Abstract

More than 48 million Americans do not have health insurance, and some of those who are insured are underinsured, comprising of more than 32 million people. Carrying out health care reform would ensure every person in the country has access to proper health care. This assists to a large extent in regard to cutting down the costs. The households, businesses, and the entire economy, in general, would derive great economic benefits.

People who might be against the health care reform must reconsider their position by looking at the benefits that come with the reform to have a National Health Insurance. Taxing the rich to finance the health insurance for all the people in the country should be considered as a positive move because this benefits the majority in the community.

Introduction

The “National Health Insurance” (NHI) is a program under which individuals in a country are insured for the “costs of health.” It can either be the responsibility of the public sector or the private sector to manage the NHI. However, there are also situations where the management is carried out jointly by both the public and private sectors.

The funding system for the “National Health Insurance” is not similar among nations; each country may follow its own system in funding it… In some nations, the payments to the NHI are carried out through taxation. This implies that they aren’t voluntary even if members of the “health scheme” the insurance finances is voluntary. In practical terms, a large number of people that pay for the National Health Insurance become members of the scheme.

In the absence of a “National Health Insurance,” many people in any particular country incur the high costs of health care, and possibly, most of them can not access health care services following the high costs. This problem can be solved by carrying out health care reform to have people to be insured. Taking the case of the United States, more than 48 million people are not insured (“HealthCareReform.org,” 2011).

Even those people who insured are underinsured (McCanne, 2004). According to “HealthCareReform.org” (2011), more than 32 million people in America are underinsured. By the country carrying out health care reform, this will save costs incurred by people, and their standard of living will be improved.

In this paper, an economic analysis of a National Health Insurance is going to be carried out in the United States context. But before the analysis is done, there is going to be a presentation of the historical background of the National Health Insurance.

National Health Insurance in the U.S – Historical Overview

According to “The Henry J. Kaiser Family Foundation” (2009), “many believe the United States is on the brink of national health reform…heath care costs seem uncontrollable while 46 million remain uninsured” (Page 1).

The level of the quality of health care is low as “many people come to realize that the United States doesn’t take the lead internationally in regard to the health of its citizens in the country” (“The Henry J. Kaiser Family Foundation,” 2009, pg.1).

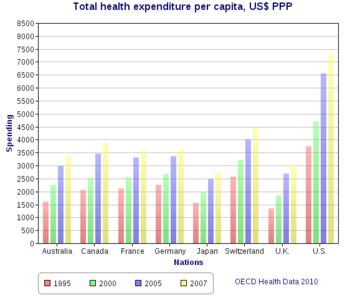

Besides, the health expenditure per capita of the U.S is the highest compared to other countries in the world, especially when compared with the other developed countries. This trend has been increasing with each coming year (OECD Health Data, 2010). This is shown in the graph below.

Source: OECD Health Data, 2010

It is pointed out that these problems “resonated during the 2008 presidential campaign where health reform held its own among the top issues, even after the economic crisis began to overshadow the election” (“The Henry J. Kaiser Family Foundation,” 2009).

At that time, the costs associated with health care were regarded as a major portion of the “pocketbook concerns” of the United States of America. “And now a White House Office on Health Reform is being newly established, while seasoned members of the Congress are readying proposals of their own” (“The Henry J. Kaiser Family Foundation,” 2009, pg. 1).

However, the United States has been on the brink of “national health reform” severally before. For instance, in the course of the twentieth century, some proposals started to give way.

In the year 1912, as it is pointed out by “The Henry J. Kaiser Family Foundation” (2009), “Theodore Roosevelt’s Bulls Moose party campaigned on a platform calling for health insurance for industry; and as early as 1915, Progressive reformers ineffectively campaigned in eight states for a state-based system of compulsory health insurance” (Page 2).

It is further pointed out that the most famous reformers of the decade that followed who were “Committee on the Costs of Medicare”, came up with a proposal to have “group medicine’ and “voluntary insurance” and following this, the term “social medicine” came up (by “The Henry J. Kaiser Family Foundation”, 2009).

In the course of time, the “American Public” has, in general terms, been supporting the “goals of guaranteed access to health care and health insurance for all, as well as a government role in health financing” (“The Henry J. Kaiser Family Foundation,” Page 1). Yet, this support naturally shrunk at the time the health reforms were conditioned on people that needed to make more contributions to the costs.

As on the one hand there may be large support by the general public for having reforms carried out on the health care system, on the other hand, “no particular approach towards achieving it rises above another in polls – perhaps not surprising given how complicated, yet personal, health care policy is” (“The Henry J. Kaiser Family Foundation”, 2009, Pg. 1).

Historians do engage in debates over a number of reasons while there has been no success in regard to the NHI proposals. The reasons include; “complexity of the issues, ideological differences, the lobbying strength of special interest groups, a weakened presidency, and the decentralization of Congressional power” (“The Henry J. Kaiser Family Foundation,” 2009, Pg. 1).

In the course of the last five decades, there has been the enactment of major health reforms in which it has been an indication of popularity for them among people, and there has been the improvement of access to health by many people. These reforms have been through “Medicare, Medicaid, and Children’s Health Insurance Program” (“The Henry J. Kaiser Family Foundation,” 2009, Pg. 1).

Very important lessons can be learned from the way these reforms were achieved and also from the attempts made to acquire the National Health Insurance. These lessons may help in achieving new health reform ways while avoiding mistakes that have been made in the past in this regard.

Economic Analysis of the National Health Insurance

According to Carter (2009), “an analysis of the new National Health Care Reforms proposed by President Obama and Congressional Democrats reveals some challenging decisions facing them ahead: rising health care costs placing U.S households in financial turmoil with an estimated 46 million uninsured Americans” (Page 1).

Many people present questions in regard to what the reason for this is and how this can be effectively dealt with. Carter (2006) points out that “the Democrats have been working to create a fundamental program designed to help lower the costs as well as create competition” (Page 1).

President Obama, together with the Congress, came up with a proposal to have health care reform. In the reform, it is planned that we have “slow health care cost growth” (Carter, 2009). The main objective of this is to have health care that is affordable by all the people in the country, to ensure all the people who are not insured totaling to over 45 million people.

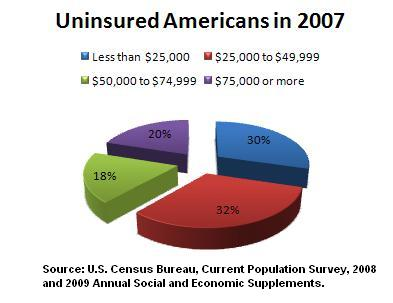

Basing on 2007 statistics, in total, the number of Americans who were uninsured was forty-five million people. Out of this number, 62 percent live in households that receive an annual income below fifty thousand dollars, and only 38 percent live in households that receive more than fifty thousand dollars annually (U.S Census Bureau, 2008). The actual statistics are shown in the chart below.

In the case where there is slowing of the cost down, this will lead to an increase in the standard of living and having market efficiencies. This would also serve to “free up resources” to assist in bringing about other “goods and services” that are desired. The governments (local, state, and federal) have already put in place programs that are aimed at assisting the poor people and the elderly, and these are the Medicaid and Medicare programs.

The cost of living is becoming higher and higher, and this is making a number of people in American society to forego their “health care coverage.” In the short run, unemployment would be lowered, and the level of employment increased through “containing health care costs and not experiencing inflation” (Council of Economic Advisors, 2009, pg 29).

In regard to the “National health expenditures” as a share of GDP in the United States of America, as per the year 2009, this stood at 18 percent. However, this figure is projected to move to as high as 34 percent by the year 2040 if no necessary reforms are carried out (Council of Economic Advisors, 2009, pg 29). The graph below represents this information more clearly.

Source: “Council of Economic Advisors,” 2009.

According to the “Council of Economic Advisors” (2009), by carrying out the expansion of the “health care coverage” in order to involve a large number of people who are not insured could most likely bring up the level of “life expectancy, reduce financial risk and the total cost of insuring them…improving health care would also likely increase the labor supply by reducing disability and absenteeism at the workplace” (Council of Economic Advisors, 2009, pg. 35).

There would be a workforce that is healthier, and this would subsequently result in increased productivity and an increased gross domestic product.

There would no be competition between small and large business organizations for the laborers who are more talented due to having in place a system that is much more equal. There would be less likely for the workers to quit their jobs because of “health care benefits (Council of Economic Advisors, 2009, pg 35)

The increasing costs for health care have great negative effects on the well-being of the families. For a number of workers, “health insurance is obtained as part of their total compensation package along with other fringe benefits, such as paid leave or retirement plan (Office Management and Budget, 2009).

The cost of health care has moved up with the “employer-sponsored health insurance premiums” (Office Management and Budget, 2009). A large number of small business organizations are carrying out changes either by employee termination or “downgrading” the employees present “compensation plans” causing these employees and those who depend upon them to have to “pay more out-of-pocket” for visits among others.

As a result of this, there would be a higher portion of the employees’ expenditure on “deductibles and co-payments.” The main objective here is to increase the amount of money put by employees in their pockets rather than reducing the amount. This “would only place burdens on families, causing them to cut-back” (Carter, 2009, pg. 3).

In considering small companies, a large number of these companies have not been able to effectively compete with the large ones as a result of the absence of the health benefits. The employees are quitting their jobs in small companies to look for work in larger companies where they can obtain substantial health care benefits (Council of Economic Advisors, 2009).

The health care reform would enable the small companies to be in a position of affording the same level of “health care compensation packs” as the larger companies. As a result, this would facilitate fair competition among companies regardless of their sizes.

At present, there are great inefficiencies in the sector of health care, “everywhere from loss of medical documentation causing duplicate tests to high administrative costs” (Office Management and Budget, 2009). This causes the medical practitioners to use “duplicate procedures,” which eventually result in “unnecessary costs.” That is why there is a need to put improved technology in place.

According to Carter (2009), “while technology is a big deal, the fact that there are so many families and individuals without health insurance is even bigger” (Page 4). Basing on an economic point of view, in most cases, the consumers are in a position to buy commodities as well as services in a “well-functioning market.”

However, this is not always the case in the “health insurance market.” In this market, there is a large number of “market failures,” and as a result of these, the costs and benefits which the families experience turn out to be different from the “true costs and benefits” (Carter, 2009).

According to Carter (2009), insurance companies use “underwriting” as a “safe-escape.” Carter gives the definition of the term “underwriting” as “a process of issuing insurance while calculating the amount of risk” (Carter, 2009, pg. 4). A large number of firms add a “premium risk” fee on the initial price, and this sometimes causes the price to “skyrocket” (Carter, 2009).

Following this, many people are compelled to essentially fail to pay and give up their “health care insurance.” “When underwriting, insurance companies usually will do a thorough background check to discover any risks the individual may have” (Carter, 2009, pg. 4).

This mostly brings about a “denied stamp” for the person. According to the “Council of Economic Advisors” (2009), a survey conducted by the “America’s Health Insurance Plans” established that “in a sample of about 1.5 million applicants underwritten for coverage, among those between 50 to 64 years of age, approximately 22 percent of applicants were denied coverage based on medical underwriting” (Page 17).

Through the health care reform, the government would be in a better position to assist in reducing fraudulent conduct by insurance companies. This will serve to reduce the overall health care cost.

By ensuring that each and every American is insured, offering an opportunity for healthcare access, many lives can be saved. The people who might have been infected with those diseases that have a high chance of being spread can receive treatment in good time before others are also infected. This would turn out to be a big “external benefit that would bring about a “higher health outcome” in the country.

According to the “Council of Economic Advisors” (2009), another proposal presented in health care reform made in a way that it would facilitate reduction of administrative costs for the health care staff and the hospitals in general is to ensure creation of “a standardized electronic billing, benefit determination, preauthorization and patient payment determination method that could be used by all providers and payers and lead to administrative simplification” (Page 19).

In the United States, there is a problem of people staying in the workforce for a longer time. A large number of people who are within the age bracket of 54 – 64 years have remained in the workforce. The reason for their stay is that they want to attain the age of 65 years in order for them to qualify for having Medicare, and this eventually affects the supply of labor.

In a situation where the health reforms are carried out, these people will find it to be pointless to stay in the workforce, and this results from having health care that is generally affordable for all the people in the country. Following the reforms, individuals will have to decide to quit their jobs at an earlier time.

The employees will experience the freedom to switch to a job they may consider they are well-equipped for at a higher level without having the fear about the limitations brought in by the health insurance.

In regard to tax implications that the health reform may bring in, it is stated that people who make less than two hundred and fifty thousand dollars per year will not be taxed. The people to be taxed are those who are considered to be rich, belonging to the upper class. They are those earning more than three hundred thousand dollars per year.

Those who do not support the reform, especially the Republicans, argue on the ground of tax increase to the rich. However, it is not ethical to “draw a line between life and costs (Messerli, 2009). Taxes have always been paid and are paid in America. Therefore, making those who are rich to pay a little more in order to assist the country in deriving the country benefits would not cause much harm.

Conclusion

The need for health care reform in the United States of American is not a new idea. The idea of health care reform was at one time introduced in the year 1993 by the then president, Clinton. The reform is aimed at ensuring all the people in the country by putting in place a “National Health Insurance” scheme. The “The National Health Insurance” has many economic benefits to the American people.

The parties that would enjoy the benefits include the business organizations, households, and the economy of the country as a whole. The lack of efficiency in the American health care system brings in many complications.

However, by carrying out the health reform, this problem would be done away with. In the course of time, after taking a new direction, this would bring about great gains for the American “health care system.” Some people may not be in support of the health care reform, but they are supposed to be made to understand the great economic gains that could come with health care reform.

Those people who emphasize the idea of raising higher taxes on the rich as a way of dismissing the reform should consider everything keenly. Keen consideration would enable them to realize that, by the rich paying a little bit more to support a plan that is aimed at benefiting everyone in the country does not hurt much.

References

Carter, M. S. (2009). National Health Care Reform a Must.

Council of Economic Advisors (CEA). (2009). Health Care Reform. Executive Office of the President.

“HealthCareReform”, (2011). American Health Care Reform.

McCanne, D. R. (2004). A National Health Insurance Program for the United States.

Messerli, J. (2009). Balanced politics.

OECD Health Data, (2010). Total health expenditure per capita PPP, 1995-2007.

“Office Management and Budget”, (2009). The White House.

“The Henry J. Kaiser Family Foundation”, (2009). National Health Insurance – A brief history of reform efforts in the U.S.

U.S. Census Bureau, (2008). Income, poverty, and Health insurance coverage in the United States: 2007. Web.