Introduction

Exploring the nature of the company’s microeconomics is an essential part of developing a successful strategy for its future growth. This paper will review the banking and financial management of the Russian company Sberbank, which began to expand globally in recent years. Frexias and Rochet (2008) describe banks as financial intermediaries, who “can be seen as retailers of financial securities” (p. 15). The purpose of this paper is to research the microeconomics of Sberbank, explore the state of the company on the market, and provide recommendations for its further expansion.

To begin the analysis, it is necessary to understand the past and the current state of the company. Sberbank originates from the Savings Offices, which was later transformed into the first bank and expanded into all major settlements of the Russian Empire (“Sberbank history,” n.d.). The company had a significant impact on the industrialization of the USSR and its success in World War II, and later became one of the primary drivers for modernization of the Russian economy (“Sberbank history,” n.d.). The company became less conservative and was open for investments, which allowed it to expand overboard (Sohn, 2019). The shareholders of the company are both Russian and foreign investors, however, the majority of the shares are held by the Central Bank of the Russian Federation, which began to sell the company’s shares in 1996 (“About Sberbank,” n.d.).The company has the most significant presence in CIS markets, it began to expand into Europe in 2013, and it also has branches in India, China, and the United States (“About Sberbank,” n.d.). The company’s existence relies heavily on its ability to resolve current issues and expand outside of the Russian Federation.

The company’s operation is being put at risk due to its attempt to restructure into a technology-oriented company. In the past few years, Sberbank has purchased multiple Russian IT companies, such as Yandex, Rambler, and Rabota.ru (Gorshkov, 2019). In late September 2020, the company has announced its transformation into a tech company that aims to digitalize all aspects of people’s lives via its services (Cordell, 2020). Sberbank has decided to drop “bank” from its name and strives to achieve the same structure as Apple and Amazon (Cordell, 2020). It has been planning to update its strategies since 2014, and the preparations began in 2018 (Gref, 2020). Cordell (2020) states that “the rebrand will cost $2.5 billion dollars and it will take the company approximately 6 years to complete the transition” (p. 23). This move puts the company in an unstable position, yet it promises a significant return on investments if this plan succeeds.

Supply and Demand Conditions

The current operation of the company results in increased possibilities for demand for currency conversions. According to monetary theory, the need for money occurs through transactions, with the economic levels being the main influencing factors. The approximation of the economic level activity occurs in GDP. In this case, the demand for currency conversion occurs by examining money against final transactions. As a result, Sberbank understands that money is assumed to possess a return rate of zero, with a nominal proxies rate through the holding of currency. That means the lower the incentive that holds cash, the higher the interest rates from token rates. For such to work, the primary coinage demand function occurs in the form of M/P = L(Y, i) (Brierley, 2016). M stands for the nominal money balances, Y is the country’s real GDP, P is the level of the price and I is the nominal level’s interest rate.

Trends in Demand over Time

According to a Sberbank survey, Russian households, especially those living in mid-size and big cities, save up to 62 percent sporadically or regularly. The main currency families normally choose to build savings as much as 94% is the Russian ruble (Gref, 2020). Those who save in dollars are only 11 percent, while 9 % prefer choosing the euros, only 2 percent save in other currencies (Gref, 2020). According to this survey, the euro and dollar-dominated savings usually give up poor yielding in terms of saving cash. However, Russian societies prefer saving in these currencies as it protects savings and helps in speculating the cross and ruble exchange rates. Thus, the company understands the market change in regards to saving structures, which will be shaping up in the next few years. That means rubble has been the primary savings mechanism in various banks in the country, however considering that interest rates go down in this regard, traders are now thinking of using alternatives.

Impact of Demand for Currency Conversion to Sberbank

By understanding the currency demand conversion, Sberbank has maintained a loyal and large customer base. The global customer base is almost 140 million customers, with approximately 2 million corporate customers. From 2014 to 2017, the country has expanded the 7.5 million people, making the corporate customers grow by over 190 000. Above all, Sberbank confesses that they have achieved notable results that bind customer relations. As a result, the past few years have increased the customer satisfaction level with the firm’s services among corporate and individual customers. The graph below shows the company’s average turnover from 2016 to 2019.

The graph shows an increment of monthly turnover, from 2016 to 2019, a fact that shows the organization’s mastering of currency demand conversion that has increased the company’s stability.

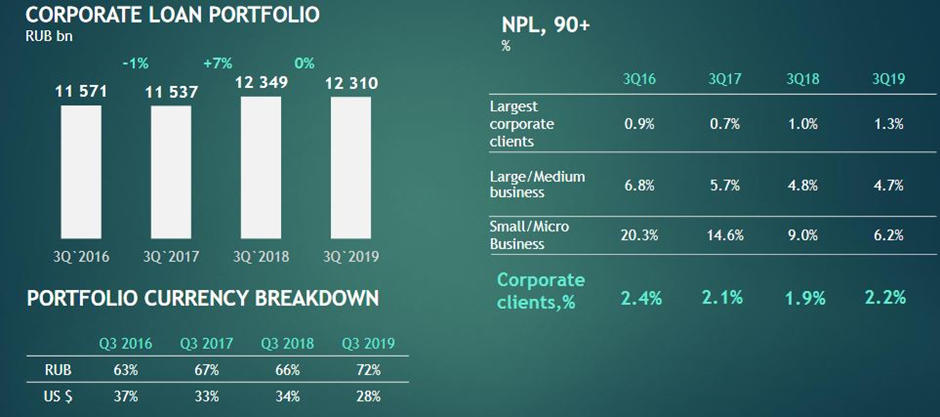

The company is now among the valued corporate lending firms, as shown in the following figure.

The figure shows the company’s stability over time, proof that the organization has been stabilizing, and that is why it is among the largest banks, with stable Russian citizens as its customers. The company is also symbolic of social responsibility with a proper innovative position.

Price Elasticity of Demand of Sberbank

The available data for Sberbank show that the company is among the central banks in Russia, and it provides all the services a bank can offer. They include presenting to the customer saving accounts, domestic and international credit cards, transfer, and deposit services, which are essential services that identify the institution. Therefore, it means that the bank is successful in serving the common person, although its pricing strategy requires more discussion. According to Russian people, the bank has personal savings and current accounts, with debit and credit cards; the loan is the firm’s leading supplier. The organization has a varied pricing strategy that relates to the customer segment. Price elasticity is the ratio that occurs between the quantity demand change in percentage or the supply, with the corresponding price change in percentage (Brierley, 2016). The demand price elasticity is a change in the percentage in quantity demanded of services and goods when divided by the price percentage change.

Table 1. The Russian Company Data

The elasticity of demand for the Sberbank will be as follows, considering the ‘total equity of the firm. The quality percentage change = the change in quantity in percentage/total change in quantity and multiplied by 100. Results will be divided by the change in price, which in this category is under the “Cash and short term investments”. The change in price in percentage will be 5, 321, 900 minus 5, 153 400, recorded in the same dates as total quantities. The results will be as follows. 4827600 – 4599600/ 4827600 + 4599600 x 100. = 228000/ 9427200 x 100.

- 0.0242x 100 = 2.42 %

- The change in quantity is 2.42 %

- Change in price in percentage will be as follows: 5321900-5153400/ 5321900+ 5153400 x 100

- 168 500/ 10475300 x 100 = 1.61.

- The price elasticity of demand for Sberbank is 2.42 % / 1.61 % = 1.5.

The determination of elasticity of demand is based on the data recorded as a purchase of the firm’s services from March to June of 2020. To get the quantity change from March to June, the total quantity of the two months, under the category of Total equity was subtracted. The amount was divided by the total quantity of the two months. To change to percentage, the results were then multiplied by 100. The procedure was the same for the pricing, which was set under the cash and short-term investment. It was assumed that the price caters to the total quantity invested in March and June, and the data used for this calculation is highlighted above.

Consumer responsiveness is affected by various factors, including an increase in population. The increase in population increases the individual per capita in terms of income levels. Such fuels the need for banking services not only in this country but also worldwide. Another factor is proper pricing on debit cards, saving accounts, and deposit rates, among other related services. The price elasticity of demand influences this firm’s pricing decision. The choices regarding prices ultimately lead to revenue growth as per the firm’s price elasticity demand. For example, a negative change that occurs due to a firm’s change in quantity demanded due to price will limit the consumer’s purchasing ability, downgrading the firm’s revenue. Sberbank offers prices that target the consumers’ knowledge, and thus quantity demand increases, which later leads to the organization’s revenue growth.

Cost of Production

From the revenue, net income and cash flow as noted in the following table, it is clear that apart from the results dated 6/30/2020, the organization’s revenue and net income have been increasing.

Table 2. Russian Company Data

The information means that Sberbank’s production cost has been favorable to the extent of supporting the organization’s growth. Sberbank is a technology-invested company, and thus most of its production is through expertise. For instance, the company operates on its own cloud and thus offers a unique experience of use and receiving infrastructure. Ordering of services is through a portal, which makes it easier for the execution of requests as well as infrastructure issues in reduced time. This event is helpful as it accelerates the product output making the bank more effective. The performance of the resource request is dependent on the peak and level of the loads needed. The organization has created an internal tariffing, making it easier for accounting to be kept in real use with the available assets. The efficiency and the firm’s fast ability to execute commands and services are helpful in meeting its demands and reliability, hence profiting the firm’s business.

The concept of variable and fixed cost has empowered Sberbank to reach the current level of service provision in the country. The fixed cost offers expenses that are predetermined but remain the same throughout a specific period. For instance, Sberbank has, for a period, stuck on the static expenses in offering debit card services. As a result, the organization has loyal followers; however, in terms of the loan, the company employs variable cost mechanisms, which change over time to help clients fit into the plan they choose.

Overall Market

Sberbank operates in multiple markets, where it possesses various shares operating on the institute’s strengths and vulnerabilities. Gorshkov (2019) states that Sberbank has a “28.9% share in assets, 32.4% in corporate loans, 40.5% in household loans, 20.9% in corporate deposits, 46.1% in individual deposits, and 39.3% in the capital” (p. 7). Sberbank Factoring, financial services for enterprises, retained its portfolio in the first quarter of 2020 and increased its market share to 22.2% (“Sberbank increases its market share,” 2020). Moreover, the company has a significant presence in Kazakhstan, Ukraine, Czech Republic, Austria, Serbia, Croatia, and other CIS and European countries (Gref, 2020). Cordell (2020) states that Sberbank is “Russia’s most valuable publicly-listed company with a market capitalization of more than 5.2 trillion rubles ($67 billion)” (p. 25). The current situation for the company allows it to take risks and experiment with new technologies.

Due to the state of the banking industry in the Russian Federation, barriers to entry are set extremely high. Primary competitors of Sberbank are other state-controlled banks, such as VTB, Gazprombank, and Rosselkhozbank, while private-owned banks lag behind (Gorshkov, 2019). Their shares of assets are 15%, 7%, and 4% respectively, and the largest private bank owns 4% of the sector (“State banks dominate the Russian banking sector,” 2019). This situation, while unhealthy for the market, can be viewed as positive for Sberbank.

The position of the firm on the market is stable, as it experiences constant growth and surpasses its competitors by a large margin. Moreover, the share of the state-owned banks grows steadily, while the presence of private banks diminishes, reducing the pressure from the competition (Gorshkov, 2019). Strategies of the other state-controlled banks in the Russian Federation include expansion beyond financial services as well (Gorshkov, 2019). Therefore, the market can be described as an oligopoly that features high barriers to entry. Being the largest bank in the Russian Federation in terms of operations, the company has already begun to seek new opportunities to gain more leverage abroad.

Conclusion

As Sberbank aims to expand its services beyond banking and financial intermediation and become an Amazon-like technology provider, this task requires global access to the market. At this moment, the company is held down by the restrictions that were placed on some of its subsidiaries and affiliates by the United States and the European Union (Sohn, 2019). This incident significantly impaired the company’s ability to expand, led to many lost possibilities, and forced Sberbank to change its future plans to comply with these sanctions (“Sberbank CEO: U.S. sanctions on Russia,” 2019). One of the possible exits from this situation is to lower the state-owned percentage of the share, as it was one of the main reasons Sberbank has been added to the list of sanctioned companies (Sohn, 2019). It is essential to come with a solution to this issue first, as it places the company under unnecessary pressure which could impair its transformation.

The company can use Amazon’s business strategy as an example of its own future production. While the presence of Amazon and Apple on the Russian market is relatively small, outside of this country it will be difficult for Sber to obtain a significant share. Current plans of the company include a copy of Amazon’s services, such as streaming services, the virtual assistant, the market platform, and others (Press Trust of India, 2020). However, at this moment, it seems to lack innovative ideas to become truly competitive. It has to resolve this issue and take all measures to assume the position aimed at all customers across the globe and adopt trends as they become promising, instead of reacting to the emerged ones.

As new technologies continue to emerge, it is vital for the company to keep a close look at their efficiency for the planned expansion. Such technologies as neural networks, cloud storage, and the Internet of Things had a significant impact on similar companies’ performance, and Sber needs to adopt them in order to become competitive. Sberbank must become the force of innovation instead of aiming to satisfy customers’ demands if it wants to create a sustainable technology provider.

References

About Sberbank. (n.d.). Sberbank. Web.

Brierley, D. (2016). Sberbank sees ‘signs of stabilization’ in Russia, but asset quality remains in focus.

Cordell, J. (2020). Russia’s Sberbank unveils sweeping transformation into a tech company. The Moscow Times.

Gorshkov, V. (2019). The State in Russia’s banking sector. Kyoto Institute of Economic Research [PDF document].

Gref, H. 2020 Sberbank Strategy [PDF document].

Press Trust of India. (2020). Russia’s Sberbank enters tech space; to compete with Google, FB, Amazon. Business News. Web.

Sberbank CEO: No end in sight for U.S. sanctions on Russia. (2019). Russia Business Today. Web.

Sberbank history. (n.d.). Sberbank. Web.

Sberbank of Russia: Factoring increases its market share by 3pp to 22% in 1Q20. (2020). MarketScreener.

Sohn, E. A. (2019). Russia sanctions: The exception or the rule? KYC360.

State banks dominate the Russian banking sector. (2019). BOFIT.

Stock Analysis Report (n.d). Sberbank of Russia. Web.