Introduction

Over the past few decades, the financial markets have witnessed rampant product innovation. One of the reasons for this shift arises from increased demand for investment by both individual investors and institutional investors. A large number of investors are considering financial assets as a viable investment destination. The banking industry is one of the economic sectors which have undergone significant transformation as a result of financial product innovation (Caoutte, Altman & Narayanan, 2006, p.9).

The resultant effect has been an increment in the number of investment vehicles. In addition, the rampant rate of technological innovation and increased deregulation has created opportunities for banks to expand their operations. The resultant effect was an increment in competitive pressure within the industry. In addition, the rate of economic growth in various countries has culminated into an increment in personal disposable income and hence their consumption power. In a quest to attain a higher utility, consumers have increased their demand for money in order to meet their needs (Caoutte, Altman & Narayanan, 2006, p.10).

As a result of an increment in demand for money coupled with the high rate of competition, most banks have become less stringent in their lending practices. This has culminated into an increment in credit risk. According to Anson (1999), bank loans are one of the aspects which expose banks to credit risk. Credit risk refers to the probability that a loan holder will not meet the requirements of loan repayment in line with the agreed terms.

Apart from loans, banks also experience credit risk as a result of other products’ financial instruments. These instruments have been developed in an effort to meet the increasing investment demand in financial assets. Some of these instruments include bonds, options, swaps and equities. The increment in the rate of credit risk has stimulated financial institutions to incorporate the concept of credit risk management.

Credit derivatives

According to Anson (1999, p.1), credit derivatives refer to financial instruments specifically designed to ensure that there is the effective transfer of particular credit exposure with regard to an underlying asset amongst a number of individuals. Alternatively, credit derivatives can be defined as bilateral financial contracts which enable one party to pass-on credit default risk to another (Choudhry, 2005, p. 1). Over the years, one of the major forms of risks that firms faced related to credit. This was a challenge for firms since there lacked a well-developed risk management product to deal with this risk.

According to JP Morgan Group (2009, p.6), credit derivatives have undergone a significant evolution during the past decade. This sentiment is further advocated by JP Morgan Group which is of the opinion that that credit derivatives are amongst the fastest growing investment vehicles with regard to the financial markets. JP Morgan Group (2009, p.6) further assert that this growth has originated from increased product development. Prior to the development of credit derivatives, credit risk management mainly entailed diversification of loan portfolio. In addition, credit risk management was also undertaken by sale or disposal of positions in the financial market (Stewart & Peat, 2009).

Most investors who have invested considered derivatives as viable investment vehicles integrated insurance policies or alternatively letters of credit as credit risk management strategies. However, these strategies proved to be inefficient. This arises from the fact that credit risk management was not separated from the particular asset in with risk was associated. For example, a corporate bond has a number of risks associated with it one of them being credit risk. The only strategy which could be used to adjust the bond from credit risk is by either buying or selling the bond. Incorporating such a strategy has a negative effect with regard to positioning. This depicts numerous inefficiencies (Kolb & Overdahl, 2006).

According to JP Morgan Group (2009, p.6), credit derivatives play a significant role in credit risk management. This arises from the fact that credit derivatives enable independent management of credit risk. These financial assets act as bilateral financial contracts which separate the various elements of credit risk from the instrument. The risk is transferred between the parties involved. This culminates into separation of ownership of credit risk and its management from the various quantitative and qualitative elements related to the financial asset. Anson (1999, p.1) is of the opinion that credit derivatives are increasingly being incorporated by asset managers as one of the strategies to hedge against credit risk.

Operation of credit derivatives

Credit derivatives can be classified into three main categories as outlined below.

- Credit default swaps

- Equity default swaps

- Total return swaps

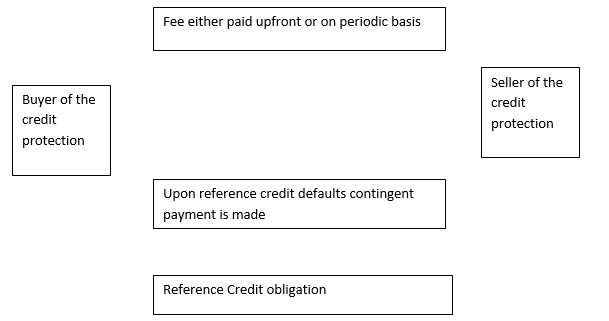

Within the credit market, credit default swaps are amongst the most common derivative instruments (JP Morgan Group, 2009, p.6). Credit default swaps are defined as a unilateral contract which covers default events. In this case the CDS buyer enters into a contract whereby he will be required to pay the CDS seller a predetermined fee either up-front or on periodic basis. The contract requires the seller to make compensatory payment which only becomes due if credit default occurs within the period of the contract. If no default occurs within the stipulated period, the contract seller does not have the obligation to make the payment. As a result, the contract is terminated.

Settlement of CDS can either be under two terms which include physical or cash. With regard to cash terms, the seller is under an obligation to pay the seller an amount which is equivalent to the estimated amount multiplied by the post default price. The post-default price is usually the mean of a number of market quotations. On the other hand, the buyer is required to deliver the estimated reference obligation. The reference obligation refers to the party which issued the debt instrument this could either be the government or a corporation (Anson, 1999, p.47). The buyer is in turn given the par value. The figure below gives an illustration of how CDS operates

Total Return Swaps

This entails a bilateral contract which covers either appreciation or deterioration scenarios. This means that the parties involved enter into an agreement which stipulates the terms of transfer. The receiver is expected to receive the total amount of returns associated with the credit reference. These include the appreciation and the coupon. However, a periodic float payment has to be made. With regard to total return swap, the exchange mainly occurs from the buyer to the seller in the event of the price of the asset increasing and vice versa. Through total return swap, both credit and price risks are transferred.

Equity default swaps

These are a new development in the credit derivative market. According to Overhaus, Bermudez, Buehler and Ferraris (2008, p.196) equity default swaps are an improvement of the credit default swaps. Equity default swaps entail two main parties who include the buyer and the seller. The main objective of the protection is to ensure that the value of the stock do not decline to a level which is considered to be relatively low in comparison with price at which the stocks are traded at inception.

The key difference between the CDS and EDS lies in their payment. According to Overhaus et al (2008, p.196), payment of a CDS is made upon occurrence of a default event which is accompanied by a steep decline in share price. On the other hand, the EDS protection payment usually occurs if the value of the share declines below a point which is relatively far from zero. This means that payment of the EDS protection does not have to be necessarily accompanied by credit default (Banks, Glantz & Siegel, 2006).

Collateralized debt obligations

According to Overhaus et al (2008, p.196), collateralized debt obligations refer to a form of asset-backed securities. Their value and payment results from a portfolio of various fixed income assets. CDOs are classified into two main categories depending on the underlying risk. These include;

- Senior tranches

- Junior tranches

The degree of risk associated with senior tranches is minimal compared to junior tranches. The payment of both the principal amount and the interest is dependent on their seniority. According to Overhaus et al (2008, p.197), the rate of interest associated with junior tranches is relatively high compared to senior tranches. Two main concepts are involved in the development of CDOs. The first step entails construction of a form of Special Purpose Entity (SPE) which includes a collection of underlying assets. Some of the commonly held underlying assets which form the portfolio include corporate loans and mortgage backed securities.

The SPE then issues bonds of varying interest rate. The amount obtained from selling the bonds is used to buy a collection of the underlying assets. The cash flow received from the asset is used in making payments associated with the CDOs(Banks, Glantz & Siegel, 2006). Senior CDOs are given preference during payment. Returns on equity and junior securities are the next to be paid. In case of a loss, the burden is born by equity securities, junior securities and then senior securities in that order.

According to JP Morgan Group (2009, p. 23), synthetic CDOs refers to a type of CDO whose investment vehicle is the Credit Default Swaps. Synthetic CDOs enable investors to access a wide range of fixed income assets. These instruments are classified into credit tranches depending on the degree or credit risk associated with the instrument (Choudhry, 2005, p. 120).

Benefits of credit derivatives

According to Choudhry (2005, p.1), credit derivatives are currently being considered as an important development in relation to management of financial risks. In the banking industry, credit derivatives present the banks with an opportunity to position themselves effectively within the credit market. Through financial engineering, which have been sourced from various derivative markets, it has become possible for banks to transform various credit risk into credit-linked securities which are demanded by investors. According to JP Morgan Group (2009, p.3), credit derivatives offer investors with a considerable degree of flexibility with regard to leverage.

The users of these instruments have an opportunity to define their desired degree of leverage. Through development of Total Equity Swaps, it has become possible for banks to avoid administrative costs which are usually associated with direct ownership of an asset (Overhaus, Bermudez, Buehler & Ferraris, 2008, p.196). As a result of credit swaps, the risk is borne by the counterparty. This means that credit derivatives are acting as an avenue through which investors can distribute credit risks associated with bank loans and other investment vehicles affiliated with the capital market (Lucas, Goodman &Fabozzi, 2007, p.4).

Benefits of CDOS

According to Lucas, Goodman and Fabozzi (2007, p.4), CDOs exposes investors to a wide range of investment vehicles. This means that the CDOs enable investors to incorporate the concept of diversification in their investment process. Lucas et al (2007, p.4) assert that CDOs result into leveraging of the degree of exposure associated with a given asset portfolio. In addition, the equity characteristic of the CDOs enables the investors to attain non-recourse.

This means that investors can be able to hold a debt instrument without being liable for losses which may result from occurrence of a risk. CDOs provide a relatively higher spreads in comparison with other debt instruments which are rated similarly. There other types of CDOs which provides the investors with a high degree of certainty with regard to returns.

This makes CDOs to be highly effective tools for hedging against credit risk exposure while at the same time providing investors with a wide range of new investment and diversification opportunities. According to Lucas et al (2007, p.4), CDOs provides investors with an opportunity to invest in a wide range of assets which would have otherwise proven to be challenging for investors to access on their own. This ultimately plays a significant role in improving portfolio diversity. Synthetic CDOS are also beneficial in that they enable an investor to transfer risks associated with loans.

Despite the benefits associated with credit derivatives and CDOs, these investment instruments are very complex. This makes it difficult for individual investors to understand them hence their reluctance to incorporate them in their investment portfolio.

Extent to what the mismanagement of the risks inherent in these instruments contributed to the onset of the sub-prime debt crisis of 2007/8

Mismanagement of risks associated in various financial instruments played a significant role in the onset of the subprime debt crisis during the period ranging from 2007 to 2008. In an effort to attain a high competitive advantage, financial institutions engaged themselves in the development of financial products which would meet the increased investment demand. However, the development of these assets was not well undertaken.

For example, the financial institutions did not undertake a comprehensive analysis of the risk inherent in these assets. The financial institutions such as banks issued loans to borrowers with a low credit rating. This means that the financial institutions did not conduct a comprehensive analysis of the borrowers’ credit worthiness. Some of the debt instruments issued did not require any form of collateral. As a result, the debt instrument was exposed to a relatively high default risk.

Conclusion

From the discussion above, it is evident that there has been a significant shift with regard to investment over the past decade. The financial assets are one of the investment vehicles which are being considered as viable investment destination. In order to meet the demands of the investors, there has been increased development of credit derivatives. Financial institutions such as banks have incorporated these assets as an alternative to bank loans which are characterized by a high probability of credit risk. Both individual and organizational investors have incorporated these assets in their investment.

Through credit derivatives, investors have been able to hedge against credit risk. For example, development of CDOs provides investors with a wide range of investment vehicles which they can incorporate in their portfolio. This means that the investors are able to diversify their investments thus minimizing loss which may result from occurrence of a risk while at the same time maximizing their returns. Credit derivatives also enable investors to hedge against risk via transferring the risk inherent in a particular debt instrument to another party. However, these instruments are very complex which makes it a challenge for individual investors to understand.

The increased rate of financial asset innovation amongst financial institutions is one of the factors which contributed to the subprime debt crisis. This is due to the fact that the concept of risk analysis was not well incorporated in the development of the asset. In addition, these assets were issued without considering the borrowers creditworthiness thus increasing the probability of default.

Reference List

Anson, M.J. (1999). Credit derivatives. Pennyslavania: New Hope.

Banks, E., Glantz, M. & Siegel, P. (2006). Credit derivatives: techniques to manage credit risk for financial professionals. New York: McGraw-Hill Companies.

Caoutte, J., Altman, A. & Narayanan, C. (2006). Financial instruments. Massachusetts: University of Massachusetts.

Choudhry, M. (2005). An introduction to credit derivatives. Sydney: Prentice Hall.

JP Morgan Group. (2009). The JP Morgan guide to credit derivatives. New York: JP Morgan.

Kolb, R. & Overdahl, J. (2006). Financial derivatives; pricing and risk management. Washington: Butterworth.

Lucas, D., Goodman, L. & Fabozzi, F. (2007). Collateralized debt obligations: structure and analysis. New York: McGraw-Hill.

Overhaus, M.O. & Bermudez, A., Buehler, H. & Ferraris, A. (2008). Equity hybrid derivatives. New York: Butterworth-Heinemann.

Stewart, J. & Peat, M. (2009). Credit derivatives: current practices and controversies. Sydney: University of Sydney.