Introduction

When countries generate budgets for each fiscal year, they always have priorities. Most imperative is always the welfare of its citizens, considering that they contribute immensely through taxation. Ever since the 9/11 attacks of the Twins Towers, the budget took a sudden shift, with the military gaining the second-biggest share of the resources allocated for different duties. Healthcare has the greatest portion getting 26% of the entire amount. The military gets 23% of the resources, and the other sectors share the remaining 51% (Anthony and Bauer 31). The US federal budget that serves the military could exceed the amount initially anticipated.

According to some Republican leaders, the Pentagon overly budgeted for the US military after 9/11, even though it neglected other important sections, including welfare and education. Part of the society feels that the funding is sufficient for the military considering US’s susceptibility to attacks from neighboring states. On the other hand, other US citizens believe that excessive funding of the military only encourages laxity because the military personnel earns huge allowances, but they rarely go into wars. In most cases, the US solves its disputes through dialogue unless in extreme cases, which are rarely ever since 9/11 and WWII.

Thesis Statement

The US federal government allocates excess resources to its military, and some money could assist in other areas of the economy.

Government Expenditure on US Military

The US government ensures that its armed forces have all the requisite materials to engage in war whenever it unfortunately occurs. This explains expenditures in research and evaluation, military personnel, peacekeeping, and defense ministries, among others. NASA, commonly referred to as Space Operations, equally need financing from the same budget. By the beginning of 2012, the military budget augmented from less than $100 billion to about $700 billion (Mann 136). Following the austerity, the government, in 2013, sought to reduce the budget in order to reduce the national debt and the interest while financing other areas of the economy. The US military has many subsections in need of finance; some of the key sectors that require constant funding are discussed below.

Operation and Maintenance

By the end of 2011, the US federal government spent almost $162 billion to maintain the military personnel, including housing medication, and emergencies. Currently, the country operates on a budget of $291 for operations and maintenance. This includes internal conflicts and terrorist attacks, and the socio-economic welfare of the military personnel. The government’s rationale is to keep the families of the military personnel safe and content, as the move boosts their morale at work. The same amount of money sustains rehabilitation programs for military families, including guidance and counseling programs (SIPRI yearbook 2010: armaments, disarmament, and international security 10).

Military families have to deal with issues pertaining to distance relationships, and this affects the trust within the homes. Parents could be violent, and this might be worse when a woman is a military personnel. In order to safeguard the future of children, the government initiated the rehabilitation programs. The government had to introduce an additional $22 billion to provide excellent housing for its growing military base (Cochran 80).

Procurement

The military constantly requires machinery and weapons in order to secure US borders. When purchasing new weapons and other military equipment, there is a need to assess the latest technologies in criminology and terrorism. The military has to procure equipment for the navy, the military aid, terrorist activities, and internal wars. Internal wars are limited ever since WWII, and this explains why the US seeks a reduction in the amount allocated to procure weapons annually. In order to purchase weapons, the military has over $128 billion, and this excludes the maintenance of the same objects (SIPRI yearbook 2010: armaments, disarmament, and international security 13). Procurement includes the consultation of military experts and scientists who identify the growing trends in crimes. The amount serves such people, thus making it possible for the military to keep watch of any harm within and outside its borders.

Research and Development

Research and development (R&D) is an element of western civilization attributed to the US. Constantly, in different sectors of the economy, the federal government plays a significant role in financing research and development. Within the military, research and development are inevitable because systems need to improve their operation styles. After the 9/11 attacks, the research and development unit of the military overly engaged in laser technology, considering that terrorism took a similar trend. Sophisticated technologies are the only viable techniques of dealing with crimes today and the US federal government allocated $75 billion towards research and development.

In addition, it contributed $20 billion to cater for nuclear technology, which would assist the country in dealing with nations such as Iran and North Korea that invested in nuclear energy (Lloyd 99). In 2013, the US government sought to intervene in Iran’s nuclear case, the Republicans disagreed with the US president because this would be an additional cost to the United States’ federal budget.

Aid

The US military has to prepare for military aid in countries such as Somali, Iran, and others nations susceptible to terrorist attacks. This includes encounters in which its military forces engage in the NATO interventions. Countries rich in natural resources especially oil, diamond, gold, and gas often engage in internal conflicts following the ownership of such resources. The US actively mediates given that it has the veto power and is the world super power. The US federal government allocated $41.9 billion towards military aid in foreign states. Generally, the US military budget for the fiscal year 2014 is $665 billion, which is a slight reduction from the 2011 budget. This includes expenditure on veterans while excluding that for the national executive council of the defense team.

According to President Obama, after military personnel retire from work, considering they helped the country secure its borders, they need recognition, and financial assistance. This includes families of the military personnel who died while in office. This coupled with social security assists in improving the lives of veterans after they stop serving the country at the capacity of military forces. The President kept a promise of reducing the federal budget of 2011 developed by the pentagon. In 2013, the US President, Barack Obama reduced the military budget by about 0.8% (SIPRI yearbook 2010: armaments, disarmaments, and international security 16). There is a possibility that the trend would continue until the military gains stability because the greatest fear is the possible reoccurrence of the 9/11 attacks.

Effects of government spending on US military

Reduced spending on other areas of the economy

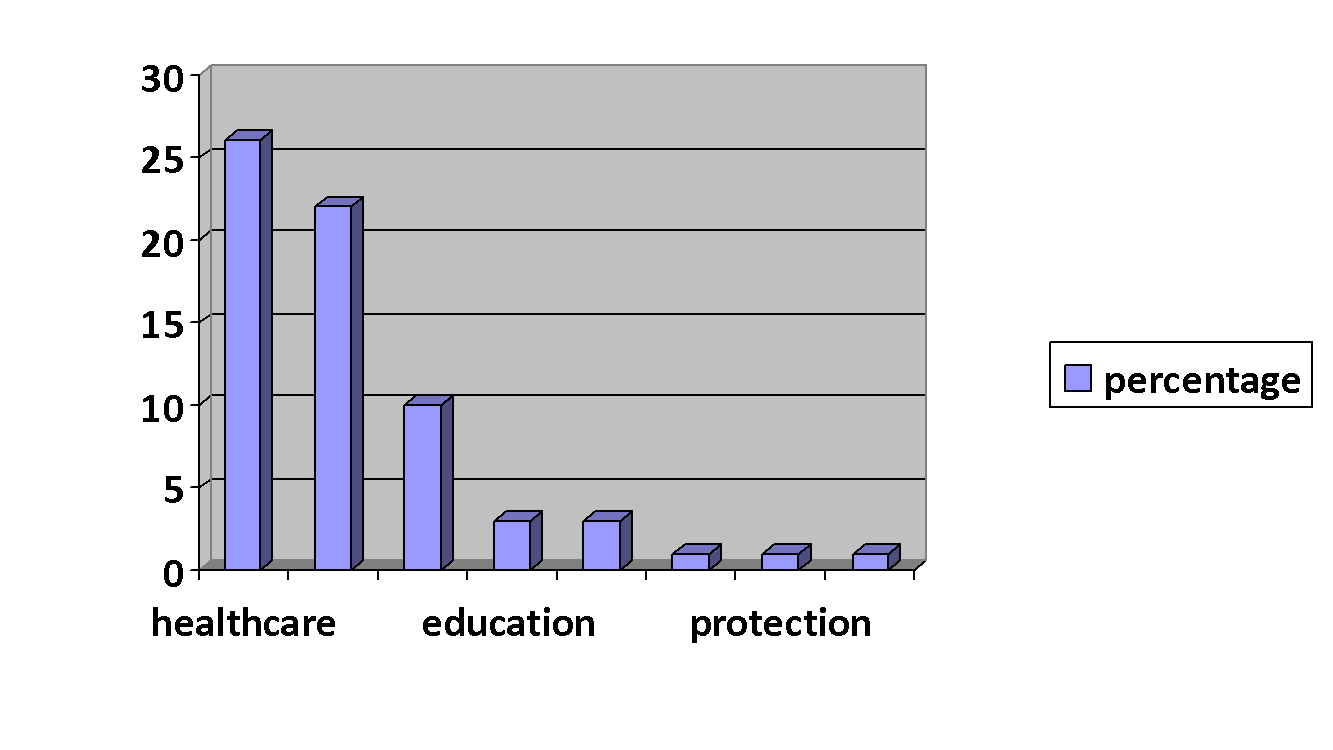

The following graph explains the federal budget for the fiscal year ending 2013 and beginning 2014.

The military budget equals the expenditure on interest, education, and welfare. Ordinarily, this reduces expenditure on important elements of the society especially education and welfare. There is temporary assistance for needy families (TAFNF), social security, food stamps, and assistance during voting. These coupled with other social welfares require the same amount allocated for the military. The US citizens spend a lot of money on taxes, and they should have value for their money.

The money should not only benefit the security docket because welfare and education are equally important for the Americans. Since 9/11 attacks, there have been a particular concentration on the military docket and most resources have been diverted to finance research and development in the military. A big portion also serves nuclear innovations even though such activities do not help the people in dealing with domestic problems. Before allocating $41.9 billion to foreign military aid, the government should consider channeling a significant portion to domestic issues. With a total spending of $3977.1 billion, the government could be able to reduce poverty especially in the suburban areas (Anthony and Bauer 37). Through TAFNF and other social welfare programs, the US government would be able to create jobs for most Americans; this would increase income generation translating into taxes.

Encouraging Laxity

In human resource management, there is a correlation between good payment and laxity. The additional $28 billion for housing and payment of military personnel might expose them to excess comfort, thus disabling them from accomplishing their tasks in good time. In addition, they have access to free medical services while their children go to military schools. The comfortable lifestyle coupled with veteran packages might distract the military personnel, hence making most people seek job opportunities in the forces. This affects talent management since most people intend to enjoy the attractive packages at the expense of protecting innocent civilians, as well as pursuing jobs in their areas of specialization. The military personnel have an assurance of the biggest portion of the 23% because they have access to about $162 billion (Lloyd 118).

According to the society, this provides the military with an opportunity to engage in various leisure activities because they rarely go to war, but they have the assurance of a good sum of money. Instead, the biggest portion of the amount should go into research and development because the nature of crimes keeps changing across the globe. Good housing is necessary because it increases the comfort levels of the military personnel, but the government should not overly concentrate on the military.

Increasing Taxation

The Obama administration faces many allegations because of increased taxes since 2009. According to the government, the federal and the local states require a similar amount of money for social welfare, security, and healthcare. Recently, the government underwent a major shutdown forcing the White House to resume duties after 14 days of no operation. Though embarrassing, it ensured the sustenance of the healthcare policy, which takes up over 24% of the entire federal budget (SIPRI yearbook 2010: armaments, disarmaments, and international security 19). This notwithstanding the amount of taxes collected for the military. Naturally, this affects the economy since it strains the citizens forcing people to work extra hard to live a comfortable life.

Securing its Borders since the US is Vulnerable to Attacks

Expenditure on the military forces would definitely help the US in securing its borders. A safe country naturally attracts investors and this would be exceptionally important for the US because Asian nations are also competing for the stardom that it enjoys. Stable security measures attract immigrants to work together to make the economy strong (Sigal 14). This explains why the US still has the ability to host many immigrants who work towards the sustenance of the US economy. When economies grow, the lives of the residents improves because all resources generated by people work for the benefit of the same individuals. Robert Gates, the Secretary of Defense, justified the government expenditure on military forces claiming that crimes keep changing and the US is under many threats. As such, dealing with adversaries requires adequate preparation and the government should increase expenditure on the security docket considering its significance to the US economy.

Impacts of Decreasing Expenditure

Conflict of Interest

There are disagreements between the Republicans and Democrats because they have mixed reactions concerning many government policies. Government spending is of particular interest to the Republicans because they keep the Obama regime under watch. The two groups disagreed about financing nuclear operations when the country can hardly take care of the education docket. Education is wide and the 3% allocated towards it might not sustain the policy over the long-term. This excludes finances for second language acquisition, which the government does not provide for the growing immigrant population.

When the Congress shares different opinions about a subject, this deters the overall growth of the United States’ economy. Markedly, the Congress plays an integral part in approving the budget since without the support of two-thirds of the entire Congress, the president cannot approve of the same. This led to the government shutdown in 2013 because the Republicans and Democrats who constitute the majority legislatures disagreed over the 26% allocation of resources to healthcare. The same applied to the nuclear operations in the US and the alleged military intervention on the nuclear energy saga in Iran. Clearly, disagreements within the Congress explicit through the government shutdown naturally destroyed the image of the country considering this was the second time it happened after the country’s inception.

Budgetary Constraints

The budget constraints caused after allocation of excess resources to the military following the 9/11 attacks resulted in austerity in terms of resource management. The society is exceptionally strict about the federal government spending seeking accountability for each resource used in building the economy. Between 2009 and 2011, the US faced the adverse effects of the global inflation because they still had to contribute a lot of resources towards the upkeep of the military forces. The military rarely engages in internal wars, but the costs of maintenance of the military personnel gets expensive on a daily basis (Cochran 85).

However, decreasing the budget would demoralize military personnel from working. According to Barney Frank, a renowned legislature in the 2009 Congress, the government should cut expenditure on the military forces because it might not sustain the forces in future (SIPRI yearbook 2010: armaments, disarmaments, and international security 27). In the end, it would be difficult for the federal government to fund the welfare or education policies. The national debt in the US will definitely increase and affect other areas of the economy.

Conclusion

The US has had an established military network since it gained independence. The US should adopt a similar trend in managing its military forces considering that it has the expertise and resources to engage in wars of all kind. Initially, the country used to spend a reasonable amount to ensure safety for the growing population and this trend helped it to safeguard it economy by reducing its national debt while investing in job creation.