Introduction

A.P Moller-Maersk group was first established in 1904 as a company that focuses on delivering transport and logistic services. The organisation is a pioneer in the port and shipping industry with over 110 years of experience. The company has expanded its activities to energy solutions, creating a standalone energy division. It has more than 88,000 employees and operates in more than 130 countries. The subsidiary of this group, Maersk Container Industries and APM terminals, mainly focuses on handling logistics and transport services. It has a great team that has been provided with a good working environment with a unique culture that extends to all of its departments worldwide. This report provides the management and leadership theories that the organisation uses to enhance their performance in the logistic industry. Furthermore, the report shows the organisation’s business strategy, culture, director agency problem, and the predominant logistic challenges that the organisation faces.

Management Theories Applied to the Organisation

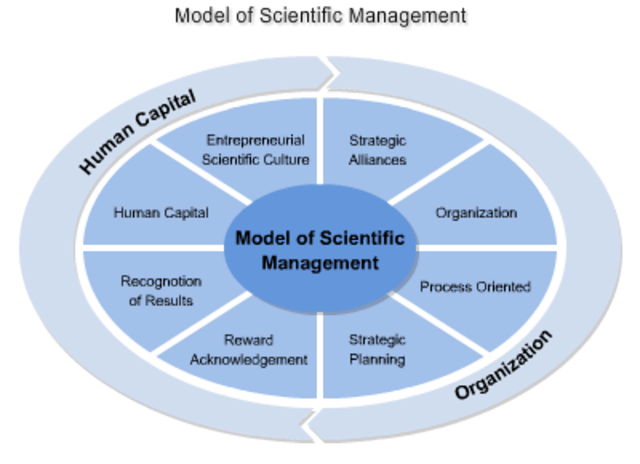

The management theories are implemented in modern organisations to enhance their performance in the business environment. Business organisations rely on several management theories to help them manage their day-to-day activities. These principles, guidelines, and frameworks play a crucial role in the company’s culture. The following are the management theories that the Maersk group implement in its daily activities. These include scientific management theory, systems management theory, and contingency management theory.

The scientific management theory was first proposed by a mechanical engineer named Frederick Taylor. The theory suggests that using force to enhance employee performance is not significant in ensuring the success of an organisation (Calvo and Calvo, 2018). It is essential that the managing section use task simplification to ensure that productivity within the organisation is attained (Found et al., 2018; Mazzarol and Reboud, 2020). Initially, many organisations did not have a standardised procedure for managing their employees, and motivation was the only tool to enhance their performance (Bakari, Hunjra and Niazi, 2017). Money was the key player in serving the interest of the best parties. Despite these factors being old-fashioned, Maersk employees are paid well, which makes it part of the motivation to deliver quality services (Mazzarol and Reboud, 2020; Dahlgaard-Park, Reyes and Chen, 2018). The current collaboration between the management team and employees of the Maersk group has also favoured their remarkable achievement in the market.

The system management theory brought an alternative method of running an organisation. This method proposes that an organisation is like a human body with several parts that operate in unison. The theory suggests that organisation success directly depends on the individual elements that make up the organisation (Mazzarol and Reboud, 2020; Dahlgaard-Park, Reyes and Chen, 2018). The components include interrelation, interdependence, and synergies between the organisation’s subsystems. The theory considers the employees a crucial part of the organisation (Found et al., 2018; Dahlgaard-Park, Reyes and Chen, 2018). However, other elements such as business units, organisation workgroups, and business departments are also significant (Found et al., 2018; Martineau and Racine, 2020). The managerial team has to consider these units’ operations to identify the best management approach. This enables the organisation to operate as a single entity rather than every element operating on its own as isolated parts of the same organisation. The Maersk group has several departments such as marketing, human resource, customer care services, financial, and management departments that enable the company to operate multinational.

The contingency management theory postulates that there is no single approach that suits the management of an organisation (Mazzarol and Reboud, 2020). Several internal and external factors impact the organisation’s performance (Found et al., 2018; Dahlgaard-Park, Reyes and Chen, 2018). The theory identifies various variables such as the leadership style implemented, the technology in operation, and the organisation’s size.

Leadership Theories Applied to the Organisation

The Maersk group’s leadership requires an individual capable of transforming to the changing conditions such as the COVID-19 pandemic and the changing technology. Various leadership theories apply to the Maersk group, such as trait theory, contingency theory, situational theory, and participative theory (Northouse, 2019). The trait theory assumes that individuals inherit certain qualities that make them suitable for certain leadership qualities. These qualities include courage and self-confidence that enable leaders to make critical decisions for organisational performance (Bakari, Hunjra and Niazi, 2017). The contingency theory focuses on the environment being the key player in determining the suitable leadership style (Corbett and Spinello, 2020). In this theory, no leadership style is ideal for a particular organisation. This shows that for an organisation to be successful, the leaders must adjust their behaviors according to the situation and the qualities of the followers.

The situational theory focuses on the leaders making decisions based on situational variables. This depends on the type of organisation and the knowledge and skills of the followers. The participative theory proposes that an ideal leadership style involves other members of the organisation in the decision-making stages (Bhattacharyya and Jha, 2018). This allows the members to share their input through participation in group forums (Thompson and Glasø, 2018). Maersk is an organisation that uses labor division to enhance its success in the oligopoly market.

Maersk Group Implementing Management and Leadership Theories

The setting up of Maersk Group into a logistic business was done in 1973. The company serves many businesses, individuals, and companies across the globe and local needs (Sornn-Friese, 2019). Several factors differentiate the Maersk shipping company from other multinational companies (Sornn-Friese, 2019). The company plans, manage and coordinate its business operations across many nations. The organisation and management of the companies start at the central headquarters, which sets up the strategies and goals of the company (Sornn-Friese, 2019). The company has a distributed control located in several nations to manage its business operations. It uses content management to provide a delegated decision-making structure that provides clear goals and career development for the organisation leaders.

The top managers of the Maersk group are located in the United States, Thailand, Japan, and Indonesia. These managers have played a crucial role in enhancing the organisation’s success (Sornn-Friese, 2019). This is portrayed by their action of enabling the company to expand globally. The success of this group began with the managers acting decisively on the setting up of the local services at the Panama shipping section (Sornn-Friese, 2019). They used their leadership skills to enhance the international knowledge regarding the Maersk group (Sornn-Friese, 2019). Initially, in 1974, the company had only 30 employees worldwide. The section of the company has managing director, marketing and sales, ship operations, finance and IT, and conference matters.

The development of the country offices led to the organisation’s expansion in major business areas in Asia, North America, Europe, and other parts of the world. The country offices were the trans-nationalisation step of the Maersk group as this was the revolutionary step that the organisation took (Sornn-Friese, 2019). Every country had its management board that handled the shipping and freight services. The organisation’s leadership connected all the offices, and employees were selected based on their qualifications of personality and intellect (Sornn-Friese, 2019). The company stationed employees in a given region for a certain period and later moved to another region (Sornn-Friese, 2019). The rotation of the employees from one region to another enables them to create strong ties with the organisation forming a “Maersk-blue brotherhood.” The leadership and management of the organisation enabled the company to expand its business.

Business Strategy

The business strategy of the Maersk organisation first began in 1985 when the management of the Maersk set a goal of the company becoming the most successful company in the shipping industry. To achieve the target, the company came up with three elements: door-to-door services, first-class services, and global coverage, and the three-element became part of the company’s motto (A.P. Moller – Maersk, 2018; Disanferdinand, 2018). The company required well-trained employees, technology, specialised shipping equipment, and set up customer care services to achieve these targets. A combination of all these made the company’s success attained (A.P. Moller – Maersk, 2018). Furthermore, the entrance of the company into several geographical markets and the experience the company had gained through Panama were sufficient to enhance the company’s performance.

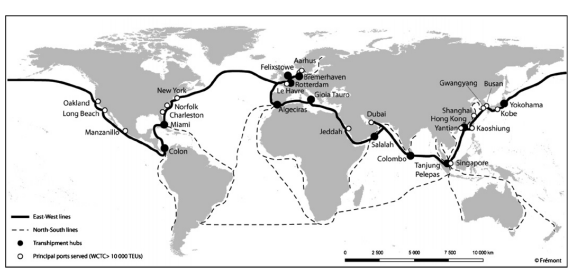

The establishment of the offices in several strategic locations is Maersk’s strategy to grow its business. These offices play a crucial role in the supply chain of the logistic industry (A.P. Moller – Maersk, 2018). The offices set up in places such as Africa, Europe, and Asia enhanced the expansion of their supply chain. Because of the rapidly growing business, the company expanded its network in West African nations such as Togo, Senegal, and Ivory Coast (A.P. Moller – Maersk, 2018). The Asia route to North Europe helps the company save on the shipping coast as they can deliver goods to West Africa through that route.

Maersk has the largest shipping network in the shipping industry, making it able to reach a considerable number of clients worldwide. The company makes a huge profit by transporting many containers to many parts of the world (A.P. Moller – Maersk, 2018). Currently, the company has channels in almost all countries that have access to the sea. Having large productivity is significant in lowering the cost of production (A.P. Moller – Maersk, 2018). This concept similarly applies to the Maersk Company in general. The company has many vessels, making them have a reduced cost of transportation, enabling them to increase their profit margins (A.P. Moller – Maersk, 2018; UNCTD, 2019). Furthermore, having many containers allows them to compete effectively, especially during price wars with other shipping companies. This is because they can reduce the shipping cost without significantly impacting their profit margins.

The company’s management is also among the strategy that the company uses to outsmart its competitors. Its effective management enables Maersk to use its vessels together with the hired ones, thereby reducing its operating costs in the market (A.P. Moller – Maersk, 2018). When the company experiences low demand, they usually terminate the contracts of the chartered vessels, enabling them to engage in other business activities and reduce their operation cost, hence minimising the chances of losses (A.P. Moller – Maersk, 2018). This strategy is essential because it allows the company to respond effectively to demand swings periods. Furthermore, the company usually increases its number of vessels through chatters, reducing the cost of purchasing new vessels.

When offering contracts to significant clients, the company usually allocates them up to 25%, which masks its profit from being negatively impacted by low prices in the market. Also, allocating up to 50% of capacity to medium and small clients with low bargaining power enables the company to negotiate better prices (A.P. Moller – Maersk, 2018). The Maersk group’s membership style has also helped the company to grow. This is because the company can access funds from the members, enabling them to finance new vessels to expand their supply targets (A.P. Moller – Maersk, 2018). This makes the company access cheaper funds to finance their projects than their competitors.

More affordable fund access also helps the company negotiate for lower prices without affecting its profit margins. The company’s marketing strategy is also effective in ensuring that the company can reach a large number of clients globally. These marketing strategies include door-to-door cargo delivery (A.P. Moller – Maersk, 2018). The customer care service has also enhanced the company’s performance by setting up policies that favor the customers. The policies include a refund guarantee if there is a problem with the shipping and timely notification whenever a delay has been experienced.

Internal Culture Influence

Maersk Company has a signifying culture that is implemented in all of its subsidiaries all over the world. The organisation’s headquarters and local offices have a multi-cultural staff that reflects the various global market in which the organisation operates (Verner and Michael, 2018). The organisation’s culture is reflected on five core principles set up by the core founder A P Moller. These principles include our employees, our name, constant care, uprightness, and humbleness. The five principles can transform the organisation whenever there are inevitable changes (Verner and Michael, 2018). The organisation can adapt to the market conditions and adjust itself effectively by following its culture (Verner and Michael, 2018). These values have enabled the company to thrive well at the international level.

The organisation can handle a cosmopolitan environment, allowing multiple offices in various geographical locations (Verner and Michael, 2018). The company has maintained the same culture in all of its offices regardless of the geographical location. The company operates in Copenhagen the same way in Taiwan and Japan, irrespective of regions with different cultural backgrounds (Verner and Michael, 2018). The company is always looking for motivated individuals who have professional skills in handling the logistic operations within the organisation (Verner and Michael, 2018). All the employees follow the organisation’s core values, making it operate in unison in its branches (Verner and Michael, 2018). These principles are the guidelines that navigate the company’s day-to-day operations. The interaction within the organisation is positive as the employees socialise with each other regardless of their ethnic background.

Pitfall Associated with Director Agency

The director agency problem occurs when the manager or the director of the organisation conflicts with the interest of the organisation’s shareholders. The director performs a task on behalf of the organisation with the company always looking for the best interest, which is profit maximisation and minimising the cost of operations (ElKelish, 2017). At one point, the director may end up operating in a way that the shareholders do not find significant (Guo, Mann and Reza, 2019). It may lead to loss of funds or even over expenditure on things that would not be necessary for the company.

Minimising Risks Associated with the Agency Problem

Although it may be difficult to avoid the agency problem, there are several ways the organisation may be able to minimise this problem. These include legal mechanisms, incentives, and compensation schemes.

Legal Mechanism

The agency problem is among the crucial areas of commercial law. The subjects involved in the agency have the same goal and are linked by a fiduciary relationship (Hoi, Wu and Zhang, 2019; Pokhodun, 2021). These people may have the same goal but differ in their objectives, leading to various conflicts of interest. Despite the commercial agents being self-employed actors, they are usually not fully independent as they are in the middle between the distributor position and the employees (Hoi, Wu and Zhang, 2019; Pokhodun, 2021). The principals usually select them to purchase or sell with a complete overview of the contract terms. Despite the principal being protected by the law, notable differences usually occur between the two groups in response to liability and compensation issues (Lazonick, 2017; Pokhodun, 2021). This occurs typically with agents dealing with international commercial agencies as they operate in different systems simultaneously.

As the company is entering into a new market environment, the principals do require the agents’ knowledge to enable them to avoid unnecessary expenditures, which may lead to overspending (Panda and Leepsa, 2017; Pokhodun, 2021). This provides the agent with a job opportunity to operate within a contract, which benefits the two parties (Panda and Leepsa, 2017). However, as the agent possesses more information on state affairs, they find it an opportunity to benefit themselves without considering the principal’s interest. This usually results in a conflict between the two parties, affecting their relationship.

Therefore, it is crucial to identify the causes of the misalignment of incentives to lower the adverse outcomes. Also, risk aversion is among the factors that lead to the agency problem as the two parties have different risk preferences. The agents prefer ventures that have low risk despite having low profits, while the principal has a considerable risk to take (Rossi, Boylan and Cebula, 2018). The legal measures are significant in lowering the agency problem as it provides regulation through which the agency is expected to operate (Rossi, Boylan and Cebula, 2018). The legal framework may not operate in every nation; thus, the companies have to develop the regulation under which their agents will operate.

Incentive

It is important to note that the agency problem can be best solved by aligning the agent’s and the principal’s interests through minimum costs. The agency costs are the internal costs that generally arise because of the relationship between the two parties. This cost involves bonding costs, finding a suitable agent, costs due to ineffective decisions, and watching the agent’s actions (Pepper, 2018). The monitoring costs include the audit fees, operating rule establishment costs, compensation plan, and budget restrictions. The principal’s agency costs are losses incurred by the principal to ensure that the agent’s behavior is in the principal’s interest (Rossi, Boylan and Cebula, 2018). The Problem of agency cost is crucial when the principal operates within the civil law legal system (Pepper, 2018). They are perceived as financially strong and can assume the risks whenever the agent works outside the scope. Furthermore, the principal is usually responsible for their agent’s actions to the third parties, which results in additional costs.

Based on the contract between the principal and the agent, various mechanisms have been proposed to lower the agency cost. Although the legal system differs from one nation to another, having good corporate governance is essential as it helps in protecting the two groups (Guo, Mann and Reza, 2019). Additionally, institutional ownership is also significant in lowering agency costs (Rinaldo and Puspita, 2020). This is because the shareholders can monitor the agents’ transparency as they have the necessary resources to monitor the management decision. Furthermore, they have a high percentage of shares, controlling the project investments. Managerial ownership is also a solution to the problem as the managers will maximize the company’s value.

Compensation Schemes

It is crucial to adopt a significant compensation scheme to align the agent and the principal incentive to motivate the agents to be industrious. The company’s aim will always be to maximise the profits within the agent’s set schemes (Pokhodun, 2021). It is crucial to select a scheme that satisfies both parties to prevent conflict of interest. The agent’s work needs to be noticed as they are always in action to ensure that the company succeeds, and this requires suitable compensation to keep them motivated (Rossi, Boylan and Cebula, 2018). The compensation scheme is dependent on the company ownership structure. However, the agents tend to have higher risks when the company ownership is diversified, selecting less risky projects with low profit.

Providing a significant amount of remuneration to the agent aids in aligning the incentives of both groups. For the companies to maximise the professional potential of the agent and ensure equality, it is necessary to introduce an incentive contract that will cover the damage compensation (Hoi, Wu and Zhang, 2019). This will help constrain the agent’s interest, making them treat the clients with due care. The contract should include rewards, thereby increasing the agent’s incentive to make them active in the relationship (Guo, Mann and Reza, 2019). This is significant as the agency value will increase, expanding the net income of the involved parties. Installation of the contingency fee is significant in ensuring that the agent acts with equity.

How the Organisation is Susceptible to Agency Problem

The corporate managers and officers managing the shipping industries are susceptible to making decisions that are not in the interest of the shareholders but of themselves. The shipping industry has adopted chiefly the model where the vessel management of the company is sub-contracted to other vessel management organisations that the corporate managers or officers usually manage (Gulfem and Ozaydin, 2016). The ship owners contracted out their vessels to third parties for multiple reasons, such as income generation (Gulfem and Ozaydin, 2016). However, the vessel management company is linked with the company’s management, and the earnings from the business tend to benefit the corporate management instead of benefitting the company.

Through this conflict of interest, the manager of the shipping companies tends to benefit from the deal at the expense of the shareholders. The shipping industry is among the many sectors of the economy that suffers from the director agency problem because of the nature of the operation. The varying nature of laws from one region to another makes them susceptible as they expand their supply chain (Gulfem and Ozaydin, 2016). The shipping companies have found themselves paying double prices for managing their vessels, which affects the profit margin of these organisations while it serves the interest of a few individuals (Gulfem and Ozaydin, 2016). Other ways the shipping industry is affected by this problem include the sales and purchase of vessels, ship chartering, and commercial management.

The Predominant Logistic Challenge in the Organisation

Adopting New Technology

Currently, technology has expanded in various sectors of the economy, including the logistic industry. It is necessary for shipping companies to adopt the latest technologies to compete effectively, as enormous changes have occurred since the pandemic’s onset (Mullins, 2021). The organisation’s productivity is maximised by using programs like warehouse management systems to enable the easy keeping of inventories (Mullins, 2021). Maersk Company has focused on integrating the changing technology into its business operation to enhance its competitive advantage in the market. These five goals enable them to operate well even in the changing business environment.

The company has acquired a logistic company to handle e-commerce which creates a positive relationship between the client and the company. E-commerce has been growing rapidly since the onset of the COVID-19 pandemic. This makes them expand their marketing strategy, thereby enhancing their performance in the market (Transport and Logistics, 2021). E-commerce has helped the company offer delivery within 48 hours, representing approximately 95 percent of the US market and 75 percent within 24 hours, making them able to serve small and medium enterprises. This strategy has enabled the company to compete effectively in the logistic industry market.

Changing Business Environment

Since the pandemic, the business environment has dramatically changed as many countries have imposed a regulation that negatively impacts the shipping company’s performance (Mullins, 2021). The supply chain was significantly reduced as many clients were affected globally.

Supply Chain and Demand

The current problems facing the Maersk Group are the supply chain’s disruption because of the increased demand for shipping services. The demand for workers in various sections of the US supply chain has become a critical problem for this organisation (Cherington, 2021). This is because most of the shipping business takes place between the US and other parts of the world, making it a significant company business area (Maersk, 2021). The Los Angeles terminal operates at 20 hours of gate pass, accommodating nearly 2000 appointments (Maersk, 2021). This has become a problem as the demand keeps on rising with time. Maersk Company has taken various steps to solve the problem of capacity and distribution by enacting multiple strategies.

Firstly, the company has integrated the asset into the supply chain. This has been made to be in line with their global integrator strategy. This includes 46 warehouses in North America, 75 ports operating globally with 4 in the US, 700 fleets, and 500 trucks within the US (Maersk, 2021). Secondly, the company has increased the number of vessels on the US to Asia route by approximately 40% (Maersk, 2021). The company has also redeployed some of its fleet from other parts of the world where the trade is not extensive enough to serve the demand of the transpacific trade lane (Maersk, 2021). Thirdly, the company is expanding the East coast port through supply chain creation. This was enhanced by coming up with various alternative routes to the ports of the Southwest pacific. Thirdly, the company is expanding its landside logistics by creating distribution locations and warehouses to meet the cargo flow in areas with high demand.

Fourthly, the company targets US cargo exports as the largest exporter of US products. The company focuses on increasing exports through engagement in other sectors, such as the agricultural sector (Maersk, 2021). Sixthly, the company has focused on reducing the rate of carbon emission, which is an environmental factor that is of great concern (Maersk, 2021). The company aims to use new vehicles and vessels with low emission rates to attain the target of zero carbon emission in their supply chain.

Conclusion

In conclusion, management theories and leadership theories are significant in enhancing the performance of the Maersk group. The organisation applies the scientific management theory, system management theory, and contingency management theory. The leadership theories used include trait theory, contingency theory, situational theory, and participative theory. The above management and leadership theories are significant in helping the organisation plan, manage, and coordinate its operations globally. Maersk’s strategy has promoted its performance by implementing door-to-door services, first-class services, and global coverage. Its enormous shipping network has supported its growth, especially during price wars. Its management team provides the necessary skills that help the organisation outsmart their rivals. It has implemented a unique culture in all of its departments, promoting its operations at the international level. However, the director agency problem is a significant threat, and the company can minimise this problem through legal mechanisms, incentives and compensation schemes. The leading challenges that the company faces include adopting new technology, the changing business environment, and supply chain and demand.

Reference List

A.P. Moller – Maersk (2018) Annual Report. [online] Copenhagen. Web.

Bakari, H., Hunjra, A. and Niazi, G. (2017) ‘How does authentic leadership influence planned organisational change? The role of employees’ perceptions: integration of theory of planned behavior and Lewin’s Three Step Model.’ Journal of Change Management, 17(2), pp.155-187. Web.

Bhattacharyya, S. and Jha, S. (2018) ‘Findings on leadership theories.’ Strategic Leadership Models and Theories: Indian Perspectives, pp. 97-126. Web.

Calvo, N. and Calvo, F. (2018) ‘Corporate social responsibility and multiple agency theory: A case study of internal stakeholder engagement.’ Corporate Social Responsibility and Environmental Management, 25(6), pp.1223-1230. Web.

Cherington, B. ‘GBR – Logistics Challenges in 2021.’ [online] Gbreports. Web.

Corbett, F. and Spinello, E. (2020) ‘Connectivism and leadership: harnessing a learning theory for the digital age to redefine leadership in the twenty-first century.’ Heliyon, 6(1), pp.3-10. Web.

Dahlgaard-Park, S., Reyes, L. and Chen, C. (2018) ‘The evolution and convergence of total quality management and management theories.’ Total Quality Management & Business Excellence, 29(9-10), pp.1108-1128. Web.

Disanferdinand, A. (2018) ‘Human resource management.’ International Journal of Scientific and Research Publications (IJSRP), 8(9), pp. 3-14. Web.

ElKelish, W. (2017) ‘Corporate governance risk and the agency problem.’ Corporate Governance: The International Journal of Business in Society, 18(2), pp.254-269. Web.

Found, P., Lahy, A., Williams, S., Hu, Q. and Mason, R. (2018) ‘Towards a theory of operational excellence.’ Total Quality Management & Business Excellence, 29(9-10), pp.1012-1024. Web.

Gulfem, N. and Ozaydin, G. (2016) ‘An exploration of service problems encountered in ship agency industry.’ Dokuz Eylul niversitesi Denizcilik Fakültesi Dergisi, 8(1), pp.3-6. Web.

Guo, R., Mann, W. and Reza, S. (2019) ‘Are acquisitions of intangibles less subject to agency problems?’ SSRN Electronic Journal, pp.1-6. Web.

Hoi, C., Wu, Q. and Zhang, H. (2019) ‘Does social capital mitigate agency problems? Evidence from Chief Executive Officer (CEO) compensation.’ Journal of Financial Economics, 133(2), pp.498-519. Web.

Lazonick, W. (2017) ‘Innovative enterprise solves the agency problem: The theory of the firm, financial flows, and economic performance.’ SSRN Electronic Journal, pp.3-46. Web.

Maersk. (2021) Maersk ready to confront supply chain challenges and propose solutions. Web.

Martineau, J. and Racine, E. (2020) Organisational neuroethics. 1st ed. Springer International Publishing.

Mazzarol, T. and Reboud, S. (2020) Small business management. Singapore: Springer.

Mitrefinch. (2021) Transport and logistics: challenges & trends. [online] Web.

Mullins, H. (2021) ‘Top 7 logistics challenges facing the industry.’ Global Trade Magazine. Web.

Northouse, P. (2019) Leadership: theory and practice. 8th ed. SAGE Publications.

Notteboom, T., Pallis, A. and Rodrigue, J. (2021) Port economics, management and policy. Routledge. Web.

Panda, B. and Leepsa, N. (2017) ‘Agency theory: review of theory and evidence on problems and perspectives.’ Indian Journal of Corporate Governance, 10(1), pp.74-95. Web.

Pepper, A. (2018) ‘Executive pay as a collective action problem.’ Agency Theory and Executive Pay, pp.77-99. Web.

Pokhodun, Y. (2021) ‘Minimizing the agency problem and aligning the interest in international commercial agency.’ Contemporary Research on Organisation Management and Administration, 9(2), pp.2-15. Web.

Rinaldo, D. and Puspita, V. (2021) ‘Independent parties in minimizing agency problem in Indonesia: an alternative model.’ HOLISTICA – Journal of Business and Public Administration, 11(1), pp.13-28. Web.

Rossi, F., Boylan, R. and Cebula, R. (2018) ‘Financial decisions and ownership structure as control mechanisms of agency problems: evidence from Italy.’ Corporate Governance: The International Journal of Business in Society, 18(3), pp.531-563. Web.

Sornn-Friese, H. (2019) ‘‘Containerization in Globalization’: a case study of how Maersk line became a transnational company.’ Shipping and Globalization in the Post-War Era, pp.103-131. Web.

Thompson, G. and Glasø, L. (2018) ‘Situational leadership theory: a test from a leader-follower congruence approach.’ Leadership & Organisation Development Journal, 39(5), pp.574-591. Web.

Timetoast timelines (2022) History of Management timeline. [online] Web.

Trinity Templar. (2021) Contingency approach to management » Trinity Templar. Web.

United Nations Conference on Trade and Development (UNCTD) (2019) Review of Maritime Transport 2019. [online] New York: United Nations Publications. Web.

Verner, W. and Michael, J. (2018) Revisiting single case studies in international business research: the case of Maersk line. Web.