Introduction: Tesla

Tesla

Tesla’s fundamental mission is to hasten the world’s shift to renewable energy. In 2021, the global portfolio of Tesla automobiles, power storage, and solar panels will assist the company’s consumers avoid 8.4 million metric tons of CO2e emissions (Tesla Impact Report, 2021). Dai and Zhang (2022) state that Tesla was established on July 1, 2003. The company’s foundation was in response to the realization of a conflict between the manufacture and use of gasoline automobiles and the protection of the natural ecosystem. Tesla’s aim since its inception has been to offer Electric Vehicles (EVs) superior value propositions such as long-range, rechargeability, power efficiency, competitive prices, and outstanding reliability without renouncing aesthetics (Daxue Consulting, 2022). The concept of combining performance cars with new energy vehicles arose, intending to appeal to high-income clients who are environmentally conscious (Dai and Zhang, 2022). Tesla’s Model S and Model X aim at the premium sedan and SUV segments, while the Model 3 and Model Y target the mass automotive market (Daxue Consulting, 2022). With a $6.3 million investment, Elon Musk was appointed as the chairman of Tesla in February 2004 (Dai and Zhang, 2022). Moreover, Tesla’s expansion was progressively on pace owing to Musk’s financial support.

Tesla is a vital player in the worldwide EV business and the global vehicle industry. According to Daxue Consulting (2022), the company has a market valuation of USD 941.9 billion as of August 2022, making it the world’s sixth most valuable corporation. Tesla shipped 936,200 automobiles worldwide in 2021, up from 499,550 units in 2020, representing an 87.4% year-on-year increase. Regarding the model popularity, the company delivered 911,208 mid-market Model 3 and Model Y vehicles in 2021, representing 97.3% of total deliveries (Daxue Consulting, 2022). The company strives to be the best in every parameter related to its purpose of hastening the deployment of renewable energy (Tesla Impact Report, 2021). Tesla intends to continue boosting manufacturing quantities and product accessibility in order to optimize its effect. More practically, they hope to sell twenty million electric vehicles annually by 2030, up from approximately one million in 2021(Tesla Impact Report, 2021). Therefore, the most significant environmental effect is accomplished by replacing ICE cars with EVs as promptly as possible. Tesla also aspires to replace fossil-based energy generation with renewable sources of energy.

Current Context: China

China is a significant market for the automobile sector, notably for electric vehicles. According to Daxue Consulting (2022), China is an ideal location for production due to its large customer base, powerful central financial system, developed industrial manufacturing chain, and lithium-ion battery production output. Moreover, China’s strengths in rare-earth metal processing and electronics manufacturing are critical for creating essential EV parts such as batteries, motors, and electric interfaces.

Essentially, Investing in China was a strategically crucial moment for Tesla. According to Daxue Consulting (2022), Tesla had three fundamental goals when it entered the Chinese market. The first objective was to increase its market share in the world’s largest EV market. The second ambition was to avoid China’s demand that foreign automakers form joint ventures with Chinese producers. Finally, the company aimed to safeguard the intellectual property incorporated into its expanding EV portfolio. Daxue Consulting (2022) acknowledges that Tesla emerged as the first foreign automaker to be granted complete autonomy while maintaining one hundred percent ownership in China. The corporation abandoned nationalization in 2018 and reached an agreement with the Shanghai government to acquire the 854,885 square meters of the 05 land in Shanghai as Tesla’s Gigafactory 3 (Dai and Zhang, 2022). Tesla should not to be concerned about forced technology (IP) transfers of its trademarks because China revised its Foreign Investment Law in 2020 (Daxue Consulting, 2022). For instance, automobile manufacturers such as BMW, Mercedes-Benz, Toyota, Ford, and other foreign companies have pursued this arrangement for years.

Tesla’s market share in China increased dramatically with the completion of its Gigafactory in Shanghai. Dai and Zhang (2022) emphasize that the company’s sales in the Chinese market now represent 29.6% of global sales, yet it has experienced a slew of challenges since entering the Chinese market to the present day. Dai and Zhang (2022) claim that most academics assume Tesla has significant prospects in the Chinese market, but an examination of the existing scenario reveals significant hazards. The corporation’s macroeconomic prospects are pessimistic, and industry growth is substantially lower than anticipated (Dai and Zhang, 2022). For instance, Tesla experiences hurdles and difficulties, such as overpricing, a lack of charging piles, and low flexibility. The current challenge also includes decreased growth due to the high competition in China.

Choice of Challenges

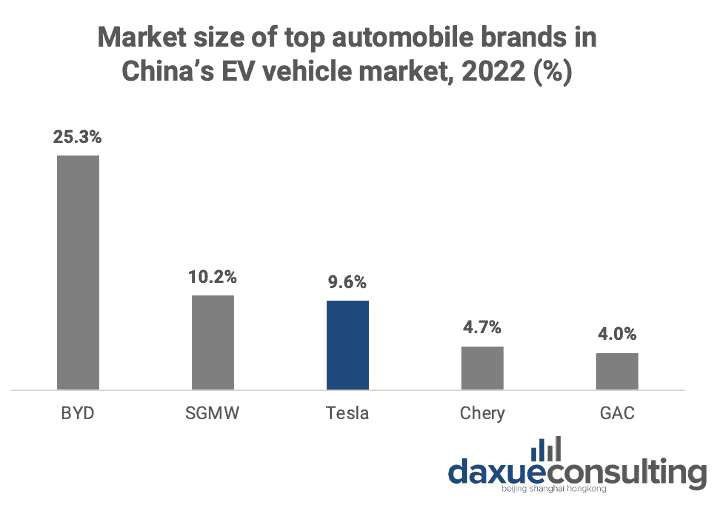

Tesla is one of China’s largest electric-vehicle makers, representing just a tiny portion of the country’s immense EV sector. Strategic performance goals can be articulated in various ways, including market share, revenue growth, profits per share, dividend growth, and operational returns (McGahan,1999). Descalsota (2022) asserts that except for Tesla, four of China’s top five automobile manufacturers are domestic. From January through May, Tesla held the third-largest market share in the Chinese EV market (Descalsota, 2022). Unlike Tesla, China’s indigenous manufacturers make diesel-powered vehicles in addition to EVs; GAC, Chery, SGMV, and BYD are Tesla’s four most formidable domestic rivals in China (Descalsota, 2022; Daxue Consulting, 2022). Figure 1 illustrates the market size of top automobile brands in China in 2022.

Consequently, Tesla has 9.6% and is highly competitive in the market. Nonetheless, Dai and Zhang (2022) argue that Tesla’s sales have suffered due to the rising competition, the use of new technologies by rivals, and Tesla’s simplistic design as several of the primary causes behind the company’s challenges in the Chinese market. Such designs failed to stand out among China’s plethora of new energy vehicles. The paper will focus on three level analyses, such as national, industry, and organizational, to reveal the reason behind Tesla experiencing challenges in China in 2022. Additionally, the recommendations will be adapted to the identified challenges in order to make theoretical and practical relevance.

National-Level Analysis: PESTEL

Choice of the Framework

Notably, the PESTEL framework was selected to conduct a national-level analysis. Peterdy (2022) claims that a PESTEL study is a strategic framework that is often used to examine a company’s business environment. Initially, the framework was known as a PEST analysis, which stood for political, economic, social, and technological elements; in more recent times, the framework was expanded to incorporate environmental and legal issues.

Political factors, in general, are those that are influenced by governmental actions and policies. Concerns such as corporation taxes, other fiscal policy efforts, free trade conflicts, and competition are among them (Peterdy, 2022). Interest, employment, inflation, and exchange rates are examples of economic elements that are related to the larger economy and are clearly financial in nature. Social elements are more challenging to quantify than economic aspects; they relate to changes in how stakeholders view life and leisure, which might have an influence on business activities (Peterdy, 2022). Demographic concerns, lifestyle patterns, and consumer perceptions are examples of social influences. Peterdy (2022) adds that managers and researchers should understand how technology issues might affect a business or an industry. Technological factors comprise, but are not limited to, automation, how R&D may affect expenditures and competitiveness, technological capabilities, and cyber security.

As the business community came to appreciate that alterations in the physical environment might bring material dangers and possibilities for firms, environmental factors arose as a natural addition to the initial PEST framework. Carbon footprint and climate change consequences, involving physical and transition hazards, are instances of environmental factors (Peterdy, 2022). Consequently, legal variables are those that originate from shifts in the regulatory environment and have an impact on the whole economy, specific industries, or even specific enterprises within a sector. Industry regulations, licenses and permissions necessary to operate, employment and consumer protection legislation, and intellectual property protection are examples of legal considerations to explore.

The Importance of Using the Framework

While change might be an unpleasant and unexpected event, it is unavoidable. On the other hand, planned modifications are very desired, particularly in the face of substantial dangers (Elnaj, 2022). Therefore, to analyze and improve American-based Tesla’s strategic decision-making in China, six external variables should be investigated: politics, economics, society, technology, environment, and law. Management teams and committees utilize the framework in strategy development and corporate risk management planning. PESTEL analysis also serves as a standard method among management consultants to assist their customers in developing innovative products and market efforts and among financial analysts to identify aspects that may impact model assumptions and the budgeting process.

PESTEL Framework to Assess the Environment in China

Political

From a political point of view, the stability of China’s governmental structure is a plus for Tesla’s growth. The host country’s more stable administration will keep the energy turnaround on track (Liu et al., 2021). An et al. (2022) claim that American policy cohesion cannot be assured because policy support for the new energy automotive sector differs dramatically between the anti-establishment group supported by Trump and the establishment group advocated by Biden. The industrial architecture for the new energy electrification period has yet to be finished; coherence will have a crucial impact on whether the US can preserve its leading position (An et al., 2022). Consequently, because of the differences in political systems, China has more solid policy backing for the new energy sector based on the predefined strategy of ‘Made in China 2025’ and a more constructive approach toward the modernization of diverse industries. Liu et al. (2021) acknowledge that the country may take the initiative to reduce tensions and overcome obstacles in the energy transformation process due to China’s stable political environment.

Financial and fiscal incentives are significant advantages for company growth. Promoting sustainable power has long been a trend in China (Liu et al., 2021). Due to the high initial investment costs of hydro, nuclear, wind, and solar power facilities, fiscal incentives, such as grants, tax credits, and reimbursements, are required. China, for instance, offers subsidies for on-site renewables in order to eliminate energy poverty and guarantee equitable access to energy supplies (Liu et al., 2021). As manufacturing and economic activity restart after the outbreak, China is more likely to make corporate initiatives (An et al., 2022). For instance, the government offers advantages to businesses such as lowering taxes and fees, giving particular loans with financial incentives and granting targeted subsidies.

Nonetheless, the ongoing trade war between China and the United States shows that their partnership has shifted from complimentary to competitive. Liu et al. (2021) acknowledge that when China unveiled the ‘Made in China 2025’ plan, the West became concerned that China’s expanding power might undermine the US’s international economic standing and dominance (Liu et al., 2021). Trade considerations and intellectual property rights are not the only issues at stake in the conflict between China and the West. Because the United States and China are fighting for hegemony, the trade war may extend longer than predicted (Liu et al., 2021). China would suffer more specifically because non-tariff obstacles in the trade conflict will amplify the underlying negative impact.

Additionally, the level of bureaucracy is a critical political vulnerability for international firms like Tesla. A bureaucratic system in China would make scaling up renewable energy problematic in some areas since the regulatory and legal framework for manufacturing, transferring, and delivering renewable energy is still unclear (Liu et al., 2021). Hence, there would be a monopoly in the supply of grid connection devices, with higher prices and hazards but no standards.

Economic

Tesla benefits from China’s economic growth comeback following the COVID-19 outbreak. Liu et al. (2021) acknowledge that China, in particular, is the world’s most excellent industrial power user in the whole industrial sector. Following the COVID-19 pandemic, the global economic downturn is one of the most severe threats confronting the G20 countries. Liu et al. (2021) add that domestic electricity generation has remained strong due to China’s economic recovery in the first quarter of 2021. Nonetheless, China has enormous unemployment illustrates a severe constraint for commercial operations. Because of the trade war and the COVID-19 epidemic, the entire globe will go into a deep slump and massive unemployment (Liu et al., 2021). To prepare for a future disaster, China could convert this difficulty into an opportunity by reforming its energy policy ahead of time.

The improvement of battery technology in China presents an opportunity for firms such as Tesla. Liu et al. (2021) state that because advanced batteries have moved from specialist to general industries, they constitute a turning point for technologies such as electric cars and solar energy accelerators. Battery and microprocessor improvements have significantly decreased the expenses of other electric car components (Liu et al., 2021). As battery costs fall, new business models for batteries arise, providing new functionalities ranging from supplementary services to on-demand solutions.

China’s industrial overcapacity is primarily reliant on exports to the foreign market. Liu et al. (2021) argue that manufacturing industry outflows constitute a significant issue since China competes in low-end manufacturing with several emerging nations such as Mexico, India, Vietnam, Indonesia, Turkey, and Brazil. Essentially, China is becoming more reliant on external economic development. Tariffs and limiting customs clearance in the United States will significantly raise the possibility of production interruption and the ruin of international trade partnerships, or perhaps the disruption of the complete supply chain (Liu et al., 2021). It has compelled China’s labor-intensive export firms to relocate to resource-rich neighboring nations such as India, Vietnam, and Burma, where tariff barriers do not exist. The scarcity of young labor casts doubts on China’s industrial future.

Moreover, the supply chain problems are experienced by Tesla currently. Tesla reduced car production at its Shanghai manufacturing owing to components shortages induced, in part, by a neighboring supplier’s Covid lockdown (Kolodny, 2022). Ashcroft (2022) claims that Tesla deliveries fell nearly twenty percent in a record quarter due to lockdowns at the e-car maker’s Shangai Gigafactory, supply interruption, and inflation. The company’s new vehicle deliveries for the quarter ending in June were about one-fifth lower than its highest-ever quarterly total, with the firm explaining the drop in supply chain disruption and China’s continuous series of Covid-19 lockdowns (Ashcroft, 2022). Hence, broad supply chain problems and rising input costs have also impacted production levels, leading Tesla to raise current model pricing while simultaneously looking for near-term cost-cutting opportunities as the year ends.

Despite experiencing difficulties, China is offering significant assistance for Alternative Energy Vehicles (AEVs), which benefits Tesla’s development. Notably, China has overtaken the United States as the world’s largest renewable vehicle market, accounting for forty-one percent of worldwide sales (Liu et al., 2021). The massive AVE market allows China to participate in the economic growth and prosperity of the electric car industry and innovative traffic systems. Electric vehicle sales remained strong in 2020, with a thirty-eight percent increase globally and approximately thirteen percent growth in China (Liu et al., 2021). In essence, electromobility signifies a distinct future energy trend from fossil fuel usage.

Social

As the world’s focus moves to climate change, the issue of decreasing carbon emissions becomes more pressing. An et al. (2022) state that from rom a social standpoint, electric vehicle production is advancing as carbon emissions are reduced, and more people prefer electric over gas-powered automobiles as their primary means of transportation. Customers can see how using electric vehicles would significantly lower vehicle expenses because the energy costs used by electric vehicles are far cheaper than the fuel price for petroleum vehicles to cover the exact distances (An et al., 2022). In China, Tesla may capitalize on societal attitudes around carbon emissions. Liu et al. (2021) argue that because fossil fuels lead to pollution by producing CO2 and other greenhouse gases, public support for renewables might hasten the shift. Consequently, while CO2 emissions from energy in the United States continue to plummet, the Chinese government has supported low-carbon lifestyles.

Chinese customers are becoming more concerned about the effects of automotive emissions on pollution levels in order to minimize their environmental impact. Ma et al. (2021) acknowledge that China’s aggressive promotion of the environmental protection idea of “green water and green mountains are golden mountains and silver mountains” has consistently increased the Chinese people’s understanding of environmental preservation (p. 13). Citizens’ opinions regarding environmental pollution are constantly shifting concerning the relevant policies of the respective countries (Ma et al., 2021). With the confirmation of the notion of environmental preservation and energy conservation in new energy cars, as mentioned earlier, social and cultural aspects influence customers’ preference for new energy vehicles while diminishing their selection of gasoline-powered cars.

Nonetheless, two key growth challenges for electric cars are battery life and charging. An et al. (2022) suggest that with present technology, the battery life of electric vehicles, for instance, has a fixed maximum limit and varies considerably based on environmental factors such as temperature. Dai and Zhang (2022) state that at the moment, Tesla’s charging pile in China lacks extensive coverage and is incompatible with the national standard battery system, which is a substantial source of irritation for new energy cars in China. Charging piles are challenging to locate in many places, and owners of new energy vehicles must travel a significant distance to find them (Dai and Zhang, 2022). This issue causes hassle when refilling, which causes consumers in many cities to hesitate to purchase new energy cars. Furthermore, the charging period and the number of charging piles are critical sources of frustration.

Technological

Significantly, energy science and technological advancements are diverse and progressive. Liu et al. (2021) note that new energy technology, such as electric automobiles, is the product of technological improvements that will progress and accommodate the performance criteria approved by customers. These sustainable energy technologies are providing a chance for industrial upgrading in China. Because of the cost reductions in renewable energy, electricity is shifting to the center of modern energy security (Liu et al., 2021). Carbon emissions reduction involves utilizing the capabilities of the digital energy economy. Data on energy production, manufacturing, and devices are shared in a cloud foundation (Liu et al., 2021). The goal is to accomplish the consolidation and affiliation of energy transfer, data, and capital flows, resulting in improved energy security prediction and precision.

China’s new energy vehicles have advanced to a high level of development. Ma et al. (2021) demonstrate that according to a China Automobile Industry Association data study, China’s output of new energy cars reached 248000 units in June 2021, a 1.3-fold growth over the previous year. The output has constantly grown with more mature manufacturing processes and scientific and technical innovation in relevant manufacturing lines. Furthermore, the sales volume of new energy cars in China reached 256000 in June 2021, a 1.4-fold rise compared to 2020 (Ma et al., 2021). The volume of new energy sales has established a new historical record and achieved a record milestone. As a result, the share of new energy cars in automotive sales is increasing.

Nevertheless, one of the major impediments to developing new energy vehicles is the possibility of ethical difficulties. An et al. (2022) emphasize that data protection and ethics in emergency situations are the two most pressing challenges. People in China prioritize convenience and have zero tolerance for firms that reveal personal details about them and are willing to fight for their rights and values (An et al., 2022). The Trolley Problem is an ethical quandary that develops during an emergency. While there does not seem to be a suitable solution to this problem, the sequence to which the new energy vehicle may react must be pre-programmed.

Environmental

Environmental pollution is a hazard because emissions from industry and autos regularly generate harmful smog. Liu et al. (2021) mention that the toxic haze lasts for days or weeks in many Chinese cities. More than a fourth of China’s land has been shrouded in smog, leaving significant cities with murky skies (Liu et al., 2021). Furthermore, additional pollutants such as oil and trash flowing into the oceans are detrimental to marine organisms. In this circumstance, China should take more steps to limit carbon emissions and safeguard the environment for the next generation. Because of the significant uncertainty in energy supply, climate change and sustainability are also critical threats (Liu et al., 2021). Sustainable development is the foundation of energy security challenges. Official media and press in China must encourage social education and raise public knowledge of environmental sustainability.

Legal

National and municipal commitments assist Tesla’s ability to operate in China. Liu et al. (2021) argue that the government and its policy commitments are critical to the growth of renewable energy. Green energy policies at the local level have surpassed the national level. China has created the 14th Five-Year Plan to attain net zero emissions, which will significantly affect the future energy revolution predicated on these national and municipal promises (Liu et al., 2021). Nonetheless, a fundamental issue in China is the shortage of renewable energy patents. Patent, intellectual property, and trademark protection are becoming increasingly essential in China, although this has resulted in an increase in legal concerns (Liu et al., 2021). Globally, the United States continues to possess the most patents on renewable energy technology. Therefore, Chinese energy businesses would face patent obstacles through numerous licensing arrangements with global rivals.

Industry-Level Analysis: Porter’s Five Forces

Choice of the Framework

The extent to which investment inflows push returns to the free market level in an industry influences businesses’ capacity to maintain above-average profits. Porter (1980) states that the level of competitiveness is not determined by chance. The industry’s fundamental economic and technological qualities influence the strength of the five primary competitive forces: “threat of new entrants, bargaining power of buyers, the rivalry between existing competitors, the threat of substitute products, and bargaining power of suppliers” (Porter, 1980, p. 30).

All five factors influence decision-making and the development of competitive business strategy. Porter (1980) identifies that the objective of a company’s competitive strategy is to identify a position in its industry where it can best deal with or affect these competitive forces to its advantage. Awareness of the underpinning sources of competitive tension can disclose an industry’s basic attractiveness, illustrate a company’s critical weaknesses and advantages, and clarify the areas where change initiatives may result in the highest payoff (Porter, 1980). Moreover, the five forces analysis may discern the market dynamics that guarantee tremendous importance as either threats or opportunities.

The Importance of Using the Framework

Understanding both the competing dynamics and the broader industry structure is critical for successful strategic decision-making and establishing a compelling competitive plan for the future. Martin (2022) argues that Porter’s Five Forces is a macro technique in business analytics; it examines the whole economy of the sector. The implementation of Porter’s Five Forces model is required to study the company’s competitiveness and comprehend its position in the industry. Identifying competitive dynamics and the underlying causes, as a result, uncovers the foundations of an industry’s current profitability while giving a framework for predicting and influencing competition (Martin, 2022). After the analysis, the firm can implement an effective plan to increase its competitive edge.

Tesla is one of the pioneering companies in the field of new energy cars, which are becoming increasingly popular. Nonetheless, because new energy vehicles are still in their early phases, Tesla has many formidable competitors, both known and undiscovered. Porter’s five forces approach is critical for analyzing Tesla’s strengths and dangers in terms of competitive ability to operate, rivals, future competitors’ ability to enter, substitutability of alternatives, and suppliers’ and buyers’ bargaining powers (Yang, 2022). According to Porter (1980), consumers, suppliers, substitutes, and future entrants are all rivals, and their prominence varies according to the circumstances. Hence, five competitive forces collaborate to establish the intensity of industry competitiveness and profitability; nonetheless, the most potent force or forces become critical in strategy design. Industry structure can evolve progressively over time, and businesses’ strengths and limitations in coping with structure will be distinctive (Porter, 1980). On the other hand, analyzing industry structure should be the preliminary stage for strategic planning.

Porter’s Five Forces Frameworks to Assess the EV Industry in China

Threat of New Entrants

Prospective industry entrants bring new potential, a drive to grab market share, and frequently insufficient resources. Porter (1980) argues they can reduce profitability by bidding down prices or inflating costs. The choice to enter or expand into an industry is often influenced by the entrance deterrent price, which after accounting for product quality and service, simply balances the prospective benefits of entering against the predicted costs (Porter, 1980). Nonetheless, if the market is distinguished by product differentiation, entrants will find it incredibly challenging to compete with established enterprises for sales channels and buyers (Porter, 1980). Product differentiation implies that established companies have brand recognition and consumer loyalty due to previous advertising, customer support, and product variances.

Although Tesla was one of the first firms to enter the new energy industry and demonstrate a high brand awareness, there are still many businesses that have the possibility of entering the market if electric vehicles are strongly promoted worldwide. The automotive business is a typical high-end manufacturing industry, requiring a high level of technology and finance (Shu, 2022). Yang (2022) emphasizes that if Tesla intends to achieve long-term growth in the target market, it should concentrate not just on present rivals but also on overlooking potential newcomers. Thus, the company should consider the market’s new pressures because the transportation business affects many people’s livelihoods, and policies that support the creation of new energy vehicles are actively encouraged.

Tesla has long been at the forefront of the high-tech business, and it is currently expanding the autonomous driving and artificial intelligence industries. Nonetheless, Tesla faces a challenge from emerging new Chinese brands as prospective rivals (Yang, 2022). According to Cheng (2022), the first electric automobile powered by Huawei’s HarmonyOS operating system was delivered in Shanghai in March 2022. The Aito M5, the mid-sized SUV, costs 249,800 yuan ($39,651) after subsidies (Cheng, 2022). In contrast, Tesla increased the post-subsidy pricing of its Model Y in China by 21,088 yuan to 301,840 yuan in December.

New electric vehicles are intended to reduce demand for foreign premium brands like Tesla. Regarding the domestic competition, “Nio’s ET5 luxury sedan, Xpeng’s G9, Li Auto’s L9 full-size SUV, and BYD’s Model 3 competitor Seal” are among the new vehicles available for purchase in August 2022 (Ren, 2022, para. 2). All five battery-powered versions are so-called next-generation vehicles, with standard technologies like as object recognition technology, assisted parking, and semi-autonomous driving. Ren (2022) acknowledges that these models include high-performance batteries, which have received praise and significant pre-orders from buyers. Several new models outperform Tesla’s vehicles due to the improved technology and better components they employ (Ren, 2022). Additionally, these vehicles will be able to entice some purchasers away from Tesla’s Model 3 and Model Y in China. The new market entrants are priced far into the six-digit bracket, positioning themselves as critical rivals to Tesla (Ren, 2022). Their ascension up the pricing ladder reflects the rising maturity of China’s EV manufacturers, emphasizing Tesla’s struggles in maintaining its sales lead. Moreover, all new models are tailored to Chinese drivers based on research into local customer demand.

Bargaining Power of Buyers

In recent years, the electric car sector has matured in different locations. Yang (2022) claims that customers have various automotive options, including electric and standard gasoline vehicles. Consumers have more and more options as the number of electric car models from different businesses grows, and cost performance improves (Yang, 2022). Jing (2020) asserts that Tesla has garnered a vast number of devoted consumers through its disruptive technical innovation. Tesla’s facility will begin manufacturing once the order is received. Even after the payment is completed, Tesla consumers will have to wait at least one month before driving their own Tesla vehicles (Jing, 2020). Nevertheless, when looking for a new automobile, car purchasers may easily swap from one manufacturer to another (Cheng, 2021). For instance, as new domestic automobile companies begin to produce electric vehicles at cheaper costs than Tesla, consumer bargaining power is increasing.

Rivalry Between Existing Competitors

Rivalry arises when one or more competitors are under pressure or sense a chance to strengthen their position. Porter (1980) claims that existing competitors compete for a position through techniques such as pricing competition, promotion battles, product debuts, and enhanced customer services. Diverse competitors with different tactics, backgrounds, attitudes, and affiliations to their parent organizations produce volatile competition since they have different aims and beliefs about how to compete (Porter, 1980). Therefore, because of their different conditions and ambitions, foreign rivals frequently offer a tremendous degree of diversity to industries.

The battle between rivals in China’s electric vehicle industry reached a fever pitch. Du and Li (2021) acknowledge that Tesla, being a famous company, has recently become the focus of public opinion on multiple occasions. Although it has provided some marketing benefits, it also allows negative Tesla news to be easily magnified in the Chinese market. Meanwhile, as a catfish agitating the local, new energy car sector, it is unavoidable that some local businesses would exploit public sentiment and hinder Tesla from growing its market. Yang (2022) asserts that there are new energy cars like BYD, NIO, and XPEV in China, as well as classic Mercedes-Benz, BMW, and Audi globally. This industry will only grow in size as more firms enter it. Mercedes-Benz has even declared that starting in 2025, all new model architectures would be entirely electric (Yang, 2022). Additionally, several Chinese brands have considerable overlap in customer groups with Tesla among new electric vehicle enthusiasts. In contrast, older brands and Tesla significantly overlap customer segments among higher-end customer groups. Descalsota (2022) states that apart from Tesla, four of China’s top five automakers are domestic (See Table 1).

Table 1: Five of China’s top car manufacturers

For instance, per the EV volumes, Tesla had the third-largest proportion of the Chinese EV market from January to May 2021, accounting for 6.6 percent of the marketplace. Because BYD has several collaborations with Chinese public transportation providers, it is destined to become a key competitor for Tesla in China (Yang, 2022). According to Descalsota (2022), BYD is the leading EV maker in China: From January through May 2021, the Guangzhou-based company held a 27.9% market share in China. The manufacturer’s prominent firm, BYD Co. Ltd, was established in 1995 by Chinese billionaire Wang Chuanfu. BYD produced five top ten best-selling plug-in vehicles in China in 2021 (Descalsota, 2022). Moreover, many of the company’s plug-in car models are available in both battery-powered electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) variants.

SAIC-GM-Wuling, or SGMW, is a collaboration between three firms, such as SAIC Motor, General Motors, and Liuzhou Wuling Motors Co Ltd; it was established in 2002. Descalsota (2022) mentions that from January to May 2021, China’s market share is 10.1 percent. Wuling Hongguang Mini EV, a microcar produced by the firm, was the best-selling plug-in automobile in China in 2021 (Descalsota, 2022). Essentially, the model costs at least 28,800 Chinese yuan ($4,104), making it China’s cheapest electric car. Chery, a state-owned enterprise situated in Anhui, was established in 1997. From January through May, it held a 4.9% market share in the country (Descalsota, 2022). Chery is most recognized for the Chery QQ Ice Cream, a BVH ultra mini hatchback. The vehicle is one of the most affordable EVs on the market. From January through May 2021, it was the ninth-best-selling EV in China (Descalsota, 2022). Hence, the hatchback was priced at 29,900 Chinese yuan in December 2021.

State-owned manufacturer GAC represented 4.2 percent of China’s electric vehicle industry from January to May 2021. The GAC Aion S is a commonly used model in the business; the tiny electric car was China’s sixth best-selling electric vehicle. As of 2020, the beginning price is 139,800 Chinese yuan, or $20,891 (Descalsota, 2022). Thus, the competition between existing homegrown rivals, such as BYD, SGMW, Chery, GAC, and Tesla, is intense.

Tesla’s designs are not as innovative as the new energy cars in China. Dai and Zhang (2022) argue that when compared to other domestic businesses’ new energy cars, Tesla’s models disappear into the background. Descalsota (2022) demonstrated the designs of Tesla Model 3, GAC Aion S, Chery QQ Ice Cream, SGMW Wuling Hongguang Mini EV, and BYD Song PLUS EV. The models of top EV industry leaders are illustrated in Table 2.

Table 2: EV vehicles’ designs in China

Hence, Chinese brands provide a choice of vibrant colors and attractive appearances that correspond with the aesthetic of China’s youthful generation. Because young customers constitute most of the current consumer market, they are more willing to adopt new types of products that meet their expectations (Dai and Zhang, 2022). On the other hand, Tesla vehicles are more visually appealing to older generations and cannot attract many potential purchasers.

Two factors matter when deciding whether to buy Tesla’s electric cars or local alternatives: cost and driving range. According to Cheng (2021), the price was a crucial focus among potential EV vehicle purchasers. Another essential factor for Chinese buyers was how far the automobile could travel on a single battery charge (Cheng, 2021). Lastly, many Chinese drivers opt for electric vehicles due to favorable government policies, such as initiatives that make it significantly more accessible and less expensive to get license plates for electric vehicles.

Threat of Substitute Products

In a broad sense, all enterprises in an industry compete with industries creating replacement products. Porter (1980) acknowledges that substitutes limit an industry’s profit potential by imposing limits on the prices that enterprises in the industry can demand. The more appealing the price-performance balance given by replacements, the greater the pressure on industry revenues. Porter (1980) emphasizes that the effective measure against alternative products may need industry-wide action. While advertising by a single business in an industry does nothing to boost the industry’s strength against a substitute, extensive advertising by all industry players may significantly strengthen the industry’s collective stance (Porter, 1980). Moreover, the trend analysis may help determine if a company’s strategy should be geared toward intentionally avoiding a substitute or recognizing the alternative as a vital competitive factor.

Electric vehicles are popular among customers as a new sort of automotive, and various new replacements have debuted on the marketplace. Yang (2022) mentions that in the early stages of electric vehicle development, the presence of substitutes is a dilemma not only for Tesla but for the whole electric car industry. For instance, Nissan’s hydrogen energy vehicles posed a significant challenge to its alternatives (Yang, 2022). Nevertheless, in terms of the overall process of automotive electrification, hydrogen fuel cell technology will be an ideal replacement if lithium battery advancement is slow.

Bargaining Power of Suppliers

The factors that influence supplier power are usually beyond a company’s control. Porter (1980) acknowledges that If a supplier group is controlled by a few enterprises and more focused than the industry to which it supplies, it will have a vital influence over prices, quality, and conditions. Yang (2022) demonstrates that the newest vehicles have arrived on the market at cheaper costs, and the peak sales of the Model 3 have been dropping. Even speculation is that Tesla will release a less expensive model shortly (Yang, 2022). Because there is much rivalry for Tesla, brand uniformity is a significant challenge. Yang (2022) notes that Tesla has employed the pure visual Autopilot mode on the Model 3 /Y. It will no longer be integrated with millimeter-wave radar, lowering production costs and allowing Tesla to complete the commercialization process more rapidly. The company has factories all around the world, including in China, that have attained large-scale machine automation and can manufacture in enormous volumes with fewer employees, lowering prices significantly (Yang, 2022). Tesla’s new energy electric car is comprised of three components a lithium battery, a motor, and the entire vehicle (Jing, 2020). Many of these three categories of providers are on the market, and more will emerge in the future (Jing, 2020). Additionally, Tesla has selected the policy of distributing suppliers, which gives the company significant bargaining leverage with suppliers.

Organizational-Level Analysis

Choice of the Framework: VRIO

The VRIO framework is a method for evaluating a company’s internal resources and abilities to determine whether they may be a source of sustainable competitive advantage. Jurevicius (2022) states that VRIO is an acronym that stands for value, rarity, imitability, and organization. Galpin (2019) emphasizes that the framework has become a typical test for determining how effectively a specific core competency provides or does not offer a corporation a competitive advantage. It consists of four primary criteria concerning a resource or capacity used to assess its competitive potential (Galpin, 2019). The first is value, which indicates if the resource or capacity allows the organization to increase its efficiency or effectiveness. The second factor is a rarity, which indicates if control of the resource or capacity is focused in the hands of a small number of people. The next consideration is imitability, which indicates if the resource or capability is challenging to replicate and whether there will be a considerable cost disadvantage to a corporation attempting to purchase, create, or recreate the resource or capability.

Consequently, the fourth factor is an organization, which determines whether the corporation is structured in such a manner that it is ready and able to capitalize on the resource. Chatzoglou et al. (2018) add that the ‘O’ in the VRIO model refers to the organizational skills and resources that aid in the implementation of business strategy. Even though they are imitable in theory, they play a significant part in developing competitive advantages (Chatzoglou et al., 2018). Therefore, organizational skills and resources are complementary since they are not sources of competitive advantage in and of themselves but are crucial in assisting organizations in realizing the full potential of their strategy.

As a result, the company’s resources should be valuable, rare, hard to imitate, and incomparable. A resource or capacity that fits all four conditions might provide the organization with a long-term competitive advantage (Jurevicius, 2022). The framework’s first inquiry is whether a resource offers value by allowing a corporation to capitalize on opportunities or protect against risks (Jurevicius, 2022). Resources are significant if they assist firms in increasing the perceived value of their customers.

The Importance of the Framework

Internal analysis should be performed to determine core skills based on the VRIO framework in order to comprehend and improve Tesla’s strategy. Han (2021) mentions that the essential determinants of competitive advantage and economic strength are the firm’s resources and capabilities, which are employed to assist companies in improving business performance and sustaining economic growth. Hence, internal analysis assists a company in determining if its resources and competencies are potential sources of competitive advantage and developing plans to capitalize on such sources.

The Framework to Assess Tesla’s Resources

Tesla Motors has abundant resources thanks to Elon Musk’s distinctive leadership, which contributes to acquiring dynamic skills and, eventually, creating a long-term competitive advantage. The resources analyzed via VRIO include brand, battery pack, technology, the Gigafactory, manufacturing process, direct sales, OTA software updates, and Elon Musk’s leadership, as illustrated in Table 3.

Table 3: VRIO

Tesla’s brand image is crucial and unique because Musk has personally developed exceptional crossover value from Space X to Hyperloop. An et al. (2022) acknowledge that the personal IP is linked to Tesla, which evokes public opinion, and strengthens the affirmation of brand trust. Moreover, it allows it to occupy users’ minds with optimistic assumptions and establishes the brand’s high-end image.

This type of marketing adheres to the logic of fission and effectively acquires core users. Tesla’s strategy strengthens the company’s reputation and successfully develops a high-end, trendy, and creative vehicle image in the automotive sector (An et al., 2022; Du and Li, 2021). Tesla’s marketing behavior provides people with a sense of security and identification that extends beyond their requirements, eventually forming an ever-expanding circle with shared value awareness in early marketing. Han (2021) emphasizes that Tesla Motors pursued different initiatives such as direct sales, service, and a charging network while attaining both creative innovation and quantitative effectiveness. The corporation holds 3304 patents worldwide, 269 among them in China (Tesla Patents, 2022). Most of Tesla’s patents focus on the battery and electric powertrain components, the vehicle’s most critical components (Han, 2021). Tesla’s main competency is the battery pack because it is intended to provide flexibility in battery cell chemistry, shape, and vendor in order to adapt to future improvements.

The company has amassed a substantial technological portfolio, which may enable it to bring lower-cost automobiles to market. Tesla has made significant investments in innovation; its’ engine and battery pack technology is the most valuable and rare strategic component (Han, 2021). Imitating this capacity is expensive and requires a high level of technological competence. According to An et al. (2022), Tesla’s technological advances are at the heart of the management system’s batteries (BMS). The corporation has retained the crucial technology of handling multiple battery cells. The company strives to enhance battery technology, range, and performance; the new LFP battery has a million-mile range (Madhok, 2020). Tesla partly encloses a small number of cells in a cell container containing coolant to increase the pack’s capacity density and the battery management system’s safety (An et al., 2022). Essentially, peak charging power of up to 250 kilowatts can be handled by the Tesla V3; it takes a few minutes to recharge at a supercharger station.

The primary benefit of establishing a factory in China is the cost reductions associated with local sourcing and manufacturing. The Tesla Gigafactory was created out of need and will provide enough batteries to meet Tesla’s estimated car demand (Tesla Gigafactory, n.d.). The Gigafactory now manufactures Model 3 electric motors and battery packs, as well as Tesla’s energy storage devices, Powerwall and Powerpack; in terms of kWh, Tesla presently manufactures more batteries than all other automakers combined (Tesla Gigafactory, n.d.). Madhok (2020) claims that using parts supplied by Chinese sources instead of importing them from the US and paying extra taxes reduces production costs. With the Gigafactory expanding production, Tesla’s battery cell costs will fall dramatically due to economies of scale, innovative manufacturing, waste minimization, and the basic optimization of placing most manufacturing operations under one roof (Tesla Gigafactory, n.d.). By lowering the cost of batteries, Tesla can make goods available to an increasing number of people, allowing them to have the most significant potential influence on the world’s transition to renewable energy.

Tesla’s flexible manufacturing strategy and high-technology content are unique, valuable, and challenging to replicate among automakers. The company’s competitive edge is the manufacturing process, which should unavoidably be tied to automation, streamlining, vertical integration, and innovative approaches (Kane, 2021). Merano (2021) asserts that the processing, welding, coating, and assembly workshops are linked to shorten the logistical route between each activity and thereby increase efficiency. Through elevators and machine transfer lines, Giga Shanghai also uses longitudinal space in all of its workplaces. Merano (2021) highlights that the location of Giga Shanghai’s docks is also a method of running the plant effectively, reducing time and expenses. Every day, the plant handles almost 2,000 containers; each customer order influences the order in which the manufacturer delivers automobile parts through the assembly line (Merano, 2021). Moreover, suppliers respond to client orders by providing parts as each order is placed. Tesla China assures that few to no parts are required to be stored at a warehouse with this degree of coordination with suppliers and in Giga Shanghai. The manufacturing process is valuable; nonetheless, it can be replicated by a vast number of rising Chinese EV competitors in the long run.

Tesla employs a direct sales approach, often better suited to goods with short development cycles and minimal development expenses. According to An et al. (2022), instead of selling through dealers, which has the drawback of a time lag between production and sales and product development that is not adaptable to market demand. The firm has invested much in expanding its network of stores and service centers, and it incurs high operational costs (Han, 2021). Direct sales allow potential customers to engage with Tesla Product Specialists and learn about the automobiles before deciding which new car to purchase. Tesla’s stores and service centers are critical to the corporation in educating consumers and maintaining a positive brand reputation (Han, 2021). It is also rare, as Tesla is the only automaker to use a vertically integrated distribution approach. The resource is expensive but not impossible to replicate; the stores give a short-term competitive edge.

An additional valuable resource is the over-the-air (OTA) software updates for electric vehicles. Madhok (2020) mentions that the firm uses these updates for servicing and adding new features. V10 software upgrade adds advanced infotainment capabilities like video and music streaming and karaoke (Madhoc, 2020). Moreover, vehicles have a Smart Summon, often known as smart parking. Han (2021) notes that Tesla’s FSD chip allows the company to remove third-party vendors from the key technological area, accelerating the advancement of self-driving technology. After upgrading the software through OTA, the FSD processor has excellent performance, and the FSD computing platform can manage the computational requirements of fully autonomous driving (Han, 2021). Software and hardware are better matched with a fully designed hardware system, and Tesla is stronger at software development, which significantly enhances autonomous driving effectiveness. Nonetheless, Elon Musk praised China’s local electric-vehicle producers, calling them the most competitive in the world (Denton, 2021). The technologies advance fast in China, and Tesla’s platform can be replicated or improved by local EV companies.

Customers have given the corporation, its products, and Elon Musk a novelty value. Han (2021) argues that few CEOs in the sector have the same track record and understanding of alternative energy. Due to Elon Musk’s leadership, the firm has developed a strong brand via exceptional performance. Han (2021) states that Tesla depends on word-of-mouth and media attention to spread its message. Elon Musk and customer advocates are crucial to the firm and uncommon in a sector with low switching costs and brand loyalty (Han, 2021). While rivals may influence brand impressions by offering new models, Elon Musk is inimitable.

Conclusion and Recommendations

Tesla is a significant participant not just in the global EV sector. The company aims to increase production numbers and product availability to maximize its impact. Because of its vast customer base, centralized solid financial system, sophisticated industrial manufacturing chain, and lithium-ion battery production output, China is an ideal market for Tesla. The market offers enormous development opportunities, but an assessment of the current reality exposes substantial risks. The corporation’s macroeconomic prospects are bleak, and industry growth is far lower than expected. For instance, Tesla confronts problems such as overpricing, a shortage of charging stations, and a lack of flexibility. The current challenges include slower expansion, increased competition, and the threat of new market players in China. The research focuses on three levels of analysis, including national, industrial, and organizational, to determine why Tesla is facing issues in China in 2022 and to offer recommendations. The findings provided insight into Tesla’s position and competitive strategy in China, as well as its existing advantages and disadvantages and the future direction of efforts. The PESTEL analysis demonstrates China’s political and economic edge due to its stable policy and more extensive market. Tesla is now experiencing a favorable deployment and development trend in the Chinese market. Nevertheless, it must contend with the growth and pursuit of new energy firms and numerous dangers and obstacles from public opinion (Du and Li, 2021). The company has a significant presence in new energy cars, but China’s new energy vehicle expertise is not far behind that of the United States, and specific innovations have already exceeded the battery (Liu et al., 2021). It is recommended that Tesla should keep its market position and competitiveness by consistently increasing the battery life on its automobiles and assisting the industry in setting the benchmark. The simplicity of Tesla’s exterior design has impacted its sales (Dai and Zhang, 2022). The vehicles should be redesigned to suit the aesthetics of today’s youth.

Customers in China are growing increasingly worried about the consequences of car emissions on pollution levels in order to reduce their environmental impact. As a result, Tesla’s revolutionary energy vehicles may be further developed in China. Establishing a large number of experience stores and service centers to get client benefits, for example, achieving the goal of increasing customer numbers, may benefit Tesla over existing rivals. Furthermore, selecting accurate and superior public relations strategies is vital in the Chinese market to boost awareness among potential buyers. It is fundamental to expand the coverage of charging stations in China to further the development of new energy cars. Such a move is favorable to the growth of the new energy automotive sector. Moreover, the battery endurance must be increased. The robust battery durability of Tesla’s new energy cars is one of the primary factors promoting Tesla’s growth in the Chinese market. The two fundamental issues in China are data privacy and emergency ethics. Citizens emphasize convenience, and they have zero tolerance for companies that divulge personal information about them while fighting for their rights and ideals. Thus, Tesla should further improve data privacy and boost customers’ trust.

According to Porter’s five forces model assessment, Tesla faces several strong rivals as well as the threat of numerous new competitors. Yang (2022) underlines the need to investigate the current five-force model if Tesla intends to develop in the target market. Furthermore, extensive future research on client demands and preferences, for instance, vehicle design, price, battery life, and additional vehicle functions, should be undertaken. Tesla has consistently been at the forefront of the high-tech sector, and it is currently aggressively expanding the autonomous driving and artificial intelligence industries (Yang, 2022). China, as a critical global automotive market, should be a strategic market for Tesla, and the company should continue to invest in the Chinese market.

Tesla held the third-largest share in the Chinese EV market in 2021. Aside from Tesla, four of China’s top five EV manufacturers are Chinese: BYD, SGMW, Chery, and GAC. When considering whether to buy Tesla’s electric vehicles or local alternatives, two considerations come into play: price and driving range. Tesla’s pricing philosophy should be reconsidered because rivals provide similar functionalities at cheaper rates. Furthermore, new entrants pose a danger since new electric vehicles are meant to diminish demand for international luxury brands such as Tesla. The corporation should not just focus on current competitors but also future newcomers like Nio’s ET5 luxury sedan and Xpeng’s G9. The new EV versions beat Tesla’s vehicles due to enhanced technology and better components. As a result, it is advised to invest in R&D in order to track current trends and gain a competitive advantage over new EV models.

Tesla has effectively developed a niche and high-end brand image using dislocation competition and the celebrity effect. Its initial cost is high, and the vast amount of celebrities buying Tesla has helped it create a niche and high-end brand image (Du and Li, 2021). Nonetheless, with the gradual expansion into China, Tesla’s products should no longer be restricted to high-priced and niche supercars. The company should progressively advance vehicles with more diverse designs and price levels to capture various groups of customers and further occupy the market.

Tesla has a huge potential for additional growth and development in China based on the VRIO platform. Because of Elon Musk’s exceptional leadership, the firm has a wealth of resources, which contributes to obtaining dynamic talents and, eventually, establishing a long-term competitive advantage. Tesla’s marketing approach helps to build the company’s reputation while also effectively developing a high-end, stylish, and innovative car image in the automotive industry. Furthermore, Tesla’s primary expertise is the battery pack, which is designed to enable flexibility in battery cell chemistry, form, and supplier in order to respond to future advances. Nonetheless, there is a growing number of new creative EV brands in China that can imitate and replicate Tesla’s expertise. As a result, improving battery pack technology should be a top priority in order to compete.

Brand, battery pack, technology, the Gigafactory, production process, direct sales, OTA software updates, and Elon Musk’s leadership are among the resources assessed by VRIO. Despite the precious few resources, competition in China’s electric vehicle business is increasing. Electric vehicles are already the norm, and the Chinese government will continue encouraging their use. Given the continued introduction of EVs into China and the number of new brands in the sector, Tesla’s market share may continue to decline. As a result, it is critical to improve the manufacturing process at Gigafactory, which suffered greatly during the Covid -19 pandemic, introduce cheaper models based on consumer preferences, innovative software, and hardware, and focus on aggressive advertising.

Tesla’s customer service strategy change should emphasize highly personalized customer care. To begin, Tesla should learn more about Chinese customers and summarize all consumer information in order to build a comprehensive customer database. Second, it is vital to respond to customers before they realize they need Tesla; extensive data predictably enable Tesla to identify and fix issues (Jing, 2020). The company must build well-trained and empathetic personnel to promote proactive customer service operations. Customers select Tesla first and foremost for the reputation of Tesla electric vehicles, which implies that all Tesla corporate operations meet customer expectations. Furthermore, buying motivation, conduct, spending habits, interests, and hobbies are significant. For instance, research has shown that Chinese clients like more brilliant colors and contemporary styles; consequently, the new models should meet the expectations of potential customers. Tesla can scientifically respond to client requirements and establish product development directions.

Tesla should exploit development possibilities following COVID-19 by expanding market expertise and interaction in all areas of China to increase product and brand awareness progressively. Capturing shifts in demand during the pandemic’s recovery is now a significant development potential for Tesla (Du and Li, 2021). The company should boost manufacturing efficiency, expand output, and cut delivery times in China to achieve continuing cost and price reductions and, ultimately, grow market share.

Tesla should continue to progress in the direction of environmental conservation. One potential strategic move is the establishment of recycling centers for old and trash automobiles, where the recycled vehicles are evaluated, and those that may still be utilized are restored, rebuilt, and updated (Du and Li, 2021). To acquire a competitive advantage over Chinese rivals, Tesla might expand the field of electric models and manufacture urban transport vehicles, such as buses, taxis, and trucks, as well as use, established technology for autonomous driving.

Reference List

An, J., Chen, Z. and Luo, J. (2022) ‘Whether Chinese new energy vehicle can beat Tesla in a foreseeable future’, 2nd International Conference on Enterprise Management and Economic Development (ICEMED 2022), Atlantis Press, pp. 1175-1180. Web.

Ashcroft, S. (2022) Tesla blames China lockdowns & supply disruption for Q2 woes. Supply Chain. Web.

Chatzoglou, P. et al. (2018) ‘The role of firm-specific factors in the strategy-performance relationship: Revisiting the resource-based view of the firm and the VRIO framework’, Management Research Review, 41(1), pp. 46-73. Web.

Cheng, E. (2021) Why some Chinese are buying local electric car brands like Nio – instead of Tesla. CNBC. Web.

Cheng, E. (2022) Huawei’s competitor to Tesla electric cars is set to hit China’s streets on Saturday. CNBC. Web.

Dai, X. and Zhang, H. (2022) ‘The opportunities and challenges of Tesla’s entry into Chinese market’, 7th International Conference on Social Sciences and Economic Development (ICSSED 2022), Atlantis Press, pp. 823-829. Web.

Daxue Consulting (2022) Tesla in China: Domination the EV market with 0 budget. Web.

Denton, J. (2021) Tesla’s Musk calls Chinese EV rivals ‘the most competitive in the world. Barrons. Web.

Descalsota, M. (2022) Take a look at Tesla 4 biggest rivals in China’s booming, $124 billion electric-vehicle market. Business Insider. Web.

Du, X. And Li, B. (2021) ‘Analysis of Tesla’s marketing strategy in China’, 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021), Atlantic Press, pp. 1679-1687. Web.

Elnaj, S. (2022) How technology leaders can manage economic uncertainty? Forbes. Web.

Galpin, T. (2019) ‘Strategy beyond the business unit level: corporate parenting in focus’, Journal of Business Strategy, 40(3), pp. 43-51. Web.

Han, J. (2021) ‘How does Tesla Motors achieve competitive Advantage in the global automobile industry?, Journal of Next-generation Convergence Information Services Technology, 10(5), pp. 573-582. Web.

Jing, N. (2020) ‘Research on Tesla’s customer care innovation. Management Science Informatization and Economic Innovation Development Conference (MSIEID), IEEE, pp. 469-478. Web.

Jurevicius, O. (2022). VRIO framework explained. Strategic Management Insight. Web.

Kane, M. (2021) Tesla shows entire Model Y production process in Shanghai. Insideevs. Web.

Kolodny, L. (2022) Tesla production lags in Shanghai due to parts shortages, Covid restrictions. CNBC. Web.

Liu, S.Q. et al. (2021) ‘How is China’s energy security affected by exogenous shocks? Evidence of China–US trade dispute and COVID-19 pandemic’, Discover Energy, 1(2). Web.

Ma, S. et al. (2021) ‘Development status and trend of new energy vehicles in China: Consumer data analysis based on internet’, International Journal of Education and Humanities, 1(1), pp. 10-15. Web.

Madhok, A. (2020) Tesla’s Chinese foray: Why, what, and how?, Counterpoint. Web.

Martin, M. (2022) How Porter’s five forces can help small businesses analyze the competition. Business News Daily. Web.

McGahan, A.M. (1999) ‘Competition, strategy, and business performance’, California Management Review, 41(3), pp. 74-101. Web.

Merano, M. (2021) Tesla China gives sneak peek at Giga Shanghai operations with new video series. TeslaRati. Web.

Peterdy, K. (2022) PESTEL analysis. Corporate Finance Institute. Web.

Porter, M. E. (1980) ‘Industry structure and competitive strategy: Keys to profitability’, Financial Analysts Journal, 36(4), pp. 30-41. Web.

Ren, D. (2022) China’s EV war: Tesla’s rivals rev up the fight as Nio, Xpeng, Li Auto, BYD and Huawei roll out new models to bite at the bellwether’s ankles. South China Morning Post. Web.

Shu, J. (2022) ‘Analysing on external environment and industrial competition of high-tech companies’, 7th International Conference on Social Sciences and Economic Development (ICSSED 2022), Atlantis Press, pp. 76-80. Web.

Tesla Gigafactory (n.d.) Tesla. Web.

Tesla Impact Report (2021) Tesla. Web.

Tesla Petents – key insights and stats (2022) Insights by GreyB. Web.

Yang, X. (2022) ‘Research on Tesla’s market – Based on Porter’s five forces and ratio analysis model’, 2nd International Conference on Enterprise Management and Economic Development (ICEMED 2022), Atlantis Press, pp. 773-777. Web.