Currently, the amount of data available to businesses continues to grow at an exceptional rate due to the developments in artificial intelligence and big data. Within the last two years, approximately 90% of all existing information was generated through various digital instruments (Ruiz-Real, Uribe-Toril, Torres, & De Pablo, 2020). This eventually requires businesses to keep up with the progress and ensure that their respective units gain access to all vital data sets in time. When a new company emerges, its management firstly creates a thorough profile that could be later altered to showcase the business’s stronger sides or mitigate the weaker suits (Makridakis, 2017). Even though this task seems to be rather complicated, the current state of technology proves that it may be possible for actuaries to foresee specific business outcomes and predict whether the company will become successful within its first years in the market. With multiple actuaries currently affecting the state of worldwide economics, a prediction instrument’s deployment might significantly affect the relationship between economics and artificial intelligence.

Theoretical Background

Statistical methods of predicting specific outcomes tend to impact different areas of study. Economic and financing decisions can also be mediated by improved access to background information, as the team might be capable of reaching higher levels of consistency and accuracy when processing raw data (Wagner, 2020). This happens due to the increasing popularity of actuary-related tasks that can be utilized to predict future events based on past proceedings systematized and tested for statistical validity. Artificial intelligence is an essential technology for actuaries and potential investors because it is never affected by common human bias (Marwala & Hurwitz, 2017). The process of decision-making under the influence of artificial intelligence systems tends to overcome the eventual limitations of human predictions. Vochozka, Kliestik, Kliestikova, and Sion (2018) suggest that statistical models employ empirical evidence in a meaningful way, and the growing size of data sets does not pose a challenge for the system either. Statistical methods could also be used to reduce information asymmetry and predict even the most unexpected outcomes while being bound by rationality and the lack of bias categorically affecting actuaries.

The role of artificial intelligence for actuaries may also be explained by the growing strength of decision-making analytics and their predictive capability. According to Subroto and Apriyana (2019), this instrument could be utilized to mimic human behavior and alter the decision-making rules following the input data. However, it may come with both benefits and constraints for actuaries, as not all decisions should resemble human behavior or replicate it entirely. As it is correctly mentioned by Albrecher et al. (2019), most digital prediction systems for actuaries might be unfettered from human-like bias and its derivatives. Nevertheless, a significant effort should be exerted to affect the potential outcomes of prediction-related activities positively. The growing amount of data available to actuaries creates the biggest challenge for startup success prediction due to the presence of irrelevant, invalid, or obsolete information (Kliesen & Tatom, 2018). This is why actuaries are often dealing with behavior analytics, as their essential task is to detect the potential drawbacks of the most viable solutions and define the best pathway to resolve the issue.

Purpose of the Study

The utmost purpose of the current study is to ensure that actuaries at hand will gain access to all the required information within a matter of seconds to make decisions related to startup management. Depending on the organization’s state, it will be concluded if it may be worth investing in the startup at all. With a comprehensive digital information processing tool, many actuaries would also become able to sense the consumer demand and develop a better understanding of how customer loyalty could be nurtured. With a hybrid intelligence system, both actuaries and investors might expand their operations internationally and contribute to global markets instead of focusing solely on the local business environment. More small- and medium-sized businesses appear daily, so it may be crucial to invest in prediction mechanisms to speed up the adoption process and help venture capitalists build plenty of effective partnerships. The proposed method of predicting startup success would also prioritize the market environment instead of being a mere tool for actuaries rather than businesses, employees, or consumers.

Method

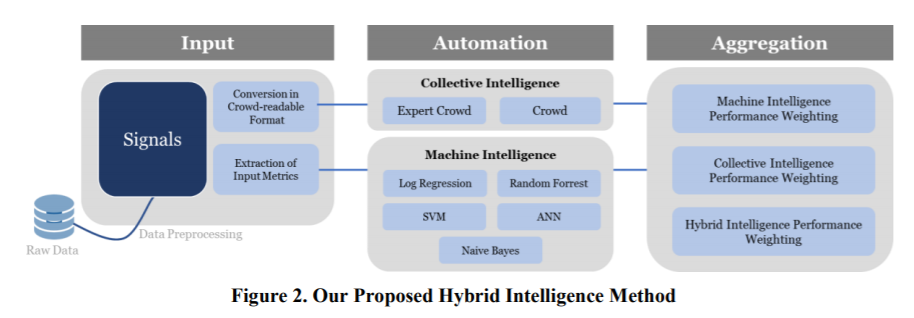

After reviewing relevant literature on the subject, the author decided to employ hybrid intelligence, as it most definitely falls under all the specifications mentioned above. Following Dellermann, Lipusch, Ebel, Popp, and Leimeister (2017) and Makridakis (2017), the author of the proposal expects to resolve startup investments’ real-world problem by evaluating the potential of companies based on past data sets and the power of artificial intelligence. The idea will be that the input data is automatically processed by the system and then aggregated reasonably (see Figure 1).

Although most information on startups tends to be dualistic and abstract, the author of the current proposal expects to utilize abstract learning to employ a proactive approach to investments and help actuaries make the best use of artificial intelligence and a quickly growing body of evidence on startups.

References

Albrecher, H., Bommier, A., Filipović, D., Koch-Medina, P., Loisel, S., & Schmeiser, H. (2019). Insurance: Models, digitalization, and data science. European Actuarial Journal, 9(2), 349-360.

Dellermann, D., Lipusch, N., Ebel, P., Popp, K. M., & Leimeister, J. M. (2017). Finding the unicorn: Predicting early-stage startup success through a hybrid intelligence method. In Thirty Eighth International Conference on Information Systems (pp. 1-12).

Kliesen, K. L., & Tatom, J. A. (2018). Is American manufacturing in decline? Business Economics, 53(3), 107-123.

Makridakis, S. (2017). The forthcoming Artificial Intelligence (AI) revolution: Its impact on society and firms. Futures, 90, 46-60.

Marwala, T., & Hurwitz, E. (2017). Artificial intelligence and economic theory: Skynet in the market. New York, NY: Springer.

Ruiz-Real, J. L., Uribe-Toril, J., Torres, J. A., & De Pablo, J. (2020). Artificial intelligence in business and economics research: Trends and future. Journal of Business Economics and Management, 22(1), 1-20.

Subroto, A., & Apriyana, A. (2019). Cyber risk prediction through social media big data analytics and statistical machine learning. Journal of Big Data, 6(1), 1-19.

Vochozka, M., Kliestik, T., Kliestikova, J., & Sion, G. (2018). Participating in a highly automated society: How artificial intelligence disrupts the job market. Economics, Management, and Financial Markets, 13(4), 57-62.

Wagner, D. N. (2020). Economic patterns in a world with artificial intelligence. Evolutionary and Institutional Economics Review, 17(1), 111-131.