Introduction

Small and mid-size firms (SMEs) have sales, assets, or a particular percentage of workers below a predetermined range. Each country defines a small and medium-sized (SME) firm differently. Specific size criteria must be satisfied, and the business sector is also frequently considered. The European Union (EU) defines a small business with fewer than 50 workers and a medium-sized business with less than 250 laborers (Juergensen et al., 2020). Additionally, these firms’ average financial sheets cannot anticipate 43 million pounds in revenue in a single year (Juergensen et al., 2020). This work has four major activities, and the firm being evaluated is Ades, a well-known commercial grocery superstore in South East London. Many critical factors are studied in the first task to determine development prospects. The second duty is to evaluate potential capital sources, while the third task is to develop a growth strategy for the firm. This area generates the business’s purpose, vision, goals, objectives, and marketing budgets. Following that, efficient marketing tactics for the suggested firm are devised. Finally, the last part discusses numerous escape strategies and options.

LO1: Analyze the Key Considerations SMEs should Consider when Evaluating Growth Opportunities

P1: Analysis and Justifications of Key Considerations of Ades Foods for Evaluating Growth Opportunities

Growth is critical for an organization’s long-term existence since it enables the acquisition of assets, recruitment of new personnel, funding initiatives, and allows business productivity and profitability. Growth may also help an SME raise its reputation, extend its supplier base, and improve its stability and profitability (Mathias and Williams, 2017). However, for growth to be effective and sustained, it must be planned and motivated by the proper factors. Before preparing for expansion, each firm should evaluate various factors, including strategic edge, the resources necessary, and the influence on consumers (Mathias and Williams, 2017). Competitive advantage refers to the variables that enable a business to provide better or more cost-effective services or products than its opponents.

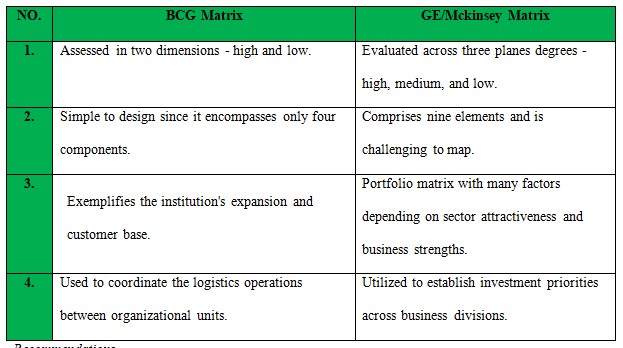

Competitive edge refers to the elements that enable a business to create products and services more efficiently or affordably than its competitors. These elements allow the producing unit to produce more significant revenue or profit margins than its market competitors. Competitive advantages are ascribed to characteristics, including pricing, identity, product quality, logistics system, proprietary information, and client experience (Wagner and Hollenbeck, 2020). If SME entrepreneurs can build a competitive edge, they will be able to trade merchandise and services economically and conveniently. On the other hand, strong competitiveness indicates that the firm is likely to prosper and is capable of growth (Blanchard et al., 2011). In assessing Ades’ competitive edge, the paper analyzes the BCG matrix and GE/Mckinsey matrix to determine the firm’s best growth opportunities.

Portfolio Strategies (BCG Matrix and GE/Mckinsey Matrix)

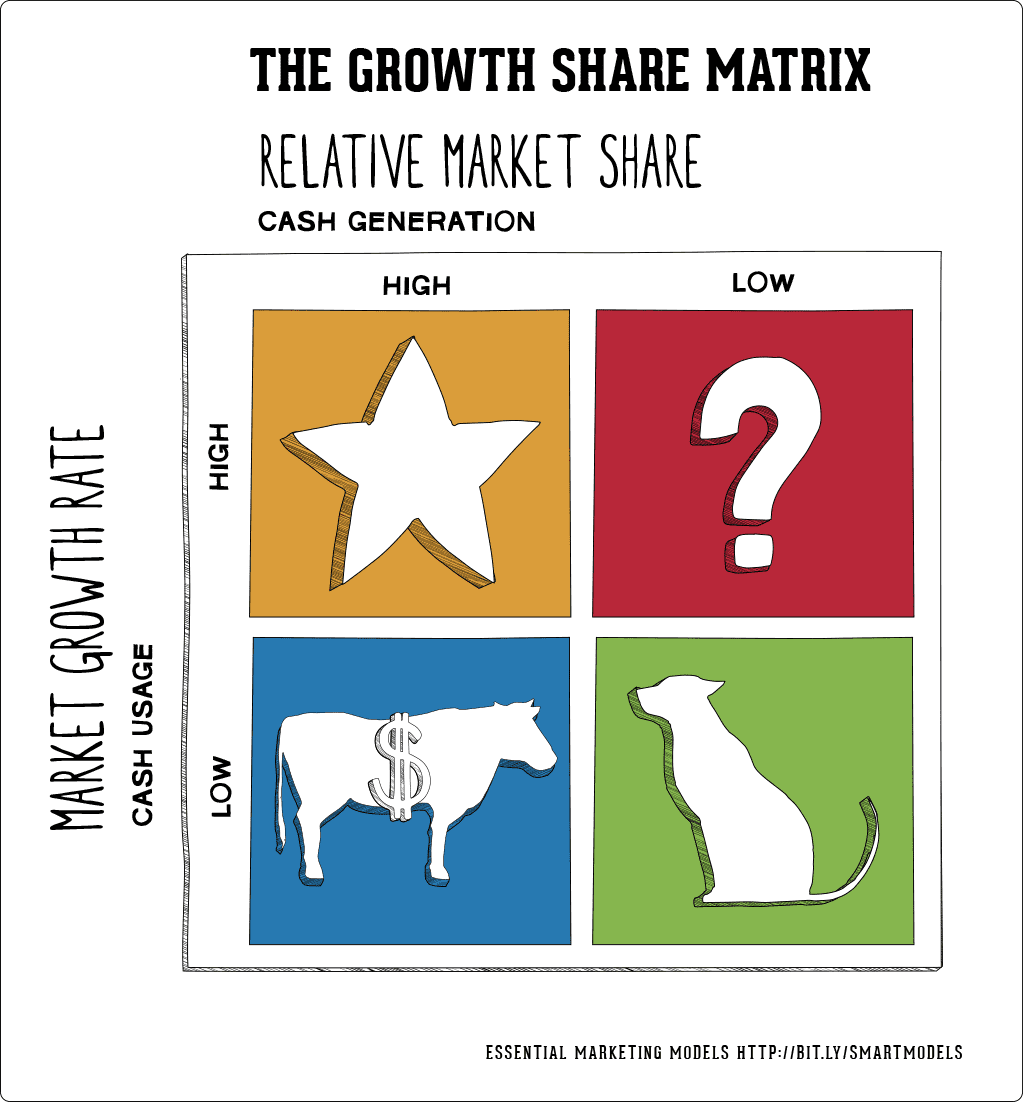

The Boston Consulting Group’s (BCG) growth-share dashboard is a framework that uses visualization tools of an organization’s goods and services to assist management in determining which merchandise to retain, sell, or increase investment in. The matrix visualizes a corporation’s offers as a four-square lattice, with the y-axis indicating market growth and the x-axis reflecting customer base (Chiu and Lin, 2019). The BCG growth-share matrix divides commodities into four groups, characterized probabilistically as cash cows, dogs, question marks, and stars. Each classification region has its own set of distinct qualities.

If an item has a small customer base and is growing slowly, it is deemed a dog and must be disposed of, dissolved, or rebranded. Dogs, located in the lower right sector of the matrix, earn little income for the corporation because of their small market share and decline in growth (Chiu and Lin, 2019). As a result, dogs can become cash magnets, tying up corporate finances for extended periods. As a result, they are solid contenders for divestment. Cash cows are commodities in low-growth regions but have a reasonably considerable market share for the firm, and the corporation should milk the cash cow for as long as possible (Chiu and Lin, 2019). The lower-left quarter shows that cash cows are often market leaders in mature brands.

Generally, these goods offer returns that exceed the industry’s development rate and are self-sustaining in terms of cash flow. The worth of cash cows may be assessed due to their highly predictable cash flow tendencies. Goods in high-growth marketplaces that account for a large share of that marketplace are called stars and should receive further investment (Chiu and Lin, 2019). The stars in the upper left quadrant earn a lot of money and devour a lot of business cash. If a star can maintain its market leadership position, it eventually develops into a cash cow when the industry’s general growth rate slows. Controversial possibilities are those in high-growth areas where the firm does not have a significant market share. In the upper right corner of the grid, there are question marks. They often expand rapidly yet absorb a substantial portion of the firm’s activities (Chiu and Lin, 2019). Products in this region should be evaluated constantly and thoroughly to see whether they are still viable. Thus, the BCG matrix evaluates Ades Company’s current corporate strategy and guides where to commit more, terminate, or create items.

GE/Mckinsey Matrix

As with the BCG Matrix, the GE-McKinsey Matrix is a strategic analytical procedure used in business structure to evaluate focus areas based on sector desirability and a corporation’s competitive strength. By merging these two factors into a grid, a firm may map its business divisions and choose where to engage, retain, and yield or dispose of. Unlike the BCG Matrix, the GE-McKinsey algorithm employs many elements to calculate the value of the two components, market attractiveness and competitiveness (Shtrikov and Shtrikova, 2020). The GE Mckinsey Matrix’s vertical scale contains the attribute market desirability, which may be classified as excellent, moderate, or low.

Sector attraction is determined by how profitable it is for a firm to expand and perform inside a particular field. The larger the investment value of a marketplace is, the more desirable it becomes, and in the long-term, there will exist competitiveness and prospective transformations in the competitive environment (Shtrikov and Shtrikova, 2020). The horizontal plane considers an entity’s competitive intensity, which may also be split into high, medium, and low (Shtrikov and Shtrikova, 2020). This characteristic indicates how powerful or effective a firm is compared to its competitors.

Recommendations

According to the GE/McKinsey and BCG matrix evaluations of Ades Company, it is advised that the institution deliver high-quality African and Caribbean refreshments at a reasonable cost to customers to attract more customers and grow its market share. Both the GE and BCG matrixes are critical for analyzing growth plans; nonetheless, in the instance of Ades Company, the GE matrix has a more significant number of goods and classifications and hence appears to be the most effective. The BCG matrix is excellent for a specific market segment, but the GE matrix identifies the regions on which Aden Company should concentrate its efforts. It is more polished than the BCG matrix since it replaces the BCG matrix’s single measure, market growth, with many elements, market attractiveness.

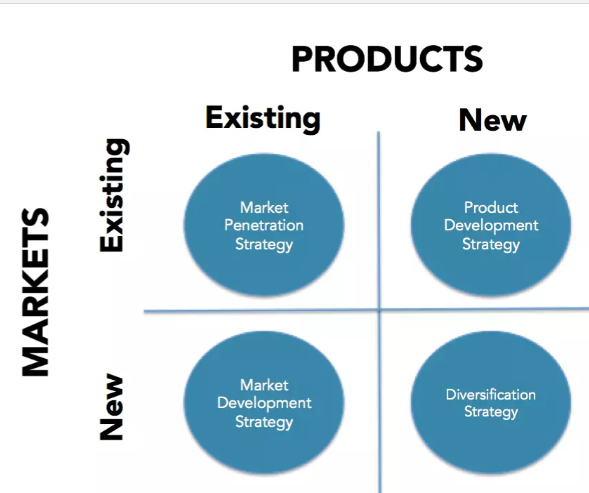

P2: Evaluating Growth Opportunities by Applying Ansoff’s Growth Matrix

The Ansoff Matrix, sometimes referred to as the marketplace, and product expansion lattice, is a strategy organizations use to examine and execute their development strategy. The structure illustrates four ways for assisting a business in growing and assesses the hazards connected with each approach. Market penetration is the first sector of the Ansoff Matrix and has the lowest risk of the four growth strategies. It occurs when a corporation strives to expand in a market where it already has commodities, activities, or other offers (Zanjani et al., 2020). Ades Company expands its market share by lowering its prices and improving its products to make them more appealing to customers. Market development is the second quarter, and it refers to the process through which a business leverages its present products to expand into new markets (Zanjani et al., 2020). Thus, this may involve growth into different townships, other areas, the country, or even worldwide if the business is local.

When a company develops from their existing markets into a niche venture in which they do not currently exist, regardless of the nature of the new market, this is referred to as a market penetration growth plan. Product innovation, the third section of the Ansoff Matrix, refers to how a company develops new offers for its open marketplace (Zanjani et al., 2020). A plan for product advancement growth is just as hazardous as an approach for market development growth. This method will increase product selection from which buyers may pick. Diversification is the fourth and last part of the Ansoff Matrix, and it poses the greatest danger to enterprises (Zanjani et al., 2020). This growth plan is used when a firm wishes to penetrate new markets by launching innovative products, solutions, or other offers. Therefore, this is the most dangerous scenario since it includes an unproven product in a market in which the business has no prior expertise.

Table 3: Ades Company Ansoff Matrix

LO2: Assess the Various Methods through which Organisations Access Funding and when to use Different Types of Funding

P3: Assessment of Potential Sources of Funding and Advantages and Drawbacks of each

Crowd Funding

Crowdfunding is a method of financing in which a small amount of money is raised from a considerable number of individuals over the internet or online. Crown financing has several advantages: it is the quickest form of raising capital without incurring any expenses (Mochkabadi and Volkmann, 2020). It is an excellent means of gauging public response and perception, as stakeholders can monitor the success of the enterprise they financed. Additionally, through this funding procedure, investors might become devoted consumers. Nevertheless, crowdfunding has several downsides, including that not every entrepreneur or firm is eligible to use the system. Consequently, if the goal is not met, the shareholders withdraw their funds, and the firm becomes bankrupt (Mochkabadi and Volkmann, 2020). As a result, a business with a restricted infrastructure, online presence, or fewer items may have difficulty participating in crowd fundraising.

Peer-to-Peer Lending (P2P)

Peer-to-peer (P2P) borrowing is a method of debt financing that allows participants to lend and borrow money without the intervention of a bank or financial institution. Then, P2P lending was referred to as crowd financing or community borrowing (Freedman and Jin, 2017). Additionally, P2P lending refers to borrowing funds without the assistance of a banking institution or a regular bank. As highlighted in this text, the preceding are some of the benefits of peer-to-peer funding. It is a simple and fast online registration procedure, offers lower interest rates than conventional financial institutions, and has no late payment fee (Freedman and Jin, 2017). Furthermore, the debtor stays unidentified to creditors, and mortgage companies cannot approach the client directly. On the other side, P2P funding has some drawbacks. This method involves high-interest rates and a liquidity shortage in the P2P lending market.

Venture Finance

Venture capital is a type of finance in which stakeholders provide monetary assistance to start-up small businesses with the possibility for long-term expansion. Nonetheless, external financing is typically provided by wealthy individuals, investment firms, or corporations (Burns, 2014). Venture capital has a plethora of pros and downsides, as enumerated in the text. The primary benefits are as follows: venture capital funding can provide financial help to start-ups and small enterprises in exchange for crucial consulting and direction (Burns, 2014). Furthermore, venture investors are often well-connected in the corporate sector. The primary downsides of this kind of funding are the minority shareholding and loss of control.

The Boston Consulting Group’s (BCG) growth-share matrix is a methodology that leverages modeling technologies to aid executives in selecting which offerings to keep, trade, or make investments in. The GE-McKinsey Matrix is a key analysis tool used in company structure to prioritize priority areas based on industry attractiveness and an entity’s competitiveness. Combining these two variables into a grid allows a corporation to describe its segments and decide where to interact, maintain, and yield or dispose of resources. Both the GE and BCG composites are crucial for examining growth strategies; however, in the case of Ades Foods, the GE matrix has a greater number of products and classes and hence looks to be more successful. On the other hand, the Ansoff framework outlines four strategies for aiding a corporation in growth and evaluates the risks associated with each design.

LO3 Developing a Business Plan (including Financials) for Scaling up the Business

P4: Business Plan including Financial Information and Strategic Objectives for Ades Cash & Carry Ltd.

A corporate plan is a blueprint that details how a firm, often a start-up, establishes its policies and targets to accomplish those ambitions. A proposal describes the organization’s promotional, budgetary, and operational strategies (Brinckmann et al., 2019). Business plans are critical statements distributed to both the domestic and foreign audiences of a corporation (Brinckmann et al., 2019). For example, a strategic plan seeks investment or financing before a firm has developed a proven history.

Section 1 Executive Summary

Ades is a well-known wholesale grocery superstore in South East London. Ades provides high-quality African and Caribbean beverages and meals that are inexpensive and accessible to clients in the United Kingdom, London, and the European Union. It expands its selection of high-quality items, including meals and beverages, and offers them at low costs to maintain a competitive advantage in the market (Ades, 2018). Ades supplies an array of goods, including groceries, food, veggies, chicken, fish, and ethnic cuisines, as well as health and cosmetic products, infant supplies, and hospitality. As Ades (2018) explains, the goal of this venture is to offer high-quality meals and beverages that are both inexpensive and approachable to London residents. Nonetheless, this organization is managed by a dedicated staff with extensive expertise in the food industry and a long history of building a positive name in the retail sector.

Section 2 Owner’s Background

Mr Michael Adedipe, an innovative and courteous entrepreneur, is the brains underpinning Ades Cash & Carry. Since 2004, the firm has operated in the Royal Borough of Greenwich. Over ten years ago, the computer programming graduate founded his first business in the south London town of Charlton on East Moor Street (Ades, 2018). Ades Cash and Carry is one of South East London’s leading specialized wholesalers, with over 4,000 goods on exhibition. They stock well-known varieties of Caribbean and African cuisine, pharmaceuticals, party supplies, cooking tools, and various other home items (Ades, 2018). People and organizations located regionally, domestically, and worldwide are among their consumers (Ades, 2018). The company is recognized for providing high-quality items at competitive costs.

Section 3 Product and Services

Ades is a South East London-based Afro-Caribbean commercial and retailing Cash & Carry. Ades’ mission is to keep growing its product lines, including high-quality beverages and snacks provided at reasonable costs, to capture a larger market share (Ades, 2018). The institution’s vision is to transform its small and medium-sized entities into global enterprises via the provision of high-quality commodities (Ades, 2018). Ades’ aim is to bring high-quality African and Caribbean beverages and foods that are inexpensive and convenient to clients in the United Kingdom, London, and the European Union.

Ades Cash & Carry has numerous objectives detailed in the paragraph. First, Ades aims to increase its profit margins by 10%, from £12,217,517 in 2017 to £13,439,268 in June 2019 (Ades, 2018). Second, to exceed consumer expectations by providing high-quality beverages and snacks. Thirdly, to offer a diverse selection of items and types throughout African and Caribbean cuisines (Ades, 2018). Fourth, to increase client base, retention, and devotion by at least 10% by June 2019 (Ades, 2018). Finally, to establish a positive status as a one-stop-shop for chefs, merchants, eateries, and distributors of Caribbean and African food and beverages.

Section 4 Competitor Analysis

Competitor analysis (CA) is a method that entails recognizing rivals and analyzing their advertising and business tactics to gain a better understanding of their strengths and shortcomings, as well as those of their firm. Market advantage gives a broader view and comparative information on the complete marketing scene. Competitor assessments evaluate all available data to get insight into how to mitigate risk and make informed decisions (Hatzijordanou et al., 2019). This study aims to undertake a SWOT analysis of Ades Cash & Carry Ltd to ascertain its competitiveness in the food sector. Ades’ rivals include Happy Drinks Co. and Coffee Masters UK in the UK food business.

SWOT evaluation (strengths, vulnerabilities, possibilities, and challenges) is a tool for evaluating a business’s leading advantages and developing strategic plans. The SWOT analysis considers internal and external issues and existing and future opportunities (Hatzijordanou et al., 2019). Thus, this SWOT evaluation is intended to assist a comprehensive, fact-based, information-driven examination of Ades’ initiative or sector strengths and limitations. The organization must maintain the study’s accuracy by eliminating presumptions or gray zones and instead focusing on real-world situations (Hatzijordanou et al., 2019). Therefore, businesses should view it as a recommendation, not a mandate.

Strengths

- Hotels and restaurants specializing in particular meals and beverages sometimes operate as chains or networks of hotels around the nation. Ades operates on a worldwide scale and, as a result, has an excellent distribution infrastructure that ensures items are available to clients regardless of geographic location.

- Since the food and beverage sector’s goods are manufactured on a large scale, their costs are competitive. Ades Cash & Carry maintains low prices, enabling clients to afford its items.

- The modern world is mostly governed by social networking sites like Whatsapp, Twitter, Facebook, and Instagram. Ades skillfully utilizes these channels, allowing it to reach a much larger audience and acquire many new clients (Ades, 2018).

Weaknesses

- Ades does not have a dedicated expenditure for research and development due to its tiny size. Chefs and cooks adhere to a certain culinary method and produce the same product repeatedly.

- Ades operates on a razor-thin margin between raw product availability, processing, and consumption. Thus, this would be done if Aden Cash & Carry had a reliable vendor.

- Although its profit margins were initially modest, Ades Cash & Carry requires a significant investment to operate (Ades, 2018).

Opportunities

- The majority of the world’s largest corporations in the food and beverage industries have shifted their operations online. Ades can have its customer select any of their preferred meal items and make an order for shipment.

- Ades can embrace technology for record-keeping, smart broilers and ovens in the kitchen, and an internet ordering mechanism. Then the entire operation will become more efficient, and there will be no delays or kitchen-related safety problems.

- Mechanization, mass manufacturing, and economies of scale have decreased the cost per item. Due to the reduced interest rate, it provides an opportunity for SMEs like Ades to sprout.

Threats

- Technology and internet buying have simplified the process of entering this sector. As a result, the food and beverage business has grown fiercely intense.

- Because the market is extremely competitive, the availability of raw materials is restricted. A corporation’s operation is contingent upon its ability to maintain positive relationships with its suppliers.

- Due to the market’s saturation with several rivals, buyers have numerous alternatives for ordering the same goods. Ades’ African and Caribbean cuisine must be distinctive in such a setting.

Section 5 Marketing and Pricing Strategies

A pricing model is a technique for determining a commodity’s or service’s competitive rates. This technique is used in conjunction with the other promotional pricing tactics, including the 4P approach (items, cost, placement, and promotion), consumption pattern, competitiveness, consumer expectations, and ultimately, product characteristics. This concept is a critical element of the marketing mix since it is dedicated to creating and boosting sales for a business, which eventually results in profit. Ades uses penetration pricing to penetrate the market and increase profitability. Ades offers a variety of high-quality snacks and drinks at a reasonable price. They do, however, require a more comprehensive marketing approach to increase product exposure and sales.

Table 4: Ades Cash & Carry Marketing Strategy

Section 6 Operational Plan

Ades Cash & Carry Ltd offers an in-house workforce of process managers and operational specialists overseeing every project, from transportation to food and beverage preparation. To maximize its operational processes and provide full approval for its customer’s food and beverages, Ades will streamline their activities by acquiring self-sustaining ingredients from local food producers. Consequently, the company will continuously monitor and report clients’ requests and ensure that the foods and beverages are ready on time to prevent consumers’ lengthy wait and delivery times. Ades will strengthen its relationships with its commodity vendors and assist them with creative ideas and financial assistance to improve their operations, which will result in improved stock operations and management for Ades Ltd.

Section 7 Financials Plan

Table 5: Key Financial Information of Ades Cash & Carry Ltd (Ades, 2018)

Section 8 Back-up Plan

Along with a crisis management plan, a contingency plan encompasses a comprehensive institution progression strategy that serves as the architecture for an organization to endure a cyberattack and rebound with minimal to no damage to the company, image, or records. Ades Cash and Carry Ltd will develop a business succession plan by contracting with a renowned agency with the necessary skills and resources to construct a solid firm continuity tactic.

LO4 Assessment of Methods of Exit Strategies of Small Business and their Implications

P5 Analysis of Exit or Succession Methods for Business and Benefits and Drawbacks of each

The exit plan of a firm is the investor’s tactical strategy to sell their stake in a company to another organization or shareholder. The exit plan enables the proprietor of a small or beginning firm to dissolve or minimize their ownership position in the enterprise. As Moro Visconti (2020) explains, several reasons for exiting a firm include intense rivalry, decreasing earnings, transferring it on to close relatives, retiring, capitalizing on achievement and reputation, and changing interests. The following sections describe the many exit plans available to small firms.

Liquidation

Although liquidation is the strategy for closing a firm, the term often refers to selling the business’s goods at a significant discount to generate cash. The advantage of insolvency is that it is a straightforward process that may be completed quickly (Pisoni and Onetti, 2018). Additionally, after an organization is liquidated and the proceeds from the sale of its possessions are dispersed to borrowers, any outstanding unsecured company debts that are not individually secured are wiped off. The disadvantage of liquidation is that it may yield the cheapest financial return, which may upset bondholders. Moreover, the liquidator’s responsibility is to recover any funds owing to the firm during insolvency, including outstanding payments from an overdrawn directors’ principal amount (Pisoni and Onetti, 2018). Where a director owes money, it will be regarded precisely like any other corporate debt and must be repaid.

Initial Public Offering (IPO)

An initial public offering, or IPO, is the first public selling of a company’s shares. Unlike a private corporation, a public institution sells a portion of its shares to shareholders from the wider populace, as public enterprises are often larger and experience rapid development. An upside of an IPO is that it enables businesses to raise more capital to assist with debt repayment (Pisoni and Onetti, 2018). Nonetheless, going public may be challenging for small firms due to the enormous time and financial investment required. If SMEs are looking for a quick exit plan, an IPO may not be the best option.

Acquisitions

An acquisition occurs when a business acquires another corporation, and an acquisition exit plan occurs when a firm transfers management of its activities to the entity that acquired it. A benefit of seeking an acquisition as an escape route is that it may lead to an elevated business valuation, resulting in a more excellent sale price (Pisoni and Onetti, 2018). Furthermore, acquisition by a rival may be more advantageous than seeking to sell a business to a favorable buyer, as purchases allow proprietors to concentrate their efforts on obtaining the highest possible sale price. The disadvantage of this exit plan is that it can be tough to bargain with a favorable partner, as both parties may feel pressured to make a good deal, which can result in a firm being under- or over-valued.

D4 Evaluation of Exit or Succession Methods for Ades Cash & Carry Ltd with Justified Recommendations

Entrepreneurs create businesses intending to promote their concept, adapt to changing market conditions, and grow through time. However, there are occasions when they wish to explore other endeavors, quit, or sell a firm that is not profitable. In such circumstances, Ades Ltd has a variety of exit techniques available to depart the firm without suffering losses securely. The methods vary according to whether the firm should continue after the proprietors’ departure, transfer to a family member, or be fully liquidated. A suitable strategy may be determined by assessing the company’s profit potential and consumer demand. IPO is the most effective technique for Ades Ltd to raise unlimited capital by making shares publicly available for purchase on the open market. Ades Ltd.’s accounting information must be made public, as becoming public will provide funding for company development, including developing creativity, expanding the product line, and recouping part of the initial investment. Additionally, Ades can liquidate when it cannot earn a profit from its company, and all of its assets can be liquidated to satisfy debts and recoup the initial investment.

Conclusion

A corporate plan is a road map outlining how a business, frequently a start-up, defines its policies and objectives to achieve its aims. Due to the massive scale manufacturing of items in the food and beverage sector, their costs are competitive. Ades Cash & Carry maintains low prices to ensure that its products are affordable to consumers. Ades Ltd.’s most successful raising limitless cash is through an initial public offering (IPO), making shares publicly accessible for buying on the open market. The financial statement for Ades Ltd. must be publicly disclosed since this will offer money for corporate growth, including increasing inventiveness, extending the product range, and reimbursing a portion of the original investment.

References List

Ades (2018). Ades Foods. Web.

Blanchard, K., Oncken, W. and Burrows, H. (2011). The one minute manager meets the monkey. London: Harper Collins, London.

Brinckmann, J., Dew, N., Read, S., Mayer-Haug, K. and Grichnik, D. (2019). ‘Of those who plan: A meta-analysis of the relationship between human capital and business planning.’ Long Range Planning, 52(2), pp.173-188.

Burns, P. (2014). New venture creation: A framework for entrepreneurial start-ups. Basingstoke: Palgrave MacMillan.

Chiu, C.C. and Lin, K.S. (2019). ‘Rule-based BCG matrix for product portfolio analysis.’ In International Conference on Software Engineering, Artificial Intelligence, Networking, and Parallel/Distributed Computing (pp. 17-32). Springer, Cham.

Freedman, S. and Jin, G.Z. (2017). ‘The information value of online social networks: Lessons from peer-to-peer lending.’ International Journal of Industrial Organization, 51, pp.185-222.

Islami, X., Mustafa, N. and Topuzovska Latkovikj, M. (2020). ‘Linking Porter’s generic strategies to firm performance.’ Future Business Journal, 6(1), pp.1-15.

Mathias, B.D. and Williams, D.W. (2017). ‘The impact of role identities on entrepreneurs’ evaluation and selection of opportunities.’ Journal of Management, 43(3), pp.892-918.

Mochkabadi, K. and Volkmann, C.K. (2020). ‘Equity crowdfunding: A systematic review of the literature.’ Small Business Economics, 54(1), pp.75-118.

Moro Visconti, R. (2020). ‘The valuation of technological startups.’ In The Valuation of Digital Intangibles (pp. 155-192). Palgrave Macmillan, Cham.

Pisoni, A. and Onetti, A. (2018). ‘When startups exit: Comparing strategies in Europe and the USA.’ Journal of Business Strategy 39(3), pp.26-33.

Shtrikov, A.B. and Shtrikova, D.B. (2020). ‘Evaluation of the effectiveness of personnel adaptation process in small business.’ In International Scientific and Practical Conference (pp. 593-605). Springer, Cham.

Wagner, J.A. and Hollenbeck, J.R. (2020). Organizational behavior: Securing competitive advantage. Routledge.

Zanjani, S., Iranzadeh, S., Khadivi, A. and Feghhi Farahmand, N. (2020). ‘Designing a corporate growth strategy based on Ansoff matrix using fuzzy inference system.’ Innovation Management in Defense Organizations, 3(2), pp.151-178.