Executive Summary

The aim of this paper is to assess the options of operating business within an emerging economy; in order to do so; the paper will focus on the steel industry of China and the aspects of market entry by Voestalpine Group, an Austria-based business. To carry out a proper assessment of the country and the success of market entry, it is vital to conduct a PESTLE analysis of China, perform a SWOT analysis of the Chinese steel industry, assess Porter’s five forces in the industry, and consider the entry mode for Voestalpine steel company. In addition, it is also important to analyze the organizational strategies for market entry, scrutinize the human resource management strategies, and examine the environmental and corporate social responsibility issues arising from the venture. In order to devise this country report for a company operating in a specific industry, it is also essential to explore the business development options for the firm and advise the firm regarding the strategy it should undertake. On the other hand, this paper will critically reflect the recent concerns regarding the development of international business practices in emerging economies and comprehensively consider any latent threats or obstacles of operating within a contemporary communist nation.

Introduction

Voestalpine (2013) suggested that Voestalpine Group is an Austria-based corporation that makes premium steel commodities using the best possible technological infrastructures; moreover, according to Voestalpine (2012), it is the leading provider of steel-strip in Europe and the leader in making heavy-plate and bulky-turbines; therefore, this business has a strong financial position to undertake foreign direct investments in emerging economies.

PESTLE Analysis of China

Political Factors

Fogel (2010) noted that constitutionally, China is a socialist nation under the public’s democratic authoritarianism, which is directed by the proletariat with the involvement of labors and farmers; moreover, the government of the country includes a multi-party collaboration structure and political conference under the direction of Communist Party of China. The constitutional structure makes sure that merely Communist Party of China is in power; however, as a prerequisite of admitting this party into power, numerous other political parties join a dialogue with the government regarding the administration of national circumstances; in this way, multiparty collaboration and sovereignty of lower class is ensured (Fogel 2010). The electoral concept in China implies to a method through which individuals select public servants and representatives of people’s congresses at different categories in the nation; conversely, National People’s Congress, the supreme institution of the nation, is the legislature or parliament, and the constitution has bestowed it vast law-making authorities. However, there are uncertain apprehensions for foreign businesses in terms of political risk due to the likelihood of nationalization of industries, elimination, expropriation, currency conversion, agreement dismissal and so on; additionally, another political menace is the continuous conflict amid the central and regional governments regarding appropriate legislation, making it hard for foreign businesses to distinguish the true regulations (Fogel 2010).

Economic Factors

It is an optimistic factor for the foreign businesses wishing to invest in China that from the 1970s, China has shifted from a blocked, planned economy, towards a more open, market economy, playing one of the most significant roles in the fields of globalization; in carrying out the transformation, reorganizations were made in collectivized agricultural-sector, economic centralization, nationalized businesses, banking, etc.

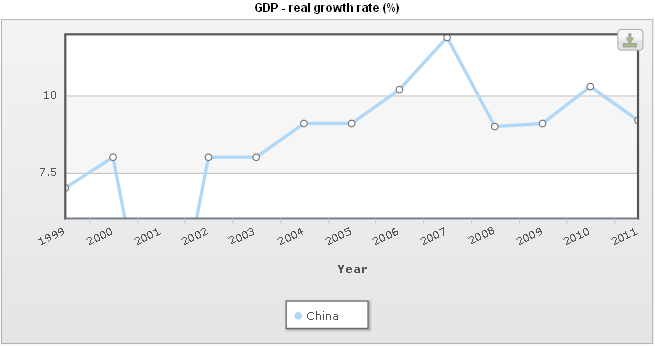

According to Indexmundi (2013), the gross domestic product growth rate of the country is quite impressive from an overall viewpoint; for example, it was the highest in 2007 (above 11 percent). Even though it fell to nine percent in 2008 due to the global financial crisis, it later on enhanced to 10 percent in 2010 and above nine percent in 2011; however, the figure regarding GDP growth rate shows this in more detail.

The World Bank (2013) has pointed out that from a general point of view, GNI index of China has gradually increased from 1981 to 2009, indicating that there has been significant development of the country throughout the period of past 28 years, which had reached the highest peak in 2002. However, the chart of the ‘GNI index of China’ shows this elaborately, and it is important to note that the graph suggests that in 2008 and 2009, the GNI index was above 42, whereas in 2002, it was almost 43.

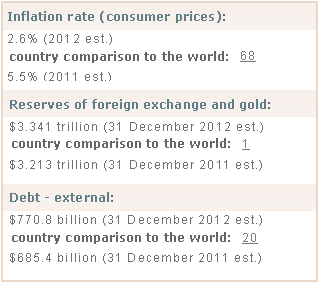

CIA (2013) suggested that in 2010 to 2011 this country suffered from elevated inflation rate caused by credit-fuelled incentive agenda; although retrenchment initiatives lowered inflation, the gross domestic product accordingly lowered below eight percent in 2012; moreover, the economic crises in the EU region added supplementary hindrance over China’s economic expansion this year. The table named ‘inflation rate, reserves, and external debt’ indicates that the inflation rate of the country was above two and a half percent in 2012, and five and a half percent in 2011; moreover, the reserves were above three trillion US dollars in 2012, and external debt was above 770 billion US dollars in the same year (CIA 2013).

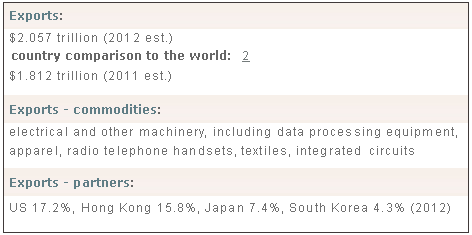

The table on exports of the country shows that China’s exports were above two trillion US dollars in 2012, and the country was at the second position in the world ranking in terms of exports.

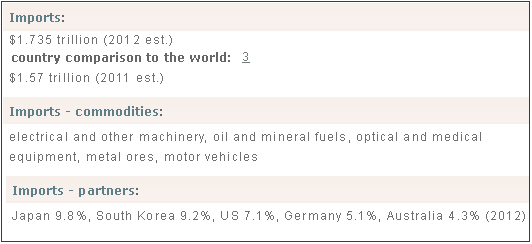

The table on imports of the country shows that China’s imports were much higher than one trillion US dollars in 2012, and the country was at the third position in the world ranking in terms of imports.

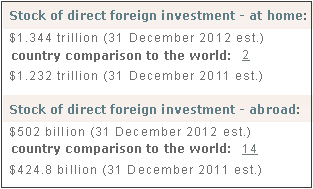

It is important to note from the table of ‘foreign investment’ that China is in a great position in terms foreign direct investment at home (ranked at the second position), which means that a large number of foreign investors are gaining good profits by investing in the Chinese market, for which more and more investors are encouraged towards this market.

Socio-cultural Factors

Boontanapibul (2010) argued that in China’s society, conducting business includes a vast extent of bond creation tradition; so, it is highly crucial for any company wishing to enter this market to appreciate that fact that without the introduction of a strong affiliation with potential corporate collaborators and clients, it would not be possible for them to succeed in long-term. Even in this era, this country consists mostly of a male-dominated social structure where males carry on to possess a prevailing place within the family structure, especially when it comes to decision making; however, at present days, it is notable that the females are obtaining better justice as they are increasingly supplying their earnings within the family (Diversicare 2006).

According to Diversicare (2006), although China is formally an atheist country, religious conviction even now has a major role in Chinese life; moreover, though Confucianism is mostly considered an ideology other than a religion, the social and traditional features of the country are arranged based upon it; however, in China, the key religions are Buddhism and Western Catholicism.

On the other hand, it is notable that seven key languages are present in the country, and Mandarin is the chief language in the society (spoken by more than seventy percent people, and practiced at most of the educational institutions); in addition, some other verbal languages in the country include Tibetan, Korean, Uygur, Turkic, Cantonese, Mongolian, etc. On the other hand, Diversicare (2006) noted that Chinese natives confine one hand in the other against their chest during salutation, and they greet others by nodding or bowing; nevertheless, no precise conventions are present in Chinese tradition regarding clothing and conformist outfits are hardly worn by people; however, attires are selected based on comfort or any particular occasion.

Technological Factors

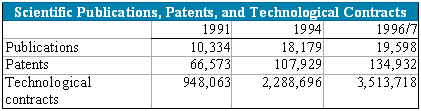

Yao (2001) has noted that the country has greatly developed in the technological arena from all spheres due to more investment in research and development from the part of the government and rapid improvement of human resources and skilled IT workers through edification and training. The table regarding the ‘Technological development of China’ shows the extent to which the technical publications, exclusive rights, and technical agreements have increased during the 1990s; it is notable that from 1991 to 1996, the country’s technical agreements with other nations rose from 948063 to 3513718. As a result, there is no doubt that for any company wishing to enter the steel manufacturing industry of China, it would be a huge support that it would not be required to introduce the technicalities from other nations, as China is already proficient in this regard.

Legal Factors

At this stage, it is important to argue that it is an alarming factor for businesses as well as individuals that this country does not possess an autonomous legal system; as a result, it is completely directed under the authority of the government, which in fact worsens the troubles it faces as an authoritarian realm. According to M&A Law Firm (2011), China got the membership of World Trade Organization in 2001, bringing massive changes in the legal circumstances of businesses; so, transformations were made in terms of lowering taxes (from 15 percent in 2002 to almost nine percent in 2008), liberating market, encouraging overseas-investment, restructuring intellectual property safeguard, removing trade barriers, and managing exchange-rates. Although from an overall viewpoint, these features indicate that overseas steel companies could get a business-friendly environment in China, it is important to keep in mind that there is strict legislation governing overseas businesses, for example, ECL (2008), company law, environmental law, labor dispute mediation and arbitration law, and so on.

Environmental Factors

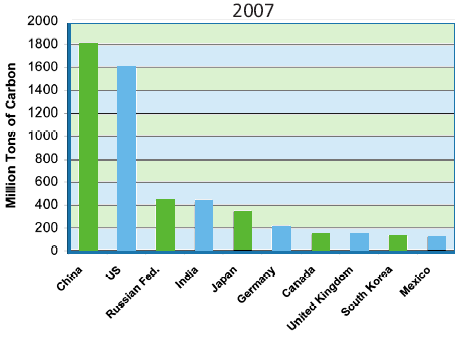

China regulates most of the businesses, industries, and other bodies through its environmental protection law when it comes to protecting its ecology and natural heritage from the harmful impact of industrialization and globalization. As a result, any player of the steel industry must comply with this regulation; however, because of the fact that China is now emitting more carbons than that of others, and there are increasing pressures to strengthen the laws to protect ecology, the situation could become stricter. Kundak, Lazic & Crnko (2009) noted that in 2007, China was the highest producer of carbon, whilst the US was the second-largest; this has been shown in the figure below.

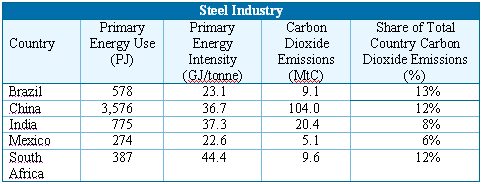

Moreover, Lawrence (2001) noted that carbon dioxide emission from steel industry of China is much higher than that of some other emerging economies; the table regarding ‘CO2 emission from steel industry comparison’ shows that twelve percent of China’s total CO2 emissions come from the steel industry, which is much higher than India or Mexico.

This could mean that Voestalpine would need to face greater challenges as it will be a player in the steel industry; therefore, it would be a challenge for the company to carry out its manufacturing process by keeping in mind the extent to which carbons could be emitted.

SWOT Analysis of Steel Industry in China

Strengths

According to the report of Ernst & Young (2013), this country has the biggest industry in steel sector; so, figure-four shows that China’s steel manufacture and consumption rate is much higher than that of India:

Ernst & Young (2013) noted that China’s steel sector is highly business-friendly and its trading activities are also in a better position; figure-five shows huge exports of Chinese flat steel products from 2007 to 2011:

ITA (2013) noted that from June to July 2013, steel imports from China to the United States amplified to more than 13 percent, whilst imports from China to the United States were over 47 percent in July 2013, indicating 28 percent increased than average imports in 2012; moreover, July’s imports symbolized seven percent of USA’s entire steel imports; figure-six shows this in detail:

According to ITA (2013), imports from China to member states of NAFTA lowered by nearly 12 percent in volume from May to June 2013, indicating that its steel industry has strengthened through better production of steel in the domestic market in terms of quantity.

Weaknesses

Holloway, Roberts & Rush (2010) pointed out that the steel products production growth of China has decreased significantly in recent years; figure seven shows that whereas in 2005 the production growth was above 30 percent, in 2010, it was about 15 percent:

Figure-eight below shows the comparison of different nations in terms of steel manufacturing intensity and the level economic development, which indicates that China has poorly performed in terms of tonnes of steel produced per capita GDP than Japan and the USA:

Opportunities

Ernst & Young (2013) noted that steel demand in China is anticipated to increase by above three percent in 2013; moreover, by 2016, Chinese GDP from steel production is anticipated to increase much more than the USA, Eurozone, Japan, and India, as shown in figure nine:

The infrastructural situation in China is much better than India as shown in figure-ten, this means China is more prospective for foreign investors:

The exports of China is much higher than imports of this country, which indicates a huge opportunity for foreign investors in the Chinese market as China produces higher quantities at lower costs, resulting in higher exports; this has been shown in figure eleven:

Threats

China possesses about 2700 industrial units, but the majority of them are undersized, with facilities under one million tonnes annually, manufacturing steel with outmoded technology (Ernst & Young 2013)

- There are many trade barriers for foreign investors in terms of tariffs, legal strictness, local rivals, and so on.

Porter’s five forces in the Chinese Steel Industry

- Bargaining Power of Suppliers: Because of administrative strategy, the unpredictability of the value of raw materials, recession, and delivery expenses, this force is high to moderate, as shown in figure-12;

- Bargaining Power of the Buyers: According to figure-12, this force is moderate because although rivalry is quite high in the industry, the demand of steel is extremely high and it is predicted to gradually increase in the future:

- Threat of New Entrants: There are little risks from new entrants as they do have funds, expertise, familiarity or procedural awareness; they also find it hard to cope in adverse competition and strict regulations

- Threat of Substitutes: Threat of substitute items are moderate because although many companies offer similar products, the demands of all items are very high; moreover, Voestalpine mostly offers finished steel products, and few Chinese firms offer these items

- Competitive Rivalry: This market is highly competitive in China due to the presence of many players; however, as Voestalpine is already an experienced and established steel company in Austria, it would not suffer much trouble.

Entry Mode for Voestalpine Steel Company

It would be best for Voestalpine to enter the Chinese market through a joint venture strategy with an already established local Chinese business in order to lower down legal troubles of company formation and high tariffs imposed by the government for foreign investors. It is important to state that majority of Chinese industrial units are undersized, with outmoded technologies and facilities under one million tonnes annually. Therefore, another rationale behind the choice of joint venture strategy would be that many local businesses would already be eager to get free support from another firm in terms of better technologies and higher investments in regard to factory expansion, making it easier for Voestalpine to enter in to contract with them. In addition, Sun (1999) has pointed out that there would be a number of benefits for multinational corporations to enter China through a joint venture, which, for example, include the following:

- Lesser legal hazards

- Smaller expenditure to enter through a joint venture than setting up freshly

- Voestalpine will get free access to local business’s assets, like factory spot, established supply chain, and established networks

- Voestalpine would only be required to give the local firm technological support and investment for factory enlargement

- Voestalpine would be able to use a local firm’s expertise regarding market

Recommended Organisational Strategies to Market Entry

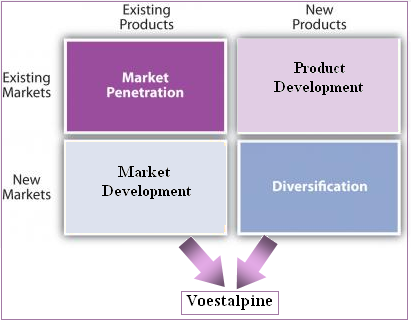

Voestalpine will need to consider a number of organizational strategies for this foreign market entry; it is notable that Voestalpine would enter a new market with new and existing products, so according to Kotler (2003), it would be viable for this company to focus on market development and diversification strategies; this has been shown in figure-13.

However, it is important to state that it is not possible at this stage for Voestalpine to formulate an organizational structure for market entry because it will enter the market through a joint venture and so it would have to discuss and negotiate a new organizational structure for the Chinese market. Although there are many trade barriers and challenges affecting the choice of strategies and strategic business development, the following strategies can be helpful for Voestalpine.

Voestalpine presently offers finished steel products (for example, automotive-tubes, temperature exchanger-tubes, hollow-redraw, motorized tubes, oil-country-tubular-goods, pressure-tubes, faultless steel, and so on), and few Chinese firms offer these items; therefore, Voestalpine’s strategy would be to offer these products as the demand for such new items will be high in China. However, another strategy of Voestalpine would be to undertake mass marketing strategy; therefore, it would be feasible for this firm to offer certain items that it does not produce presently, for example, searing rolled-plates, standard platter, warped steel, beam steel, line bar, round-steel, welded-pipe, steel filament, h-shaped-steel, strip-steel, and so on. This is because local firms already produce this item and Voestalpine could market them without any newly added cost. According to figure-14, Kalyanaram and Gurumurthy (1998) noted that before any strategy formulation, it is vital to focus on the market features and capacity evaluation; so, Voestalpine must keep this in mind:

Human Resource Management Strategy

Voestalpine will have to negotiate the apt human resource management strategy with its joint venture partner to formulate a fair and mutual staffing policy. However, ICSC (2001) and Jackson (1993) noted that while implementing the staffing policy, all firms must keep in mind the ideal human resource management strategies to attain success. Some of these are outlined in figure-15; it shows that the strategies must include ensuring superior workplace atmosphere, safeguarding life and belongings, ensuring appropriate employment and maintenance, fair authority, proper health, security, and medical allowances, and so on:

Environmental and CSR Issues Arising from the Venture

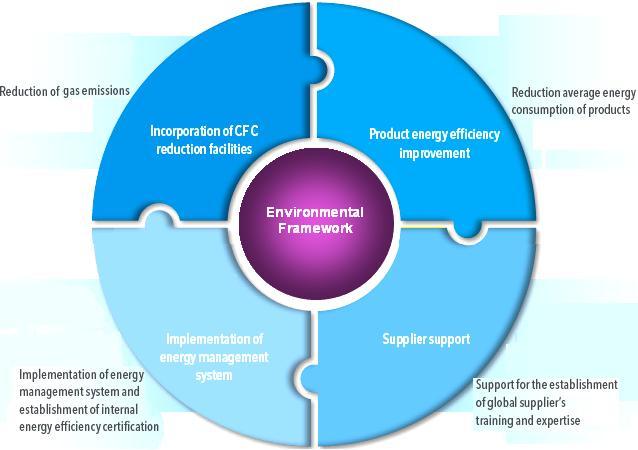

It has been discussed earlier that manufacturing businesses in the steel industry threaten the environment in many ways, and especially by carbon emission. Although by conforming to the environmental laws of China, it would be possible to reduce the pollution levels, Voestalpine, as part of its corporate social responsibility, must consider the following strategic framework in figure-16 for environmental safeguard, which suggests that the key strategies should be the integration of chlorofluorocarbon lessening facilities, execution of energy organization scheme, seller-support, and product-energy effectiveness development:

Conclusion

At this stage of the paper, it is important to state that the Chinese steel industry is a highly lucrative market in terms of high demands and cheap production costs. Moreover, the local firms lack adequate technologies, which indicate that they will readily accept joint venture offers from Voestalpine, which possess the best technological infrastructures; therefore, this foreign direct investment is anticipated to generate huge success in the near future.

Reference List

Boontanapibul, C 2010, Doing Business in China: Cultural Factors, Start-up Concerns, and Professional Development.

CIA 2013, The World Factbook. Web.

Diversicare 2006, Chinese culture profile. Web.

Ernst & Young 2013, Global steel 2013. Web.

Fogel, G. K 2010, Business environment in china: economic, political, and cultural factors. Web.

Holloway, J., Roberts, I. & Rush, A 2010, China’s Steel Industry.

ICSC 2001, A Framework for Human Resources Management. Web.

Indexmundi 2013, GDP – real growth rate.

ITA 2013, Steel Industry Executive Summary: September 2013. Web.

Jackson, S. E 1993, Diversity in the Workplace: Human Resources initiatives, The Guilford Press, New York.

Kalyanaram, G. & Gurumurthy, R 1998, Market Entry Strategies: Pioneers Versus Late Arrivals. Web.

Kotler, P 2003, Marketing Management, Prentice Hall, New Jersey.

Kundak, M., Lazic, L. & Crnko, J 2009, CO2 emissions in the steel industry. Web.

Lawrence, E. O 2001, Energy Use and Carbon Dioxide Emissions from Steel Production in China. Web.

M&A Law Firm 2011, Legal Guide to Doing Business in China. Web.

Sun, H 1999, Entry modes of multinational corporations into China’s market: a socioeconomic analysis. Web.

The World Bank 2013, GINI index. Web.

Voestalpine 2012, Annual Report 2012/13. Web.

Voestalpine 2013, Overview. Web.

Yao, Y 2001, In Search of a Balance: Technological Development in China. Web.