Introduction

For the last 30 years, bank institutions have represented more than half of the commercial lending sector and approximately a quarter of the entire corporate credit market. The institutions are cautious creditors and repeatedly work to make credit accessible to credit-worthy companies and individuals throughout the country. Bankers analyse several factors before lending or investing. The features are corporate plans, cash flow forecasts, asset base, auctions, market inquiry, and commercial feasibility. Banks come up with loaning choices on a case-by-case basis. The conditions of the lending rely on the economic status of the specific commerce in the context of commercial market situations. For instance, if economic problems have an undesirable effect on a company’s monetary condition, then the risk to the financial institution loaning to the organization will be high. During such situations, the financial institution will be required to request for more security before the lending or the credit might be more costly. However, if the company is creditworthy and the lending institution believes it can pay the loan, the credit will be issued. The article below analyses the credit quality problems of banking institutions’ lending and investment decisions over the last 30 years.

Analysis

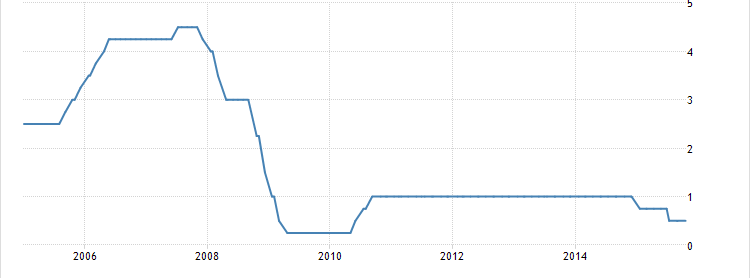

In the last 30 years, credit quality issues affecting banking institutions have been associated with regulating credit rating agencies, CRA. Between the year 1990 and 2000, investor confidence was high. However starting from the year 2000 to 2006, investor assurance decreased, leading to a recession that saw the rise in interest rates as indicated in figure 1 below. Based on the business scandals that devastated investor confidence towards the year 2006, it is apparent that credit quality problems in the last 30 years are the results of let downs on the role of issuers, mediators, stakeholders, supervisors and CRAs. The events that led to the 2006-2009 Recession are largely attributed to the problems caused by CRAs. The top CRAs in Canada are Dominion Bond Rating Services, Canadian Bond Rating Services, Moody, Fitch, and Standard & Poor. Before the 1980s, these CRAs used to earn their incomes through subscriber fees. However, they have changed their business model. Currently, they charge their issuers for their evaluation facilities. The above agencies offer an assessment of the creditworthiness of issuers in the market. The assessment illustrates how an issuer will probably make timely disbursements of his or her credit.

One major problem that has affected the credit quality is the transparency of the CRAs. As such, CRAs are mandated to rate issuers using specific metrics. In the recent past, concerns have arisen on how the agencies evaluate their issues. The companies have been accused of not being transparent in their ranking and rating processes. The criticisms have highlighted insufficient revelation by CRAs of their procedures. Financial institutions have been questioning their basic assumptions and assessment criteria. Critics have also highlighted that CRAs are not satisfactorily helpful on the limitations of their evaluations.

For instance, concerns have been raised on whether these institutions offer a satisfactory revelation of the lack of solid substantiation of the information they are provided prior to the release of the assessments. Equally, financial institutions have raised issues with the fact that CRAs do not continuously offer them certifiable and effortlessly comparable past performance date on their scores. The above concerns are considered a credit quality problem by banks because it affects their lending and investment decisions.

Another problem that has affected the credit quality over the last 30 years is the quality of the rating process by CRAs. Between the years 1990 and 2006, the prices for RMBS and CDOs witnessed considerable growth. During the same period, the products continued to become more multifaceted. At the same time, CRAs also experienced an increase in growth’s volume and complexity. The above led to difficulties in the quality of their rating process. As such, their staff numbers did not match the advancement in the market. Therefore, it was more common for scores to be released without concerns being addressed. During the same period, resource limitations prevented agencies’ capability to monitor in a well-timed manner the score assigned. Thus, CRAs were blamed for being slow to appraise and lower existing assessments. The above issues are also considered a credit quality problem by banks because it negatively influences their lending and investment decisions.

Conclusion

In the last three decades, concerns have arisen over the role of these CRAs. They are blamed for the 2007-2008 Recession that affected the global economy. As such, the institutions are responsible for the credit quality problems that affect financial institutions’ lending and investment decisions. One major problem that has affected the credit quality is the transparency of the CRAs. Another problem that has affected the credit quality over the last 30 years is the quality of the rating process by CRAs. The issues are major credit quality issues experienced by banks because they adversely influence their lending and investment decisions.

References

Beller, Alan. Lessons Learned from the Market Meltdown. New York: Practising Law Institute, 2008.

Boyarchenko, Svetlana. “Credit Risk, Credit Crunch and Capital Structure.” SSRN Electronic Journal SSRN Journal 12, no. 3 (2007) : 585-625.

Cole, Harold. “Credit Where Credit’s Due.” The Economist. 2014.

Evanoff, Douglas. The First Credit Market Turmoil of the 21st Century. Singapore: World Scientific, 2009.

Farzad, Roben. “The Cliff Is Not a Credit-Rating Crisis.” Bloomberg. 2012. Web.

Foley, Stephen. “Ratings from Credit Crisis Haunt Agencies – FT.com.” Financial Times. 2013. Web.

Leonard, Robin. Credit Repair. 8th ed. Berkeley, CA: Nolo, 2007.

Saunders, Anthony. Financial Institutions Management: A Risk Management Approach. Toronto: McGraw-Hill Ryerson, 2010.