Introduction

The forward foreign exchange market is a crucial component of the global financial system because it enables individuals, businesses, and governments to mitigate the risks associated with currency exchange rate fluctuations. This market allows parties to purchase and sell currencies at a predetermined price for future delivery, providing a measure of certainty in a volatile economic environment (Nguyen & Do, 2020). This paper will critically reflect on the main activities and utility of the forward forex market for buyers (importers) and sellers (exporters) of goods and services. Additionally, the report will investigate the advantages and disadvantages of this market, evaluate its efficacy, and assess its influence on the global economy.

Understanding the Forward Foreign Exchange Market

The forward foreign exchange market is a platform where contracts exchange currencies at a future date. Both parties concur on the exchange rate, and the transaction is settled on the agreed-upon future date (Islam et al., 2020). This market is essential for companies that deal in foreign currencies because it enables them to hedge against fluctuations in exchange rates (Nan & Kaizoji, 2019). On the forward market, participants can lock in the exchange rate they wish to use in the future, allowing them to safeguard themselves against potential losses caused by unfavorable exchange rate fluctuations. This aspect of the forward market is especially advantageous for businesses engaged in international trade, where changes in exchange rates can significantly impact the bottom line.

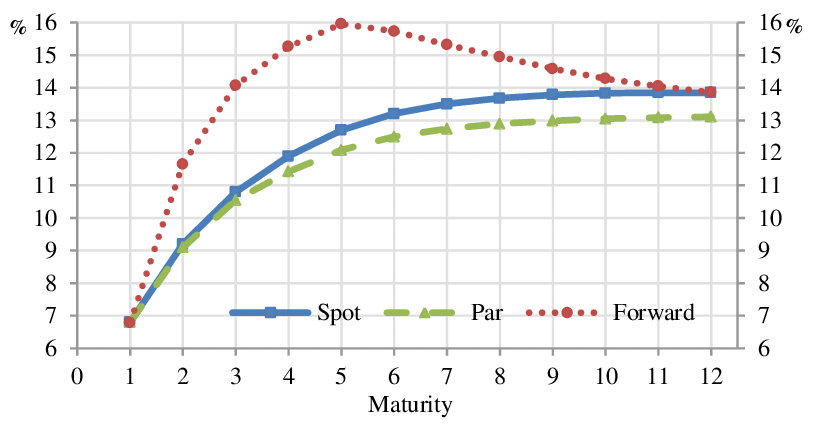

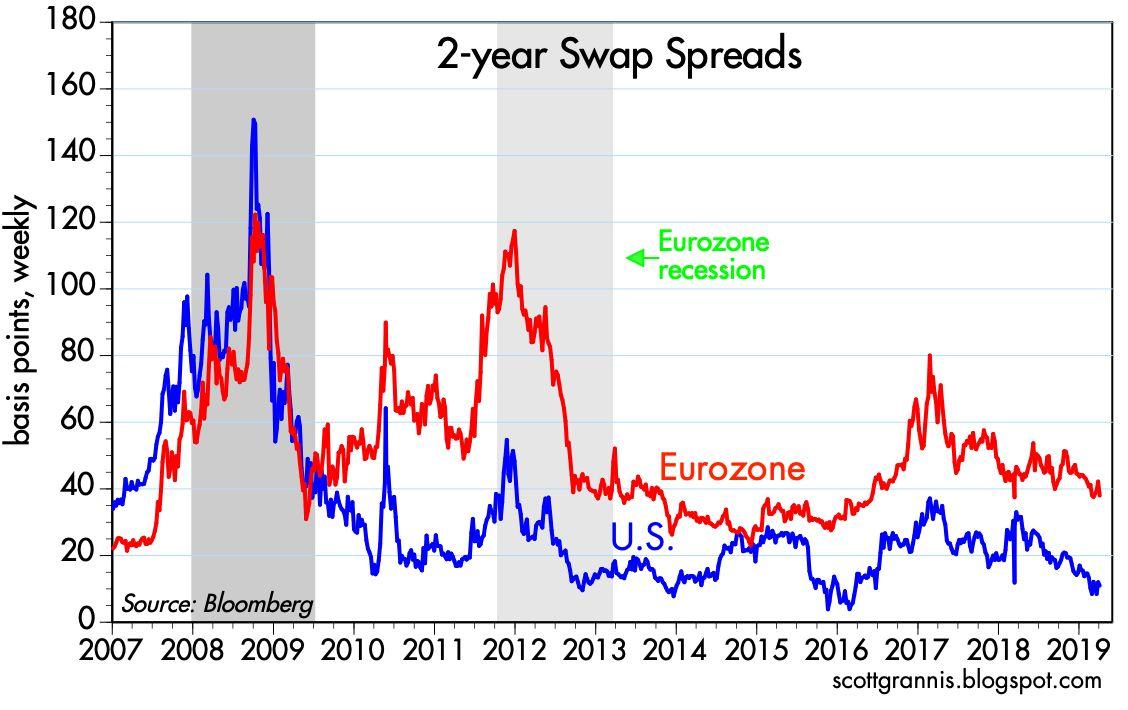

The difference between the spot and forward rates is vital to the forward foreign exchange market. The forward rate is the exchange rate determined for an upcoming date in a forward contract as opposed to the spot rate, which is the rate of exchange between two currencies at the moment (Fu & Luger, 2022). According to Chaudhry et al. (2019), the forward rate is calculated by considering the current exchange rate, the interest rates of the two currencies, and the length of the forward contract. If the forward rate is greater than the current market rate, it is known as a premium; if it is lower, it is known as a discount. Forward or exchange points refer to the difference between the spot and forward rates. Figures 1 and 2 depict the forward locations and swap points for the EUR/USD currency pair, respectively.

Key Activities in the Forward Foreign Exchange Market

Hedging

Hedging, speculation, and arbitrage are significant activities in the forward foreign exchange market. Importers and exporters use hedging as a risk management strategy to protect against the unpredictability of exchange rate fluctuations (Mussa, 2019). The forward foreign exchange market enables them to secure a specific exchange rate for a future transaction, reducing their exposure to currency value fluctuations (Kumar, 2020).

Additionally, hedging enables companies to plan their budgets better and forecast their profits, resulting in more excellent financial stability (Lin & Bai, 2021). However, businesses must pay a premium to secure the forward contract to hedge. This expense must be accounted for in their financial planning, and hedging must be carefully considered.

Speculation

Speculation entails having a position on the potential future movement of a currency’s value to profit from fluctuations. Traders in the forward foreign exchange market utilize various methods, including technical and fundamental analysis, to forecast currency movements (Gong et al., 2023). Speculation is a high-risk endeavor that necessitates a comprehensive comprehension of the market and the factors influencing currency values (Haab & Nitschka, 2020). Speculation can be lucrative but result in substantial losses if the market moves against the trader’s position. Therefore, it is essential to cautiously approach speculation on the forward foreign exchange market and employ suitable risk management techniques.

The Usefulness of the Forward Foreign Exchange Market for Importers and Exporters

The Forward Foreign Exchange Market provides importers and exporters various advantages that facilitate international trade. Regarding prospective exchange rates, the market offers a degree of certainty, one of its primary advantages (Mishra et al., 2020). This is because the forward momentum enables traders to secure a specific exchange rate for a future date, eliminating the potential impact of currency fluctuations on transactions (Almaskati, 2022). As a result, the market enables importers and exporters to budget and plan with greater confidence, enhancing the predictability of cash flows, reducing risk, and facilitating improved decision-making. In addition, the forward market allows businesses to mitigate currency risk, allowing them to concentrate on their primary business activities rather than currency fluctuations.

Critical Reflection on the Forward Foreign Exchange Market

The forward foreign exchange market is vital to international trade and investment. However, its efficacy and effect on the global economy have been contested. A significant criticism of the market is that it can generate volatility and instability in exchange rates, leading to economic imbalances and uncertainty for importers and exporters alike (Ahmad et al., 2020). Furthermore, the market’s ability to foresee future exchange rates is questionable because it heavily relies on the assumption that economic conditions will remain stable, which is frequently not the case in a global environment that is constantly changing.

Conclusion

The forward foreign exchange market is an indispensable financial market that permits importers and exporters to mitigate against currency risks and conduct business more confidently. Primary market activities, such as hedging, speculation, and arbitrage, significantly impact market dynamics. Despite its numerous advantages, limitations and hazards are associated with the market’s use. In light of the market’s impact on the global economy, conducting a thorough analysis of the market and its performance is crucial. Additional research is required to identify potential enhancements to reduce the market’s risks and increase its utility.

References

Ahmad, W., Prakash, R., Uddin, G. S., Chahal, R. J. K., Rahman, M. L., & Dutta, A. (2020). On the intraday dynamics of oil price and exchange rate: What can we learn from China and India? Energy Economics, 91. Web.

Almaskati, N. (2022). Oil and GCC foreign exchange forward markets: A wavelet analysis. Borsa Istanbul Review, 22(5), 1039-1044. Web.

Chaudhry, A. F., Hanif, M. M., Hassan, S., & Chani, M. I. (2019). Efficiency of the black foreign exchange market. International Journal of Economics and Finance, 11(2), 165. Web.

Cho, D., & Chun, S. (2019). Can structural changes in the persistence of the forward premium explain the forward premium anomaly? Journal of International Financial Markets, Institutions and Money, 58, 225-235. Web.

Fu, H., & Luger, R. (2022). Multiple testing of the forward rate unbiasedness hypothesis across currencies. Journal of Empirical Finance, 68, 232-245. Web.

Gong, Y., Wang, X., Zhu, M., Ge, Y. E., & Shi, W. (2023). Maximum utility portfolio construction in the forward freight agreement markets: Evidence from a multivariate skewed t copula. Journal of Futures Markets, 43(1), 69-89.

Haab, D. R., & Nitschka, T. (2020). Carry trade and forward premium puzzle from the perspective of a safe‐haven currency. Review of International Economics, 28(2), 376-394. Web.

Islam, M. S., Hossain, E., Rahman, A., Hossain, M. S., & Andersson, K. (2020). A review on recent advancements in forex currency prediction. Algorithms, 13(8), 186. Web.

Kumar, V. (2020). Liquidity shocks: A new solution to the forward premium puzzle. Economic Modelling, 91, 445-454. Web.

Lin, B., & Bai, R. (2021). Oil prices and economic policy uncertainty: Evidence from global, oil importers, and exporters’ perspective. Research in International Business and Finance, 56(5). Web.

Mishra, A. K., Rath, B. N., & Dash, A. K. (2020). Does the Indian financial market nosedive because of the COVID-19 outbreak, in comparison to after demonetization and the GST?. Emerging Markets Finance and Trade, 56(10), 2162-2180. Web.

Mussa, M. (2019). The exchange rate, the balance of payments and monetary and fiscal policy under a regime of controlled floating. In Flexible Exchange Rates and Stabilization Policy (pp. 97-116). Routledge.

Nan, Z., & Kaizoji, T. (2019). Market efficiency of the bitcoin exchange rate: Weak and semi-strong form tests with the spot, futures and forward foreign exchange rates. International Review of Financial Analysis, 64, 273-281. Web.

Nguyen, V. C., & Do, T. T. (2020). Impact of exchange rate shocks, inward FDI and import on export performance: a cointegration analysis. The Journal of Asian Finance, Economics and Business, 7(4), 163-171. Web.

Yan, M., Chen, J., Song, V., & Xu, K. (2022). Trade friction and price discovery in the USD–CAD spot and forward markets. The North American Journal of Economics and Finance, 59. Web.