Introduction

The entertainment industry is one of the attractive spheres of numerous companies. People’s desire to be amused and have positive emotions means there is an opportunity to generate billions. At the same time, the emergence of new players in the sphere is limited due to the presence of giant corporations that dominate this segment and introduce extremely complex entry barriers.

Giants such as Netflix, Disney, Amazon, and others compete to expand their loyal audience and, at the same time, retain existing clients. The fierce rivalry influences the corporations’ strategies, approaches to making the content, interactions with clients, and the desire to continue growth to acquire new benefits. For instance, the streaming market is one of the fast-growing sectors viewed as the new market for giants dominating the market.

Currently, the global video streaming market size is around $455.55 billion (“The global video streaming market size,” 2022). Which is more important, it will continue to grow and reach the size of 1,902,68 billion in 2030 (“The global video streaming market size,” 2022). That is why Disney, one of the leading companies in the sphere, is making a lot of effort to conquer the market. However, it faces numerous challenges and struggles to achieve profitability.

Disney’s Overview

The Walt Disney Company is one of the big international companies which generates revenues from various activities. Thus, together with its subsidiaries, it is an entertainment organization that operates in two big segments: Disney Media and Entertainment Distribution (DMED) and Disney Parks, Experiences, and Products (DPEP) (The Walt Disney Company, 2022a). It operates in various countries, with around 220,000 people employed to work in different divisions (The Walt Disney Company, 2022a).

Income Analysis

Following the company’s financial report for 2022, the corporation generated $82.7 billion, which is $15.3 billion (23%) higher compared to the previous year (The Walt Disney Company, 2022a). Furthermore, its net income grew by $3.1 billion in 2022 (The Walt Disney Company, 2022a). Analyzing the company’s major sources of income, it is critical to admit that the service revenues increased 20% ($ 12.4 billion) to $74.2 billion due to the theme parks and resorts and theatrical distribution (The Walt Disney Company, 2022a). Product revenues also grew and became $8.5 billion, which is $2.9 billion more than in 2021 (The Walt Disney Company, 2022a). The numbers show that the company remains beneficial and has a high and growing revenue due to its practical work in areas that have been traditionally beneficial for Disney.

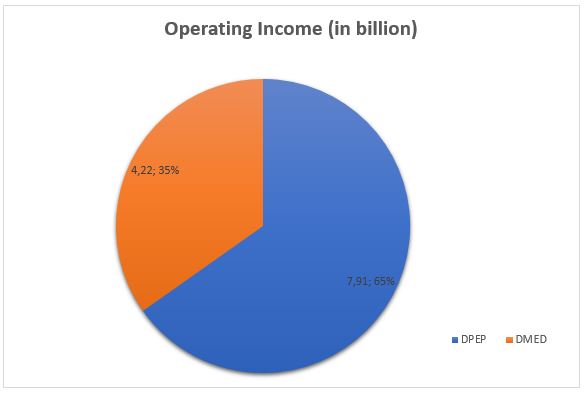

Thus, analyzing the corporation’s operating income, the following breakdown can be formulated:

The media segment generates less revenue than the parks and main products created by Disney. Furthermore, by analyzing the revenues within DMED and comparing them with DPEP, the following breakdown can be offered:

In such a way, it is possible to admit that the second segment, including direct-to-customer operations encompassing the streaming services, is associated with lower income than other Disney activities. The company focuses on improving the situation and ensuring that more profit is acquired due to the employment of current opportunities in the streaming sector. However, at the moment, it is characterized by the comparatively low profit compared to other activities traditionally crucial for Disney.

Spending Analysis

At the same time, the cost and expenses also increased as Disney had to finance new activities and support new products. Following its report, in 2022, the cost of services comprised $49 billion because of a higher price for production and the constantly growing cost of the direct-to-customer segment (The Walt Disney Company, 2022a). These also include the technical support costs, operating labor, distribution costs, and cost of sales (The Walt Disney Company, 2022a).

The higher costs at direct-to-consumer increased sports and programming costs mean that Disney has to compensate expenses by using revenue from other spheres and guaranteeing that the new activity is supported (The Walt Disney Company, 2022a). However, the recent results also show that regardless of the investments, the revenue remains low, and there is no significant growth. It means that a new strategy for managing the segment is required.

The Role of the Direct-To-Consumer Line

Currently, Disney’s direct-to-consumer line of business includes several essential elements. These are Disney+, Disney+ Hotstar, ESPN+, Hulu, and Star+ video streaming services (The Walt Disney Company, 2022a). The line encompasses the essential products for improving Disney’s position in the streaming segment and finding new loyal clients. These are mainly subscription services, which means that the revenue depends on the degree to which the corporation manages to create content that would be attractive to clients and offer it to them (The Walt Disney Company, 2022a).

The subscription fees, advertising sales, and pay-per-view fees are critical for ensuring that Disney will evolve and improve its presence in the market (The Walt Disney Company, 2022a). However, the company’s report shows a significant growth in operating loss, which comprised $1.5 billion (The Walt Disney Company, 2022b). At the same time, the revenue remains comparatively low, meaning that additional regulations are required.

Summary

Thus, Disney’s annual report states that the decrease in results of the primary streaming services was associated with specific factors. First, Disney+ results are explained by the growing production loss because of the focus on the quality of content (The Walt Disney Company, 2022b). Furthermore, the absence of Premier Access releases, such as Black Widow or Jungle Cruise, affected the viewers’ readiness to pay and remain loyal clients (The Walt Disney Company, 2022b). As a result, regardless of the constantly growing production costs, the revenue does not achieve the desired level.

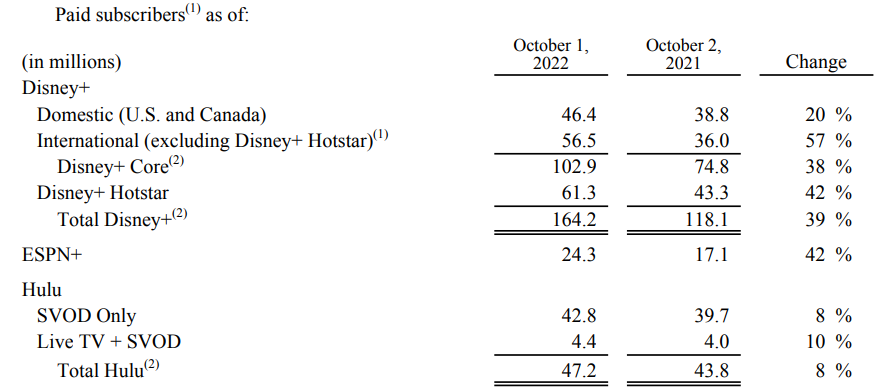

Furthermore, Hulu also shows decreased results, although the service was acquired specially for streaming needs. The unsatisfactory results are explained by the higher programming and production costs, while the subscription revenue growth was insignificant (The Walt Disney Company, 2022b). However, there is a positive dynamic in the number of paid subscribers:

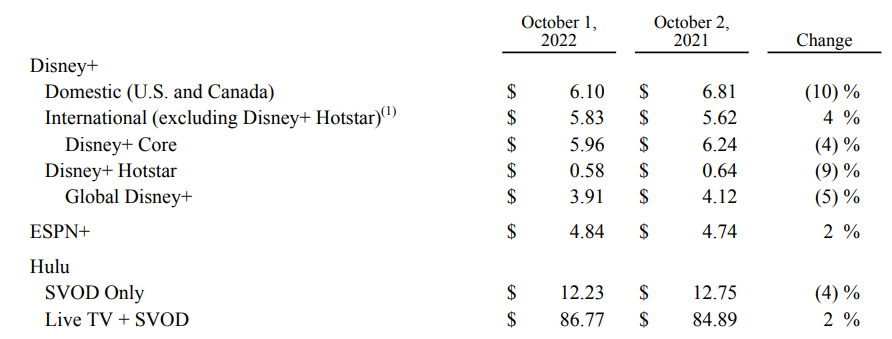

The table above shows that all services managed to acquire new clients during the one-year period. Disney is effective in promotional campaigns and can attract the additional number of clients necessary for stable growth. At the same time, along with an increasing number of subscribers, the revenue per paid subscriber is not always positive:

The table shows that for Disney+, the sum decreased from $6.81 to $6.10 (The Walt Disney Company, 2022b). It is explained by a higher mix of subscribers to multi-product offerings (The Walt Disney Company, 2022b). Furthermore, Hulu’s revenue per paid subscriber was reduced from $12.75 to $12.23 due to the lover advertising revenue and other reasons similar to the previous ones.

The given data shows that the constant increase in the number of clients and paid subscribers does not guarantee the corresponding revenue growth. The increase in operating costs and the need to devote additional finances to projects of this sort require Disney to alter its current approach to managing the segment and introduce new methods to make its streaming services beneficial and profitable. Otherwise, there is a high risk of being unable to compete with the other actors operating in the segment, such as Amazon or Netflix.

Problem

The financial data above shows that Disney remains one of the most powerful companies operating within the entertainment segment. It increased its revenue in 2022, compared to 2021, and reported its 23% growth. The sales of the products traditionally associated with Disney, such as merchandising services at Disney, are at a high level. However, there is a severe problem with the corporation’s attempt to enter the streaming segment. The acquisition of Hulu and the focus on developing Disney+ and ESPN are the steps made to attain success in this sphere. Unfortunately, considering the high level of rivalry, the unsatisfactory results might deprive Disney of the chance to hold its leading positions and improve them.

Financial Losses on Different Platforms

As a result of the recent changes, Disney experienced serious losses. First, there was a critical decline in its TV business, which impacted the decision to raise subscription fees for streaming services (Barnes, 2023). At the same time, its streaming operations lost around $512 million in the recent quarter (Barnes, 2023).

The total streaming losses since Disney+ was introduced comprised around $11 billion (Barnes, 2023). The problem is also complicated because Disney+ lost around 11.7 million subscribers recently, which became a serious hit for the company and its plans for future development (Barnes, 2023). In the long term, the given tendency might have a pernicious impact on Disney and its opportunities to dominate the market (Sorkin et al., 2023). For instance, the closest competitor, Netflix, generated $31.6 billion in 2022 using streaming services (Netflix Inc., 2023). It is a 6.7% increase compared to the previous year (Netflix Inc., 2023). Disney’s need for change is evident as it cannot compete with other strong players in the segment.

Disney also has ESPN and Hulu as services, helping to improve its operation within the streaming segment. However, currently, these platforms require assistance and support along with changes in the strategic approach. For instance, ESPN is experiencing pressure from cable cord-cutting and continuously growing prices for sports broadcast rights (Barnes, 2023). It impacts the subscription fees, and numerous individuals cannot afford to pay this amount of money.

For Hulu, the situation is also complex as it remains not as popular as other streaming services. Additionally, following the agreement with Comcast, the better Hulu performs, the more Disney has to pay to buy the rest of the assets in 2024 (Sherman, 2022). There is no clear strategy for the platform at the moment, and it continues to remain a problem for Disney.

Lack of Trending Content

Another critical problem Disney faces when trying to improve its performance in streaming services is the growing demand for content and quality. As stated in the company’s report, the audience requires the outstanding quality of products and premiers that are popular or belong to famous franchises. For instance, the Black Widow helped streaming services to attract subscribers and generate a desired income (The Walt Disney Company, 2022a). However, the absence of well-known or expected products reduces the interest in Disney’s streaming services. It means that the cost of production will continue to grow.

Furthermore, other giants, such as Amazon, offer products like the Lord of the Rings, Rings of Power, and multi-million series based on global bestsellers. For Disney, it introduces the need to create similar products and invest millions in products that would be attractive to the audience. Following the recent report, the expenses and cost of production increased compared to 2021, and revenues only partially compensated them. For this reason, the current strategy implying significant investment with no return cannot be topical anymore and should be replaced with a new, more effective one.

Inadequate Content Strategy

The content strategy also leads to a particular crisis in streaming services managed by Disney. For instance, the survey results show that Disney+ subscribers want the company to make more adult-oriented content (Tran, 2021). Disney has always been associated with entertainment for children, such as cartoons, animated movies, and similar products (Tran, 2021).

However, with the acquisition of Hulu and ESPN and the desire to become a more active player in the market, the company has to move forward and create content meeting the constantly altering demands of its target audience, which is comprised of young and middle-aged people (Tran, 2021). This means that the current content strategy might be a problem for the service and should be reconsidered to create a basis for future evolution.

Summary

In such a way, the market investigation and Disney’s annual report show that the company faces a serious crisis regarding its attempts to enter the streaming market. The pressure from competitors requires specific actions, such as the increased cost of production, diversification of content, and finding new subscribers. However, the growth in the production costs is not followed by the corresponding increase in revenue.

As a result, Disney suffers from significant financial losses, which should be compensated by using income generated by other activities. However, in a long-term perspective, this situation might have a pernicious impact on the company and its ability to compete with its closest rivals. The problem requires much attention from top management, strategic analysis, and changes in the course Disney uses regarding its streaming services. It would lead to the improvement of the corporation’s position in the market and its further development.

Possible Solution

SWOT Analysis

The choice of an effective strategy for altering the company’s work should be performed by using the main strategic analysis tools. It will help to collect data necessary for selecting the methods that would promote the desired change. For this case, a SWOT analysis should be performed to consider the future action plan.

In such a way, the analysis shows that the central problem faced by Disney is linked to factors impacting streaming services and their inability to generate revenue for the company. At the same time, there is currently a window of opportunity due to the peculiarities of the current environment. The company might enter new markets which became available due to the spread of the Internet. Furthermore, creating new online content distributed using these channels will empower the company’s positions, and it’s becoming more potent in strategic areas (Jia, 2021). Additionally, the original content might help to broaden the target audience and find new subscribers, which is essential for the ability of Disney’s streaming services to succeed.

The company’s current financial position and recognized brand image can be considered major strengths. Additionally, Disney has an experienced team of managers and content creators who can be used for future projects. These factors can be considered when creating the strategic plan and deciding on actions to restructure the company’s work. Additionally, the high level of competition is the major threat that should be taken into account. Altering the existing situation associated with the streaming service will address this potential challenge, meaning that the strategy will benefit Disney and resolve its current problems.

New Strategy Development

International Expansion

In such a way, considering the information acquired from SWOT analysis and data offered by Disney in its financial report, the following strategy for making the streaming division profitable can be offered. First, it is essential to expand its international reach to find new potential subscribers. Recent research shows that Disney has strong positions in markets that have always been viewed as critical for the corporation (The Walt Disney Company, 2022a). These include North America and Europe, where most viewers have watched Disney’s products since childhood.

However, in other fast-growing regions, such as Asia or the Middle East, the corporation’s position is weak and cannot compete with its closest rivals (Cook, 2022). For instance, in India, Disney failed to reach the planned number of clients while the market size remains big, and there are numerous opportunities for generating profit (Cook, 2022). It means that by improving its international presence, the company can create the basis for its future rise and ensure its ability to compete with its rivals. Additionally, it might attract some competitors’ subscribers, meaning that their positions will be weakened (Cook, 2022). For this reason, it is one of the potentially attractive options that might be favorable for Disney.

Content Diversification

Second, diversification of the content existing at the moment is critical as it is one of the claims admitted by many clients. Although Disney produces much content and focuses on providing its audience with high-quality products, many subscribers remain dissatisfied with the proposed movies or shows (Cook, 2022). They lack diversity and innovative ideas that might be attractive to them (Cook, 2022). For this reason, to compete with its main rivals, Disney has to reconsider its current approach to making products for streaming services. It mainly relies on well-known franchises, such as Star Wars or Avengers and this universe, while other products are less popular.

For this reason, Disney should consider finding new ways to create content, which can be performed as it has a skilled team of content makers and talented managers (Sturgill, 2019). The creation of a new successful franchise might be complex and require significant investment; however, in the future, the potential costs will compensate for losses, meaning there will be a chance to create more products attractive to clients.

Merging Platforms

Another strategic step for improving Disney’s performance in the streaming segment implies the radical reconsideration of the current approach used by the corporation. Hulu, ESPN, and Disney+ are different services offering various content and subscription peculiarities. Furthermore, Hulu and ESPN remain available mainly in the USA, and they are not known in other fast-growing regions, which is a critical limit for the company (Cook, 2022). The annual reports show that these streaming platforms might be detrimental because of the constantly growing cost of production and the need for significant investment found by using other sources of income (The Walt Disney Company, 2022a).

In such a way, the existing paradigm implies the existence of three different teams with their tech and content specialists and employees. Significant managerial effort and organization are required to guarantee that effective collaboration is established. Under these conditions, merging all these platforms into a single one might be a potentially beneficial solution for Disney.

Potential Strategy Outcomes

Single Focus

The strategy will help the corporation to transform into a strong streaming service characterized by specific advantages. First, the teams consisting of tech and content specialists will be able to focus on a single product instead of trying to maintain various platforms that are not known abroad, such as Hulu and ESPN. As a result, Disney+ attempts to enter new markets will be simplified as the company will use a brand name that is known to the majority of the population in the target markets (Jia, 2021).

Improved Advertising

Furthermore, it would improve advertising opportunities and make advertising more cost-effective (Sturgill, 2019). The establishment of a single platform with clear rules and the demands for brands that want to cooperate will lead to attracting new potential investors. Additionally, Disney+ is a more well-known brand than Hulu or ESPN, meaning that the number of partners might increase (Jia, 2021). In this regard, it is possible to expect increased revenue and higher cost of advertising, which is beneficial for Disney.

Reduced Costs

The merger might also contribute to reducing operating costs, which is one of Disney’s main problems. The constantly increasing production prices and the need to create content for every platform distracts the brand from competition with other giants, such as Netflix or Amazon, and leads to the emergence of critical problems with the attempts to popularize Disney’s streaming services (Harvard, 2021).

In such a way, the emergence of a new, bigger platform encompassing Disney+, Hulu, and ESPN might be a beneficial step to attain a serious competitive advantage, reduce costs, and offer new products to all clients globally, regardless of the region where they live. Merging the existing platforms might benefit the company because of the numerous advantages that might be acquired. The successful example of competitors that use one platform to interact with their audience proves the numerous benefits of this approach (Harvard, 2021). It simplifies interaction with the audience, acquisition of feedback, and introduction of changes when necessary.

Simplified Release Management

Finally, the introduction of a single streaming platform will simplify arranging the same time for all global releases. For several reasons, Disney must release shows and other content on the same day. First, it will satisfy the feeling of excitement all viewers have before watching new movies (Sturgill, 2019).

Second, it will prevent them from spoilers provided by those who have already seen an episode (Sturgill, 2019). Third, it will revitalize discussions of the content and warm up the interest in a new product related to the franchise in the future. Finally, by creating more international releases, Disney will be able to impact the audience in various regions, which is essential for finding new subscribers.

Conclusion

Altogether, Disney remains one of the leaders in the entertainment sphere. Its annual report shows that revenues remain high, and the company continues to evolve. Corporation’s theme parks, products, and movies attract clients, increasing their sales. However, Disney’s attempts to enter a new streaming segment are not as successful as expected.

Disney+, Hulu, and ESPN do not generate high revenues while operating costs continue to grow. Moreover, compared to the closest rivals, the corporation fails to acquire a high number of subscribers and generate income from subscription fees. The problem leads to significant financial losses and an inability to dominate the market. For this reason, there is a need for a new strategy that would help to address the problem and make Disney streaming services profitable.

The strategic analysis of the situation shows that specific actions should be performed. First, it is necessary to diversify the content to guarantee that new clients are attracted and old ones are retained. Second, Disney might consider merging all its platforms to make the company more effective and ensure that the attempts are focused on supporting one platform. Furthermore, the solution to the problem might require globalization and entering new regions, which require fresh content and consideration of local people’s needs. Accepting the proposed strategy, Disney might make its streaming services beneficial, increase income, and ensure the production costs are covered by the revenue acquired due to the growing number of clients in various regions. It would also help the brand to resist its main competitors.

References

Barnes, B. (2023). For Disney, streaming losses and TV’s decline are a one-two punch. The New York Times. Web.

Cook, D. (2022). Disney’s streaming strategy is a home run – Here’s why. The Motley Fool. Web.

The global video streaming market size was valued at $455.45 billion in 2022 & is projected to grow from $554.33 billion in 2023 to $1,902.68 billion by 2030. (2022). Fortune. Web.

Harvard, C. (2021). Disney, Netflix, and Amazon oh my! An analysis of streaming brand competition and the impact on the future of consumer entertainment. Findings in Sport, Hospitality, Entertainment, and Event Management, 1(7), 38-43. Web.

Jia, Y. (2021). The streaming service under pandemic with the example of performance of Disney+. Advances in Social Science, Education and Humanities Research, 631, 815-818. Web.

Netflix Inc. (2023). 2023 proxy statement. Web.

Sherman, A. (2022). Hulu is facing an existential crisis as Disney approaches a 2024 deadline to buy Comcast’s 33% stake. CNBC. Web.

Sorkin, A., Mattu, R., Kessler, S., de la Merced, M., & Livni, E. (2023). Bob Iger tweaks Disney’s strategy on streaming. The New York Times. Web.

Sturgill, J. (2019). Beyond the castle: An analysis of the strategic implications for Disney+. [Undergraduate Honors Thesis]. Web.

Tran, K. (2021). Disney+ must tweak its content strategy. Here’s how. Variety. Web.

The Walt Disney Company. (2022a). Fiscal year 2022 annual financial report. Web.

The Walt Disney Company (2022b). The Walt Disney Company reports fourth quarter and full year earnings for fiscal 2022. Web.