Introduction

The aim of this dissertation is to identify and study the impact of diversifying portfolios of real estate securities mainly based on two categories. The first category is the geographic diversification of real estate securities portfolio and the other is diversification based on the property type.

A substantial number of academic literature can be found that justifies the degree to which the growth from international diversification of equity portfolios results from divergences observed in industrial structures in various countries. However, when it comes to the subject of using the comparative significance of the factors such as country and property category in order to elucidate the cross-sectional distinction of proceeds to national real estate securities indices, it is seen that the area is much under-researched.

This lack of documentation comes as a surprise as it may be argued that international real estate security diversification may perhaps be more effectual than international stock diversification. It has been found that international real estate securities present broader diversification across continents as compared to international common stocks (Hill, 2006). Further, researches also reveal that correlations amid national real estate indices are considerably lower when evaluated against the correlations found among national stock and bond indices (Partington, 2005).

The fact that correlation among national real estate securities markets is found to be exhibiting appreciably lower values can be observed in various research documents in the relevant field. Yet, little or practically no efforts have been made to give an explanation for why national real estate indices show signs of such incongruent behavior. This can be accounted largely to the fact that there is a clear deficiency of necessary as well as consistent and dependable international statistics relating to the behavior of real estate markets.

On the other hand, it has been observed that quite a number of researches have been carried out in the financial economics domain in an effort to explicate the low correlation found among equity markets. Studies divulge that one explanation for the same is that country-oriented features are significant in the elucidation of return variation and should be considered with much appreciation. Dissimilarity in economic policies, financial policies, authorities and legal administrations and provincial economic disparities stimulate country-specific deviations in returns to a large extent. Another important factor to be considered in order to explain the return alteration is the significance of industrial composition. Industries are improperly correlated. Consequently, realms with diverse industrial configuration exhibit inappropriately correlated equity markets. (Partington, 2005)

A number of academic research literatures bear out the fact that the country-oriented factors are more significant as compared to industry-oriented factors when examining stock returns disparities (Brown, 2008). However, some researches establish that industrial configuration has a noteworthy role to play while making an effort to explicate stock price trends (Partington, 2005). Further, studies also indicate that industry-configuration issues have of late assumed greater significance as compared to country-oriented features in rationalizing stock return deviations (Crumley, 2006).

As for exploration into real estate markets, the established standards for diversification of portfolios are country-orientation and property category. The better approach towards diversification of real estate portfolios is often contemplated. The question of whether to diversify based on the country factors or across property kinds is a major concern for investors. A number of experimental researches carried out across a specific country point toward the fact that diversification based on property type is more advantageous in curtailing portfolio risk as evaluated against diversification based on geographic factors (Louargand, 2004). However, practically only a few or rather no researches assess the intrinsic worth of diversifying real estate securities portfolios geographically or diversification based on nature of the property.

The aims and objectives have a clear direction and a defined course. It deals with the identification of a better approach towards diversifying real estate securities portfolios. It aims at providing a better understanding of the scheme of things in the real estate markets and tries to contribute to the argument of whether to diversify portfolios based on geographic factors or property type. As argued above this area is highly under researched and there is little documentation to exemplify the merits and demerits of each factor. The goals laid out in this dissertation are contemporary and would shed much light on the concerned domain. (Partington, 2005)

Literature Review

The research document is appropriately structured in order to gain a proper understanding of the issue at hand. The matter of this discussion relates to the appreciation of both geographic and property type related features in reducing the risks in the diversification of real estate portfolios. Thus clear understanding of relevant terms is of utmost importance. This necessitates extensive referencing and falling back on other works by various authors in the relevant fields. Examining previous researches carried out in the fields gives us a comprehensive discernment about their works and facilitates giving the research a better direction.

The following list provides the works of other authors which have been referenced in this paper under different contexts to better explain the concepts and increasing the reliability of the document. The reliability of these documents are well formulated and assured by Hardin. (Hardin, 2008)

- (Hartzell, Watkins and Laposa [1996])

- (Eichholtz [1996])

- (Solnik [1974]), (Lessard [1974]), (Grinold, Rudd, and Stefek [1989]), (Drummen and Zimmerman [1992]), (Heston and Rouwenhorst [1994]), (Beckers, Connor, and Curds [1996]), and (Griffin and Karolyi [1998])

- (Roll [1992])

- (Cavaglia, Brightman, and Aked [2000])

- (Fisher and Liang [2000]) and (Lee [2001]) (Hardin, 2008)

The findings of the studies carried out by (Hartzell, Watkins and Laposa [1996]) indicate that international real estate securities offer a more panoptic diversification across continents as contrasted against international common stocks. The examination of (Eichholtz [1996]) reveal that correlations amid national real estate indices are considerably lower when evaluated against the correlations found among national stock and bond indices. Thus by observing the these results we understand how important it is to make a proper evaluation of the real estate markets to decide on which approach should be adopted for real estate securities portfolio diversification. (Louargand, 2004)

The importance of a cross-sectional study is immense as it helps us understand the on-goings of the financial economic markets which run parallel to the real estate markets. Thus this study also makes extensive references to works carried out in the financial economic arena.

The different explorations of (Solnik [1974]), (Lessard [1974]), (Grinold, Rudd, and Stefek [1989]), (Drummen and Zimmerman [1992]), (Heston and Rouwenhorst [1994]), (Beckers, Connor, and Curds [1996]), and (Griffin and Karolyi [1998]) give us the idea that the country-oriented factors achieve a more significant status as compared to industry-oriented factors when examining the equity markets. On the other hand, the fact that industrial configuration has a noteworthy role to play while making an effort to explicate stock price trends is indicated by the findings of the studies conducted by (Roll [1992]).

Further, the investigations of (Cavaglia, Brightman, and Aked [2000]) also divulge that industry-configuration issues have of late assumed greater significance as compared to country-oriented features in rationalizing stock return deviations. Such references gives the reader of this paper an idea about the extent of researches carried out in the parallel financial economic domain in contrast to the scant ventures undertaken by researchers to explore the field of real estate markets. (Hardin, 2008)

However, few studies have been performed to gain an understanding in this field. (Fisher and Liang [2000]) and (Lee [2001]) generated pure property category and geographic location indices for the United States and the United Kingdom, correspondingly. After considerable pondering over the data collected their analysis revealed that property type diversification can be more beneficial as compared to geographic diversification of real estate securities portfolios.

It is also proposed that in the data analysis phase more references would be drawn upon to contrast the findings of this paper with those researches which have been previously carried out in this field. (Pivo, 2006)

Thus this paper organizes its contents into different pertinent sections. Each section provides a detailed discussion with reference to the context it is discussing. The research document would be segmented into sections each explaining the background and methodology used for the execution of the research. The document would first introduce the readers to the research topic following which it would provide him/her with a through understanding of the concepts employed in this particular research. The next phase would contain the data and information gathered which would be presented for further evaluation.

The ensuing segment presents the methodology and techniques employed to carry out the analysis of the data. Following this segment would be the actual analysis phase. After the analysis phases is completed a comprehensive conclusion would presented in which the findings of this research would be documented and contrasted with results of prior researches. The number of sections for the document is kept to an optimized level. The numbers of sections are neither too few which would make the research ambiguous nor is it in excess which would increase the complexity of the document and make it difficult for the reader to understand. Only relevant and pertinent information is provided and the validity of the argument is maintained. (Brown, 2008)

Data and Methodology

Data

The data used for this research paper are taken from Global Property Research General Property Securities Index which is a market-weighted total return index. The index comprises of 400 property firms based in the following nations: Australia, Austria, Belgium, Canada, Finland, France, Germany, Hong Kong, Italy, Japan, the Netherlands, New Zealand, Norway, the Philippines, Singapore, South Africa, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

The data used are the time period ranging from February 1990 to November 2002. The index incorporates equity investors as 75 percent of proceeds are accounted for by equity real estate investments, investment companies given that 75 percent of operational yields are consequential of investment actions along with domestic investors since 75 percent of the outlay portfolio are comprised of domestic real estate. For the firms having a listing in multiple stock exchanges, only the stock exchange listing of the nation in which the company is based is measured. Firms are classified into the property category sub-indices based on Office, Residential, Industrial, and Retail.

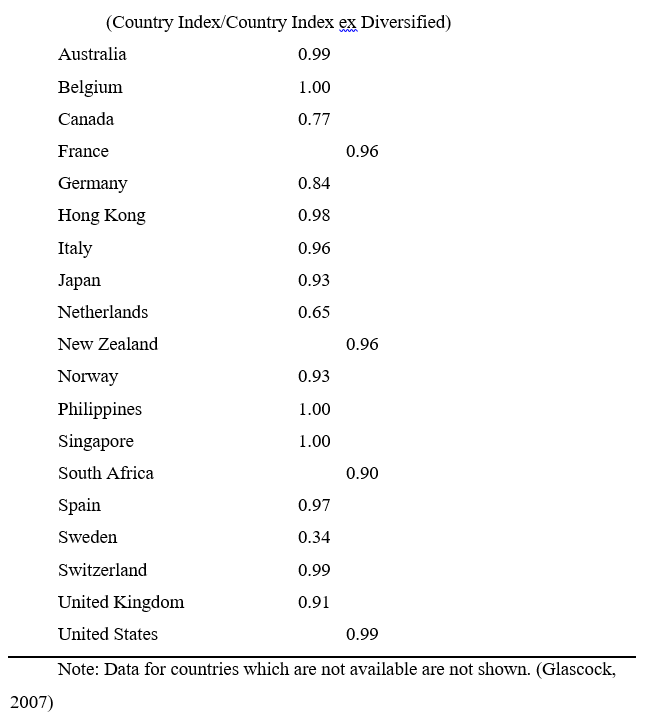

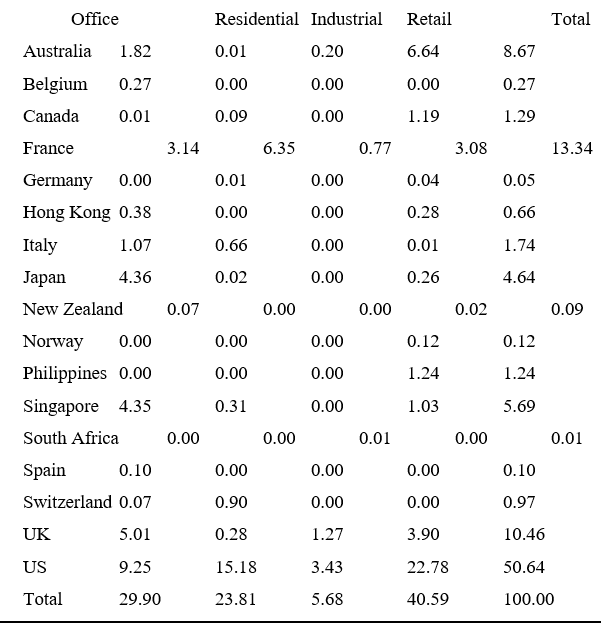

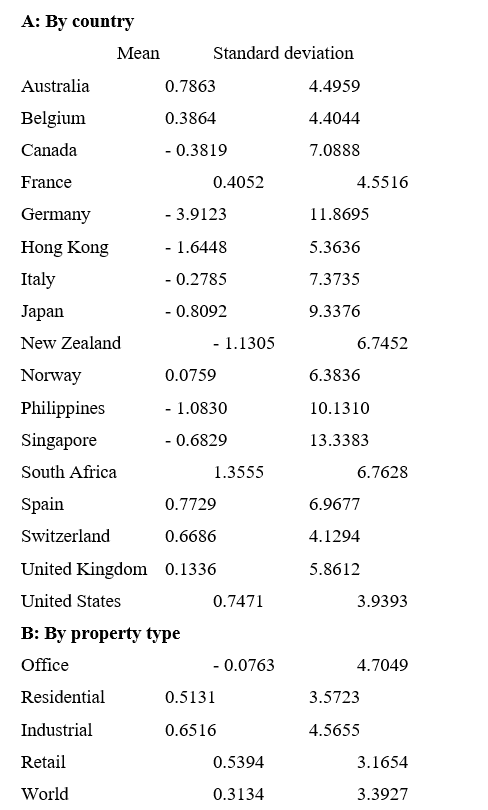

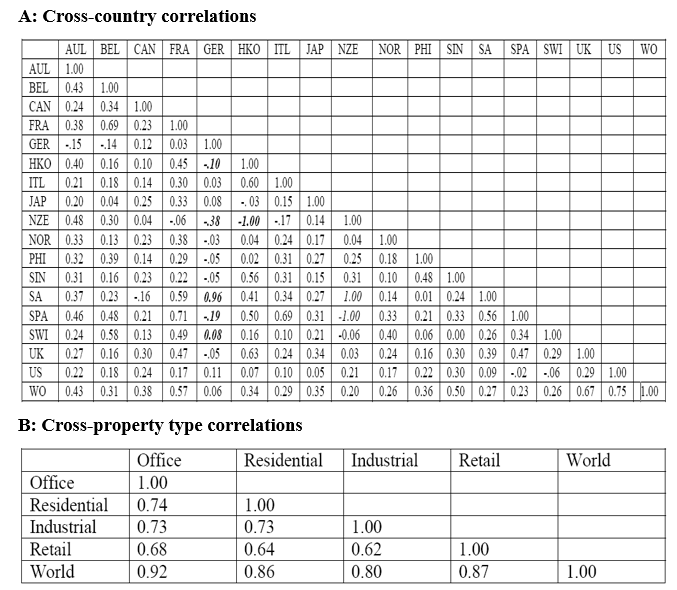

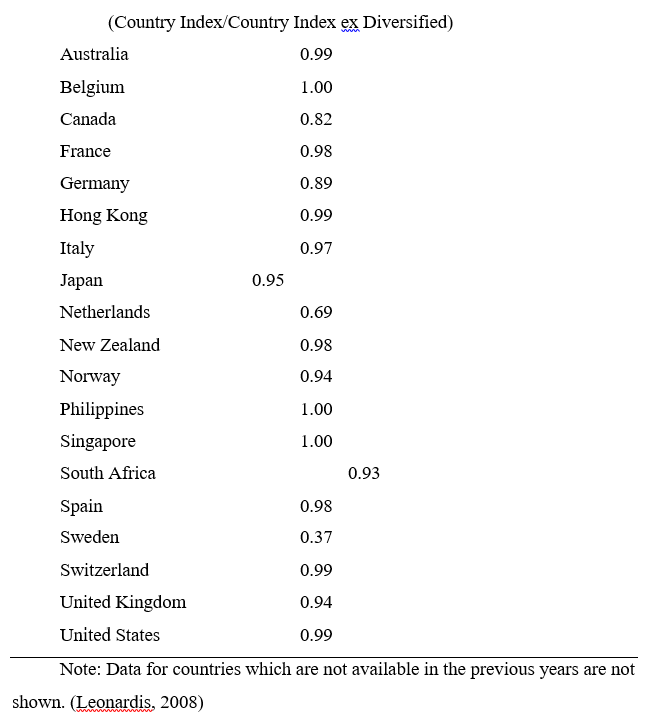

Table 1 lists the correlation coefficients between the two indices (country index/country index ex diversified). Table 2 demonstrates that the property type configuration of country indices and the geographical spread of the property type indices are not homogeneous. Table 3 sums up the behavior of the seventeen countries and four property types in the time period ranging from 1990 through 2002. All proceeds are calculated in US dollars and are articulated as per month percentages. Table 4 presents a synopsis of the cross-country and cross-property type correlation coefficients with relation to monthly returns expressed in US dollars. Correlations considered from less than ten data points are demonstrated in italic fonts.

Data obtained from the text of Daniele De Leonardis and Roberto Rocci provides a comparatively current data. However, the breakups of property types are not available. This range from 2004 to 2007.

Methodology

To analyze the data provided in the above section, the cross-sectional, dummy variable regression framework of Heston and Rouwenhorst (1994) is used in order to extract pure country and property type returns feature. The comparative significance of these aspects in minutely scrutinized for elucidation of the cross-sectional instability and correlation arrangement of national real estate securities index returns. Additionally, the comparative implication of country and property type issues in real estate portfolio diversification is also inspected. This examination will provide new substantiation to the questions of whether or not it is more advantageous to diversify real estate securities portfolios across geographical areas in lieu of property types by widening the outline to incorporate international portfolio diversification approaches. (Crumley, 2006)

The disparity in the return of a given real estate security can be accredited to one of numerous aspects, embracing the following as well:

- a general global feature return applicable to every single real estate securities,

- general deviation in the nation in which the security is based, and

- the property type grouping in which the security fits in.

The remaining deviation can be ascribed to other causes uncorrelated with international, local or property type impacts and can be categorized as security-specific deviation. (Oppenheimer, 2007)

The subsequent representation for the return on the ith real estate security that fits into the property type group j and nation k is put forward as follows:

Rit = αt +βjt + γkt + eit .. (1)

Here αt is the general global factor return applicable to every real estate securities during the time period t. βjt is the property type influence, γkt is the nation impact, and eit is the security-specific interruption. Formulation (1) permits different impacts of property type and country influences, but discards any relations among these factors. It is supposed that that the security-specific interruptions have a zero average and restricted variance in relation to returns in each nation and property type groups, and are uncorrelated among real estate securities. Data for real estate securities indices situated across seventeen nations spread over four property type groups is considered. A property dummy Pij is formulated which is equivalent to one if security i fits into property type group j or else and is considered to be zero. A country dummy Cik is taken into account which is equivalent to one if security i fits in to nation k or else is considered zero. For every period t we can redraft formulation (1) as:

Ri = α + β1Pi1 + β2Pi2 + …+ β4Pi4 + γ1Ci1 + γ2Ci2 + …+ γ 17Ci17 + ei ..(2)

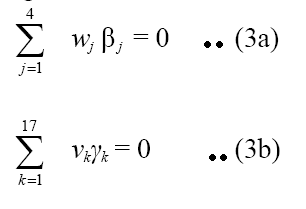

Cross-sectional projection for Equation (2) across the four property type groups, P, in all of the seventeen nations, C, put through the following restrictions:

Here wj and vk indicate the value weights of property type category j and country k in the world market portfolio of real estate securities. The least squares estimate of the intercept in equation (2) represents the return on the value-weighted world market portfolio of real estate securities. Given that the estimated interruption are statistically unrelated to each property type as well as country dummies by structure, the mean residual is negligible in all property type groupings and in every nation. Further, because the global real estate market index is merely the value-weighted mean across every property types and nations, the mean interruption for the global value-weighted real estate market index is also negligible. The least-squares approximation of α can therefore indicate the value-weighted real estate market. (Liow, 2008)

The cross-sectional regressions per month capitulates the nation and property type coefficients. These coefficients β’ and γ’ are deduced as the approximated pure property type influence and approximated pure nation impact. The pure property type return is the least-squares approximation of the return on an internationally diversified portfolio of companies in the jth property type group. With relation to this context, a internationally diversified portfolio possesses an identical nation configuration as compared to the global real estate securities market and is consequently liberated of country constraints. Likewise, α’ + γk’ is an approximation of the pure return on the country portfolio, k.

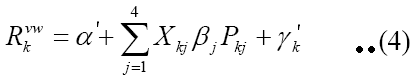

This approximation method permits a decomposition of Rkvw, the authentic value-weighted index of nation k, into a factor that is applicable to every nation, α’, the value-weighted mean of the property type influence found on the exclusive composition of the elements that comprise of its index, and a country-specific factor, γk’, as follows:

Here Xkj stands for the fraction of the entire market capitalization of nation k belonging to property type group j. Formulation (4) asserts that the return on a nation index can be at variance with the return on the global property market portfolio and can be accredited to the following rationales: 1) the property type configuration of the nation varies from the global real estate portfolio and 2) the returns on the nation’s properties vary from the returns on properties within the same property type groups in different nations. (MacKinnon, 2009)

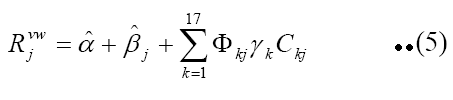

Correspondingly, all value-weighted property index return, Rjvw , can be broken up into a constituent that is applicable to every property type grouping, α’, the value-weighted mean of various country factors, and a property type-oriented factor, Bj, as follows:

Here Φkj denotes the fraction of the capitalization of the world property type index comprised of country j‘s properties. It should also be noted that there are no interruption factors are considered in formulation (4) and (5) for the reason that for all nation and property type, the residuals are considered negligible by construction. (Zhenguo, 2008)

Conclusion

The above described method allows the research to enhance its generalizability in addition to strengthening of the construct as well as internal validity. The organized approach to the research philosophy is consistent with the measures that should be taken in order to successfully answer the research question. (Hardin, 2008)

Bibliography:

Brown, Gerald R & Seow-Eng Ong. 2008. Estimating serial cross-correlation in real estate returns. Managerial and Decision Economics. 22, 7, 381-387. Department of Real Estate, National University of Singapore, Singapore.

Crumley, Ryan & Donna K. Fisher. 2006. Analysis of international joint ventures within real estate investment trusts. Briefings in Real Estate Finance. 4, 3, 217-227. Henry Stewart Publications; School of Economic Development, Georgia Southern University, USA.

Glascock, John L & Lynne J. Kelly. 2004-2007. The Relative Effect of Property Type and Country Factors in Reduction of Risk of Internationally Diversified Real Estate Portfolios. University of Cambridge; Howard University

Hardin, William G, Kartono Liano, Kam C. Chan. 2008. Influential Journals, Institutions and Researchers in Real Estate. Real Estate Economics. 34, 3, 457-478. Florida International University, Department of Finance, Miami.

Hill, Matthew. 2006. Financing corporate real estate: the impact of corporate real estate in the shareholder value equation. Briefings in Real Estate Finance, 2, 4, 313-325. Structured Solutions, Maple Securities (UK) Ltd, Ryder Court, 14 Ryder Street, London SW1Y 6QB, UK.

Leonardis, Daniele De & Roberto Rocci. 2008. Assessing the default risk by means of a discrete-time survival analysis approach. Applied Stochastic Models in Business and Industry. 24, 4, 291-306. Intesa SanPaolo SpA, Corporate Banking, Milan, Italy.

Liow, Kim Hiang. 2008. Real estate and corporate valuation: an asset pricing perspective. Managerial and Decision Economics. 22, 7, 355-368. Department of Real Estate, National University of Singapore, Singapore.

Louargand, Marc & Michael Gately. 2004. Outlook 2004: the paradox of real estate capital markets and space markets. Briefings in Real Estate Finance. 3, 4, 365-374. Henry Stewart Publications. Cornerstone Real Estate Advisers, Inc. One Financial Plaza, USA.

MacKinnon, Gregory H & Ashraf Al Zaman. 2009. Real Estate for the Long Term: The Effect of Return Predictability on Long-Horizon Allocations. Real Estate Economics. 37, 1, 117-153. American Real Estate and Urban Economics Association. Department of Finance and Management Science, Sobey School of Business, Saint Mary’s University, Halifax, Nova Scotia, Canada.

Oppenheimer, Pete H. 2007. A critique of using real options pricing models in valuing real estate projects and contracts. Briefings in Real Estate Finance. 2, 3, 221-233. Henry Stewart Publications. Department of Business Administration, North Georgia College and State University, Dahlonega, USA.

Partington, Graham & Max Stevenson. 2005. The probability and timing of price reversals in the property market. Managerial and Decision Economics. 22, 7, 389-398. University of Technology Sydney, Lindfield, NSW, Australia.

Pivo, Gary. 2006. Exploring responsible property investing: a survey of American executives. Corporate Social Responsibility and Environmental Management. 15, 4, 235-248. ERP Environment. University of Arizona, Tucson, AZ, USA.

Zhenguo, Lin & Yingchun Liu. 2008. Real Estate Returns and Risk with Heterogeneous Investors. Real Estate Economics. 36, 4, 753-776. American Real Estate and Urban Economics Association, Washington.