Relevant international studies occupy their place. Moreover, all this should include the need for a unified anti-corruption strategy, its flexible legal support, and effective control over the implementation of decisions made (Yan, 2020). The targets are also quite transparent, including the inter-country coordination of anti-corruption plans and counter-corruption action roadmaps. Besides, detection of zones of high corruption risk, suppression of activities of mercenary and criminal organizations, search and discovery of illegally obtained property, and its return to legal owners (Yan, 2020). In addition, neutralization or minimization of negative social consequences of corruption.

This also includes the adoption of special international programs and the conclusion of international treaties and agreements. The implementation of norms of international anti-corruption law into the national legislation and control and analytical measures are also of significant value (Zamudio-González, 2021). Such a system guarantees a sufficiently high level of internationally coordinated political, law-enforcement, information-analytical, and auditing activities. Accordingly, the fighting methods agreed upon by States are designed to ensure transparent and efficient international trade (Zamudio-González, 2021). This requires that the efforts made be consistent with the principles of legality, voluntariness, and non-interference in the internal affairs of partner countries. They also follow reciprocity and transparency, the minimization and elimination of the consequences of corrupt acts, and stability (Brusca, Manes Rossi and Aversano, 2018). Therefore, these basic principles in international relations are built on the architecture of the fight against corruption schemes.

International mechanisms and global legal standards for combating corruption are relatively recent by historical standards. In the first stage (1950-1960), the main focus was on the problems of tackling bribery of officials in international financial transactions (Jeppesen, 2019). However, even at that time, many countries perceived the issue of corruption, especially at the elite level, quite seriously and made it one of the priorities in their legal policy. Gradually, the understanding came that corruption was insidious and extremely dangerous. Moreover, the concept of corruption includes not only bribery and embezzlement, not only bribery and corruption extortion. Besides, it is a wider range of unlawful acts of lucrative content (Peters, 2018). They include nepotism, protectionism, shady lobbyism, laundering of illegally obtained funds, and the creation of non-governmental structures for corrupting the ruling elite, business, and bureaucracy.

The second stage referred to the seventies and eighties of the last century when the first steps were taken to develop international agreements on financial and economic cooperation and anti-corruption protection of investments. It was also when the global system developed principles to combat the most dangerous selfish and corrupt practices. On December 15, 1975, the UN General Assembly adopted resolution number 3514 against bribery in international business transactions (Peters, 2018, p. 1287). During this time, the International Development Association (IDA), the International Centre for Settlement of Investment Disputes (ICSID), and the Multilateral Investment Guarantee Agency (MIGA) are created (Peters, 2018, p. 1287). In 1968, the United Nations Research Institute on Crime and Justice began to function. The formation of these structures was a direct response to the increasing conflict of interest and institutionalization of corruption (Lohaus and Gutterman, 2021). It was also a response to the entrenchment of corrupt practices in fairly organizationally sustainable forms not only at the national but also at the global level.

The third stage is characterized by active scientific development of corruption issues. In accordance with the requirements of the resolution of the VIII UN Congress (1990), “Corruption in Public Administration” develops scientific and conceptual apparatus and studies the prerequisites, sources, and forms of corruption offenses (Lohaus and Gutterman, 2021). In addition, political-legal bases are being formed, and the tools of counteraction to corruption crime are being developed. The features and corpus delicti of corruption crimes in the form of bribery, extortion, and corruption fraud have been defined for the first time at the international legal level. Other international anti-corruption institutions also function quite effectively (Lohaus and Gutterman, 2021). They differ in their legal status, powers, objectives, tasks, intellectual and human potential, financial possibilities, authority, and influence. The United Nations Development Programme (UNDP) and the Venice Commission of the Council of Europe play an integrating role. They have initiated many documents of global anti-corruption orientation (Branco, 2021). This includes measures against corruption practiced by transnational and other corporations, their intermediaries, and other parties involved.

Hence, the development of international anti-corruption policies had a positive impact on the emergence of international trade. This is because, gradually, the principles of fairness, transparency, and transparency became mainstream in international trade (Lester, Mercurio and Davies, 2018). However, corruption schemes acquired new manifestations to which the international community had to respond. At the same time, the development of corruption in some states had a negative effect on the global level (Lester, Mercurio and Davies, 2018). Therefore, at the level of international institutions and organizations, a struggle has emerged and continues in order to reduce the negative impact of corruption on the conduct of international trade.

It is essential to mention that the WTO is the leading institution in the field of international trade, and its primary goal is to combat trade barriers. However, there is no agreement within the GATT/WTO system that focuses exclusively on the issue of corruption. Corruption within the GATT/WTO system is dealt with through four mechanisms: the Dispute Settlement Body (Wolf, 2018). There are also the WTO Trade Protection Act and the WTO Agreements, including creating a single agreement dedicated to anti-corruption. At the same time, an essential mechanism is to bring all Member States together in the WTO as a forum for negotiation.

The obvious advantage of fighting corruption under the GATT/WTO system is the ability to eradicate or at least reduce the volume of bribes in international trade. These mechanisms are complementary to national anti-corruption laws and international conventions to which WTO members have acceded. The Dispute Settlement Body, Appellate Body, and Commissions are a way of monitoring the implementation of anti-corruption measures (Wolf, 2018). In addition, the WTO is an international forum that has accumulated considerable experience in resolving conflicts related to the existence of trade barriers that limit the free exchange of goods and services.

The reduction of corruption has a significant positive effect on international trade. Thus, developing countries can only increase their role in world trade by combating corruption in state structures. Otherwise, the expansion of foreign exchange has no influence on citizens’ living standards and welfare (Kruessmann, 2022). The positive effect of the fight against corruption within the framework of the WTO can only manifest itself if the establishment does not abuse its powers. It also carefully examines individual cases that involve the potential use of corrupt practices.

At the moment, fighting corruption through the WTO Dispute Settlement Body appears to be a much more effective mechanism than signing conventions and charters, the principles set out which are recommendatory in nature. Moreover, the liberalization of international trade will reduce corruption in the long term by reducing government influence in this area. Finally, the creation of a separate agreement within the framework of the WTO, as suggested by Nicholls, can be a fundamental step toward eliminating corruption in international trade (Kruessmann, 2022). However, it may take decades for it to be drafted and negotiated by all members.

It is worth mentioning that after a long preparation, the United Nations adopted the Convention against Corruption. It draws attention to the need to create specialized state bodies to combat corruption (Bauhr and Grimes, 2017). Furthermore, it focuses on the organization of personnel selection in the state apparatus and the adoption of codes of conduct for civil servants and other officials, which will avoid corruption. Moreover, the method of fighting corruption is also defined to ensure transparency and competition in public procurement and contracting (Bauhr and Grimes, 2017). The fight against corruption in the Convention is related to the adoption of criminal penalties for the laundering of money obtained through crime, for the concealment of property obtained through an act of corruption.

A significant aspect is that the Convention proposes corruption, abuse of office, misappropriation of state property, and unlawful enrichment. Such wording allows for avoiding any kind of bribery at the state and international levels (Kellenberg and Levinson, 2019). It is proposed to criminalize a bribe’s promise, offer, or solicitation. States are encouraged to criminalize the bribery of foreign public officials and officials of international public organizations (Kellenberg and Levinson, 2019). Accordingly, this would comprehensively regulate attempts at corrupt schemes in international trade.

It should also be remarked that the UN General Assembly adopted the International Code of Conduct for Public Officials as a unique tool in the fight against corruption. According to this code, public official must declare their wealth and benefits and refuse gifts. A more far-reaching international legal instrument than in Europe was the 1996 Inter-American Convention Against Corruption of the Organization of the American States, which countries have already ratified in the Americas (Van Schoor, 2017). It criminalizes not only active and passive bribery but also other acts or omissions by public officials. If such actions are aimed at obtaining unlawful benefits, as well as the use and concealment of property received due to corruption (Van Schoor, 2017). The document applies to crimes committed both domestically and transnationally.

It is not only the provision of a bribe that is punishable but also the offer to take it. According to the Convention, an official is prescribed for unlawful enrichment if a “significant increase” of their property is established. At the same time, the person cannot reasonably explain the source of its appearance (Hope Sr, 2017). The Inter-American Convention does not reduce the understanding of corruption to bribery but also includes the misuse of confidential information and public property by officials. They also achieve from the public authorities any decisions for an illegal purpose and mismanagement of any state property (Hope Sr, 2017). Thus, at the level of the UN introduced rules and mechanisms to combat the development of corruption, which have been supported and implemented by member states. This harmonizes the methods of fighting and reduces the corruption scheme at the national level (Villarino, 2020). As a consequence, it reduces the impact of corruption on international trade.

The International Monetary Fund (IMF) is also concerned with corruption, funding programs to improve economic governance, and studying the causes and state of crime in the regions. This is because the officials of these countries often embezzle the monetary resources that the IMF provides to developing countries (Villarino, 2020). In the World Bank, there is a system of strict control that aims to prevent the use of funds provided to client countries for improper purposes.

The World Bank is recognized for its high fiduciary standards, including financial management and procurement. In the same way, in the investigation and sanctioning of fraud, corruption, and corporate misconduct departments. An integral part of these standards is the legal and financial expertise that experts conduct as part of project preparation and during project implementation (Sampson, 2019). Financial management and procurement experts are assigned to all phases of preparing and implementing any project that receives Bank assistance. In addition to this legal and financial expertise, the World Bank conducts a variety of activities. This is to support countries in building effective, transparent, and accountable institutions and developing and implementing successful anti-corruption programs (Sampson, 2019). This ensures that funds are allocated efficiently and verify their distribution to avoid corruption at the international and national level.

The World Bank has a mechanism in place to combat this when funds are discovered to have been embezzled through corrupt schemes. The World Bank’s Office on Fraud, Corruption, and Corporate Misconduct is an independent entity investigating suspected fraud in World Bank Group-financed operations. Following these investigations, the Sanctions Board and the Sanctions and Debarment Unit impose sanctions in cases where the allegations are substantiated. Between 1999 and 2019, 956 corporations and individuals were suspended (Koskenniemi, 2017, p. 43). During the same period, the World Bank implemented 421 decisions made by other multilateral development banks that are parties to the mutual enforcement agreement on sanctions (Koskenniemi, 2017, p. 43). This allowed international trade to develop global principles of transparency, which is fundamental to preventing corruption.

The complexity of the fight against corruption is that corruption is not only a criminal problem but also a political, financial, and social one. Despite the general condemnation and declaration of the fight against it, corruption continues to exist confidently (Xiao et al., 2018). Therefore, an effective fight against it is possible only through a complex of measures based on a unified anti-corruption policy. The policy consists of the purposeful application of consistent standards of the state to eliminate the causes and conditions that generate and feed corruption in different spheres of society.

Proposals for Combating Corruption in International Trade

Global experience reveals the tendency of constant development and supplementation of anti-corruption legislation. Such a process is not limited to adopting and improving criminal law norms but encompasses private and public law regulations. Such diversity of legal regulation is caused by the understanding that it is impossible to eradicate corruption only through criminal prosecution (Xiao et al., 2018). This explains the importance of unifying and disseminating in all States new methods of combating corruption in international trade, including the mechanism of extended confiscation.

If a person is convicted of a crime committed for financial interest and illegally acquires property, the state may seize the property of the company or person. However, the state does not have to prove that each property held is the result of the crime for which the criminal case was opened. It is enough that a legal or natural person has been convicted of a crime committed for financial interest. The court should also establish a difference between legitimate income and wealth. This would develop strict statutory rules to help eradicate bribery (Kouznetsov, Kim and Pierce, 2018). At the same time, it will have a positive impact on international trade because businesses will be enabled to use this mechanism in case of corruption schemes.

In order to avoid corrupt acts, it is essential to ensure the legal conditions for the prevention of corruption offenses. Including increasing the transparency of procedures, identifying conflicts of interest, and other means. Corruption prevention is the organization’s activity aimed at introducing the elements of corporate culture, organizational structure, rules, and procedures. They should be regulated by internal normative documents, which ensure the prevention of corruption offenses (Ivory, 2017). Thus, it is crucial that business structures have the right to organize a system of combating corruption at the local level. For this purpose, it is essential to create appropriate motivating measures to influence business entities in the legislation. For instance, a commercial organization can reasonably prove that it actively counteracted corruption to avoid applying the general procedure of its prosecution (Heywood, 2018). That is, by the time the corruption offense was committed, it had applied some proper procedures to prevent the corrupt acts of persons related to this organization.

In addition, at the level of companies operating on the international market, there should be special procedures in place by the relevant commercial organizations to prevent the bribery of persons related to them. It should be considered criminal and unjustifiable for a company to facilitate the commission of a corrupt act by a person associated with it (Heywood, 2018). Accordingly, a corporate entity will have some legal protection from criminal prosecution if corruption prevention procedures have been implemented as part of its activities. If the organization does not have the ability to develop and implement any corruption prevention procedures, the process for criminal prosecution is similarly mitigated. Nonetheless, the company’s failure to take measures to create and implement compliance programs should not be a criminal offense (Heywood, 2018). However, if it does not lead to the commission of corporate crimes of a corrupt nature.

It is crucial to recognize that international companies have different fields of activity and focus. Accordingly, it is impossible to unify the specific procedures and methods that commercial organizations may implement in order to obtain legal status for criminal prosecution of corrupt corporate practices. Therefore, each company, based on gross activity principles, should adopt corporate anti-corruption procedures (Krylova, 2018). This will prevent the emergence of corruption schemes within the company. Six principles for preventing corruption at the corporate level can be identified. The first principle implies that a commercial organization’s procedures for preventing crime in the behavior of related persons should be commensurate with the risks of committing corrupt acts that it regularly encounters.

The second principle stipulates that the top management of any business should be involved in procedures to prevent corruption on the part of related parties. Moreover, a company’s top management is required to maintain a level of corporate culture in which crime is unacceptable in essence (Krylova, 2018). According to the third principle, a commercial organization should consider the level of exposure to potential risks of corrupt practices on the part of related parties in its activities. Regularity, consideration of all relevant information, and comprehensive documentation are required in assessing such risks.

The fourth principle requires an international company to follow due diligence procedures as part of its compliance program. Thus, they should evaluate or fail to assess the actions of individuals who either represent the legitimate interests of the company or interact with it externally. The fifth principle is that any commercial organization must strive for a unified corporate approach to combating corruption. This is ensured throughout the organization through channels of internal and external exchange of information on corrupt activities and professional training of the organization’s employees in such business (Krylova, 2018). Finally, the sixth principle enshrines that any commercial organization must periodically monitor the implementation of anti-corruption procedures as part of its program and enhance them if required.

Accordingly, compliance with such principles will create a positive image of the company in the international market. Consequently, their partners from other states will attract investment to the country of origin of the corporation. Moreover, the transparency of companies’ activities and their own fight against manifestations of corruption will make it possible to supplement international legislation designed to regulate the activity of officials (Krylova, 2018). In this case, reaching a state in international trade will be possible when officials do not demand bribes and corporations will not offer them. In this way, companies will operate according to the basic principles of competition in their particular market (Krylova, 2018). In order to implement these principles and establish anti-corruption policies at the corporate level, it is essential to involve government agencies to create mechanisms for this implementation.

At the same time, more attention should be paid to the development of corruption at the highest levels of government. This is because such corruption’s adverse influence on society’s well-being is disproportionately more significant. An in-depth definition of the term is as follows. Grand corruption is systematic actions committed by high-ranking officials to satisfy their own needs to the detriment of the economy and the public good. It includes bribery, trading in influence, and grand larceny (Krylova, 2018). Accordingly, grand corruption often has an international dimension since the use of the money received by corrupt officials often occurs outside their own countries. This type of corruption significantly negatively influences international trade because corporations do not want to do business in an environment where they have to pay bribes in addition to taxes (Krylova, 2018). Moreover, the creation of artificial obstacles, such as significant bureaucratic procedures for obtaining licenses, permits for activities, construction, or rent, are sanctioned by high-ranking officials of certain states.

Further, combating corruption in the highest echelons of government is associated with a number of difficulties stemming from its essence. Corrupt officials are those responsible for the administration of the state. This significantly impedes the possibility of identifying corrupt practices on the part of senior officials (Krylova, 2018). Moreover, a fair investigation of similar corruption cases may be biased because of pressure exerted on the judiciary by high-ranking officials. Furthermore, corruption can be “legalized” by the authorities and considered an acceptable practice for civil servants, thus making it impossible to collect evidence (Krylova, 2018). It is also essential to mention that senior officials have immunity from criminal prosecution. Accordingly, such factors indicate that corruption can take on an international dimension, which is why interstate cooperation is crucial in combating it.