Abstract

The purpose of this report was to analyze six aspects of Cookie Business. First, the report focuses on breakeven analysis and determines the number of cookies needed on average to cover the fixed costs. Second, the cost of inventory was calculated using full and variable costing. Third, a special order of 1,000 cookies was evaluated to advise the company if it should be accepted or rejected. Fourth, a new investment was evaluated to determine if the company should invest in new equipment. Fifth, the cash budget was evaluated to understand if current collection practices are correct. Finally, material and labor variances were calculated. The report is concluded with a set of recommendations and conclusions based on analysis.

Introduction

This paper focuses on the analysis of the Cookie business. In particular, the report touches upon six aspects of the company’s business, including contribution margin and breakeven analysis, inventory costing strategy, special offer analysis, investment opportunity assessment, cash budget analysis, and variance analysis. The purpose of the analysis was to provide a set of recommendations for the Cookie Business.

Part 1: Contribution Margin/Breakeven

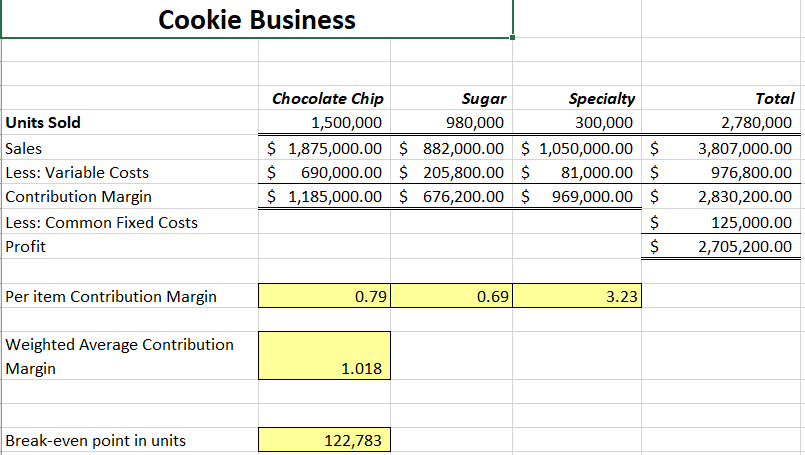

The first step in analyzing the cookie business was calculating the contribution margin (CM), the weighted average contribution margin (WACM), and the breakeven point. The calculations are provided in Figure 1 below.

The analysis demonstrates that specialty cookies had the highest CM per unit of $3.23, while sugar cookies had the lowest per unit CM of $0.69. The WACM per unit was found to be $1.02, which helped to calculate the breakeven point in units. The calculations demonstrated that the business needed to sell at least 122,783 cookies to break even.

Part 2: Full and Variable Costing

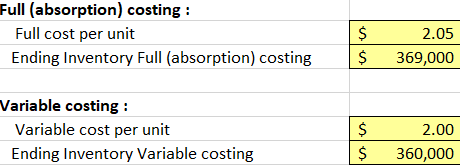

The second step in analyzing the cookie business was to calculate the full and variable costs of the remaining inventory. The results of calculations are provided in Figure 2 below.

The results demonstrate that the full manufacturing cost per unit was $2.05, while the variable cost per unit was $2. Thus, the cost of ending inventory based on the absorption costing method was $369,000, while the variable cost of the inventory was $360,000. According to Heisinger and Hoyle (2018), the absorption costing method is more advantageous for the company, as it takes into account all of the costs of production instead of considering only direct costs, which allows the company to acquire a better sense of profitability. Moreover, full costing approach is in accord with generally accepted accounting principles (Heisinger & Hoyle, 2018).

Part 3: Special Order

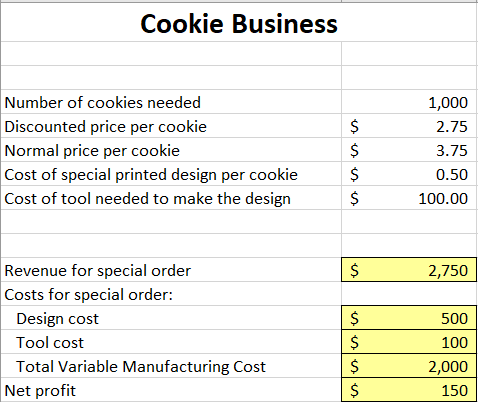

This section focused on the analysis of the special offer made to the cookie business. The company was offered to produce 1,000 cookies with special designs with a price of $2.75 per unit. Figure 3 below demonstrates the analysis of the offer’s profitability.

The analysis demonstrates that the net profit of the order is $150, which is significantly below the expected normal profitability. In general, companies should accept orders when benefits exceed costs (Warren et al., 2016). Benefits, however, are not always immediate, as potential benefits are also crucial. Sometimes, firms may accept orders if further orders may follow, if completing the order gives access to new markets, or if the order allows keep workers on their jobs in difficult economic situations when normal orders are unavailable (Warren et al., 2016).

In the present case, the benefits exceed costs, as net profit is positive. However, if the cookies were sold for the normal price, the company would have made $1,150 for the same order. Therefore, the company should take the order if the business was slow, and it has spare capacity to fulfill the order without harming the operations. Before making the final decision, the company should make sure that the customer understands that it is only a one-time event (Heisinger & Hoyle, 2018). Additionally, the company should consider if other companies such as key partners would not want to lower the prices on their orders. Only then should the offer be accepted.

Part 4: Internal Rate of Return

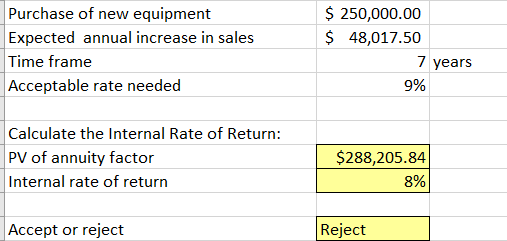

The company was offered to buy equipment to increase its sales. The equipment costs $250,000, and it will generate an increase in annual sales of $48,017.50. The analysis of the investment assuming the discount of 4% is provided in Figure 4 below.

The analysis demonstrated that the present value of the project is higher than the initial investment assuming a discount rate of 4%. However, if the internal rate of return (IRR) is taken as the central criterion for investment decisions, Cookie Business should avoid investing in the project, as the IRR of the project is 8%, which is lower than the target IRR of 9%.

Additional information should be considered before making the final decision. One of the partner’s brothers owns the company that sells the equipment and insists the equipment is needed. This implies that there may be some personal interest in promoting the equipment. Thus, the decision-maker may be accused of acting in self-interest rather than in the interest of the company. Such a decision should be avoided (Warren et al., 2016).

Part 5: Cash Budget

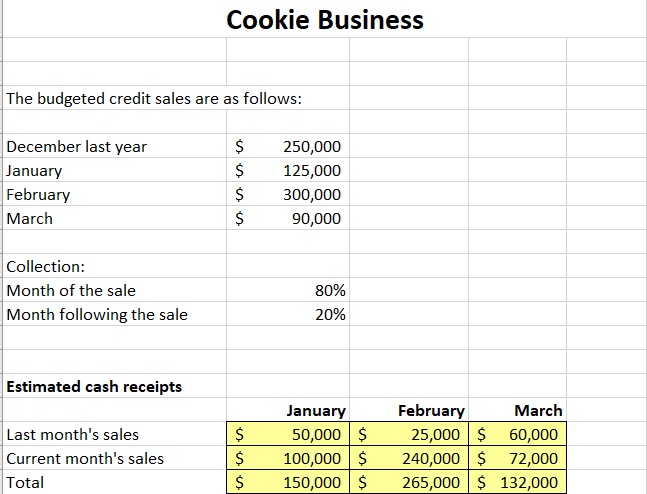

Currently, the company collects 80% of the credit sales during the current month and 20% of the credit sales in the following month. The analysis of cash budget is provided in Figure 5 below.

The analysis demonstrated that the company does not adhere to its goal of collecting $150,000 in cash each month, as the business collected only $132,000 in cash in March. Therefore, it should consider changing its current collection strategy.

Part 6: Material and Labor Variance

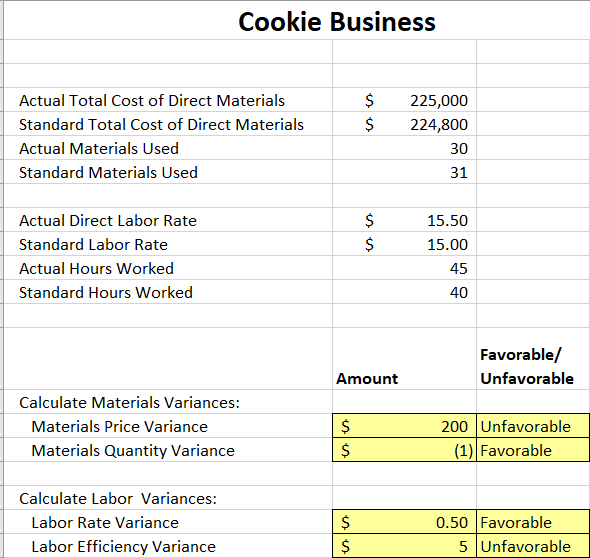

This section conducted material and labor variance analysis provided to assess the planning practices. The variance analysis is provided in Figure 6 below.

The analysis demonstrated that even though the company managed to use less material than it was planned, it paid more money for the material. Thus, the company should consider improving its cost planning strategy to improve the predictability of material costs. At the same time, even though the company managed to spend less per hour of labor, the efficiency of labor was lower. Therefore, the company may consider improving efficiency instead of saving money on labor costs per hour.

Conclusions and Recommendations

This report provided valuable insights concerning Cookie Business. First, the analysis revealed that the company needs to produce and sell at least 122,783 cookies on average to break even. Second, absorption and variable costs were calculated, and it was recommended to use absorption costing, as it takes into consideration all costs of production instead of considering only direct costs, which allow the company to acquire a better sense of profitability. Third, it was concluded that Cookie Business should accept the special offer if it has spare capacity and the stakeholders agree that it is a one-time event. Fourth, the analysis of the investment opportunity n new equipment revealed that the company should avoid this opportunity, as its IRR was below the threshold of 9%. Fifth, the report touched upon cash flow analysis, which demonstrated that the current strategy is not optimal and should be altered. Finally, the analysis demonstrates that the company should adopt new practices to decrease the variability of material cost and search for strategies to improve the efficiency of labor.

References

Heisinger, K., & Hoyle, J. B. (2018). Managerial Accounting. Flatworld Knowledge.

Warren, C., Reeve, J., & Duchac, J. (2016). Financial and managerial accounting (13th ed.). Cengage Learning.