Introduction

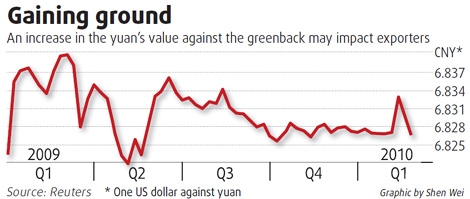

The Chinese currency (Yuan) has been recording a relatively strong performance against the US dollar. Recent data from the year 2007 has indicated that the exchange rate between China and US has been fluctuating with China gaining in most of the cases. At the beginning December 2007, the Chinese Yuan recorded an upsurge of 13% against the US dollar. Prior records indicate that between 2005 and 2007, the Yuan recorded an average growth of 14%. This strong performance of the Yuan indicates that the Chinese economy is growing at a high rate. The performance has been strong since China detached itself from the fixed rate against the dollar or what is commonly referred to as dollar pegged system. Under the dollar pegged system, the Chinese Yuan was tied to grow at the rate of 5% (Taylor & Taylor 2004, pp. 135-142). The Yuan has been floating freely since 2005. By 10th February 2010, the Yuan had gained the most against the dollar and traded at 6.9907 Yuan versus the US dollar. Though the Yuan has not been very stable, nonetheless, the fluctuation is by a very slight margin. It has gained in most of the cases. Between 2009 and 2010, performance of the Yuan against the dollar has also been relatively strong as indicated by the diagram below. The argument by analysts is that this increase in the Yuan’s value will affect the domestic enterprises; mostly the exporters.

The objective of this paper is to examine the extent to which theories of exchange-rate determination can help us to better understand the growth in value of the Chinese currency vis-à-vis the US dollar and assess the implications of this exchange-rate movement. We will first understand what we mean by exchange rates then proceed to theories.

Meaning of Exchange rate

Exchange rate of currencies is a measure of the value of one currency compared to another currency. It shows the worth of one currency in terms of another. For instance, the exchange rate of 6.886 Chinese Yuan (CNY) to the United States dollars (USD) means that 1.3 CNY is worth the same as 1 USD. Exchange rate is also referred to as foreign exchange rate or Forex rate (Taylor & Taylor 2004, pp. 142-158). Foreign exchange is very important in foreign trade because it helps the traders to exchange products at a fair value. The value of imports and exports are determined using the exchange rates. A Chinese business man wishing to import goods from the US will be able know how much to pay for the products depending on the prevailing exchange rate. Exchange rates are not constant. They fluctuate with time depending on various factors the most important one being political stability of a country. When a country’s exchange rate is high, then it indicates that the currency is strong against the other currencies.

Theories of exchange rate

Economists have categorized exchange rate theories into disequilibrium theories or models, partial and general equilibrium models. Under partial equilibrium model there is absolute and relative purchasing power parity which relate to the commodity market. The other theories in the category are covered and uncovered interest rate parity relating to the asset market. Then there is external equilibrium theory which asserts that balance of payment is the determinant of exchange rate. The general equilibrium model consists of mundell flaming theory which integrates the equilibrium in the commodity market, balance of payment and money market. This model is criticised of being bereft of valid micro foundations (Caves 2005, p. 231). Then we have the Balassa-Samuelson model that is based on profit maximization model of the firm, the redux model, market pricing model or the utility maximization model and the simple monetary model among others.

The Purchasing power parity theory

This is also referred to as the theory of inflation of exchange rate. It attempts to equalize the purchasing power of two currencies by determining their equilibrium exchange rate in the long run (Caves 2005, p. 156). It asserts that a basket of similar goods should have the same price in an ideal efficient market. It is based on the law of one price that similar goods should be sold at identical prices. For instance, if a commodity is sold in the US for USD 1 and the same commodity is also sold for 83 Yuan in China, then the exchange rate has to rhyme, meaning that it should be 83 Yuan per US dollar. This may not hold in the long run or the medium run. Under this model, the domestic price of a foreign commodity is determined by the following formula. ip* e = ip. This means that for the commodity i, it is worth p* dollars in United States of America will cost p*e Yuan in China at exchange rate e. in this case, p is the domestic price of the commodity in china and p* is the foreign price of the same commodity and e is the exchange rate of Yuan against USD; 1USD=e Yuan. This approach is called the absolute purchasing power parity and would only hold if the prices of each good are made equal between two countries and also equalize the goods baskets and their weights between the two countries.

From the computation above, we can obtain the exchange rate as follows: e=ip/ip* This means that when the price of commodity is low in domestic market, the exchange rate is low and vice versa (Alon & Drtina 2006, pp. 218-220). A USD is exchanged for less Yuan when the domestic price of the commodities is low. This means that same commodities in china have been trading at a cheaper price than in US.

Absolute purchasing power parity is criticised for its unrealistic assumptions. It assumes a risk-neutral world and an economy whereby goods will be traded without any transportation costs, export quotas and tariffs or any other extra costs. These costs make commodities to have different prices in different countries. It tries to integrate home and foreign market into one commodity market. It is therefore partial equilibrium market because it deals only with the commodity market and ignores the money market. Economists have tried to mitigate the abstractness of absolute purchasing power parity (PPP) and have up with relative PPP.

Relative PPP attempts to explain the relationship between price and exchange rates in different economies. The assumption is that transaction costs are proportional to price levels. For instance if the domestic price of a digital camera in say, china at time t is tp, and the cost of transportation is tkp where k is a scalar and constant, the foreign price of that camera say, in US will be equal to its price in china multiplied by the exchange rate say S. That is tp* = (tp+tkp) s = (1+k) tp. (in terms of domestic currency). To obtain the S= tp*/ (tp+tkp). When domestic prices are low then the foreign price of domestic commodities is high. This means the domestic currency is strong (Alon & Drtina 2006, pp. 221-228). The exchange rate is strong for the Chinese Yuan against the dollars.

Interest rate parity theory

Interest rate parity is also referred to as international fisher effect. This is an algebraic expression that tries to relate exchange and interest rates of different currencies. The theory uses the assumption that the proceeds obtained from borrowing one currency, exchanging the currency for another, investing the converted currency and later converting the currency back, is always equal to the proceeds obtained by investing the initial currency. Interest rate parity can be categorised as ether covered or uncovered interest rate parity. The uncovered interest rate parity gives a relationship between exchange and interest rates of two currencies that are in equilibrium. The theory assumes that an investor makes the decision to invest in a specific currency based on his or her speculation with respect to depreciation rate (Egert, Laszlo & Ronald 2006, pp. 257-260). The equation for uncovered interest rate parity is represented by:

- (1+ rt) = (1+ rt*) (set+1/ st)

Where t is present period, (t+1) is the next period, r*t and rt are the foreign interest rate and current domestic interest rate respectively. St is referred to as spot exchange rate while set + 1 is the spot exchange rate for the next period. To understand the context, we consider two countries: United States and China, where China is the domestic country and U.S. the foreign. If firm from China wish to invest in U.S., it has to convert its currency to U.S. dollar. After one period, the firm will have gotten a return amounting to (1 + rt) (1/st ) per unit investment. After period t, its total returns from the investment will amount to (1+ rt*) (set +1 / st). On converting back the returns to Chinese Yuan, the amount is expected to be approximately equal to what would have been earned by direct investing the Chinese Yuan. If this is the case, then the two currencies are said to be at par. However, if the returns are less then Chinese Yuan can be said to be stronger than the United State dollar.

Covered interest rate parity gives the relationship between interest rates and their respective forward exchange rates. Equation for covered interest rate parity is given by:

- (1 + r) = (1 + r*) (F/s)

With F standing for forward exchange rate ((Egert, Laszlo & Ronald 2006, pp. 261-324).

Mundell Fleming theory

This is an economic theory that was established by Robert Mundell and Marcus Fleming. The model tries to explain the relationship between economy output and the nominal exchange rate. The theory asserts that it is difficult for a country to maintain a fixed exchange rate, autonomous monetary policies and free capital movement. According to the theory, an increase in money supply leads to reduction in local interest which in turn results in the country’s interest rate going down compared to global interest rate. This results in country’s currency depreciating in value. The opposite happens in case of a decrease in money supply in the country. This theory tries to establish the effect of trade deficit to exchange rate between two currencies. In case there is a level of trade deficit in a country, it would result in the country’s currency being worth less compared to other currencies. For instance, if there is a trade deficit in United States, the American dollar would be worth less compared to Chinese Yuan (Bahmani-Oskooee & Abm 2005, pp. 671-682). This is the phenomenon that leads to such a country experiencing a low influx of imports while its exports are sold at a high rate. It would become cheap for persons in China to purchase from U.S. than it would be for people in America purchasing from China.

Effects of Yuan appreciation against U. S. dollar

The trend of appreciation in Japanese Yuan has both negative and positive effects to its economy. As Yuan continues gaining stand against U.S. dollar, it means that Japanese products will lose their competitiveness in global market. This is because the price for Chinese products will go high in the market. In return, it will be difficult for the country to increase it level of export while more products will be found to flood the country’s market. This may be detrimental to country’s economy. With its products not gaining any competitive advantage in the market, Chinese industries will not increase their sales volume. Consequently, it will be hard for these organizations to engage in gainful employment.

Another detrimental effect of Yuan appreciation to China will be a decrement in direct foreign investment level. Unites states has been one of the major countries with a lot of direct foreign investment in China. If Yuan continues appreciating U.S. dollar will lose value in China. In return, those American companies with direct foreign investment in China will lose interest on their investments (Bahmani-Oskooee & Abm 2005, pp. 683-696). This may lead to most of these companies relocating their investment in other countries thus adversely affecting the country’s economy. With foreign companies in China making little sales, it is becoming hard for them to maintain their operations. Manufactured products are not getting ready market due to their prices. This has led to organizations having to incur extra cost with respect to inventory management. Appreciation in Yuan value in global market implies that Chinese exports will be offered at a high price in the market. This will affect the country’s economy due to reduction in its export volume. Its exports will lack competition in the market.

Despite Yuan appreciation having negative effects on China, there are some benefits accrued from this appreciation. One of the benefits is helping the country reduce chances of inflation (Montiel 2000, para. 3-5). With the currency gaining a stable balance against the dollar, China will be able to cut down on its expenses. This is with respect to purchase of crude products such as oil and soybeans. In the past, the country has been spending a lot of money in purchasing products from other countries. Appreciation in the value of their currency will lead to prices of these products going down.

Yuan appreciation will not have effects on China alone; the trend will affect the whole of Asia as well as other continents. Most of the developing countries in Asia have for long enjoyed a healthy business relation with China. Appreciation in Chinese currency means that products manufactured from these countries will be sold at a lower price in China (Elbadawi 1994, p. 413). This will affect the development of such countries. America will stop enjoying a significant market share on its foreign direct investment in the country. As a way of reducing trade deficit with China, America will shift most of its direct investment from the country to other countries where it will be able to enjoy competitive advantage. China is one of the countries struggling to ensure that they have complied with environmental laws. Allowing for Yuan appreciation will help the country in meeting its environment conservation measures. Increase in cost of its products in global market will lead to reduction in its sales volume. Subsequently, most of its industries that are energy intensive will stop or cut on their operations. In return, emission from such industries will be contained hence observing environmental issues.

Conclusion

There are numerous theories that tries to highlight the factors considered when determining the rate at which a currency is exchanged with another. Each of the available theories uses different parameters in its explanation. Purchasing power parity assumes that every product in the world has to be sold at the same price despite the currency being used. However, the theory has been criticised for neglecting factors such as production and transportation costs which influence the price of the product. On the other hand interest rate parity assumes that return s obtained from a specific amount of currency is equal to that obtained after converting the same amount of currency to a different currency, investing it and later converting back its returns. It is divided into covered and uncovered interest rate parity with their calculations methods being the same apart from covered interest rate parity using forward exchange rate. Mundell Fleming theory is another exchange rate theory used to compare the performance of one currency with another (Illes 2009, para. 1-4). According to this theory, an increase in money supply within a country leads to its currency depreciating in relation to other currencies. The theory posits that presence of trade deficit between China and United States acts as one of the factors that has led to Chinese Yuan gaining value against American dollar.

Changes in Yuan-Dollar exchange rates have both negative and positive effects to China, America as well as other countries. This has helped China reduce inflation rate in its local market as price of imports is going down. Also the trend has led to energy-intensive industries in the country cutting down on their production rate consequently mitigating global warming. Appreciation in Yuan value has led to increase in cost of Chinese products in the market (Copeland 2005, p. 174). This has led to them not gaining competitive advantage making Chinese Corporations experiencing a reduction in their sales volume. The trend has also affected other countries that enjoyed a healthy business with China. These countries are gradually losing Chinese market due to poor price of their products in the country. To ensure that further appreciation does not adversely affect the country, Chinese government ought to come with a limit of its appreciation.

Reference List

Alon, I. & Drtina, R. 2006. Chinese Currency forecast and capital budgeting. The journal of American Academy of Business, Cambridge, Vol. 10, No.1, pp. 218-228.

Bahmani-Oskooee, M. & Abm, N. 2005. Productivity Bias Hypothesis and the Purchasing Power Parity: A Review Article. Journal of Economics Surveys, Vol. 19, No. 4, pp. 671–696.

Caves, R. E., 2005, Flexible exchange rates. London: Harvard University Press.

Copeland, L. S., 2005, Exchange rates and international finance (4th Ed).Toronto: FT Prentice Hall.

Egert, B, Laszlo, H, & Ronald, M. 2006. Equilibrium Exchange Rates in Transition Economies: Taking Stock of the Issues. Journal of Economic Surveys, Vol. 20, No. 2, pp. 257–324.

Elbadawi, I., 1994, Estimating Long-run equilibrium real exchange rate in Estimating equilibrium exchange rates. Washington: Institute for International Economics.

Illes, H. 2009. Covered and uncovered interest rate parity. [Online] Web.

Montiel, P. J. 2000. The Long-Run Equilibrium Real Exchange Rate: Theory and Measurements. [Online] Web.

Taylor, A. M. & Taylor, P. M. 2004. The purchasing power parity debate. Journal of economic perspective, Vol.18, No. 4, pp. 135-158.