Introduction

The paper will examine how Clipboard Tablet Company has strategically positioned its tablets: X5, X6, and X7 in the market. Each of the tablet types has its cost, price, and R&D expenditure. There are specific decisions that the company needs to make related to these products to maximize their sales and profit. The basic decisions that are permitted in the simulation include those related to price, allocation of R&D expenditure, and continuation of the model.

Considering the fact that, Clipboard Tablet Company has introduced new types of tablets: X6 and X7, the company has faced clear choices on standardizing its products to reap the potential benefits on economies of scale. As well, it is considering if it can adapt the offer within certain markets that facilitate increased market entries or adopting an integrated approach. Moreover, the paper will look at Clipboard Tablet Company strategic positioning by utilization of the cost-volume-profit (CVP) analysis from the SLP3, then run the simulation for each of the four years: 2012, 2013, 2014, and 2015.

Strategy Implementation

In order to achieve higher sales revenues and higher profits, implementation of the strategies previously set for the promotion of the tablet types: X5, X6 and X7 is significant. As indicated in Table below, a comparison between profits made in 2012 show no difference with the 2012 profits because of no strategy changes. This pointed in the wrong direction because whenever new pricing strategies are developed, market annual fluctuations must be factored in (Weygandt, Kimmel, & Kieso, 2015).

Table 1. Previous Decisions for Clipboard Tablet Company.

The cost-volume-profit (CVP) analysis shows that a reduction in X5 price in 2012 to $280 works well with a corresponding decrease in the Research and Development allocation to 30%. This is because the customers get more concerned with the cost of X5, and the necessary improvements on the tablets X6 and X7. This will reciprocate into potential profits of $45,000,000 and a potential production of 950,356 tablets as indicated in the Table 2 below.

Table 2. The Revised Strategy according to the CVP Analysis.

In order to stabilize the price of tablet X6, there is need for further investment in its research and development. A 36% increase in the R & D expenditure will post an increase in the company profits amounting to $37,579,840 as indicated in Table 2. This strategy will also post a decrease in the volume of X6 tablets produced. Tablet X7 on the other hand, requires an improvement in its efficiency to meet the customer preferences (Needles, & Crosson, 2013). This can be achieved through increased investment in bits research and development. This will in-turn trigger a potential production of 715,201 tablets and expected profits of $30,000,000 as indicated in Table 2.

Drury (2013) indicates that gradual decrease in the prices as with the case of tablets X5 and X7 results into higher profits as shown in Table 1. Changes in the allocation for research and development will result in higher profits in 2013 as indicated in Table 1. For the company to realize the 2013 $46,000,000 projected increase in profits in 2014 for table X5, it needs to make its price to amount to $278 per unit as indicated in Table 2.

However, reduction in the price for tablet X6 will post a corresponding increase in its profits. The earlier strategy appears favorable relevant for X6 table development at this stage. A proposed $420 price will work well with a gradual reduction in the profits as indicated in Table 2.

Preservation of tablet X7’s price while contributing more towards its research and development expenditure comes handy. This will make the realization of the $35,000,000 profit margin a reality. This is because X7 is a new product in the market, therefore, the need to increase its features to reach and attract more customers.

The popularity of X5 in 2014 can reduce among the customers, and it is therefore true that the expenditure on research and development should be reduced to 29%. This will post increased profits and volume as indicated in the Table 2. It is significant to ensure high sales during promotion of tablet X6.

There must be a correlation between expenditure in R & D and the pricing. This will eliminate the mistake made in the previous strategy that resulted in reduced sales in the previous strategy as shown in Table 1. The prices need to be comparably low while more expenditure is channeled in more research and development to develop the product. Increased sales revenues and volume of X6 produced will increase to the projected profit of $50,000,000 as shown in Table 2.

Good news in 2014 will be a potential market position win by X7 as its sales revenues are expected to increase. This will be achieved through an increased volume of production of X7 as well as a reduction in its price as proposed in the previous strategic decisions. This will project an expected profit of $40,000,000 as indicated in Table 2.

The volume of production for tablet X5 should reduce in 2015 in order to enhance promotion of the other two products X6 and X7. In order to attain stable profits of $60,000,000 and sales setting at $410, the price and the R&D expenditure need to be reduced as indicated in the previous strategy (Rajan, Datar, & Horngren, 2015), which suggested an increase in the price and R&D expenditure on X6.

More expenditure in research and development is required to make X6 more appealing to the customers; however, a lower percentage is eminent. The number of customers for tablet X6 is expected to increase proportionately with the volume as product X7 will be earning higher revenues in 2015 due to its higher revenues. At this point, price stability and a reduction in the expenditure in research and development will be attained as shown in Table 2.

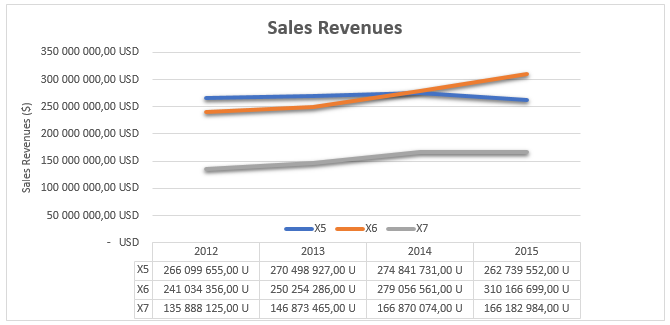

Tablets X6 and X7 will record an increase in sales as shown in Figure 1 above. The sales for X5, however, are expected to reduce in 2015 because of shifted promotion focus on the other tablets X6 and X7. It is thus, significant to spend more resources in the promotion of the cost-efficient and appealing X7 tablet.

Strategic Options

Clipboard Tablet Company can employ different strategies to deal with the above issue. The company can engage in more research and development to ascertain how consumers make their purchase decisions. This will also enable it to understand how to implement a localization strategy that will work. In the same regard, this is a strategy that will help Clipboard Tablet Company understand the mistakes it has been making, hence its inability to understand consumer behavior. Clipboard Tablet Company has over the years attempted to embrace localization strategies (Vance, & Paik, 2014).

Essentially, it has been committed to providing products and services that are based on the local tastes. This is clear indication that it does not understand what it is up against. The management in the company works under the assumption that it understands consumer behavior. The fact that it is yet to develop an effective localization strategy is a clear indication that the management does not understand how the people make their purchase decision and what they consume. This is a problem that can be easily dealt with through research. Fundamentally, the management will access the right information and use the same to make informed decisions in relation to which localization strategy will work.

In particular, the company should consider hiring more from the local population as opposed to relying on expatriates. The first option is viable. However, it may take a time before the company completes its research or gathers the necessary information that will enable it to understand the consumer behavior (Vance, & Paik, 2014). In the same regard, there is always the chance that it will not gather everything. It may miss some details that can affect the effectiveness of its localization strategies. Expatriates have tried to understand the culture for many years. It is high time they leave the task to the real experts who are the locals.

The second option is the best as locals understand the market and how it operates. Similarly, the company will be collecting information right from the source. Local employees are also consumers; hence understand their needs and preferences. Hiring locals will also enable the company to gain acceptance. Locals will be able to identify with it or treat it as one of their own. As a result, the company will be able to attract and retain high number of customers. Principally, hiring expatriates leads to the company being treated as a foreigner. As such, consumers may align with local retailers. Ultimately, the strategy will also enable the company to cut its labor costs.

Conclusion

Progressive implementation of strategy and strategy controls is essential for the company’s success. The company needs to consider more of an industrial structure. As well, it needs to make an appropriate position within the industry. The positioning of the company will determine competitive advantages that can be held. It may range from low cost, product differentiation or broad market.

References

Drury, C. M. (2013). Management and cost accounting. New York, NY: Springer.

Needles, B., & Crosson, S. (2013). Managerial accounting. New York, NY: Cengage Learning.

Rajan, M., Datar, S. M., & Horngren, C. T. (2015). Cost accounting. New York, NY: Pearson Higher Education.

Vance, C. M. & Paik, Y. (2014). Managing a Global Workforce: Challenges and Opportunities in International Human Resource Management. New York, NY: Routledge.

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2015). Financial and managerial accounting. New York, NY: John Wiley & Sons.