Introduction

The COVID-19 pandemic has caused destruction on the economies of multiple countries, wreaking havoc on a variety of sectors. Notably, the pandemic’s broader social impact has influenced investment behavior in the United States. As such, this study examines the effect of social activities on the US stock market concerning COVID-19. The COVID-19 pandemic has been dubbed a black swan occurrence. It has been compared to the economic crisis during World War II due to its devastating influence on universal health systems and, ultimately, on every area of human life. COVID-19 has been a heavier blow to the United States and the rest of the globe, but it has also wreaked havoc on the country’s economy and population.

Thus, there have been significant consequences associated with the infection. There have been both positive and negative consequences of the virus in this pandemic, particularly in the United States Stock Market. Thus, the primary objective of this paper is to demonstrate how investor behavior altered due to the epidemic. It will examine the pandemic outbreak in the United States and its impact on the stock market. It will then explore the labor market’s disconnection. To fully comprehend the effects of COVID-19 on the US economy, it is necessary to evaluate the impact on several types of industries.

Consumption accounts for approximately seventy percent of America’s gross domestic product (Baker et al., 2020). Consequently, consumption has collapsed as businesses close, with households deferring significant purchases due to concerns about their finances and jobs; accordingly, investments account for approximately twenty percent of gross domestic product, even though businesses have been putting out assets.

Effects of COVID-19 on the Stock Market

According to the US economy, the COVID-19 has resulted in a massive and dramatic decline. For instance, there has been a significant decline in the number of residents employed in large enterprises that have aided them in maintaining their lifestyles, therefore assisting the country in developing its economy through economic repercussions. Industries have many employees who help them in their operations; consequently, such diverse individuals have an implacable impact on the outcomes. For instance, if an organization employs many employees, there is a high probability that the country’s economy will expand significantly due to the volume of money exchanged.

Although, since the outbreak of the COVID-19 epidemic, the country’s stock market exchange rate has fallen precipitously near its typical level. The economy has suffered a decline as many people have been driven home due to the authoritarian rules and regulations imposed. For example, one of the laws set is that people meant to be working in specific organizations are not permitted to do so. As a result of this consequence, many people have been forced to lose their employment and have no alternative ways of obtaining their daily monetary needs.

According to Baker et al. (2020), around 4.2 percent of the gross domestic product is spent on entertainment, restaurants, leisure, and the arts. Considering that some of the essential components of the economy, such as movie theaters and restaurants, have been closed, the economy has suffered a severe decline. Because they are the primary platforms for economic growth, the figure may be closer to zero until the quarantines are lifted. “Manufacturing accounts for around 11% of the US Gross Domestic Product. However, this can be disrupted due to global supply chains being hindered by plant closures when firms close their operations in anticipation of decreased demand” (Baker et al., 2020). Ford and General Motors are two companies that have announced the temporary shutdown of their automobile manufacturing.

Since the firm would incur losses due to the COVID-19 epidemic, there has been a follow-up on the layoffs. Smaller enterprises will struggle to retain people on the payroll if their profits decline. Thus, it would be beneficial for the United States to take steps to assist firms with layoffs. The second aspect that has contributed to the coronavirus influencing the United States stock market is the death of many persons from COVID-19; these are the individuals who have made significant contributions to their economy.

Among these individuals are company owners, workers of stakeholders, and entrepreneurs. With such a loss of those, the economy may suffer significantly as a number of them would have played a critical role in their organization. Thus, with the loss of one of these people, an organization may experience a significant gap that will be difficult or impossible to close with other people as not all persons will be putting in the same effort as the other person. The US stock market was adversely affected by COVID-19 due to travel restrictions; there was no traveling outside or within the country for fear of influencing one another. With no exports and imports, it can be a more significant challenge because the government will not grow their economy by selling what they produce against what they do not; thus, the stock market will suffer a more significant decline.

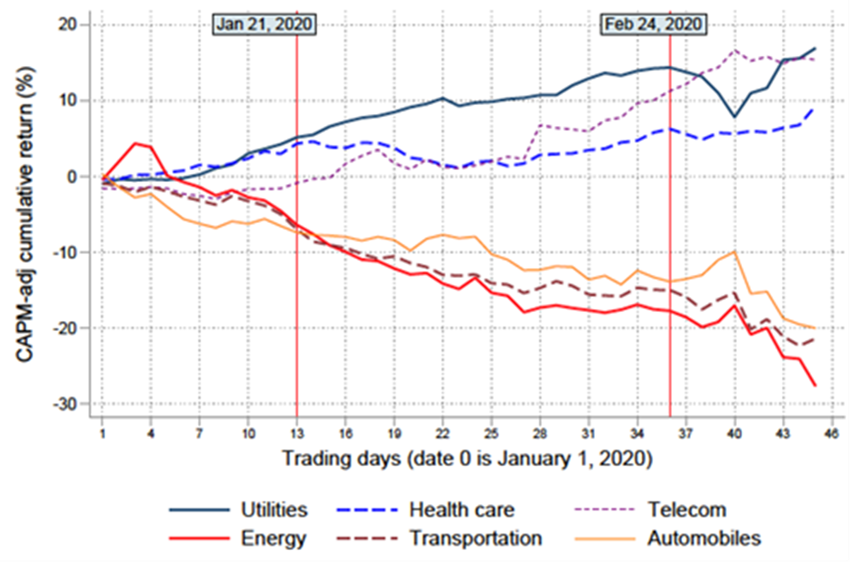

From January through April, Ashraf (2020) gathered data on 64 nations and discovered that COVID-19 had a negative reaction to stock market fluctuations. This response changed depending on where the pandemic was in its lifecycle. Notably, the nature of the markets dictated whether the pandemic’s impact on financial markets would be short-lived or long-term. Additionally, according to Baker et al. (2020), due to the pandemic, the stock market had the most volatility.

Impact on Unemployment Rates

Aside from that, COVID-19 has resulted in a considerable decrease in the country’s rate of employment. The government has, for example, implemented measures that have primarily focused on slowing the spread of the virus and flattening its growth curve since the disease’s breakout. Some of the criteria used included placing the country on lockdown and prohibiting the functioning of enterprises that were not necessary. As a consequence of the decision by the government of the United States to shut down critical activities and enterprises, numerous employees were laid off. This made the majority of individuals were compelled to stay at home and accept salary reductions as a result.

In addition, the inhabitants were encouraged to exercise social distance as a preventative step against the spread of the virus. The result has been a significant decline in the rate of unemployment, placing the United States at risk of a catastrophic economic downturn. A report released by the Department of Commerce and Industry stated that since the outbreak of COVID-19 in the United States, there had been a significant drop in employment rates. The report noted that the “United States went from having a steady employment rate of more than 3.5 percent for more than 113 months to an economy where the rates have significantly decreased” (Fazzari et al., 2021). Since the federal government shut down, more than 26 million Americans have filed for unemployment benefits.

considerable influence has also been exerted by the emergence of COVID-19 on crucial economic indices in the United States. Research published by the National Bureau of Economic Research, for example, estimates that by the time the number of new coronavirus infections begins to fall, the country’s leading economic indices would have been considerably impacted, with significant declines. Economic contraction is predicted to have been triggered by the illness epidemic, according to predictions. The country’s industrial sector has been particularly severely impacted due to the mass layoffs, which have resulted in a significant fall in the country’s actual income.

The growing number of unemployment lawsuits indicates a severe loss in the country’s productive capacity, a standard indicator of a declining gross domestic product. The quantity of discretionary cash available in the economy has also reduced dramatically, and the closure of most retail firms has been the norm in recent years. Economic projections based on various models also indicate the possibility of a further decline in the country’s gross domestic product (GDP) by the end of the second quarter of the year 2020. This resulted in the need for the government to implement new policies and develop strategies for dealing with an economy that will have significantly underperformed.

Conclusion

In conclusion, despite the terrible effects that the coronavirus has had on the stock market in the United States, it is clear that the country has gained a great deal from the adverse effects. As a result, they have learned how to cover up the areas where they went wrong. Not only did the country know, but so did the individuals, and as a result, they all took away a positive lesson that assisted them in growing their economies or stock markets. For example, when many organizations were unable to send their employees to work due to social distancing, they decided to impose the use of robots in their organization.

References

Ashraf, B. N. (2020). Stock markets’ reaction to COVID -19: Cases or fatalities? Research in International Business and Finance, 54, 101249. Web.

Baker, S. R., Bloom, N., Davis, S. J., Kost, K., Sammon, M., & Viratyosin, T. (2020). The unprecedented stock market reaction to COVID-19. The Review of Asset Pricing Studies, 10(4), 742-758. Web.

Fazzari, S. M., & Needler, E. (2021). US Employment Inequality in the Great Recession and the COVID-19 Pandemic. Institute for New Economic Thinking Working Paper Series. Web.