Introduction

This memorandum report identifies and explains key microeconomic principles using a set of simulation games. The outcome of these games illustrate how microeconomic principles can be applied within real-life situations to help us make better business decisions. This report is a summary of the simulations I played and their results, which include the key takeaways and their significance, for your review and reference. It is divided into the following sections:

Comparative Advantage

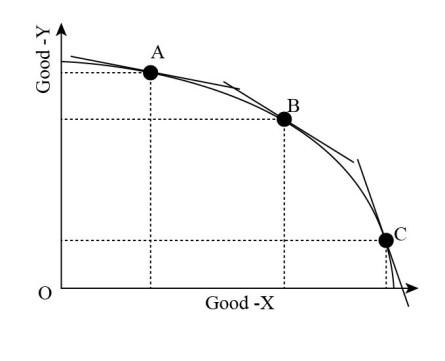

As an illustration of the trade-offs between two products that a company can create, the simulation generates a production-possibility frontier (PPF) graph. Using the PPF, you can see how much a company can produce with the tools (Mankiw, 2021). It also serves as an example of “opportunity cost,” defined as the negative value of a missed chance. The business owner must compare the trade-offs along the PPF to determine the opportunity costs of producing one good over another in the simulation (Halbert & Ingulli, 2020). This enables them to make educated choices regarding resource allocation and output maximization. The PPF is crucial because it aids decision-making by allowing business leaders to see the opportunities and costs of various production options.

A company or nation has a comparative advantage if it can produce a product or service at a lower opportunity cost than its competitors. One way in which businesses might save money is by creating goods in which they have a comparative advantage (Halbert & Ingulli, 2020). Because of this, both parties can benefit from trade as they specialize in producing the commodities in which they have a comparative advantage (Halbert & Ingulli, 2020). Yet, a company’s production possibility frontier need not shift due to commerce (PPF). A company’s PPF reflects the most it can generate with its current resources and technology; engaging in trade does not alter these limits (Brigham & Houston, 2021). Conversely, by focusing on the production of items with a competitive advantage and trading for other goods, a company can operate at a point beyond its original PPF through trade.

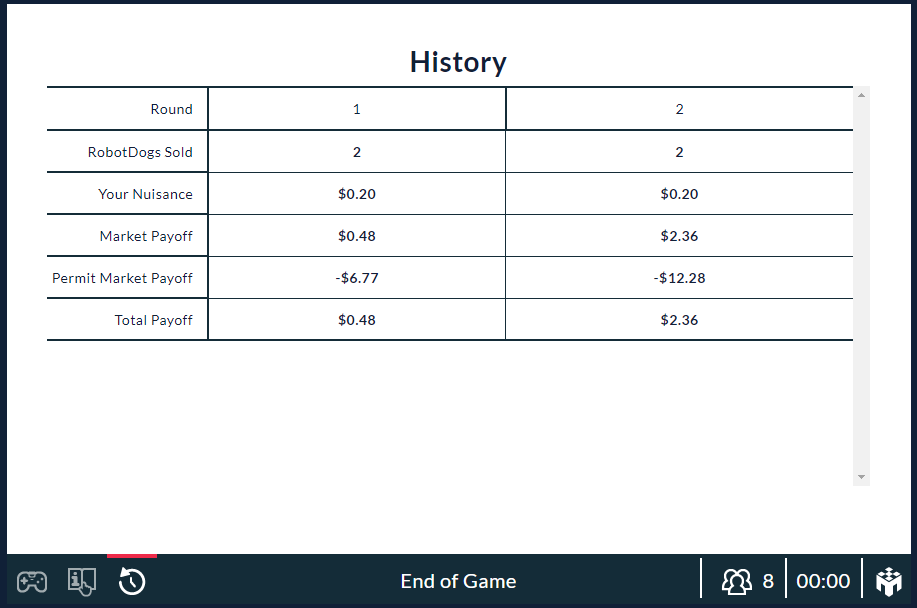

Competitive Markets and Externalities

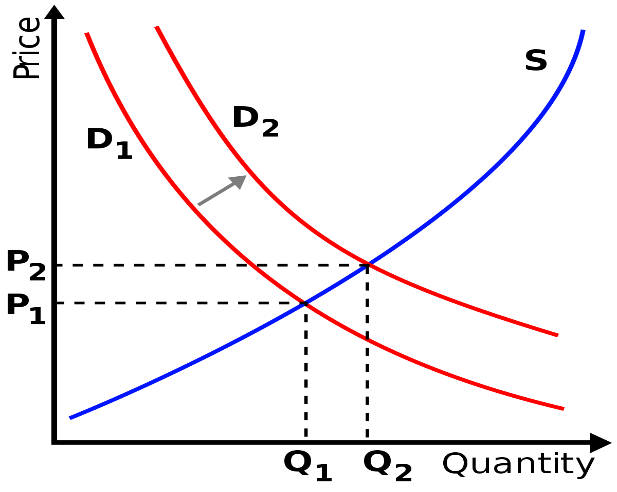

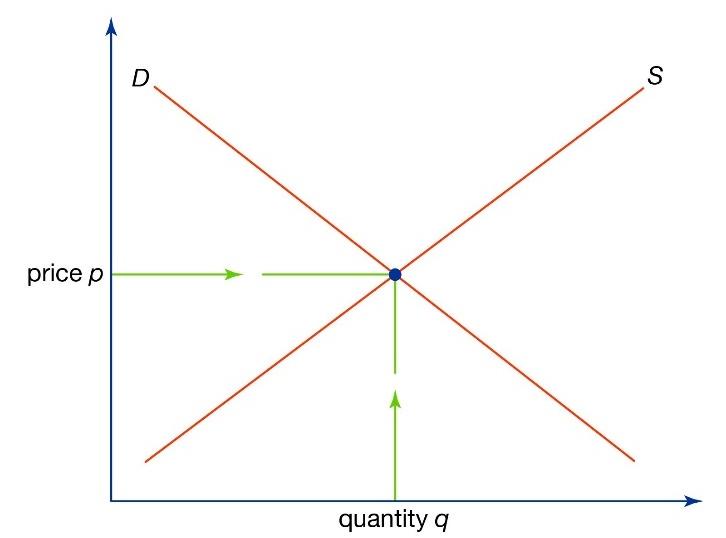

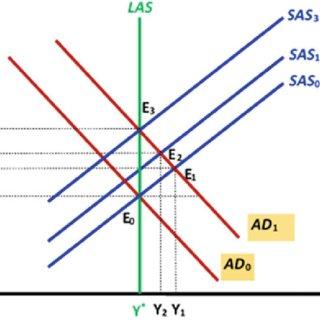

Policy interventions can shift the equilibrium between supply and demand by altering the incentives and limitations under which buyers and sellers operate. A production tax, for instance, would raise production costs, resulting in less of the good and a higher price (Mankiw, 2021). On the other hand, if the production of a thing is subsidized, more of that good will enter the market, reducing prices and possibly raising demand (Mankiw, 2021). By decreasing demand for fossil fuels, the price of these fuels may eventually decrease as more people switch to alternative energy. To better understand the effects of policy interventions on a product’s supply and demand equilibrium is important for policymakers and businesses alike.

Depending on the specifics of the intervention, the market policy can lead to either a consumer or producer surplus. For instance, if a product’s price is lowered because of an increase in supply thanks to a subsidy, consumers will have more disposable income (Zastrow et al., 2019). But a product tax can reduce production, increase prices, and boost producer surplus. Policy market interventions’ overall effect on consumer and producer surplus is context-dependent.

Production Entry and Exit

Several factors influence a company’s choice to enter a market, including the existing degree of competition, potential profitability, and any obstacles to entry. The driver’s decision to enter the market in the simulation was influenced by the high potential profits and low entry barriers associated with the ride-sharing service (Mankiw, 2021). The prospective earnings from providing rides were weighed against the initial investment in a car and insurance. It is possible to assess a market’s attractiveness and make educated decisions with the help of economic models like Porter’s Five Forces and the Strengths, Weaknesses, Opportunities, and Threats analysis (Brigham & Houston, 2021). There are several internal and external elements to consider before entering a market.

The concept of marginal costs might help a business owner choose between different production levels or labour schedules. Marginal cost refers to the price at which generating an extra product unit increases overall costs. In the simulation, the driver determined the number of daily driving hours based on the marginal cost idea (Mankiw, 2021). The driver weighed the potential loss in earnings due to staying on the road for an extra hour against the potential gain in earnings from accepting another passenger. The driver may figure out how many hours per day to spend behind the wheel by optimizing the differential between marginal revenue and marginal cost. Marginal analysis and other economic models can be used to assess the wisdom of this choice.

As fixed costs are constant regardless of output, they have a significant bearing on decisions about output in the short term. When selecting how much to create, businesses must consider their fixed costs, which remain the same regardless of output (Mankiw, 2021). Long-term, however, fixed costs are more amenable to change and have less impact on production choices. For the average-total-cost (ATC) model, fixed costs are factored into the overall cost, with the ATC decreasing as output rises. Production decisions and the form of the ATC curve can be affected by the long-term flexibility with which enterprises can set their fixed costs.

Market Structures

Table 1.

It is possible for market inefficiencies to arise when there is a lack of competition, as is the case with monopolies and monopolistic competition. When only one firm dominates a market, that company has enormous market power (Mankiw, 2021). It can charge prices well above its marginal cost of production, resulting in a deadweight loss of consumer surplus. Furthermore, since there is no genuine competition for the monopoly, there is frequently no incentive to develop or improve the product. Innovating at this rate can slow the economy and hurt consumers. Even if there are numerous firms in a monopolistic competitive market, each firm has market power due to product differentiation and can charge prices higher than its marginal cost of production (Mankiw, 2021). Because of the inability to find ideal alternatives, buyers may wind up paying more for equivalent goods.

Conclusion

Companies find microeconomics particularly useful since it gives a framework for evaluating niche markets, consumer behavior, and production decisions. Firms with a firm grasp of microeconomics can better set prices, increase output, and allocate resources effectively. Microeconomic principles should guide future company decisions to remain competitive in the market. It would be wise for a business partner to analyze the market, think about how customers might react, and weigh the pros and drawbacks of each option before making any commitments.

References

Brigham, E. F., & Houston, J. F. (2021). Fundamentals of financial management: Concise. Cengage Learning.

Halbert, T., & Ingulli, E. (2020). Law and ethics in the business environment. Cengage Learning. Web.

Mankiw, N. G. (2021). Principles of Microeconomics 9e. Cengage Learning Asia Pte Limited. Web.

Orji, F., & Vassileva, J. (2020). Using machine learning to explore the relation between student engagement and student performance. In 2020 24th International Conference Information Visualisation (IV) (pp. 480-485). IEEE. Web.

Zastrow, C., Kirst-Ashman, K. K., & Hessenauer, S. L. (2019). Empowerment series: understanding human behavior and the social environment. Cengage Learning. Web.