International expansion is a process of creation of a single world market, based on the exchange of goods and capital, broader access to foreign goods; active development of trade and industrial relations, widening the cultural exchange, the increase of information flows between geographically remote regions. It goes without saying that globalization has a great impact on the economy, especially in emerging markets. By this time, U.S. banking has contributed significantly to the development of financial markets of emerging countries such as China, Malaysia, Brazil, and others.

Alan Gibson, a manager of emerging markets, told about strategy plans of U.S. bank expansion. “I expect the largest Asia and South America regions to be covered; however, we will follow our U.S. customers in order to achieve global offering,” claims Gibson. As a result, one may note an advantage of effectiveness and development of domestic financial markets that will grow due to the U.S. bank presence by enlarging the number of financial products accessible to local consumers primarily through imported technologies and innovations. International Monetary Fund mentions the other advantage of international expansion for US banking institutions in emerging markets: the presence of foreign investors in the financial sector of Albania, for example, develops its elasticity to external shocks and persuades the solidity of credit supply and total financial stability.

However, the U.S. central bank will always put its interests ahead of the developing markets. Nowadays according to the Brazilian central bank survey Malaysia’s ringgit, India’s rupee, the Thai baht, and South Korea’s won each digressed at least 1 per cent against the US dollar (see Graph 1). “Capital flows to emerging markets should continue to be negative as U.S. interest rates move higher,” States Maarten-Jan Bakkum, the Hague senior emerging-markets strategist. Because of the weak growth environment in emerging markets, recompense is less attractive, and conditions that are more pleasurable can be found in U.S. bonds.

Unfortunately, the “Fragile Five” that consists of Turkey, India, Brazil, Indonesia and South Africa as well as other world emerging markets like Russia, Chile, and Colombia have all posted declines to the extent of 6.4% loss in January 2014. Nevertheless, Mark Mobius, an emerging-markets fund manager at Franklin Templeton Investments, reckons that the result of the US tightening is “not significant” to emerging markets as an asset class. Emerging markets worldwide come across some declining expansion, growing debt, and political ambiguity, but as they continue to develop generally in a little longer term, the possibilities for asset finance remain invariable.

Another disadvantage is that in spite of the fact that the U.S. banking segment may have little profits exposure to some emerging countries’ markets – they still have reason to be worried. For instance, Wall Street is scared that an aggravating financial system in China will defer the Federal Reserve from raising U.S. interest rates ad infinitum. That would have a tremendous impact on the banks because the sector has been waiting for a rate rise to considerable income earnings on mortgages and other loans, by turn it threatens to reduce the industry’s earnings potential going into 2016.

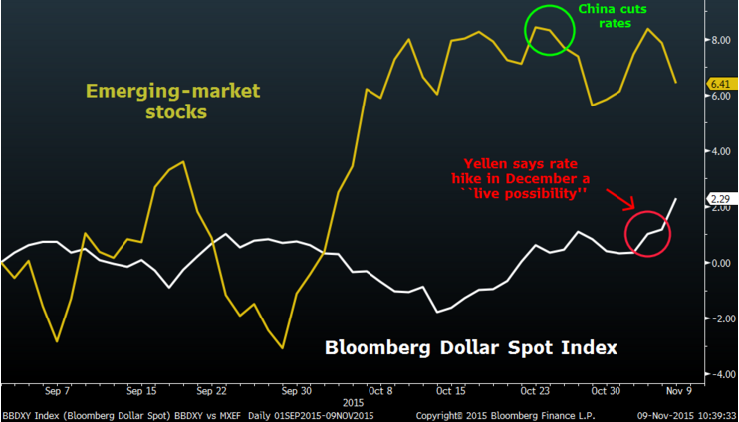

“A considerably reduce speed in China could push the Fed to delay liftoff, leading to negative consensus revisions of 2016 earnings estimates,” say analysts Erika Najarian and Ebrahim Poonawala in the latest research report. As a rule, the world financial crisis attacks emerging markets most of all. America’s economy looks relatively stable when China and other emerging markets slowing. Although US banking institutions that operate abroad are hit, too: approximately a quarter of the profits are earned in foreign currencies. The move of the dollar trade-weighted index magnitude frequently catches someone out, and the most probable applicants, in that case, are in emerging markets (see Graph 2).

The Bank of International Settlements reports that the stock of dollar debts outside America now evaluates at $9 trillion while emerging markets account for half of that amount. Only in China, in terms of dollars loans have domed to more than $1 trillion nowadays from about $200 billion in 2008. With the rise of the dollar, it becomes more high-priced to service in local currency. Consequently, borrowers have a double risk: increasing dollar and a growing cost of loans and refunding. That does not inevitably imply a wave of bankruptcies, but it does mean that some countries are moving towards deep recessions, for instance, Brazil or Russia’s property market is slowing. Besides, emerging markets squeezing under the Fed’s pressure became weaker now than in last decades.

In conclusion, it should be stressed that international expansion for US banking institutions in emerging markets has both advantages and disadvantages. Nevertheless, advantages are more attractive as they provide developing countries with technologies and know-how, stability and growth. At the same time, US banking institutions have some benefits, including profits from goods, clientele support all over the world, etc.

Bibliography

Herron, Jeremy, and Kate Garber. “U.S. Stocks Tumble in Global Selloff on Bets Fed Lifeline to End.” Bloomberg Business, 2015.

International Monetary Fund. “Albania: Financial System Stability Assessment.” IMF Staff Country Reports, 2014.

McNulty, Mary Ann. “Interview: U.S. Bank Corporate Payment Systems’ Alan Gibson.” Business Travel News, 2012.

“Mismatch Point.” The Economist, 2015.

Mobius, Mark. Templeton Emerging Markets Fund. Franklin Templeton Investments. 2015. Web.

“The Fed’s Plan to Hike Interest Rates.” The Economist, 2015.

White, Clarke. “White Clarke Report: Emerging Markets – A Crisis or Just a Drama?” Equipment Finance Advisor, 2014.

Whitehouse, Kaja. “Why U.S. Banks Are Scared of China.” USA Today, 2013.