Executive Summary

Amazon.com is an online retail company that has been in existence since 1994. Over the years, Amazon.com has been able to achieve tremendous online retail success, but recent years have seen the company struggle to distinguish itself in the market (due to increased competition). However, this paper notes that Amazon.com still has several key competencies that set it above its competitors.

These key competencies are part of the company’s corporate strategy, which is to be consumer-centric. The concept of consumer-centrism is part of Amazon’s three-faced corporate strategy, which is informed by the need to offer goods and services at the customer’s convenience and the need to offer a wide product breadth line. This paper explains that the need to offer a wide product line forms Amazon’s diversification strategy because the company has strived to reinvent itself through different product offing.

This paper also explains that Amazon’s value chain is under a strong influence from the company because Amazon controls most of the funds in the entire system. Comprehensively, this paper recommends that Amazon should be wary of the competitive influence, caused by a widening product portfolio. Consequently, the company should differentiate its products from its competitors’.

Introduction

Amazon is an online retail shop which features in the fortune 500 companies (Byers 2006, p. 1). The company offers a platform where customers purchase goods online. Mainly, the site started as an online bookstore, but its products were diversified to include CDs, MP3-downloads, computer software and the likes. Amazon started in 1994, but it went online in 1995, under the leadership of Jeff Bezos, its founder (Byers 2006, p. 1).

Amazon’s headquarter is in Seattle, Washington. Its operations in the US are part of its two-faced market strategy, which is divided into its North American market and international markets. Regardless of the market locations, Amazon has strived to ensure it focuses on selection, price, and convenience as its main elements of the operation. The company’s website design is planned to allow for third-party sales across a variety of product categories. The website design is also designed to allow for easy use of website tools for its three-set of clients (consumers, sellers and enterprises) (Byers 2006, p. 1).

Amazon’s international presence is informed by its diversification strategy, where the company operates different websites for different locations. For instance, Amazon has a different website for India, US, UK, Japan, China, Germany, France, Italy (and similar markets) because it aims to appeal to the local population using different marketing strategies such as the use of local languages. Amazon’s international markets account for over 40% of the company’s revenues (Robinson, 2009, p. 3).

As of 2008, Amazon’s market capitalization was estimated at $29.4 billion. Within the same year, Amazon employee base was estimated at 20,700 employees (most of whom work in the IT and sales departments) (Robinson, 2009, p. 3). During the course of Amazon’s business cycle, Amazon suffered significant setbacks, including a low investor (shareholder confidence) and a burst in the technology bubble (Robinson, 2009, p. 3).

So far, the company has been able to weather most of these challenges, including the recent 2007/2008 global economic crisis where the company was able to chart its way into production. Amazon has achieved tremendous business growth because of its vision to be a customer-centric organization. The company’s CEO believes that it is in the company’s interest to meet consumer demands by asking consumers what they want (Shepard 2006, p. 1).

He further reiterated that, for Amazon to achieve increased growth, it needed to appeal to every consumer need, including designing the online store to appeal to the needs of every customer. For instance, Bezo explained that, if the company had ten million customers, it needed to build ten million stores to meet the needs of each customer (Byers 2006, p. 14).

This paper explains Amazon’s strategy during the period of 2007 to early 2010 by analyzing its strategic capabilities. Emphasis will be laid on assessing Amazon’s diversification strategies (going forward) and its value addition framework. Also, the factors that account for Amazon’s sustainability will be analyzed, and its position, viz-a-viz its competitors assessed. This analogy will show Amazon’s current and future market positions.

Amazon’s Strategy (2007-2010)

Amazon’s business strategy during the period 2007 to 2010 has been multifaceted. In the early periods of Amazon’s growth, there was minimal competition in the online retail market, and therefore, Amazon was operating in a relaxed business environment. In the early stages of the company’s growth, there was a strong focus on improving the company’s communication platform because Amazon’s CEO, Bezo, believed that, the future of online retailing laid on improved and continuous communications (Whittington and Scholes 2011).

It is from this ideology that Amazon was named “Amazon” because the company’s founder believed that the company would become one of the longest online retail chains (through word-of-mouth communication). The name (Amazon) was therefore borrowed from Amazon River, which is among the longest rivers of the world (Sherman 2001, p. 2). In reference to its corporate strategy, Bezo said: “A brand for a company is like a reputation for a person. You earn reputation by trying to do hard things well” (Byers 2006, p. 18).

As a result, the importance of branding was highly recommended as an area of core business advantage. Amazon has, for a long time, used its strong branding campaigns to build a good name in the online retail market. However, with the proliferation of online retail companies, Amazon has had to redefine itself as a leader in the online retail market, since it was among the first companies to venture into the business in the first place.

In its redefinition campaign, Amazon has shifted its corporate strategy from being reputation-driven (branding-driven) to being consumer-centric. This strategy has been informed by the need to provide customers with an unforgettable shopping experience. Goods sold within this framework have been presented within a wide array of product categories. This strategy has been a cyclic phenomenon where customers have increased their frequency of visits to the Amazon website, thereby increasing customer traffic (Sherman 2001, p. 2). This increase in customer traffic has resulted in increased innovation due to an increase in innovative ideas and resources. This shift in strategy has also been reflected in a change of business logo to reflect a change in Amazon’s business offing.

In realizing Amazon’s business vision (to be the largest online retail store); three areas of core business competencies are identified to drive Amazon’s vision. These are selection, price and convenience (Whittington and Scholes 2011). However, these competencies have been designed within the framework of ‘innovation’. Within the concept of selection, Amazon has strived to provide a wide array of products, including “Books; Movies, Music and Games; Digital Downloads; Electronics and Computers; Home and Garden; Toys, Kids and Baby; Grocery; Apparel, Shoes and Jewelry; Health and Beauty; Sports and Outdoors; and Tools, Auto and Industrial goods” (Whittington and Scholes 2011, p. 73). In recent times, Amazon has focused on software development and cloud computing services as areas of key competence.

With regards to its price concept, Amazon has strived to be a leader in offering quality products at minimal costs (Thompson 2001). Though Amazon offers its shipping services to selected markets, it has been able to do so at no charge at all (plus a guarantee of on-time delivery) as part of its price concept. From this strategy, Amazon has been able to be a leader (in price innovation) within the online retail market (Whittington and Scholes 2011).

With regards to its convenience framework, Amazon has been able to “please” its customers by meeting their needs and wants. To do so, Amazon has invested in intense market research to determine customer needs and wants. This market research has been further complemented by a feedback program where customers have an online platform where they can share their sentiments regarding the entire online buying experience (and the products offered within the same platform). For instance, Amazon has, in the past, invested a lot of money in gaining customer reviews on almost all its products (Thompson 2001). The three pillars to Amazon’s innovation (price, convenience and selection) have, however, been informed by the need for the company to stay innovative. This need has been further motivated by Amazon’s need to be relevant in the future.

Amazon’s innovation strategy has also been informed by studies cited in Johnson (2011) which explain how starting a successful business (and operating it well) is no guarantee for its sustainability (in the next 100 years or even two decades). Amazon has used such information to transform its corporate strategies. For instance, its shift in corporate strategy was attributed to being the reason for emerging successfully from the dot com bubble of the 90s (Thompson 2001).

During this period, Amazon reported that it had a profit base of $4 billion, but by the close of the year 2008, Amazon’s profit base was about $20 billion (Johnson 2010, p. 3). Observers explain that this tremendous performance can be solely attributed to Amazon’s regard for transformational growth as its main corporate strategy. This unabashed embrace of transformational growth strategy saw Amazon build a business model that was not only focused on embracing the changing tastes, preferences and values of consumers but also, changing product designs (Johnson 2010, p. 3).

However, to meet the changes in consumer taste, preferences and needs, Amazon invested in a new web platform that is deemed to be the seventh-largest in the world (Johnson 2010, p. 3). From this platform, the company set up lab126 that saw Amazon produce a new technological product (Kindle e-book reader) which got most of Amazon’s competitors worried about their future sustainability (Amazon.com Inc. 2011). This innovation elevated Amazon to become an original equipment manufacturer because the new innovation “was wrapped in a seamlessly integrated iTunes-type digital media platform that combined both transaction and subscription-based content delivery” (Amazon.com Inc. 2011).

Before coming up with this new innovation, Amazon had to partner with content providers to produce an unrivalled product in the online retail market. This product sold more than 500,000 units because of its appeal to provide customers with a convenient e-book reading platform (Amazon.com Inc. 2011). Amazon has also ventured into offering its customers an unforgettable experience of reading periodicals and newspapers through the same platform. This focus on transformational growth saw the company change its product offing from a pure books sales platform to a dynamic array of consumable products that can be shipped.

From this analogy, Amazon’s strategic capabilities tend to spread on some key strategic competencies. These competencies are a strong global brand, strong focus on research and development, a customer-centric vision, product diversification and a strong focus on technological innovation (Amazon.com Inc. 2011). The strong global brand may be attributed to Amazon’s initial entry into the online retail brand market. Amazon was a pioneer in this field, and it is still deemed to be among the largest online retail stores. This key competency elevates Amazon above most of its competitors and puts it at an advanced position of realizing its corporate strategies.

A strong focus on research and development is also another area of key competence that elevates Amazon to be one of the best in the online retail market. This focus on research and development has caused market jitters through the invention of new products and strategies. For instance, as explained in previous sections of this report, the production of the Kindle e-book reader caused market ripples. This product was developed from the intensive investments in research and development undertaken by the company.

Complementary to the focus on research and development is the strong emphasis on technological advancement as the main criterion for undertaking research and development initiatives. Here, it is correct to note that, most of the research and development initiatives undertaken by Amazon are done through the latest technology, and they are equally aimed to produce the best technological products of the day.

Also, close to Amazon’s research and development focus is the close eye that the company has put on consumer tastes and preferences. This competency acts as a guideline for research and development initiatives undertaken by the company because Amazon has tried to tailor its strategies and develop products that meet the needs of its customers. From this standpoint, Amazon is capable of producing valuable products in the online retail market because it has a strong focus on customer needs. This competency improves its chances of realizing its corporate strategy.

Diversification Strategies

Amazon’s diversification strategy is informed by the company’s vision to be the largest online product selection. This vision has seen Amazon divest from a pure bookselling model to include several other products. Currently, Amazon has more than 18 million products in only 14 categories, thereby pitting it to be among the largest product selections in the online retail market (Sherman 2009, p. 2).

Sherman (2009) explains that “Amazon is one of the only major Web sites where one can order a hammer, a lawn chair, a yo-yo, and a best-selling novel all at the same time” (Sherman 2009, p. 5). However, not all the company’s products are enlisted in its distribution system; only about 16 million products are in the distribution system. Apart from these product diversification strategies, Amazon has also invested in product innovation and cloud computing services. This diversification strategy has made Amazon look like a conglomerate. Other companies such as Google have adopted such a strategy (of core business diversification) because they have shifted from their areas of core business competence to other areas of business (which they have never ventured into).

For instance, Google is known to be a leader in the online search engine business, as its main area of business competence, but as years of profitability passed, the company ventured into the development of online applications (an area of business competence that it had very little experience in) (Sherman 2009, p. 2). Amazon seems to have adopted the same diversification strategy, with regards to its production of the Kindle e-book reader, because the company is mainly a virtual retail company, but it ventured into the production of physical applications for online use.

However, Amazon’s diversification strategy is unique to other businesses of the same league because most of its auxiliary business ventures are related to its core business. For instance, the Kindle reader is a clever addition to the company’s online book sales strategy because it facilitates the convenience of book reading.

The relation between new innovations and Amazon’s core business competency has mainly been motivated by the need to improve the online infrastructure for doing business. The company’s diversification plans are therefore also motivated by the intention to leverage its investments (as seen through Amazon’s venture into cloud computing to reduce business costs and take advantage of the possibilities that cloud computing offers virtual companies).

This is the same ideology that saw Amazon move from (exclusively) selling online books. The move to sell privately labelled goods has also been part of Amazon’s diversification strategy. Historically, this strategy has worked well for other companies, including Best Buy, Target, and Trader Joes (Sherman 2009, p. 2). Through this strategy, Amazon has experienced higher returns than its conventional retail channels, and equally, the new sales platform has also acted as a good forum where Amazon gets customer feedback to inform its product innovation strategies.

These diversification strategies have made many observers be very pessimistic about Amazon’s future profitability because each product innovation and diversification stint takes numerous resources and management skill. Moreover, such diversification strategies are not often perceived to be intrusions into other business competencies. For instance, the diversification into product manufacturing processes come with new design, engineering and management responsibilities that, companies often overlook. In fact, business processes such as engineering and manufacturing, may completely change the entire structure of a business, such as Amazon, which is an exclusive virtual company.

Businesses extensions are also known to go beyond what a pure reseller does and therefore, the likelihood that a company may incur more operational cost is high. Moreover, observers warn that such extensions may bring a new scale of customer support and service issues which companies may not be able to handle (Sherman 2009, p. 2). Though Amazon has (so far) not shown any signs of being affected by the dangers of business extensions, concerns are still rife (among investors) that, the company’s management should be wary about the dangers of over-diversification. Sherman explains that “common sense suggests there is only so long that, companies can continue to move in completely different directions at the same time” (Sherman 2009, p. 6).

Value Chain

In understanding Amazon.com, we have to comprehend the fact that the company is a virtual company. As such, the company is subject to retail internet platforms. To understand the company’s value chain, this section of the paper highlights the processes that take place when a customer places an order with the company. This will be an overview of the company’s value-chain system.

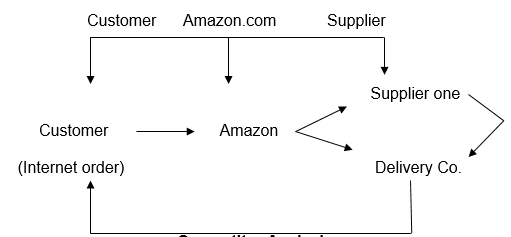

Whenever a customer places an order with Amazon, the customer will be required to give their payment details (Scribd 2011, p. 1). Often, this process includes the submission of a credit card number. Amazon thereafter initiates contact with the credit card company to verify the payments. After verification, the order is normally transferred to the supplier. The supplier then confirms that the product is ready, and Amazon takes the initiative of contracting a delivery company such as Fed Ex or DHL to deliver the goods.

This process seems simple, but it is interesting for two reasons; from the entire ordering and delivery process, we see that four entities are present in the entire value chain. These entities are Amazon, the credit card company, the supplier and the delivery company (for instance, Fed Ex or DHL). From this analogy, it is crucial to observe that, there is no contact of an Amazon employee in the entire value chain process.

This lack of contact occurs, although the customer pays for the goods through Amazon; the goods are delivered using an Amazon logo, and most interestingly, the customer paying for the good does not contact the supplier (who is often the owner of the goods sold). Amazon, therefore, has a very strong influence on the value chain system because it determines the flow of money. This value chain system is depicted in the following diagram.

Competitor Analysis

As mentioned in earlier sections of this paper, Amazon never used to have so many competitors. However, with the expansion of Amazon’s product offing, many websites are offering the same customer experiences as Amazon. Some of these online competitors are companies that provide digital content to their customers. Currently, Amazon’s main competitor is e bay. E bay has not been able to achieve the high sales revenue reported by Amazon, but when the two companies are compared in terms of their net revenues, E bay has better postings (Scribd 2011, p. 1).

Comprehensively, Amazon’s competitors can be divided into six categories: “physical world retailers, publishers, vendors, distributors, manufacturers and producers of Amazon’s products” (Whittington and Scholes 2011, p. 73). These competitors are some of Amazon’s direct competitors.

Amazon’s indirect competitors include “media companies, web portals, comparison shopping websites and web search engines” (Whittington and Scholes 2011, p. 74). Companies that provide e-commerce services are also major competitors to Amazon’s business sustainability because their business processes are similar to Amazon’s. Similarly, companies that provide internet infrastructure and other computing services are also major competitors of Amazon because some of their services infringe on Amazon’s current or potential market shares. For instance, Amazon’s venture into cloud computing is threatened by companies that provide internet infrastructure.

Also, since Amazon ventured into the web infrastructure industry, it has been at crossroads with other existing market participants such as Google and Apple because their market shares have been traditionally centred in the web infrastructure industry.

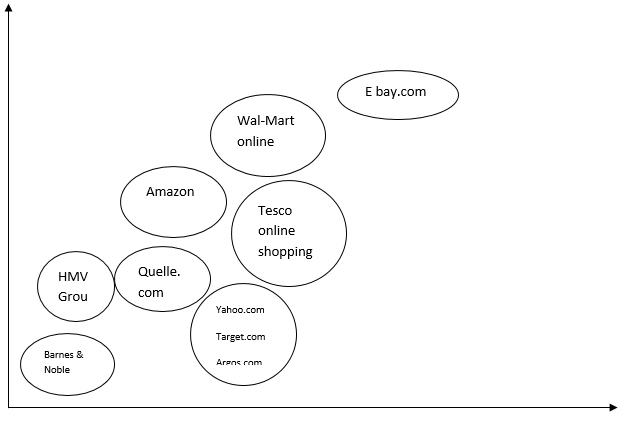

Comprehensively, it is established that; for online retail companies to command a strong market share, they ought to increase their existing product line breadth (Scribd 2011, p. 1). However, many companies have adopted the strategy of venturing into emerging markets and developing new products. Regardless of the strategies adopted by various online retail companies, there is a strong agreement that, an emphasis on product line breadth and establishing a strong geographic presence, are some of the main factors distinguishing one competitor from the other. Based on this framework, current statistics show that e bay is Amazon’s strongest competitor because it has a presence in 29 geographic locations, and equally, its products are categorized into 22 categories.

Amazon trails these statistics because it is estimated that it has a geographic presence in about seven geographic locations. Its products are also estimated to fall within 14 categories (Simmonds 2011). To compete with e bay, Simmonds (2011) observes that, Amazon needs to increase its geographic presence product categories. However, Sherman (2009) notes that increasing the company’s product categories is expected to complicate Amazon’s business model, thereby posing a risk to the growth of the company’s profit margin. Nonetheless, based on product line breadth and geographic location, the table below shows Amazon’s position (viz-a-viz its competitors).

Geographical scope

Product line breadth

From the above competitor analysis, we see that, Barnes and Noble. Com is Amazon’s main competitor when the book sales market is analyzed. Also, we can see that Amazon has a wider product portfolio, even though Barnes and Noble.com pose a stiff competition to Amazon (in the lifestyle goods market). From the same analysis, we also see that Wal-Mart poses a stiff competition to Amazon when the pharmaceutical, printing service market and the contact lenses market is considered (though both products have similar market dynamics and an almost similar pricing framework) (Simmonds 2011).

The presence of physical goods stores by some of Amazon’s competitors, such as Wal-mart and Tesco pose a real challenge to Amazon because the presence of physical stores is a competitive advantage over Amazon. E bay also has a strong competitive advantage over Amazon because of its strong geographic presence and product line portfolio (comprehensively, these competitor strengths pose a big threat to Amazon’s future sustainability).

How to Overcome Competitive Pressures

Amazon faces stiff competition in almost all its core business sectors. This competition is mainly attributed to the company’s diversification strategy, which has seen Amazon infringe in other companies’ business sectors. However, for Amazon to overcome the competitive pressures, it needs to differentiate its products in the market. This strategy is especially vital for Amazon because the online retail market is crowded with many products from other companies. This product differentiation strategy will make Amazon’s products more attractive to its customers. Amazon should, therefore be able to demonstrate how its products are unique to its competitors and how its products offer a better value preposition (compared to its competitors) (Beath 1991, p. 1).

Conclusion

Amazon’s strategy to be consumer-centric is a strong advantage to its corporate strategy. However, weighing the company’s core competencies and areas of key weaknesses, it is crucial for Amazon to distinguish its products in the market. This strategy, coupled with the company’s product diversification strategy, is set to make Amazon stand out as the best online retail company.

References

Amazon.com Inc. (2011) The Kindle Tablet. Web.

Beath, J. (1991) The Economic Theory of Product Differentiation. Cambridge, Cambridge University Press.

Byers, A. (2006) Jeff Bezos: the founder of Amazon.com. New York, The Rosen Publishing Group.

Johnson, M. (2010) Amazon’s Smart Innovation Strategy. Web.

Robinson, T. (2009) Jeff Bezos: Amazon.com Architect. New York, ABDO.

Scribd. (2011) Amazon.com. Web.

Shepard, A. (2006) Aiming at Amazon: The NEW Business of Self Publishing, Or How to Publish Your Books with Print on Demand and Online Book Marketing. New York, Shepard Publications.

Sherman, E. (2009) Amazon’s Dizzy Diversification Dance. Web.

Sherman, J. (2001) Jeff Bezos: King of Amazon. New York, Twenty-First Century Books.

Simmonds, P. (2011) Amazon.com. Web.

Thompson, J. (2001) Understanding Corporate Strategy. New York, Cengage Learning EMEA.

Whittington, J. & Scholes, K. (2011) Exploring Strategy: Text & Cases. Essex, Pearson Education Limited.