Introduction

As indicated by the case study, the main problem evident in the airline industry today is a lack of financial discipline which, when combined with its over-optimism as seen in the case of numerous willing entrepreneurs looking to own their own airline, has created a situation where profitability is a scare resource, especially for legacy carriers attempting to stay operational in light of a dire global financial recession which has drastically reduced their customer base.

Mergers and Acquisitions As A Result of the 5 Forces

Acquisitions

As seen in the case study one of the main reasons behind acquisitions in the airline industry within the U.S. was the entry then subsequent bankruptcy of numerous new airlines from the 1980s till the early have of the 2lst century. This is in relation to a strange cycle within the industry wherein the over-optimism connected to owning an airline caused many entrepreneurs to neglect the hazards and pitfalls of owning an airline. As a direct result of fuel cost increases, route rivalries as well as competition against several of the larger carriers many startups either folded within the first few years of operation. While it may be true that many of them had new airplanes they still couldn’t rival the sheer amount of market power the legacy carriers had in terms of control over ideal land slots, gates as well as routes that can be utilized for flights. These trends led to the acquisition of several of the smaller airlines as time went on as a direct result of their inability to continue operations.

Mergers

Based on the case study provided, it was seen that mergers within the U.S. airline industry were fueled by not only financial troubles faced by several of the major airlines but also their desire to expand into international markets. What must be understood is that increasing gas prices, coupled with intense rivalry and the fact that consumers did not see a difference between one airline or another resulted in passenger groups effectively being split up between airlines and fewer passengers per flight as well as greater operational costs as a consequence. The only way this could be resolved was for several airlines to merge their operations so as to create a single point of entry for travelers, thus alleviating the cost related to taking off with only half a passenger manifest.

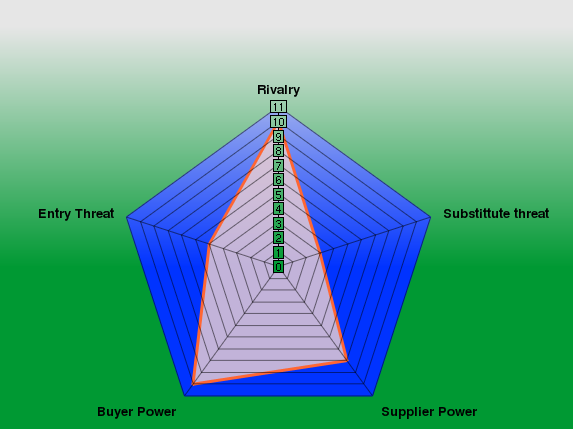

Radar Plot

Substitute Threat

Looking at the data presented by the case study, it can be stated that it is highly unlikely that substitute threats in the form of trains, cars, or other ground-based alternatives would be able to rival the airline industry in the near future. Studies such as those by Bischoff (2011) explain that within the U.S. alone, the sheer distances between states make it impractical to attempt travel via car or train unless the distance is below 100 miles or less (Bischoff, 2011: 232). This is due to the fact that the cost of gas coupled with the time would take to travel long distances; makes this form of travel even more expensive in terms of associated costs (i.e. food and hotel stays) as compared to a few hours of flight on an airplane. There is also an inherent limit to the railway system within the U.S. itself, and as such, there are several areas that are virtually inaccessible via this form of travel. Based on the fact that the radar plot above shows very little possible effects of substitute threats on the airline industry between 2009 – 2012, it is unlikely that passengers will opt for a more expensive, time-consuming, and inconvenient form of travel.

Entry Threats

When the facts from the case above have shown that entry threats were a problem from the 1980s to the early half of the 21st century, it is unlikely that such a factor would affect the airline industry from 2009 to 2012. The reason behind this is quite simple, studies, such as those by Unnikrishnan (2011), have indicated that one of the direct results of the 2008 financial crises and the current global recession is a degree of reluctance investors have had in investing in potentially risky ventures (Unnikrishnan, 2011, p. 11). The same can be said for banks that have developed even a greater degree of hesitance as a result of their exposure to toxic subprime debt. It must also be noted that while various economists have stated that the U.S. economy was recovering and that it was likely that there would a significant increase in passengers within the next 5o years, the fact remains that the period from 2009 to the present has been marked with a significant degree of financial inability, especially when taking into consideration the possible ramification of the European Debt Crisis on the American economy since Europe acts as America’s second-biggest market.

Based on these facts, it is likely that entry threats will most likely be isolated to low-cost regional carriers, while legacy carriers who control long-distance routes are unlikely to be affected. On the other hand, it must be noted that the current economic situation within the U.S. as well as Europe should significantly improve within the upcoming years, and it can be expected that a sudden upsurge in new airlines will occur. This is based on the view of the case study which states that in years when there is a significant development in profit (1999 – 2000) (2006 – 2007), the overly optimistic nature of the airline industry along with the desire of some entrepreneurs to own their own airlines will result in the creation of new entries as seen in several cases throughout the years. Unfortunately, as indicated by the case study, these new entries can cause significant pricing fluctuations which could result in a downturn in the airline industry as a direct result of a price war.

Rivalry

One of the interesting aspects shown by the case study is the increasing rivalry between legacy and low-cost carriers and the attempts of low-cost carriers such as Jetblue and Southwest etc. to expand into longer distance domestic routes within the U.S. Research data from Boeing has shown that there has been a significant rise in orders for twin-engine 747s in several markets including the U.S. The reason behind this sudden upsurge has been indicated by the article “Best & worst airlines: Southwest is tops and US Airways trails in our latest survey” (2011) to be a direct result of the development of not only an increasing amount of regional hubs within Asia but in the U.S. as well (Consumer Reports Magazine, 2011, p. 17). One of the unique aspects of the 747 is that it is not only well suited for local domestic flights between short-distance flight routes, but it is actually also capable of long-distance flights. As such, the reason behind this sudden upsurge in sales is connected with the subsequent expansion of low-cost carriers that see the fuel efficiency of the 747 twins bodied aircraft as one of the best means of entering into the main stream long-distance flight market in order to rival legacy carriers.

The reason why this particular strategy would be effective is the fact that nowadays many of the legacy carriers have been reducing the number of flights to particular routes in order to save on fuel and operational costs. As indicated by the case study, one of the main issues with new carriers entering into the mainstream market is a strangle hold as a lot of legacy carriers have over landing slots and departure gates in many of the regional hubs within the U.S. (Compart 2011: 20). As such, carriers reduce operations for cost savings, and the end result appears to be an opportunity for local low budget carriers to assume these vacated slots and offer passengers low-cost rates for tickets which the low-cost carriers can afford due to the higher fuel efficiency of their planes. As such, from 2009 to 2012, it can be assumed that the evolution of the rivalry between LLCs and Legacy carriers will intensify as a direct result of the factors that have been indicated.

This may in fact lead to a potential price war in the future with LLCs gaining the ability to outstrip legacy carriers due to them having better planes. It must also be noted that the case study has also indicated that that the only highest cost for an airline is purchasing an airplane, and as such, it is unlikely that legacy carriers will be able to immediately replicate the operational strategy of LLCs given the cost of new planes and the fact that many of today’s carriers are trying to reduce costs whenever possible. The case study gives an indication of what may happen in the future as seen in the section where legacy carriers have focused more on business and the first-class passengers due to the higher fees derived from such customers. Taking this into consideration, it could be possible that one potential evolution of the current situation is a separation of the types of passengers that particular airlines cater to with LLCs to ordinary consumers that are looking to save on their fairs. Legacy carriers, on the other hand, could focus on developing better services and amenities and focus more on business and the 1st class passengers.

Supplier Power

The airline industry has always been “beholden” so to speak to its fuel and airplane suppliers since, without them, it would be unlikely that they could continue operations. As such, it can be anticipated that in the future, subsequent changes in the way in which new planes are developed and the price of fuel for airplanes will definitely change the way in which the industry operates.

Buyer Power

As indicated by the case study, consumers continue to dictate the way in which airlines operate with greater numbers of passengers resulting in better situations for the industry. Studies such as those by Guerra (2010) indicate that within the next several years, the passengers using airlines are meant to triple, as such it can be expected that buyer power will continue to be an important influence in the airline industry just as it was before (Guerra, 2010: 47).

Reference List

Bischoff, G, Maertens, S & Grimme, W 2011, ‘Airline Pricing Strategies Versus Consumer Rights’, Transportation Journal, vol. 50, no. 3, pp. 232-250, Web.

Compart, A 2011, ‘Regional Hybrids’, Aviation Week & Space Technology, vol. 173, no. 23, p. 20, Web.

Consumer Reports Magazine 2011, ‘Best & worst airlines: Southwest is tops and US Airways trails in our latest survey’, Web.

Guerra, D 2010, ‘Capital projects in the new economy’, Industrial Engineer, vol. 42, no. 12, p. 47-51, Web.

Unnikrishnan, M 2011, ‘Did U.S. Airlines Learn From 2008?’, Aviation Week, Web.