Today, there are several ways to save money for retirement in order to provide funded income in the future. The two most famous methods are the 401k US private pension plan and the Individual Retirement Account (IRA). These two models imply some privileges in taxation as well as profitable accumulated interest. It is important to know this for each employee, as these systems have their own characteristics. Everyone can choose the most suitable model for themselves, and in order to make calculations and find out specific numbers, one can visit special calculator sites. The goal is to analyze different investment scenarios for both the 401k model and the IRA plan, as well as make calculations.

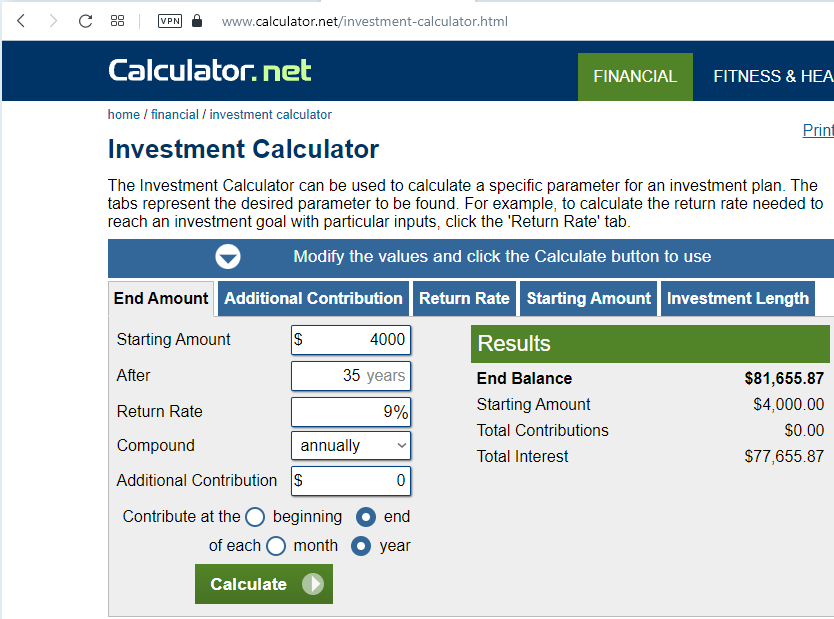

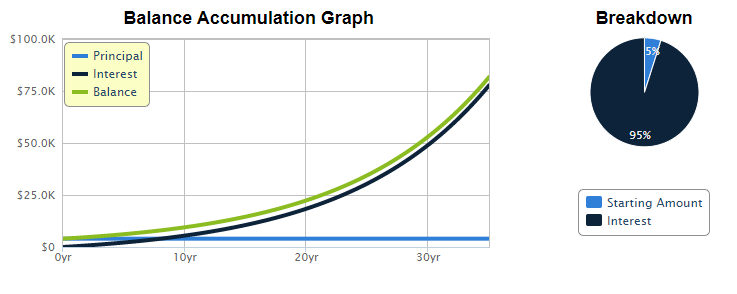

Thus, the first scenario under the IRA model was compound considering the following conditions. Firstly, I decided my starting amount to be $4000. Further, I chose to see my End Balance after 35 years; in other words, I have invested money for the long term and have not made transactions with a negative account. I am 20 years old, and I want to use my investments at 55 years old. Additionally, I consider my end balance with a 9 percent of return rate and annual compound. I decided transactions to be made at the end of every year so that I could control my financials better. Moreover, I would consider the first scenario with zero additional contributions; therefore, the result of investments could be even better. As one can observe via IRA Scenario 1 and IRA Scenario 1 (graph) screenshots, after 35 years, I would get $81, 655 in my End Balance, which is a profitable long-term investment.

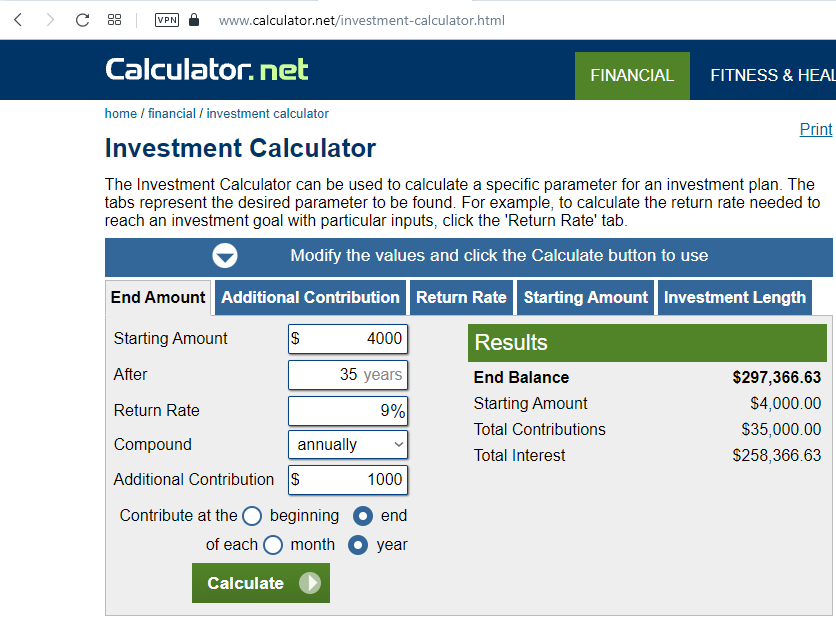

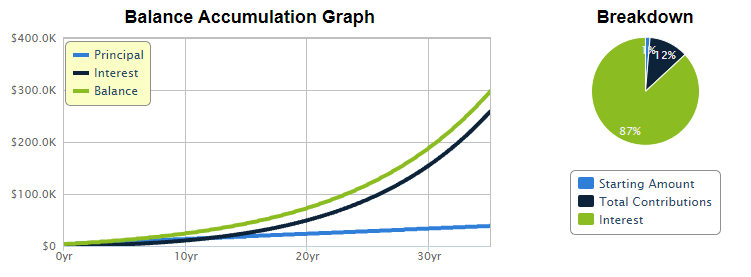

However, most of the exciting things are taking part under the IRA model in my second scenario. Under this option, all the indicators are the same, although additional contributions are equal to $1000. Additional contribution is an annuity payment; it is not a necessary option. However, it will make a return more accrued and a higher end value. As one may see on the IRA Scenario 2 and IRA Scenario 2 (graph) screenshots, the results are impressive. Again, I am 20 years old, and I want to get my investments after 35 years. Thus, with an additional contribution of $1000, in 55 years, I would have my End Balance equal to $297 366.

Therefore, a little change in investment strategy would triple my End Balance. A total contribution would be $35, 000, which would make my total interest rate equal to $258, 366. It would significantly increase my starting amount through the years, as one can see on the graph. This, in turn, would enhance my interest rate, and the next interests would be charged considering my current balance, which is a compounding interest model. With a Roth IRA, one has a number of advantages, such as tax-free money growth and tax- and penalty-free withdrawals after age 59. It makes investing in a Roth IRA at my age prudent and profitable. Although it does not have crazy interest rates, it would have workable profit and would be a reliable investment.

Another popular retirement plan in the USA is the 401k model, which is a saving retirement account. According to this plan, employees are able to contribute to their retirement accounts from their salary prior to the income tax. The retirement fee is established according to the retirement plan in the workplace. Moreover, employers can make such contributions as well. Usually, it takes 5-6 years from their contribution to the current plan before an employee may obtain vested rights. According to retirement plans, employees are able to increase account sum due to investment income; one may obtain nearly 9% of annual interest in a 401k scheme. Moreover, such a scheme allows one to have a saving function.

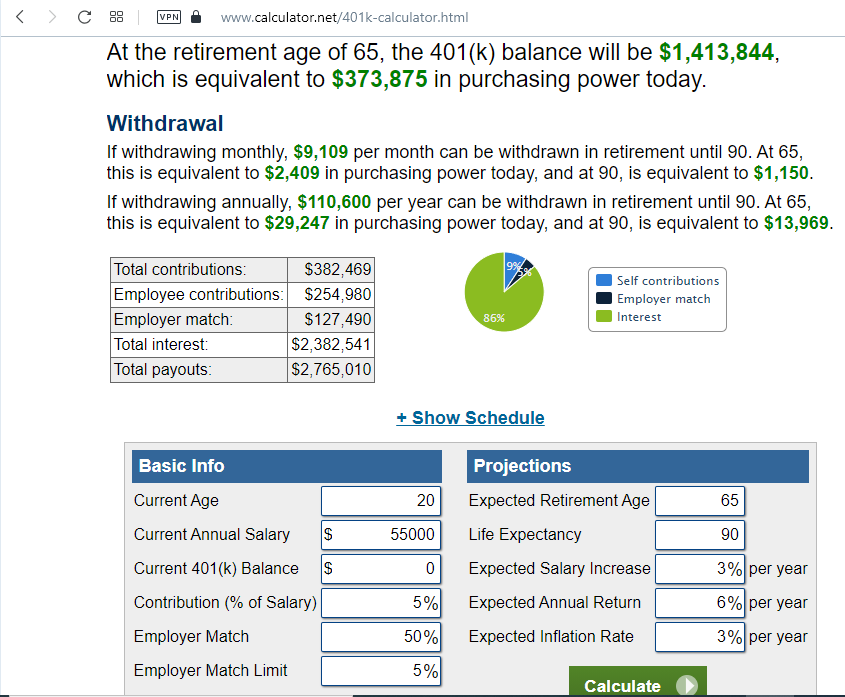

Further, it is necessary to check this model practically, namely by using certain numbers. Thus, according to my first scenario, as one may see on the 401k Scenario screenshot, I am 20 years old. My current annual salary is $55, 000, which is the average salary in the USA. My current 401 (k) balance is equal to zero, as I just started to use this model. The salary contribution would be 5%, and the employer’s match level would be 50%, which is not even the best option. According to this scenario, I am going to retire at the age of 65, and the expected salary increase is 3%. Thereby, using average indicators at the age of 65, I would have $1, 413, 844.

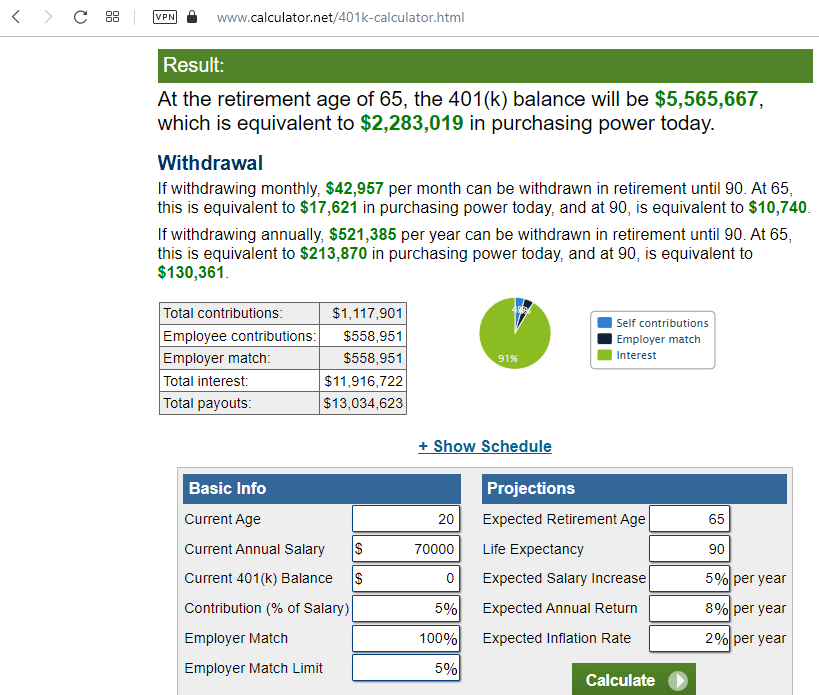

My second scenario implies using high indicators; however, they are quite widespread. I am still 20 years old, but my current annual salary is $70, 000, which is above average. My current 401 (k) balance is still equal to zero, and the contribution of my salary would be 5%, similar to the first scenario. However, the employer match level would be 100% in this case, and the expected salary increase is 5%. The expected annual return would be 8%, and the expected inflation rate would be lower than in the first case, namely 2%. As one may observe, according to this scenario, which, although being the ideal one, is quite real, at the retirement age of 65, my 401 (k) balance would be $5 565, 667. Surely, it seems to be an ideal option to have a strong financial foundation at retirement age.

The important part of the 401k model is employer-matching funds. It means that the employer contributes a certain amount of money to your retirement savings plan according to your annual contribution sum. Sometimes, employers may compensate employees’ contributions by themselves to a certain amount in dollars, regardless of compensation to the employee. Usually, employers establish a percentage of employees’ contributions to a certain part of the salary. Thus, depending on the 401k plan terms, your retirement contribution may be the same as the employee has.

If one compared IRA and 401k models, one would see both similarities and differences; however, it is difficult to say which one is better. Both offer several options for better saving and investing, such as tax-free growth (in the case of the Roth versions), tax breaks on contributions, and the ability to invest in assets. It includes mutual funds and stocks, which potentially have higher returns than bonds and saving accounts. An opening process formulates the differences, one may open IRA even online, which would be fast and comfortable. However, if one’s employee does not have a 401k option, one simply does not have an option.

Consequently, the 401k model, although harder to obtain, offers one profitable term as employers will compensate your contributions up to a certain level. Being engaged in the IRA model, one has a wider spectrum of investment choices, such as mutual funds, CDs, ETFs, stocks, and bonds. As a result, one may conclude that both IRA and 401k models are suitable and reliable options for investments. Moreover, one may start it at a young age as the final result will be higher. In addition, both models have their benefits and downsides, which make a choice between the individual.