The Disney Corporation is one of the leaders in the entertainment industry. It generated a stable annual income, which comprised around $67B in 2021. The company’s internal analysis shows it has numerous strengths, such as streaming services, recent acquisitions, and unique value. Moreover, its core competencies include a focus on creating unusual stories. At the same time, the brand works in a highly competitive industry with a high risk of substitution. It means there is a need for strategies that might help to address this problem. The further diversification of offerings might be viewed as the central recommendation for Disney.

Introduction

The modern entertainment industry is a highly competitive environment characterized by the rivalry between several giant corporations struggling to acquire new customers and preserve their leading positions. The Disney Corporation is one of the modern global leaders in the given industry. The company benefits from the high income attained due to effective leadership and strategic planning. In 2021, the brand reported an income of $67.418B, which is 3.1% higher compared to 2020 (The Walt Disney Company 12). It means the company recovered after the financial crisis caused by the pandemic and continued its further development. To a greater degree, it is explained by the significant resources and the company’s capabilities.

Internal Analysis

Today, Disney can be viewed as one of the most powerful corporations operating in the entertainment industry. Due to effective management, it accumulated substantial resources that can be used for various purposes. Thus, these include numerous studios united under the same brand, such as Pixar, 20th Century Studios, Marvel Studios, and Lucasfilm (The Walt Disney Company 14). At the same time, the corporation has streaming services that are extremely important nowadays: Disney+, Hulu, and ESPN+ (The Walt Disney Company 12).

Furthermore, the brand operates Disney Parks, which remain extremely popular globally. These resources provide the brand with increased flexibility regarding the choice of the future development strategy and help to launch new and ambitious projects helping to struggle with the main rivals. The company also possesses unique non-physical resources helping it to evolve. These include brand loyalty and reputation, net worth, and specific organizational value (Ren). These aspects are cultivated by the company’s management and support the firm’s leading positions at the moment.

Moreover, the new acquisitions and deals add capability to the Disney Corporation. For instance, the purchase of Lucasfilm cost around $4 billion for the corporation (Katz). Other important acquisitions include Marvel Studios and 20th Century Fox (Katz). At the same time, these deals provided Disney with a unique opportunity to increase the diversity of its products and acquire rights to make new movies and products (Ren). It means that Disney became an owner of several most popular franchises that can generate a stable income in the future and preserve the company’s leading positions globally. For this reason, the corporation can be viewed as a brand with unique capabilities helping it to evolve.

Furthermore, by employing the resources and capabilities mentioned above, the company introduces core competencies. These include animatronics and show design, storytelling and story creation, and efficient operation in thematic parks (Ren). These focus areas are fundamental for the brand’s further evolution and its ability to continue its evolution. The choice of the core competencies is explained by the company’s focus on creating unique content that might be attractive to viewers and help to expand the loyal audience. At the same time, it ensures that other brands will have difficulties replicating the offering (Ren). Under these conditions, the internal analysis shows that Disney has significant resources and capabilities that can be used by the brand to create the basis for further evolution.

External Analysis

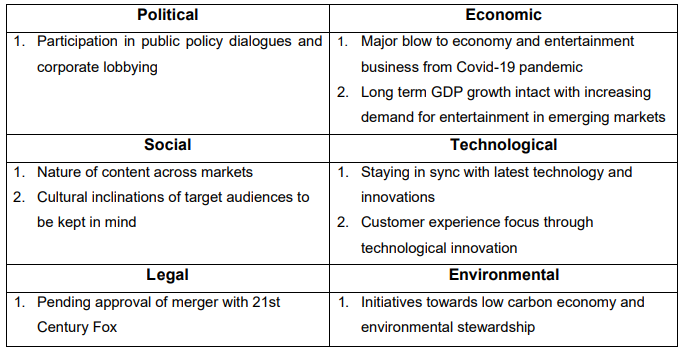

The external analysis of the company can be performed by evaluating its competitive environment and factors affecting the company and analyzing its rivals. Thus, the PESTEL analysis tool offers the following information:

The table shows that, in general, Disney benefits from the positive impact of various external factors. The company uses technological innovation to improve interaction with clients and ensure they remain satisfied (The Walt Disney Company 23). It also continues recovery from the COVID-19 pandemic and increases its revenue (The Walt Disney Company 10). The legal issues might include the necessity to acquire approval for the recent deals. However, the conditions might be viewed as beneficial for the brand’s evolution.

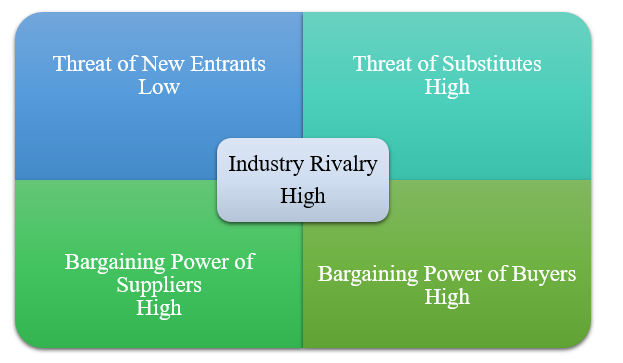

The Porter Five Forces model can also be used to acquire an enhanced understanding of the external environment:

Figure 2 shows that Disney operates in a highly competitive environment. The risk of a new entry remains low, as the industry is dominated by giant corporations that struggle against each other. However, there is an extremely high risk of substitutes as other companies constantly create and offer new products that might be attractive and interesting for the audience. Disney’s main rivals include Universal, Amazon, Netflix, and Sony (Ren). They offer similar products and focus on the same target audience. For this reason, for the brand, it is critical to generate a competitive advantage that might help it preserve its position globally.

Business and Corporate Level Strategies

Disney employs a specific business strategy to ensure it manages its resources effectively. It implements product differentiation as the major approach to selling and promoting its services. Using related diversification, the corporation introduces products for various types of its clients (Kotler and Keller 45).

It helps to retain their interest levels and ensure individuals will not use the major competitors’ services. At the same time, it promotes more effective sales. At the corporate level, the corporation uses geographical diversification as its central approach (Kotler and Keller 98). Currently, it operates in about 80 countries globally, meaning that providing various and inclusive services is critical for the brand and its further evolution (Ren). In such a way, the effectiveness of business and corporate level strategies is linked to the company’s mission and its current state. Employing available resources, the brand manages to struggle against the major rivals and satisfy the leading needs of the target audience, which is critical for further development and evolution.

Recommendations

The main recommendations can be given regarding the current situation within the entertainment industry. It remains a highly competitive environment, meaning Disney should continue focusing on generating a competitive advantage. It can be attained by creating unique content unavailable to the closest rivals (Kotler and Keller 113). It might imply combining movies with thematic parks to create live shows interesting for various types of clients. Moreover, Disney can use its substantial internal resources to increase diversity in its products to ensure a broader audience is affected. It would guarantee that the company moves forward and remains one of the leaders in the global entertainment sphere. Otherwise, there is a high risk of being outranked by the closest rivals.

Works Cited

Barakaat Consulting. “The Wald Disney Company SWOT & Pestle Analysis.” S&P. Web.

Katz, Brandon. “The Wald Disney Company’s Major Recent Acquisitions, Ranked by Cost.” Observer. 2020. Web.

Kotler, Phillip, and Kevin Keller. Marketing Management. 16th ed., Pearson, 2021.

Ren, Siping. “Analysis on the Current State of the Disney Economy and Sentiment Text Analysis on Customer Reviews.” Advances in Economics, Business and Management Research, 2021. Web.

The Walt Disney Company. “Fiscal Year 2021 Annual Financial Report.”. Web.