Component of bank funding and their importance

Banks operating in Australia have a variety of sources of funds. The main components are deposits, short-term debts, and long-term debts. Over 50% of bank funding originates from retail deposits. Approximately 40% of the total funds emanate from the financial market. Banks draw short-term and long-term sources of finance from the financial markets to increase their lending capacity. In addition, financial markets offer a variety of funds to the banks. This enables banks to spread their sources of funds and to access a large amount of money and for a longer term than deposits. Trading in the money market enables banks to manage liquidity. In addition, it enables banks to secure investment and thus, earn interest. The rest of the banks’ funds arise from the equity which takes less than 10% of the capital structure of a bank. A bank must maintain an appropriate mix of these three main sources of funds to ensure its stability both in the short and long run. This will ensure that they offer a secure place for customers’ funds and adequate return for the shareholders. Key risks that a bank must manage are liquidity, funding and credit risks (Reserve Bank of Australia 2011; Hunt & Terry 2011).

Changes in components of funding

The above three components of a bank fund offer the fundamental sources of funds in a bank. It is inevitable to point out that there has been a significant metamorphosis of funding sources that the banks use in the past few years. Specifically, banks have shifted away from the use of short-term wholesale funding to deposits. Further, there has been an increase in the use of long-term secured issuance such as covered bonds. Secondly, there has been an increase in deposits from 40% in 2007 to 52% currently. This increase in deposits is countered by a decline in short-term wholesale funding. Further, within deposit funding, banks have increased long-term deposits which attract high-interest rates. As of 2007, a term deposit accounted for 30% of total deposits and has increased to 44%. Finally, banks have shifted away from the use of wholesale debt securities. This comprises wholesale trade securities and securitization. From the analysis, it is evident that banks have “tried to increase the average maturity of their funding” (Reserve Bank of Australia 2012). The changes in the funding sources aim at providing the banks with a stable source of funds that is not highly vulnerable to market volatility. The graph below shows the trend of share of total funding composition of major banks in Australia, other Australian-owned banks and foreign banks between 2008 and 2012.

Reasons for changes in components

The changes in the funding sources for banks are mainly attributed to a reassessment of funding risk by banks globally. The reassessment was instigated by the global financial crisis which resulted in market and regulatory pressure. Before the global financial crisis, banks reported outstanding performance characterized by low lending interest rates and profuse liquidity. In as much as deposits were increasing, lending exceeded deposits in most of the financial institutions. Banks paid high-interest rates to attract deposits which is a significant source of funding. Paying high-interest rates for deposits and low interest for loans created a gap in the banking industry. To bridge this gap, banks resorted to quick sources of funding such as trading in the money market. Over time, banks reduced long-term sources of funding and resorted to short-term funding from the security market. This led to maturity mismatch caused by the growing unevenness between long-term lending to customers and short-term funding. Also, currency mismatch played a role in the changes in sources of funding. “Between 2000 and mid-2007 net long dollar position grew to around USD 800 billion being funded in Euro” (European Central Bank 2009). It created “significant exchange rate risk and considerable dependence on the foreign exchange swap market” (European Central Bank 2009). Several banks incurred hefty losses as a result of foreign exchange risk. From the discussion, banks incurred massive losses and some were faced out of the industry. Lessons learned from the global financial crisis have compelled banks to adopt long-term sources of funding.

Composition of funding in the next two years

The Reserve Bank of Australia became more thorough than it was before in monitoring the banking industry in Australia after the global financial crisis. It exerted more pressure on banks to lower the levels of funding risk. It aims to restore public confidence in the banking industry and to salvage the financial institutions which never shut down after the crisis. These regulations have brought a significant positive impact on the growth of the banking industry. First, the Reserve bank has been able to control the level of intermediaries’ funding costs by use of the cash rate. This in turn controls the level of lending rates. Further, funding costs decline in unqualified terms. Deposit pricing has been kept optimal as a result of stiff competition in the industry (Reserve Bank of Australia 2012). Finally, there has been a general rise in the spread of wholesale debt issued by banks. Strictly speaking, it might not be completely feasible for banks to curtail over-relying on the capital and security market for funding. This can be achieved when big banks adopt a long-term funding strategy thus, pulling out a small bank of the security market. The appropriate funding mix may also be attained by the need of households and businesses to reduce leverage hence, a decline in credit growth (Austrian Center for Financial Studies & KPMG 2011).

Assuming a scenario where the Reserve Bank of Australia stimulates businesses and consumer investment through low-interest rates, this will imply the availability of credit growth and deposits in the banking industry since there will be a general increase in the level of economic activity in the country. The graph below gives the values of the share of various funding sources between 2004 and 2012. From the graph, we can monitor the trend of various components and predict the composition of funding for the next two years.

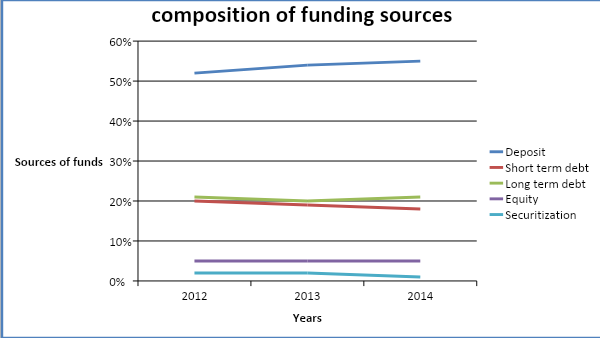

The table below shows forecasts of the composition of various funding sources for 2013 and 2014.

(Source of data for 2007 and 2012 – Reserve Bank of Australia 2012)

From the table, deposits will continue to be a major source of funding. Due to increased economic activity, deposits will grow from 54% in 2013 to 55% in 2014. Short-term debt will slightly decline due to interbank trading. Long-term debt will increase by a small margin so as to comply with the regulators’ requirements. Equity will remain stable over the years. Securitization by banks will decline up to 1% and even lower in the coming years until the industry stabilizes. The graph below shows the trend of forecasted funding sources from 2012 to 2014.

References

Austrian Center for Financial Studies & KPMG 2011, The future of Australian bank funding. Web.

European Central Bank 2009, EU banks’ funding structures and policies. Web.

Hunt, B & Terry, C 2011, Financial information and markets, Cengage Learning Australia Pty Limited, Sydney.

Reserve Bank of Australia 2011, The effects of funding costs and risk on banks’ lending rates. Web.

Reserve Bank of Australia 2012, Funding composition of banks in Australia. Web.