Introduction

In international trade, the demand and supply of currencies affect their values in the short and long term (Frieden 2016). The interest rate policies formulated by different governments to stabilize their currencies also influence supply-side economics and, by extension, the value of linked currencies (Hassan & Mano 2019). These effects have an impact on international trade, as alluded to by Martill and Staiger (2018, p. 131) who say that “the cost-effective prevention of currency crises in open economies is in the interest of all countries trading with and investing in each other.” This trend is backed by the global floating exchange rate system where market forces determine the value of a currency (Liu, Chen & Ralescu 2014).

Over the years, increased transparency in the foreign exchange market has seen a surge in trading activity for major world currencies (Frieden 2016). Market uncertainties and their potential effects on the global economy have forced some researchers to develop models and theories to explain the effects of currency fluctuations on economies (Liu, Chen & Ralescu 2014). For example, the purchasing power parity theory has been used to explain the determination of exchange rates based on the cumulative demand of two inconvertible currencies (Martill & Staiger 2018). Alternatively, through currency option pricing formulas, different mathematical models have been developed to understand the effects of currency fluctuations on economies (Liu, Chen & Ralescu 2014).

Varied fundamental and technical factors affect currency values. In addition to demand and supply forces, a country’s economic performance, inflation outlook, and interest rate regime may cause fluctuations in exchange rates (de Chene 2014; Menkhoff, Sarno & Schmeling 2016). Although a country’s economy should ideally dictate the strength of its currency, huge movements in value could equally influence its performance (Schaffer, Agusti & Dhooge 2017).

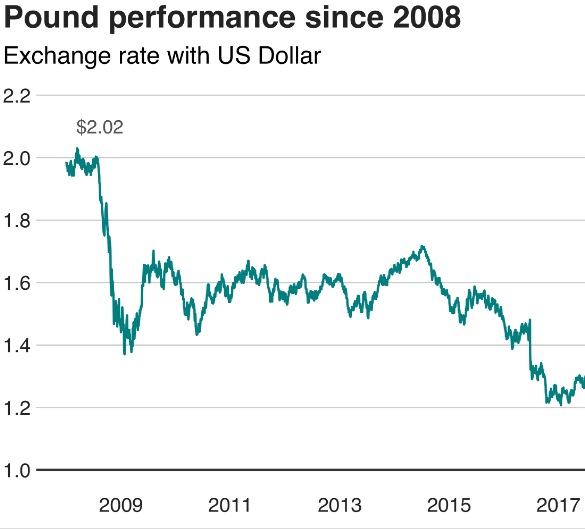

For example, currency fluctuations could create economic disturbances, uncertainty, and instability in an economy, thereby influencing capital flow. Recently, there have been increased concerns about the future of the British pound due to uncertainties about the effects of “Brexit” (Dixon & Jo 2017). Figure 1 below shows a decline in the performance of the British Pound for the last ten years.

It is difficult to predict the impact of a declining pound on the UK economy because of the latter’s complexity. In fact, according to Martill and Staiger (2018), the UK is one of the most sophisticated economies in the world. This paper suggests that a declining pound will affect the UK economy negatively. This argument is presented by first analyzing the positive impact of the currency on the economy and lastly an evaluation of its negative effects.

Positive Impacts

A declining pound could benefit UK exporters by making their foreign currencies more valuable. Concisely, they will get more value for their money compared to an alternative scenario where they are paid by a weak pound. Therefore, if the value of the pound increased, they would experience diminished spending power by paying more money (in foreign currency) to obtain the local currency.

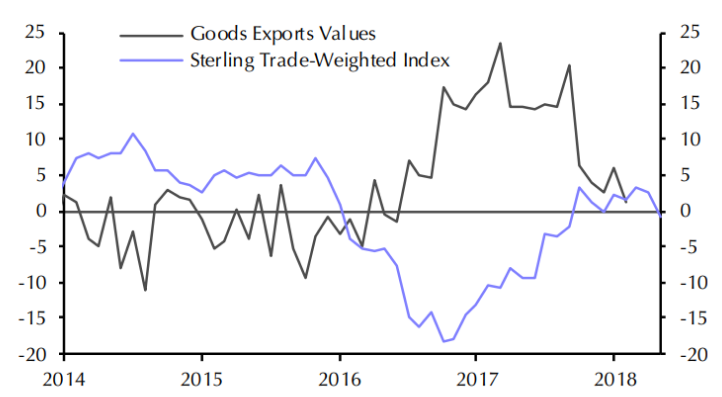

To understand the impact of a declining pound on UK exports, it is important to understand the effects of a strong currency on exporters. According to de Chene (2014), a strong pound would make British exporters uncompetitive in the global market. This is why many export-based countries try to devalue their currencies to support their export businesses. Nonetheless, a declining pound will have a net positive effect on the UK export sector. Therefore, residents who are paid in foreign currencies may find it easier to live in UK cities if the value of the pound declines. According to figure 2 below, the volume of UK exports increased with a decline in the pound between the periods 2016-2018.

Neelankavil (2015) has also explained the positive effects of a decline in the value of the pound on the UK export sector by arguing that a weak currency would support some of the country’s long-term manufacturing policies. Stated differently, the manufacturing sector will be aided by a weak currency, especially if they are producing goods for export. The opposite is also true because an increase in the value of the pound would negatively affect export-based businesses.

Negative Effects

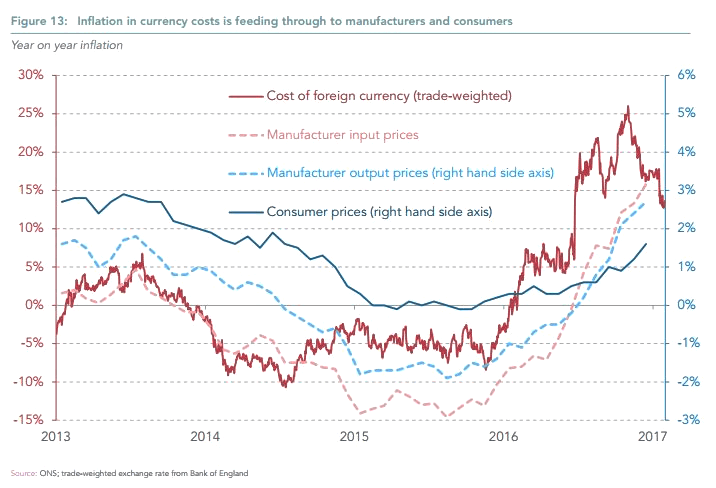

A weak pound would send negative signals to the global market about the health of the UK economy. For example, it could signify to investors that there is an unfavorable business environment (Fernandez-Villaverde & Sansches 2019). Such an outcome would have negative repercussions on the economic viability of the UK, as one of the leading markets in the world, vis-a-vis the emergence of other dominant global economies. The possible negative effects of a declining pound on the UK economy have been partly linked with the economic challenges brought by the “Brexit” referendum. A declining economy means that there will be minimal production of goods and services, low demand for products, and declining wages (Neelankavil 2015). Figure 3 below shows that an increase in the cost of the pound is commensurate with an increase in the manufacturer’s output as well as consumer price.

Collectively, a declining pound would make goods and services more expensive for the average UK citizen (see consumer price index above). Evidence of the effects of a declining pound on the UK economy can be traced to 2007/2008 when the value of the currency declined significantly amid fears of a slowing economy (Martill & Staiger 2018). Research that has been done to investigate the effects of the UK’s vote to leave the European Union (EU) has shown that political upheavals caused a decline in the pound and a net increase in inflation in the first year after the vote (Martill & Staiger 2018).

Martill and Staiger (2018, p. 42) shared this view when they said that “political upheavals cause uncertain outcomes.” Nonetheless, it is feared that a no-deal “Brexit” could further worsen the effects of a declining pound on the economy because of the possible imposition of tariffs and additional taxes on UK goods within the EU (Martill & Staiger 2018).

The negative effects of a weak pound on the UK economy could also be envisaged through a decline in wages. Arguably, the country’s economy is supported by the provision of wages to workers and employees who serve in different economic sectors. These professionals often use their incomes to support families and pay for basic amenities, such as electricity and water. Because most employees in the UK are paid in pounds, a devaluation of its value would mean a commensurate decline in their wages as well. In other words, the number of goods that could be bought with one pound would be fewer when there is a decline in its value. Moreover, a person who holds a foreign currency (say a dollar) could purchase more goods and services in the UK when the value of the pound is low.

Therefore, a devaluation of the sterling pound would imply a decline in wages because of the loss in spending power. Broadly, as alluded by Liu, Chen, and Ralescu (2014), a depreciated currency is akin to a decline in the national share price of the UK economy. It signifies a reduction in revenue and wages, subject to the economic performance of competing countries.

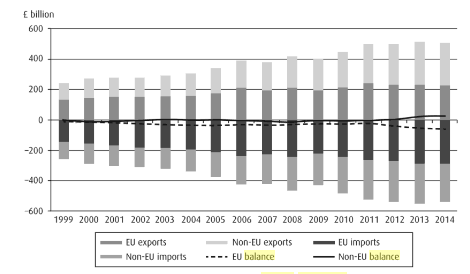

Overall, an examination of the economic dynamics of the UK economy, subject to the potential positive and negative effects of a weak currency highlighted above, shows that a declining pound will affect the UK economy negatively. This is because Britain is mainly an import-based economy. Indeed, according to statistics published by Martill and Staiger (2018), the UK has a negative trade balance for many years. For example, according to figure 4 below, the UK has had a negative trade balance with the EU for the past decade.

A decline in the value of the currency would be beneficial to exporters as they are mostly paid in foreign currencies (Martill & Staiger 2018). Other economic players would experience negative effects. For example, importers may report reduced revenue because they have to pay more money to get the same value of imports they received when the currency was strong. Therefore, based on the significance of the UK import sector to its economy, the arguments presented in this paper show that a declining pound would negatively affect the UK economy.

Conclusion

As mentioned above, the effects of a declining pound on the UK economy are best understood through a review of the currency’s effects on its import and export sectors. The UK economy is underpinned by a strong import sector because its exports are fewer. Therefore, a devalued pound would have negative ramifications on the economy because it will signify weakness and a decline in the market. Although this effect is likely to affect major international financial transactions done using the pound, it will be difficult for domestic users to experience much of the impact.

Nonetheless, it is important to point out that the current downward pressure of the pound is a result of political forces and not necessarily a lack of confidence in the fundamentals of the UK economy. Therefore, it is likely that the effects of a declining pound could be negated by a rebound of the currency in the future.

Reference List

de Chene, KM 2014, The practice of international trade, Author House, New York, NY.

Dixon, LJ & Jo, H 2017, ‘Brexit’s protectionist policy and implications for the British pound’, International Journal of Financial Research, vol. 8, no. 4, pp. 7-22.

Fernandez-Villaverde, J & Sansches, D 2019, ‘Can currency competition work’, Journal of Monetary Economics, vol. 106, no. 1, pp. 1-15.

Frieden, JA 2016, Currency politics: the political economy of exchange rate policy, Princeton University Press, Princeton, NJ.

Hassan, TA & Mano, RC 2019, ‘Forward and spot exchange rates in a multi-currency world’, The Quarterly Journal of Economics, vol. 134, no. 1, pp. 397-450.

Liu, Y, Chen, X & Ralescu, DA 2014, ‘Uncertain currency model and currency option pricing’, International Journal of Intelligent Systems, vol. 30, no. 1, pp. 40-51.

Martill, B & Staiger, U (eds) 2018, Brexit and beyond: rethinking the futures of Europe, UCL Press, London.

Menkhoff, L, Sarno, L & Schmeling, M 2016, ‘Information flows in foreign exchange markets: dissecting customer currency trades’, The Journal of Finance, vol. 71, no. 2, pp. 1-10.

Neelankavil, D 2015, International business research, M.E. Sharpe, New York, NY.

Schaffer, R, Agusti, F & Dhooge, LJ 2017, International business law and its environment, 10th edn, Cengage Learning, London.