Although previously, the merger between Three and O2 was seen as hindering competition, currently, the merger product should not be deemed an omnipotent competitive force. However, further analysis of the implications of this merger in the context of the present competition rates within the UK telecommunications industry indicates that There/O2 will not have the devastating impact that it was initially believed to have when merging (Wachsmann et al., 2020; Shapiro, 2019). Specifically, while becoming slightly more intense, especially for small and medium entrepreneurship (SME), the level of competition will not affect the situation drastically.

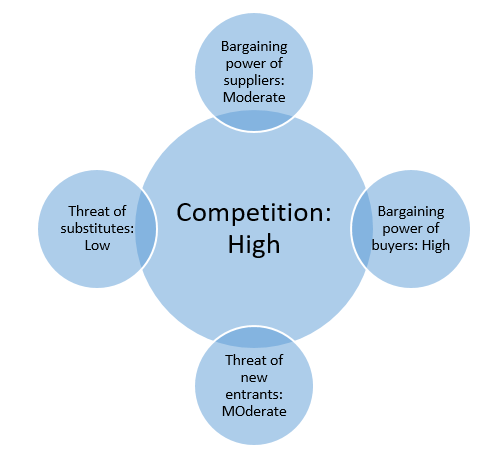

Porter’s 5 Forces Analysis

As the analysis above shows, while the merger between There and O2 will, indeed, create a powerful competitor, the result of their collaboration will not dominate the industry and the market. Specifically, given the current setting of the UK mobile industry, it is highly unlikely that the creation of a merger will hinder the competition and lead to Three/O2 becoming a monopoly.

Namely, the fact that the bargaining power of buyers, namely, their choice of the alternative options to the products and services offered by Three/O2, remains high due to the presence of other companies and cheaper opportunities, indicates that the threat of the merger as the likely dominant force has been overestimated. Moreover, the described situation is unlikely to change even in the instance of Three/O2 capturing the market since buyers will need an additional incentive to switch to using the services of a company other than their current service provider (Federico, 2017; Johnson et al., 2020).

Similarly, the bargaining power of suppliers, which is presently quite high as well due to the presence of other companies in the market, indicates that the merger between three and O2 is unlikely to disrupt the existing market balance. There is a probability that suppliers will raise prices for their service, thus, making them accessible only for the organizations of the Three/O2 caliber (Camillus, 2008; Salinger, 2021). However, presently with the abundance of suppliers and the availability of the needed raw materials for facilitating effective communication services, the bargaining power of suppliers remains moderate, therefore, keeping the competition levels high.

Finally, the threat of new entrants remains moderate since the target industry is still exceptionally lucrative (Hambrick & Fredrikson, 2005; Haucap, 2019). However, the threat of substitutes is quite low given the unavailability of alternative options for smartphones and the related communication devices (Kabeyi, 2018). The specified factors keep the competition rates high, thus, preventing a single entity from taking charge of the entire market.

Overall, it can be assumed that the merger between Three and O2, while creating a powerful entity, is unlikely to eviscerate competition within the market. Quite the contrary, it is likely that SMEs offering similar services will seek the ways of positioning their products in the fashion that will give them an additional competitive advantage.

Finally, regarding the competitive advantage as a vital tool for an organization to keep its presence in the target market and remain on its customers’ radars, one should admit that the merger between Three and O2 does not currently suggest a substantial one. Namely, even when combining their efforts, Three and O2 currently do not have the benefits that will unavoidably make the customers of other services choose the products offered by Three/O2 (Reuben, 2021). Therefore, without the competitive advantage that will allow it to dominate the competition observed presently in the UK telecommunications industry, the merger between Three and O2 should not be seen as a threat to other companies.

Reference List

Camillus, J.C. (2008) ‘Strategy as a wicked problem’, Harvard Business Review, 99-106.

Federico, G. (2017) ‘Horizontal mergers, innovation and the competitive process’, Journal of European Competition Law & Practice, 8(10), pp. 668-677.

Hambrick, D. and Fredrikson, J. (2005) ‘Are you sure you have a strategy?’, Academy of Management Review Executive, 19(4), pp. 51-62.

Haucap, J. (2019) ‘Competition and competition policy in a data-driven economy’, Intereconomics, 54(4), pp. 201-208.

Johnson, G., Whittington, R., Scholes, K., Angwin, D. and Regner, P. (2020) Fundamentals of strategy. 5th edn. Harlow: Pearson.

Kabeyi, M. J. B. (2018) ‘Michael porter’s five competitive forces and generetic strategies, market segmentation strategy and case study of competition in global smartphone manufacturing industry’, IJAR, 4(10), pp. 39-45.

Reuben, A. (2021) ‘Mobile roaming charges in Europe: What you need to know’, BBC. Web.

Salinger, M. A. (2021). The new vertical merger guidelines: Muddying the waters. Review of Industrial Organization, 1, 1-17.

Shapiro, C. (2019) ‘Protecting competition in the American economy: Merger control, tech titans, labor markets’, Journal of Economic Perspectives, 33(3), pp. 69-93.

Wachsmann, A., Zacharie, N. and Peristerakis, N. (2020) ‘The EU Court annuls the prohibition of Three UK / O2: towards a new era for EU merger control?’, Linkllaters. Web.