Introduction

The Circular Flow Diagram paradigm is a beneficial tool to grasp better how the economy functions. This model’s primary goal is to explain money circulation throughout a market. It distinguishes between the marketplaces for products and offerings and the sectors for these entities’ production parameters. Krugman and Wells (2020) enumerated that the framework has two primary segments: the domestic and the corporate sectors. These two components connect in a cyclical movement of products, services, and payments. The household segment and the business sector are described below. The enterprise element receives personnel and other manufacturing variables from the home sector. With these inputs, the business sector can generate merchandise and offerings, which are then resold to the household sector (Young, 2022). The household sector receives reimbursement through earnings and salaries from the commercial sector, sending that money back to the commercial sector as expenditures for items and services.

Task One: Brexit and the UK Economy

Over the previous three years, one big event has had a substantial impact on the UK economy, and that event is Brexit. The UK conducted a referendum in 2016, and the people who participated decided for the country to withdraw its membership from the European Union (EU), which it officially did on January 1, 2021 (David, 2023). There has been a significant impact, both favorable and negative, on the economy of the UK due to the consequence of negotiating and carrying out Brexit.

Positive Impacts

Firstly, one of the critical advantages of Brexit is that it has given the UK increased economic policy freedom and maneuverability. By leaving the EU, the UK is no longer bound to EU directives, giving it greater power over its policies, trade treaties, and regulatory requirements. This expanded autonomy could result in more beneficial trade agreements with other nations, boosting the British economy. Secondly, the UK’s exit from the EU could increase its chances of establishing trade arrangements with non-EU countries (Dhingra and Sampson, 2022). The UK may strike bilateral treaties on its conditions and eventually earn more advantageous deals than it might have as an EU member. This may result in more significant exports, international investment, and economic expansion.

Thirdly, the UK was compelled to pay subscription fees as an EU participant. These fees were a substantial financial drain on the UK economy, costing billions of pounds annually. By exiting the European Union, the UK will no longer be obligated to pay these levies, which might free up funds for infrastructural development, education, and healthcare, among other uses. Fourth, Brexit could result in an upsurge in production and agriculture in the UK. The UK will no longer be constrained by EU laws and charges, which could facilitate exports by British industries. Moreover, the UK will be able to form its trade regulation, which could result in more optimal circumstances for British producers and an improvement in their production. Lastly, exiting the EU might make the UK a more competitive global commercial hub (Dhingra and Sampson, 2022). The UK will be able to determine its norms, tariffs, and commercial agreements, which might make it more appealing to companies seeking to establish operations in Europe.

Negative Impacts

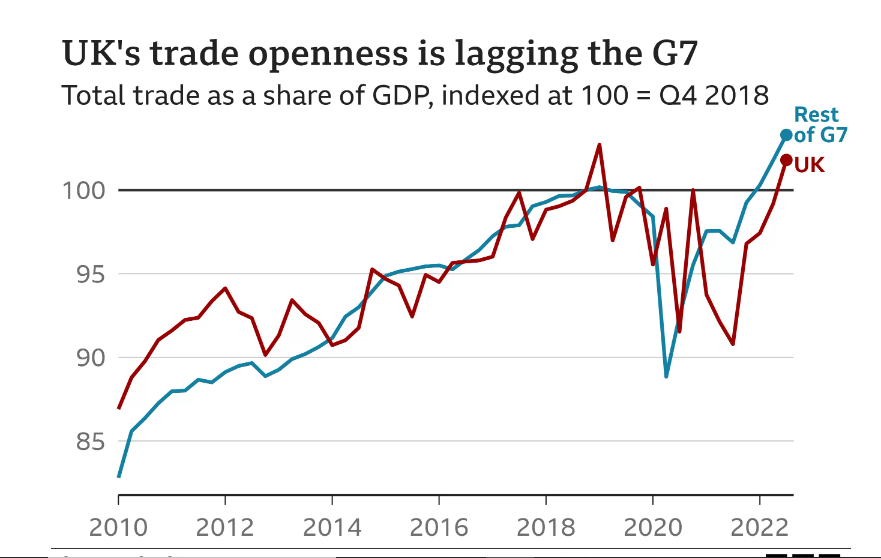

Firstly, due to the UK’s withdrawal from the customs union and unified market in 2021, enterprises operating with the EU confronted stricter regulations and new inspections for specific commodities. Therefore, this generated concerns about the future of the £550 billion commerce between the UK and its trading partners. There was an initial decline in the number of British exports to the EU. David (2023) states that trade volumes rebounded to pre-pandemic proportions when initial concerns were resolved. Nonetheless, it may be claimed that trade would have expanded more had Brexit not occurred. In a recent study of 500 businesses, more than half of respondents indicated they were still adjusting to the proposed Brexit format (David, 2023). An examination of customs categorization revealed that the variety of exports has decreased. Before the current inflation spike, the cost of staples imported from the EU, such as tomatoes and potatoes, increased by as much as 6% during 2020 and 2021 (David, 2023). At the epidemic’s peak, commerce in the remainder of the G7 jurisdictions had rebounded compared to the magnitude of their sectors, but not in the UK, as demonstrated in figure 1.

Secondly, the partnership between the UK and the EU also affects the amount of money corporations invest in manufacturing, instruction, equipment, and innovation. Since the referendum, spending has halted as firms remain concerned about economic prospects. The UK in a Changing Europe believes that if the investment had maintained its pre-referendum trajectory, it would be approximately 25% greater than it is currently (David, 2023). Analysts, such as the International Monetary Fund, believe that Brexit’s uncertainties, notably the Northern Ireland Protocol’s unresolved question, have discouraged expenditure (Ziady, 2022). Sir Richard Branson is among the corporate executives who have indicated that the burden of Brexit red tape will discourage them from investing in the UK (David, 2023). Briefings for Business, a pro-Brexit organization, asserts that the data are deceiving and that there is no proof of an investment slump due to Brexit (David, 2023). Ultimately, though, a shortage of capital renders the British economy less productive and less profitable than it could be.

Finally, modifications to the regulations governing the labor market’s free circulation and the adoption of a points-based visa system were also consequences of exiting the EU. Lord Wolfson, the CEO of Next, and Tim Martin, the CEO of Wetherspoons, embraced Brexit; nonetheless, both urged the UK to admit more employees (Ziady, 2022). According to a report by the think tanks Centre for European Reform and the UK in a Changing Europe, Brexit has reduced the number of workers in the UK by 330,000 (David, 2023). It may only account for 1% of the working population, but industries such as transportation, hospitality, and commerce have been affected extremely harshly (David, 2023). Consumers’ costs have increased as a result of labor constraints and shortages. Some analysts argue that these limits will drive corporations to increase investment and personnel training. According to a report from the House of Commons, 7,000 jobs may have been lost in the banking and finance sector, which is significantly less than the 70,000 jobs expected (David, 2023). Therefore, Brexit has increased further the rate of unemployment in the UK.

Overall, the Circular Flow Diagram instrument effectively studies the influence of particular events on the British economy. Brexit is only one event that has had substantial effects on the UK economy in recent years, underlining the necessity of comprehending the relationships between different economic sectors during times of upheaval and unpredictability. By applying this concept to a particular issue or circumstance in the UK over the past three years, investigators can acquire an overview of the economic consequences of that incident.

Task Two: Real-World Economics Events between the UK and the USA

The economic circular flow diagram model shows the movement of cash, commodities, and services throughout an economy. According to Krugman and Wells’ (2020) explanation of the Circular Flow Diagram, the illustration comprises two marketplaces: the market for products and amenities and the sector for the manufacturing variables. In the industry, for items and solutions, monetary value is traded for the merchandise and offerings. On the other hand, the market for personnel and other production components is where the workforce and other production elements are sold for monetary value. The report will utilize the terminology from Chapter 2 to describe how the Circular Flow Diagram may be used in real-world economic occurrences in the UK and the USA.

Firstly, the fiscal stance taken by the jurisdiction in the UK has been affecting the Circular Flow Diagram in several ways. The state of the United Kingdom announced the Spring Budget in March 2021 (Seely, 2023). Under this budget were various initiatives designed to assist companies that the COVID-19 outbreak had impacted. Modifying the Coronavirus Job Retention Scheme (CJRS) was one of the steps taken (HM Revenue & Customs, 2022). This scheme enabled companies to temporarily lay off some of their workers in exchange for financial assistance from the government. This measure may be found in the component marketplace, where the federal government provides monetary aid to firms to encourage them to keep their employees. Since it requires money to be removed from the sector, the state’s expenditures on the CJRS are likewise considered a leakage in the circular money stream.

Secondly, establishing an internet services levy illustrates the effects of federal guidelines on the UK’s circular flow diagram. In April 2021, the UK’s state imposed a 2% tax on the earnings of online solutions businesses, such as Facebook and Google, earning at least £25 million from UK consumers (Sherman, 2018). A digital offerings tax is a fee imposed on the income of certain technology companies believed to have a massive financial operation within a jurisdiction but no commanding presence there (Young, 2022). Adopting this tax would have multiple effects on the Circular Flow Diagram.

It would diminish the earnings of impacted digital enterprises since they would be required to contribute a part of their earnings to the authorities as tax. This would lessen the amount distributed to the proprietors or investors in the company, which could lead to a decrease in expenditure or returns (Hern, 2020). The establishment of a charge on internet platforms could also impact customer behavior. If the digital corporations affected by the levy decide to pass the cost on to their clients, this could mean higher pricing for shoppers. As a result, individuals may opt to make expenditures elsewhere, decreasing the quantity of money leaving households and entering the affected enterprises.

Moreover, establishing a tax on digital services may affect government revenue. The impacted firms’ tax contributions would boost the amount of money going into the administration. Thus, this could culminate in an upsurge in public spending or, conversely, a minimized tax rate for other organizations and individuals (Hern, 2020). Ultimately, establishing an internet services taxation in the UK would affect the Circular Flow Diagram by affecting the flow of money throughout the economy. The levy would decrease the revenues of impacted digital enterprises, alter customer habits, and diminish government income.

The COVID-19 epidemic has substantially impacted the US Circular Flow Diagram, affecting the flow of products and offerings, modifying client behavior, and contributing to alterations to state guidelines and expenditures. The circulation of commodities and solutions has been one of the pandemic’s most severe ramifications for the Circular Flow model. Critical products, like personal protective equipment (PPE) and pharmaceuticals, are in limited supply due to the epidemic’s disruption of worldwide distribution networks (Kaye et al., 2021). Due to this interruption, organizations have had trouble sustaining manufacturing and satisfying customer requirements, resulting in decreased output and revenue.

Consequently, social distancing restrictions and confinement have resulted in the shutdown of numerous enterprises, especially in the restaurant industries, thereby further diminishing economic output. Furthermore, due to the pandemic, customer perception has altered dramatically, influencing the flow of income and spending in the Circular Flow Diagram. Since many enterprises have ceased or are functioning at a limited capacity, the incomes of many households have decreased, either due to job layoffs or decreased operating time (Ozdemir et al., 2021). Thus, this has reduced consumer spending, especially on non-essential items and amenities. Nonetheless, there has also been a rise in demand for necessary items such as food and home goods, resulting in distribution network disruptions and bottlenecks.

Finally, the epidemic has also impacted federal policy and funding, altering the flow of income and expenses in the Circular Flow Diagram. The development of numerous assistance bundles and recovery efforts designed to mitigate the pandemic’s fiscal effect has been one of the epidemic’s most profound influences on federal regulation and finance. The CARES Act, for instance, gave direct funding to households, enhanced jobless benefits, and extended enterprise financial assistance and grants (LaBrecque, 2022). Similar laws designed to provide financial assistance to people and companies have been included in future relief plans (Patton, 2022). These aid programs have immediately affected the movement of income and expenditures depicted in the Circular Flow Diagram. The cash subsidies to households have raised household earnings, which has prompted a rise in household consumption expenditures.

Similarly, the loans and subsidies offered to firms have assisted them in maintaining activities and avoiding layoffs. This has contributed to preserving household revenues and protecting the economy from contracting further. Nonetheless, the execution of these aid packages has also caused a spike in public expenditure, resulting in a rise in the federal deficit (Patton, 2022). This surge in government expenditure was required to boost economic activity, but it has expressed doubts about the state’s long-term financial viability. In conjunction with the assistance supplies, the pandemic has also resulted in policy shifts that have altered the movement of income and expenses in the Circular Flow Diagram.

Conclusion

In conclusion, the Circular Flow Diagram model by Krugman & Wells (2020: p. 106) offers a helpful structure for comprehending the transfer of cash, commodities, and offerings between consumers, enterprises, and the authorities in an economy. Brexit is one occurrence that has had a substantial effect on the British economy over the past three years. Since the UK effectively exited the EU on January 1, 2021, it has encountered various economic issues, including distribution network interruptions, commercial unpredictability, and job market shifts. These effects have been felt in market mechanisms, such as workforce and logistics chains and households that have experienced financial hardship.

The repercussions of Brexit on commerce have also damaged the UK economy. With the UK no longer a member of the EU’s single market, additional customs and non-tariff restrictions have escalated the expenses associated with conducting business. Imports from the EU into the United Kingdom have also encountered comparable barriers, leading to production chain inefficiencies and rising costs for firms. Furthermore, Brexit has generated uncertainty for businesses, minimizing spending and recruitment in certain industries. When contrasting the UK to another nation, such as the USA, it is evident that both nations have encountered similar issues linked to COVID-19. However, the USA has chosen a different strategy for pandemic management, focusing more on federal grant and immunization initiatives.

These measures have affected the many segments of the Circular Flow Diagram, such as shifts in customer habits and higher expenditures by the government. For instance, the passage of the CARES Act in the USA offered cash subsidies to households, prolonged unemployment compensation, and funds for the distribution of vaccines. These measures have favorable effects on the US economy, resulting in greater consumer expenditure and a decline in unemployment. Overall, the Circular Flow Diagram model provides a good foundation for comprehending how macroeconomic factors influence numerous financial constituents. Understanding these intricate connections is vital for governments and people to navigate economic obstacles and possibilities.

References List

David, D. (2023). What impact has Brexit had on the UK economy? BBC News. Web.

Dhingra, S. and Sampson, T. (2022) ‘Expecting Brexit.’ Annual Review of Economics, 14, pp.495-519. Web.

Hern, A. (2020). UK to impose digital sales tax despite risk of souring US trade talks. The Guardian. Web.

HM Revenue & Customs (2022). Coronavirus Job Retention Scheme. Web.

Kaye, et al. (2021) ‘Economic impact of COVID-19 pandemic on healthcare facilities and systems: international perspectives.’ Best Practice & Research Clinical Anaesthesiology, 35(3), pp.293-306. Web.

Krugman, P. R., and Wells, R. (2020) Economics. Worth Publishers.

LaBrecque, L. (2022). The CARES Act has passed: here are the highlights. Forbes. Web.

Ozdemir, et al. (2021) ‘Quantifying the economic impact of COVID-19 on the US hotel industry: examination of hotel segments and operational structures.’ Tourism Management Perspectives, 39, p.1-12. Web.

Patton, M. (2022). The impact of COVID-19 on US economy and financial markets. Forbes. Web.

Seely, A. (2023). Spring budget 2021 and finance (No.2) Bill 2019-21. House of Commons Library. Web.

Sherman, N. (2018). US attacks UK plan for digital services tax on tech giants. BBC News. Web.

Young, M. (2022). Lecture 2. MOD3327 Economics for Business. Anglia Ruskin University of London.

Ziady, H. (2022). Brexit has cracked Britain’s economic foundations. CNN. Web.