Abstract

The present paper provides an analysis of American Express to make predictions concerning the success or failure of the company in 2021. Despite the unfavorable macroeconomic situation in the world, American Express managed to stay profitable even during the time of the pandemic. Even though the company’s total revenues, total assets, and profit margin deteriorated, the company managed to decrease its financial leverage and sustain efficiency. These results were achieved due to the utilization of the principles of economies of scale, following the profit maximization principle, and adhering to the selected business strategy to operate in an oligopoly. Thus, the company is expected to succeed in 2021.

Introduction

The present paper provides a microeconomic analysis of American Express, a multibillion-dollar holding company operating in traveling and financial service markets. Once started as a freight forwarding company in 1850, it evolved into one of the strongest corporations based on the principles of trust, integrity, security, quality, and sensitive customer service (American Express, 2021). The company demonstrated its financial stability during the most difficult times, including the stock market crash in 1987, the financial crisis of 2008, and the COVID-19 pandemic in 2020 (Reference for Business, n.d.). Despite the dramatic decline of the world economy during the coronavirus epidemic, American Express Managed to stay profitable with over $36 billion in revenues and over 3 billion in net profit (American Express, 2021). The company’s primary competitors are Mastercard, Visa, and Discover (Thangavelu, 2020). The present paper provides market analysis, assessment of stock market performance, profitability overview, and predictions for the company’s success in the future.

Profits and Market Environment

The market environment has a mixed impact on the profits of American Express. On the one hand, the financial market is rebounding after a significant recession in 2020 due to the COVID-19 pandemic (Business Research company, 2021). In 2021, the financial services market is expected to grow from $20.4 trillion in 2020 to $22.5 trillion in 2021 at a compound annual growth rate (CAGR) of 9.9% (Business Research company, 2021). This demonstrates that the market environment is expected to support the growth of profits of American Express. On the other hand, the traveling market experienced a colossal recession of 42% in 2020, which creates a negative environment for American Express’s growth (US Travel Association, 2021). The rebound timing in the traveling industry is unclear, as the spread of COVID-19 is difficult to predict (US Travel Association, 2021). Thus, the effect of the traveling market environment on the profitability of American Express.

Competition

Since American Express gains its revenue primarily from financial services, competition in the financial industry is observed. According to Thangavelu (2020), three major competitors of America Express are Discover Financial Services, Visa Inc., and Mastercard Inc. Visa and Mastercard have a different business model in comparison with America Express and Discover, as Visa and Mastercard operate payment processing networks that enable financial institutions to process credit card transactions (Thangavelu, 2020). Currently, the competition in the market is heated. Since American Express bears the risks as a card issuer, it can make the annual payments as low as its competitors (Thangavelu, 2020). Therefore, it is forced to target less affluent customers by issuing pre-paid debit cards (Thangavelu, 2020). In 2021, American Express had a credit market share of 0.15 estimated based on the revenues (CSI Market, 2021). America Express outperformed its competitors in terms of profitability (CSI Market, 2021).

Market Structure

The company’s market structure is believed to be an oligopoly. According to Colander (2020), an oligopoly is “a market structure in which there are only a few firms and firms explicitly take other firms’ likely response into account” (p. 321). In an oligopoly, firms are more likely to take engage in strategic decision-making, taking into consideration the response of the rivals (Colander, 2020). Between the two models of oligopoly, cartel, and contestable models, American Express operates in a contestable market as the barriers for entry and exit rather than the market structure (Colander, 2020). It is clear that financial markets are difficult to enter, as they require significant initial investments. At the same time, American Express clearly takes into consideration the decisions made by other members of oligopoly, including Discover Financial Services, Visa Inc., and Mastercard Inc. The fact that the company is forced to target less affluent customers demonstrates the need to take into consideration the reactions of the competitors (Colander, 2020). This example also shows that in an oligopoly, pricing is highly dependent on the specific legal structure within which firms interact.

Market Analysis

Brief Corporate History

American Express was founded in 1850 as a freight forward company, which helped to transport people around the country (American Express, n.d.). The company started to build its relationships with customers based so that they can trust the transportation of most valuable possessions to the company. In the early 20th century, American express introduced financial services, which quickly gained popularity (Reference for Business, n.d.). In the 1950s, the company introduced a charge card, an innovative way of paying for goods (American Express, n.d.). In the late 1980s, American Express started offering its clients Optima Card, the first credit card in the modern understanding (Reference for Business, n.d.). The company also believes that its major milestones in corporate history include the introduction of Small Business Partnership in 1987, creation of the Membership Rewards loyalty program in 1991, the introduction of the Small Business Saturday program and Shop Small movement in the early 2010s, and launching American Express application in 2010 (American Express, n.d.). In summary, the history of the company demonstrates its gradual development to becoming one of the most prosperous businesses in the US.

It is crucial to note the company’s ability to deal with uncertainty associated with market instabilities. In 1987, after the stock market crash, the company managed to stay profitable due to the diversification of its business (Reference for Business, n.d.). In particular, the company used its presence in the traveling business to sustain its financial position and utilized aggressive marketing and extension of the product line to restore after the crisis (Reference for Business, n.d.). In 2008, the company managed to stay profitable with almost $2.7 billion in net profit, improved its liquidity, adjusted its short-term strategy to minimize losses, and prepared for long-term growth after the economy rebounded (American Express, 2008). Such historical adjustments made the company trusted by millions of investors and customers around the globe.

In 2020, after the financial crisis associated with the COVID-19 pandemic struck almost all industries, American Express received a chance to prove its stability to all the stakeholders once again. In 2020, the company continued implementation of its long-term plan despite the instability of the market. In particular, it received approval to begin operations in China and partnered with 17 banks to issue American Express credit cards (American Express, 2021). The company continued its expansion by adding 3.7 million new locations outside the US (American Express, 2021). American Express also altered its short-term strategy to support its employees, protect the customers and the brand, remain financially strong, and restructure the company for growth (American Express, 2021). Thus, American Express proved its ability to generate profits even in the most difficult times.

Current Issues

COVID-19

The COVID-19 pandemic had a tremendous impact on all aspects of people’s lives around the world. According to World Health Organization (WHO, 2021), there were 158,651,638 confirmed cases and 3,299,764 confirmed deaths from coronavirus in the world by May 11, 2021. Even though the effectiveness of vaccines was confirmed by numerous studies, there is still a danger that new waves of the pandemic will develop in the future. For instance, in India, the number of new cases of coronavirus reached 387 thousand people every day (Our World in Data, 2021). COVID-19 pandemic reduced household and business activity, decreased creditworthiness of the customers, decreased ability of the employees to carry out their duties, and increased financial burden due to implementation of risk management policies (American Express, 2021). These impacts may continue to affect the company even when the outbreak is over; thus, it is crucial to make strategic decisions based on the risk.

Brexit

American Express acknowledges the fact that the exit of the United Kingdom (UK) from the European Union (commonly known as Brexit) can negatively impact the operations of American Express. The company’s management acknowledges that the fact that Brexit can lead to the deterioration of the economic environment in the UK and other countries can lead to a decrease in revenue (American Express, 2021). This risk is associated with legal uncertainty around the new relationships between the UK and all the other countries. However, after January 2021, the uncertainty is believed to have decreased as the new agreement was achieved (Veron, 2021). In particular, the danger of partial default has faded away, which had a positive impact on financial markets and the financial industry around the globe (Veron, 2021). However, Brexit still remains a major uncertainty for the market.

Intense Competition

The oligopoly in which American Express operates is characterized by intense competition and a constant decrease in profit margins to capture a larger market share (CSI Market, 2021). Visa and MasterCard have a different business model in comparison with American Express, which makes them less affected by risks (Thangavelu, 2020). The management of the company acknowledges the problem and makes strategic decisions taking this issue into consideration.

Government Regulation Issues

American Express is subject to significant supervision from the government authorities in a wide variety of instances. In particular, the company needs to adhere to banking regulation of activity, acquisition, and investment, capital and liquidity regulation, consumer financial products regulation, and payments regulation (American Express, 2021). In 2021, the US government finalized the regulatory reform, according to which all the banks and holding with assets of above $100 billion are categorized into one of four categories (Davis Polk & Wardwell LLC, 2019). These rules require to assess and report several risk factors to the US government, which may cause additional costs and compliance issues (Davis Polk & Wardwell LLC, 2019).

Since American Express entered the market of online payments competing with AliPay, ApplyaPay, and GooglePay, it needs to comply with payment regulations, which differ depending on the country. In some countries, the company that provides payment services should be locally listed, while European countries and Australia focused on interchange fees and rules that govern merchant card acceptance (American Express, 2021). Finally, the company needs to adhere to privacy, data protection, and cybersecurity regulations, which were growing stricter for the past several years due to numerous security breaches in large corporations (American Express, 2021). The fact that the company needs to adhere to numerous regulations creates a significant managerial burden for the company, increasing associated costs and risks.

Business Model

The business model adopted by American Express is guided by the idea of scarcity. The concept of scarcity is the idea that the resources are limited, while human desires are unlimited (Colander, 2020). Thus, the company aims at utilizing the limited resources to maximize the profits and benefits for its customers. The company decided to provide credit services instead of collecting fees for a transaction like Visa and MasterCard (Bhasin, 2019). The company’s management decided that they should concentrate on the promotion of spending more rather than increasing the fees for using the cards. The decision was an economic tradeoff, as American Express decided to take more risks associated with bad debt and increased volatility to avoid competing MasterCard and Visa in their very hectic niche. The decision was made according to the principles of the rational decision-making process, as turning to the model ensured that the company utilizes its exceptional strengths, such as high brand recognition, high market capital, and unique credit card schemes (Bhasin, 2019). Even though there are several weaknesses of this business model, it fits the company the best.

Stock Analysis

Financial Position

Selected Financial Data

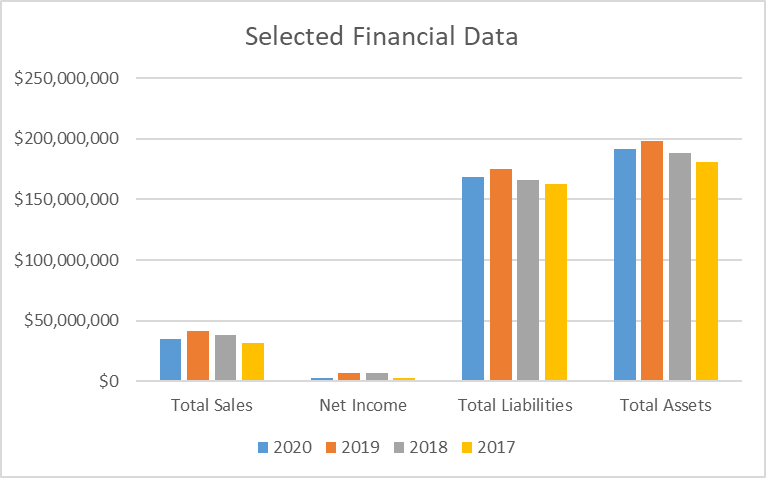

American Express experiences significant issues with the growth rates of its revenues, profits, and assets due to the financial crisis associated with COVID-19. The information on total sales, net income, total assets, and total liabilities for the past four years are provided in Table 1 below. Table 2 demonstrates the changes in growth rates calculated from the values in Table 1. Figure 1 visualizes the changes in the selected financial data.

Table 1. Selected financial data for American Express in thousands (Yahoo Finance, 2021a).

Table 2. Growth analysis for American Express

The analysis demonstrates that American Express experienced a significant decline in its financial position in 2020 due to the pandemic (American Express, 2021). However, before the crisis, American Express was growing consistently for two consecutive years in sales and assets. Moreover, Sweet (2021) that even though the decline in revenues was significant, it was not as large as it was predicted. This implies that the company managed to take the necessary actions to minimize the impact of the pandemic. In 2021, the company’s financial position is expected to rebound, and the company will start growing (Sweet, 2021).

Ratio Analysis

Ratio analysis is crucial for assessing the financial position of the company. Gapenski and Reiter (2016) state that ratios can help to assess the financial statements of companies, evaluate their profitability, efficiency of management practices, liquidity, and financial leverage. Ratios are also crucial for comparing the performance of multiple firms to make investment decisions or analyze strengths and weaknesses. Several selected ratios acquired from MorningStar (2021) are provided in Table 3 below.

Table 3. Selected financial ratios

The analysis of ratios demonstrates that the company experienced a significant decline in profitability and returns on investment. In particular, return on assets (ROA) and return on equity (ROE) decreased by 55% in 2020 in comparison with 2019 (MorningStar, 2021). This implies that the company’s ability to generate income from assets decreased (Gapenski & Reiter, 2016). Additionally, the company’s net profit margin was decreasing for two years consecutively. In 2019, the decrease was attributed to Brexit, while the crisis of 2020 was associated with the pandemic (American Express, 2021). However, it should be acknowledged that despite the global economic turndown, American Express managed to continue decreasing its level of financial leverage, which is demonstrated in the negative growth of the debt-to-assets ratio. Additionally, the efficiency of the company remained relatively stable. The fact that the company managed to mitigate the consequences of the pandemic is an optimistic sign.

Stock Prices

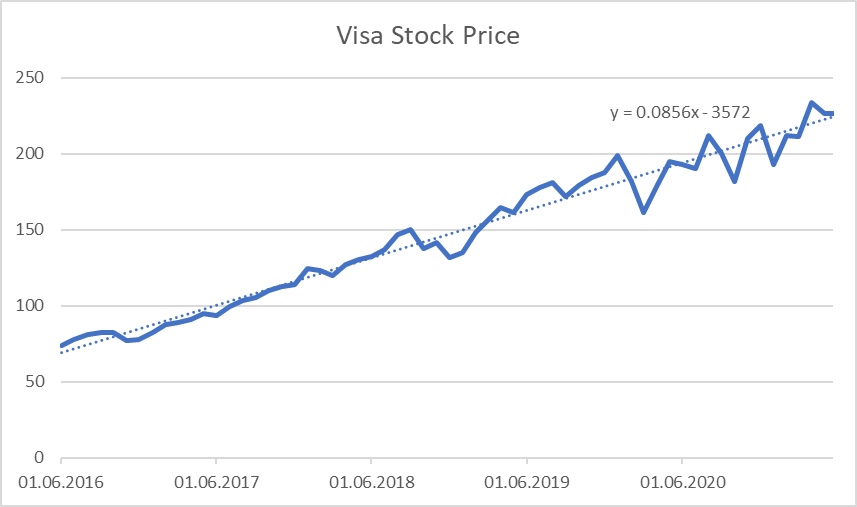

American Express demonstrated a stable growth of stock prices during the past five years. Figure 2 below demonstrates the changes in the stock price of American Express based on the Close value on the last day of the month taken from Yahoo Finance (2021a). The graph also shows a trend with a regression equation.

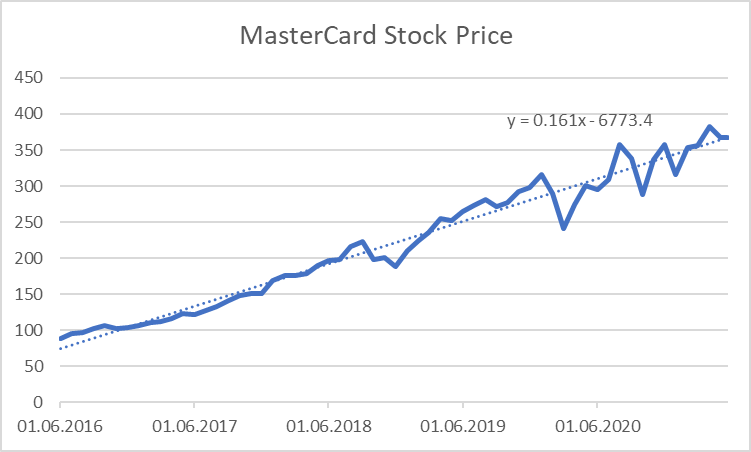

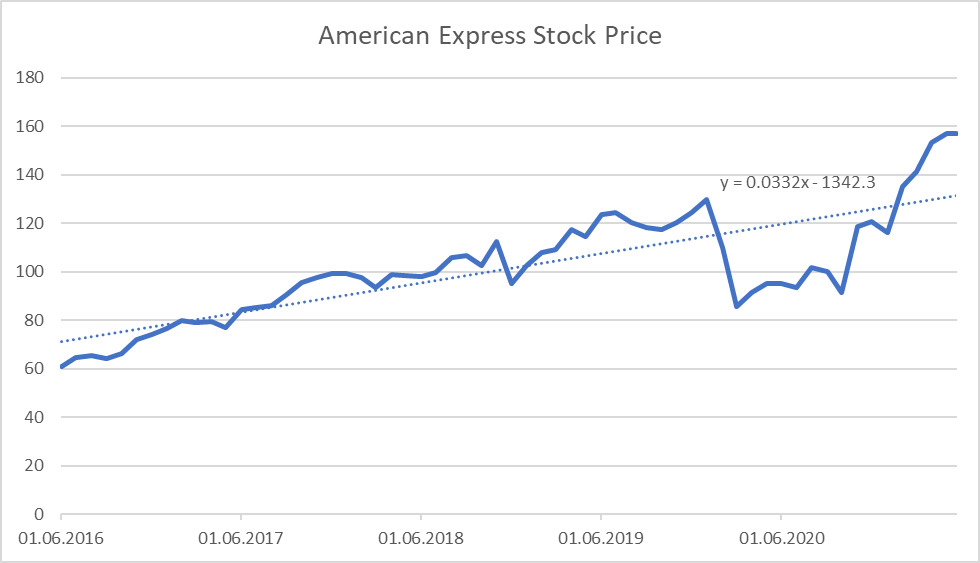

The graph demonstrates that the stock price of the company was growing at a relatively stable pace before the COVID-19 outbreak. In March of 2020, the stock price fell by 35% due to the pandemic (Yahoo Finance, 2021a). Appendix A shows the changes of the stock prices of American Express’s competitors (Yahoo Finance, 2021b; 2021c). While all three companies were affected by the pandemic, Visa and MasterCard’s stock priced rebounded within 2 months, while American Express needed almost 10 months to recover in terms of stock price (Yahoo Finance, 2021a; 2021b; 2021c). The primary reason for that is that American Express is more volatile to changes in the environment due to its business model (Bhasin, 2019). American Express bears the risks of bad debt and decline in consumption, as its business strategy was to encourage spending and to reduce service fees (Bhasin, 2019). Both Visa and MasterCard did not bear such risks, which helped them to avoid significant volatility during market instability (Thangavelu, 2020). As a result, the graphs of stock prices for Visa and MasterCard are almost identical (see Appendix A).

Forces Affecting Financial Performance

The forces affecting the financial performance are similar to risk factors mentioned in Chapter 2 of the present paper, with several additions. American Express acknowledges that its performance is affected by external economic factors, such as the COVID-19 pandemic, Brexit, and US-China trade wars (American Express, 2021). At the same time, government regulations of different countries also contribute to decreasing profit margins (American Express, 2021). In particular, the Dodd-frank Wall Street Reform and Consumer Protection Act, Federal Deposit Insurance act, and surcharge laws affect the company (American Express, 2021). At the same time, there are some social and technological forces that should be acknowledged.

The demand for online payment systems has grown significantly during the past ten years due to online shopping. In particular, the mobile payment market size was predicted to grow from $45.1 billion in 2012 to $224.3 billion in 2017, with average annual growth of 38% (Kang, 2018). The trend is both technological and social, as the demographics favor the development of online payment systems. American Express managed to launch its online application in 2017 with virtual credit cards, which helped it to improve its market performance (American Express, n.d.). However, this trend also has a negative impact on the company, as it needs to comply with an increased number of regulations around the world associated with data protection and cybersecurity.

Profits and Economies of Scale

Oligopoly brings significant limitations to American Express in terms of competition, profit generation, customers, and cost factors. First, oligopoly limits consumer choice, which may negatively affect consumer behavior (Colander, 2020). Second, the ability to generate profits is highly dependable on the strategies utilized by other members of an oligopoly (Colander, 2020). Third, while the competition is limited in terms of a number of competitors, it is still hectic, which pushes the companies to cut the prices to the point when the marginal cost will equal to the average cost (Colander, 2020). Fourth, oligopoly may promote collusion of companies, which may further decrease the competition. Finally, oligopoly creates significant barriers to entry due to economies of scale, complicated supply chain, and minimal capital investment requirements.

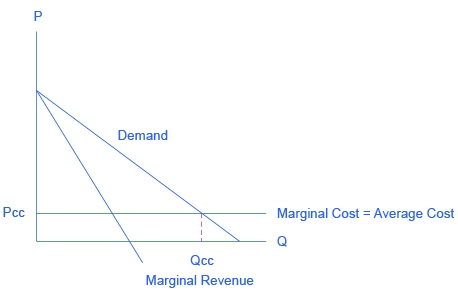

American Express has been successful in the market for three basic reasons. First, the company continued to decrease fees (reduce the price of services) in the cutthroat oligopoly competition. As a result, the long-run equilibrium will be reached at the point where the average cost equals demand, as shown in Figure 3 below (Greenlaw & Shapiro, 2018).

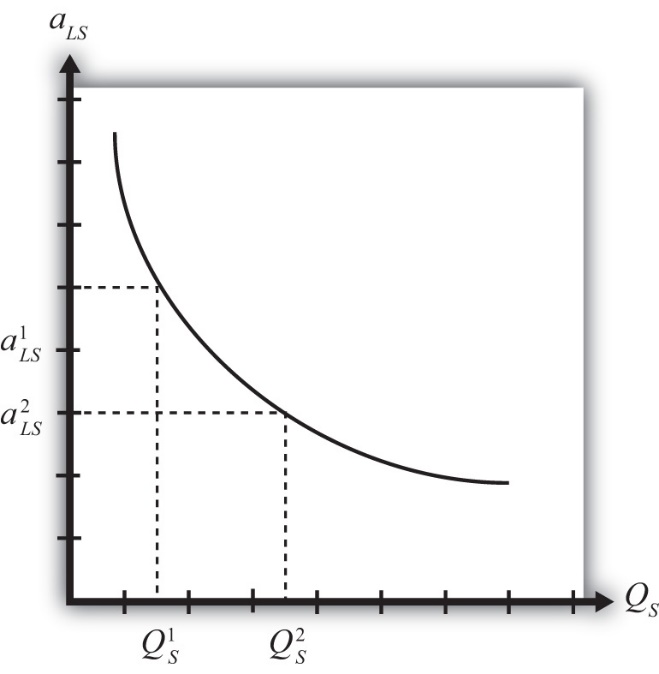

Second, American Express enjoyed the benefits of economies of scale (Bhasin, 2019). The central issue in the market is that the set cost of a global payment system is enormous, while the marginal cost of accepting one additional payment or issuing another credit card is relatively small or virtually non-existent, making the average cost decrease very fast with an increase in production, as demonstrated in Figure 4 below (Greenlaw & Shapiro, 2018).

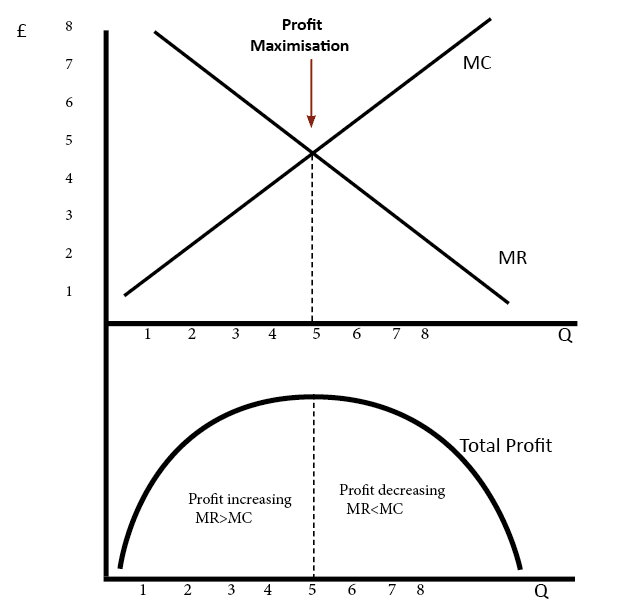

Finally, American Express managed to maximize its profits by continuously searching for equilibrium between marginal costs and marginal revenues, as demonstrated in Figure 5 below. As an example, the company decreased its total assets and paid off some of the liabilities to decrease the costs, as the revenues were slimming due to the decrease in demand (American Express, 2021).

Predictions

American Express is expected to be successful during the next year. There are at least factors that will contribute to the matter.

- The influence of the COVID-19 is expected to decrease in 2021, as control measures, such as vaccination and systematic screening help to reduce morbidity and mortality from the disease (WHO, 2021). As a result, the financial and purchasing activity is expected to rise.

- The banking industry is expected to rebound in 2021 after the significant fall in 2020 (Deloitte, 2021). The primary emphasis will be put on the development of online services as the pandemic increased the demand for online banking services (Deloitte, 2021). Since the technological side of online payments and banking is one of the central strengths of America Express, the company is expected to succeed in 2021 (Bhasin, 2019).

- The company utilizes a unique business model, which helps it to be a healthy alternative for the customers in the oligopoly. This business model proved its sustainability during the pandemic, helping the company to remain profitable (American Express, 2021).

Considering all the factors mentioned above, the current trends in the global economy, and the management’s ability to make rational decisions to maximize profits, the company is predicted to sustain its growth in 2021.

Conclusion

The COVID-19 pandemic is the primary concern both on macro- and microeconomic levels. On the microeconomic level, the pandemic decreased the demand for goods and services, which is reflected in American Express’s annual report for 2021 (American Express, 2021). The primary drivers for the decrease in demand were the governments that implemented lockdown measures to slow down the pandemic. The law of supply and demand forced many companies to reduce their production to stay profitable (Colander, 2021). This caused a decrease in profitability of firms around the globe, as they could no longer utilize the economies of scale. In other words, the fixed costs remained high, while the revenues deteriorated fast. American Express addressed the problem of high fixed costs by reducing the dependency on debt and selling some of the long-term assets (American Express, 2021). These managerial decisions helped the company to remain profitable during the time of high volatility of the outside environment.

References

American Express. (2009). Annual report 2008. Web.

American Express. (2021). Annual report 2020. Web.

American Express. (n.d.). Our history. Web.

Bhasin, H. (2019). SWOT analysis of American Express – AMEX. Web.

Business Research Company. (2021). Financial services global market report 2021: COVID-19 impact and recovery to 2030. Web.

Colander, D.C. (2020). Microeconomics (11th ed.). New York, NY: McGraw-Hill Education

CSI Market. (2021). American Express credit’s competitiveness. Web.

Davis Polk & Wardwell LCC. (2019). The final tailoring rules for U.S. banking organizations. Web.

Deloitte. (2021). 2021 banking and capital markets outlook. Web.

Gapenski, L., & Reiter, K. (2016). Healthcare finance: An introduction to accounting & financial management (11th ed.). Chicago, IL: Health Administration Press.

Greenlaw, S., & Shapiro, D. (2018). Principles of microeconomics (2nd ed.). OpenStax. Web.

Kang, J. (2018). Mobile payment in Fintech environment: Trends, security challenges, and services. Human-centric Computing and Information sciences, 8(1), 1-16.

MorningStar. (2021). American Express Co AXP. Web.

Our World in Data. (2021). Coronavirus Pandemic (COVID-19) – the data. Web.

Reference for Business. (n.d.). History of American Express Company. Web.

Regoli, N. (2019). 15 Oligopoly advantages and disadvantages. Web.

Sweet, K. (2021). American Express 4Q profit fell 15% on virus impact. AP News. Web.

Thangavelu, P. (2020). American Express’s main competition. Web.

US Travel Association. (2021). COVID-19 travel industry research. Web.

Veron, N. (2021). Financial services: The Brexit dust begins to settle. Web.

World Health Organization. (2021). Coronavirus disease (COVID-19) pandemic. Web.

Yahoo Finance. (2021a). American Express Company (AXP). Web.

Yahoo Finance. (2021b). Mastercard Incorporated. Web.

Yahoo Finance. (2021c). Visa Inc. Web

Appendix A: Stock Prices of Competitors