Despite the COVID-19 pandemic, which has caused various economies around the globe to fumble and struggle, the housing market in Singapore tends to remain in a healthy status (Global Property Guide, 2021). However, it is true that the increased demand created by the delay of the housing board for Singapore to resale the flats has made a significant increase in the housing prices, supply both short and long-term, and the quantity of the flats available in the market. How the increase in demand has affected the increase in supply will be explained with the help of a housing market diagram to help understand the concept in-depth.

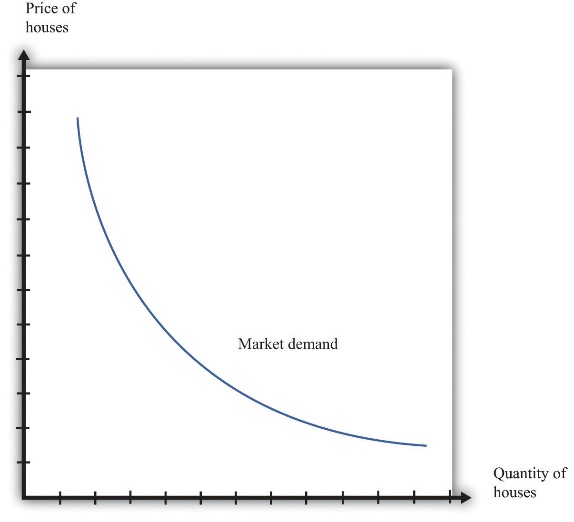

When the demand for houses and flats increases, the price of the flats tends to reduce. This is a good example from the law of the demand curve, which is best explained by two variables. First, when the price of a good or service decreases, consumers tend to make a positive demand or purchase of the product or service rather than zero, and when the price of a good or service decreases, consumers tend to buy more quantities, as shown in Figure 1 below.

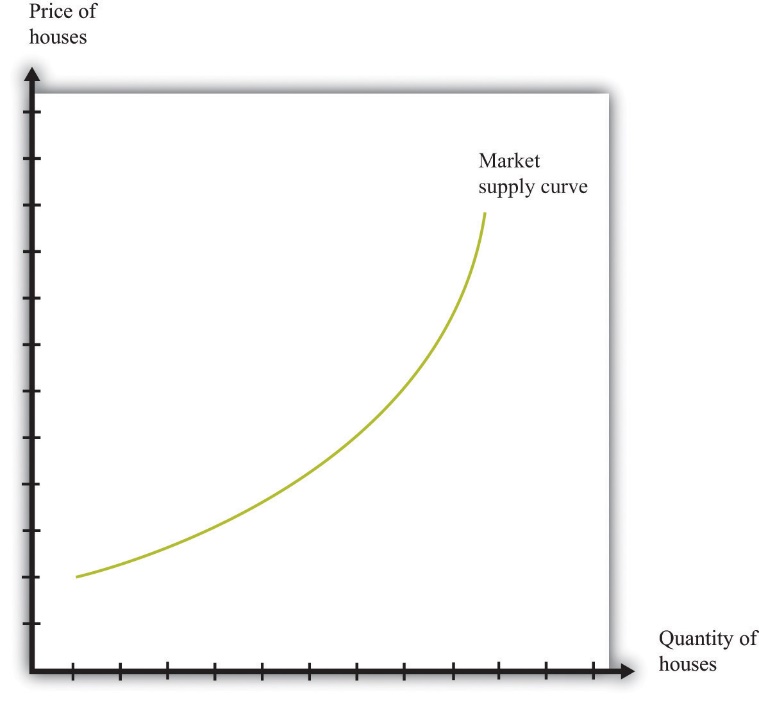

Similar to the demand curve, there exists a supply curve in the market which is developed by adding different participants in a market economy. The supply curve slopes upward because as the prices increases the quantity supplied to the market increases significantly and is affected by demand in that, as the price of the flats increase more firms enter the market producing a positive demand or quantity for the services and products. Also, when the prices increase, more firms are encouraged to produce more as shown in Figure 2 below.

Reference

Global Property Guide. (2017). Globalpropertyguide.com. Web.