Introduction

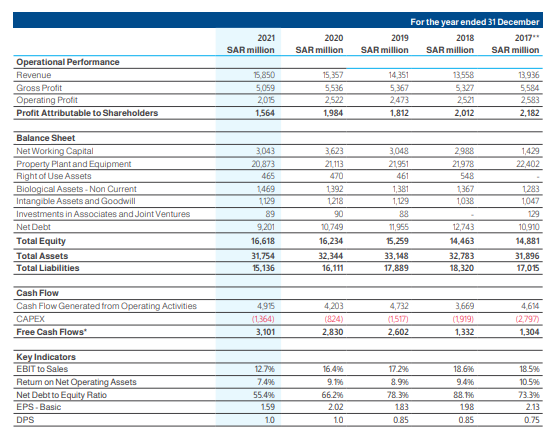

Almarai is a Saudi Arabia-based company that deals with food sales. The company has been experiencing financial fluctuations over time due to competition and changes in market trends. The following report will do a financial analysis to determine the company’s performance (Shaik, 2021). Figure 1 presents a summary of the balance sheet, income statement, and cash flow used to comment on how the company operates.

Almarai Company’s financial reports show the company’s investment status, growth, revenue, assets and liabilities. In 2019 the gross profit for the company was 5367000, an increase from the 2018 5327000 (Mabrouk, 2020). Revenues for 2021 and 2020 increased by 7% from 2018, complimented by the poultry and foods topline growth (Althumairi, 2021). The income statements show a decreased profit attributable to shareholders and increased operating profits.

The Balance sheet shows the assets and the liabilities of the company. The total assets in 2021 were 31 754 million, 32 344 million in 2020 and 33, 148 million in 2019 (Imene, 2020). With reducing total liabilities, Almarai company’s total equity was 16,618 million, 16 234 million and 15 259 million for 2021, 2020 and 2019, respectively (Osland, 2021). Based on decreasing liabilities in the past years, the company performance is impressive with more expected growth (Shah et al., 2020). With the data provided, the company is performing well with improvements in various areas (Bay, 2021). The company has potential for financial growth and is worth investing in for long-term prospects.

Comparative Analysis of Financial Information and Data

The current profitability ratio for Almarai company has a 5.1 % Return on Assets, up from 5.98 % in 2020. It means that Almarai company can return 13% profit on the assets (Maisharoh and Riyanto, 2020). The Assets turnover for the company in 2021 was 0.53, having an inventory turnover of 2.23 (Palepu et al., 2020). Compared with the industry assets turnover of 0.96 and inventory turnover of 4.43, the company has more to improve (Triyanto, 2021). The liquidity ratio for the company in 2021 was 0.43, with 70% of the total debt to equity (Hladika and Valenta, 2021). The ongoing proportion of Almarai improved to 1.31 in 2021, which however was below the business normal of 1.36 (Al Mheiri et al., 2020). Generally, the company’s performance has improved based on the 2020-2021 ROA, profits and ongoing proportion.

Conclusion

The organization’s quick and short-term liquidity position was weak because its swift proportion was less than one and below the business normal. The resource turnover of the organization marginally declined in 2021 and was below the business normal (Vinodkumar et al., 2020). The overall net revenue of Almarai decreased from 0.155 in 2021 to 0.146 in 2020 yet was higher than the business normal of 0.1048 (Dowling and Vanwalleghem, 2018). The equity multiplier value expanded in 2021, demonstrating that the number of resources funded by the organization diminished.

Reference List

Al Mheiri, W., Al-Mahmoud, M., Sultan, F., Juma, F., Al-Kaabi, M., Al-Alawi, H. and Nobanee, H. (2020) Financial Analysis of Al Marai Company. Cengage AU.

Alotaibi, K.O. (2021) ‘The effect of accounting disclosure for sustainable development on the quality of financial report and the extent of its reflection on the company value’, Multicultural Education, 7(5), pp.244-259.

Althumairi, I.A. (2021) ‘Constructing a social accounting matrix for Saudi Arabia: sources and methods’, Applied Economics, 53(30), pp.3474-3498.

Bay, C. (2021) ‘Makeover accounting: Investigating the meaning-making practices of financial accounts’, Accounting, Organizations and Society, 64(1), pp.44-54.

Dowling, M. and Vanwalleghem, D. (2018) ‘Gulf cooperation council cross-border M&A: Institutional determinants of target nation selection’, Research in International Business and Finance, 46(2), pp.471-489.

Hladika, M. and Valenta, I. (2021) ‘Analysis of the effects of applying the new IFRS 16 Leases on the financial statements’, Economic and Social Development: Book of Proceedings, 1(1), pp.255-263.

Imene, I.G. (2020) ‘The determinants of Sukuk issuance in GCC countries’, Islamic Economic Studies, 28(1), pp. 34-78.

Mabrouk, A.B. (2020) ‘Wavelet-based systematic risk estimation: application on GCC stock markets: the Saudi Arabia case’, Quantitative Finance and Economics, 4(4), pp.542-595.

Maisharoh, T. and Riyanto, S. (2020) ‘Financial statements analysis in measuring financial performance of Gulf companies’, Journal of Contemporary Information Technology, Management, and Accounting, 1(2), pp.63-71.

Osland, A. (2021) ‘Saudi Arabia: Almarai and vision 2030. In SAGE business cases. SAGE Publications.

Palepu, K.G., Healy, P.M., Wright, S., Bradbury, M. and Coulton, J. (2020) Business analysis and valuation: Using financial statements. Cengage AU.

Shah, H., Tairan, N., Garg, H. and Ghazali, R. (2020) ‘A quick gbest guided artificial bee colony algorithm for stock market prices prediction’, Symmetry, 10(7), pp. 21-92.

Shaik, A.R. (2021) ‘Components of working capital and profitability in Saudi Arabian companies’, Investment Management and Financial Innovations, 18(3), pp.52-62.

Triyanto, D.N. (2021) ‘Fraudulence financial statements analysis using pentagon fraud approach’, Journal of Accounting Auditing and Business, 2(2), pp.26-36.

Vinodkumar, D., Meharunisa, D. and Sulphey, D. (2020) ‘A Study on the growth of Almarai as a Corporate Citizen in the era that seeks Sustainable’, International Journal of Psychosocial Rehabilitation, 24(2), pp. 9-12.