This paper investigates how the exchange rate (the rate at which one currency will be exchanged for another) changes depending on the country’s economic characteristics and various political, natural, and other events. The currency chosen for the work is the Canadian Dollar, the currency of Canada (CAD). According to the available source, the most popular Canadian Dollar exchange rate is the USD to CAD rate (CAD – Canadian Dollar rates, news, and tools., n.d.). In this regard, the analysis will rely on this characteristic. The selected five-year period for analysis is from 2013 to 2017. The following table provides the average exchange rate of a country’s monetary unit for the period specified (Indexmundi. Factbook. Canada., n.d.):

Table 1. Average Canada Dollar exchange rate for the 2013-2017 time period.

Due to the present exchange rate fluctuations, the analysis will be conducted based on economic changes and crucial world events affecting the exchange rate.

Currency Exchange Rate Analysis

Before proceeding to the analysis of the exchange rate, it is necessary to understand what internal economic parameters influence on it. Internal factors include indicators of economic statistics which describe the country’s economic condition (for example, GDP, unemployment, inflation).

Analysis of the Canadian Economy. In the analysis of the Canadian economy the following parameters are taken into account: the nominal growth domestic product (GDP) at purchasing power parity (PPP) (as it directly reflects the relationships with the USA), GDP per capita at PPP, GDP growth, inflation rate, and unemployment rate. According to the recent data (International Monetary Fund, n.d.), these characteristics in the period specified are the following:

Table 2. Main Economic Characteristics of Canada.

Based on the data shown in the table, it is possible to conclude that Canada’s economic position has mainly strengthened in the specified period. There is an increase in such positions as nominal GDP, GDP per capita, GDP growth (despite the decline by 2015, the final value in 2017 is higher than in 2013), and a decrease in the unemployment rate. However, a considerable increase in inflation should be noted, which is a result of global oil prices, the European debt crisis, and China’s economic slowdown. However, it is worth noting that this value is considered normal for Canada. The State Bank of Canada annually assesses the country’s economic indicators and forecasts possible fluctuations in inflation (CAD – Canadian Dollar rates, news, and tools, n.d.). On the basis of this, various legislative financial manipulations are carried out, which allows to maintain the stable standard of living of the population of the country. Analyzing the data provided in Table 2 and Table 1, the question about the real impact of internal factors on the exchange rate arises. Indeed, taking into account the state’s domestic policy and regulation by the State Bank of Canada, it is possible to distinguish a relatively small fluctuation in the exchange rate after the fall of oil prices in 2015. The Canadian Dollar is rising as the Central Bank tightens monetary policy by raising the refinancing rate. Conversely, its exchange rate on the market falls if the regulator moves to ease monetary policy and reduces the main interest rate. The Bank of Canada has a moderately tight monetary policy in the context of the oil crisis, as it did not reduce the refinancing rate as other world regulators. That is why the Canadian currency remained relatively stable against the US Dollar. However, the influence of internal factors on the exchange rate is generally positive since modern Canada has always been known for its effective domestic policy.

Analysis of the USA Economy. Analyzing the main economic characteristics of the USA, the same parameters are taken into account. According to the recent data (International Monetary Fund, n.d.), these characteristics in the period specified are the following:

Table 3. Main Economic Characteristics of the USA.

Based on the data shown in the table, it is possible to conclude that the USA economic position has also mainly strengthened in the specified period. There is an increase in such positions as nominal GDP, GDP per capita, GDP growth (despite a decline in 2016, the final value in 2017 is higher than in 2013), and a decrease in the unemployment rate. However, an increase in inflation is also observed, and the reasons are the same as for Canada. Despite the difference in absolute values shown in Table 2 and Table 3, countries have a general tendency towards economic sustainability.

Currency Fluctuations, External and Internal factors

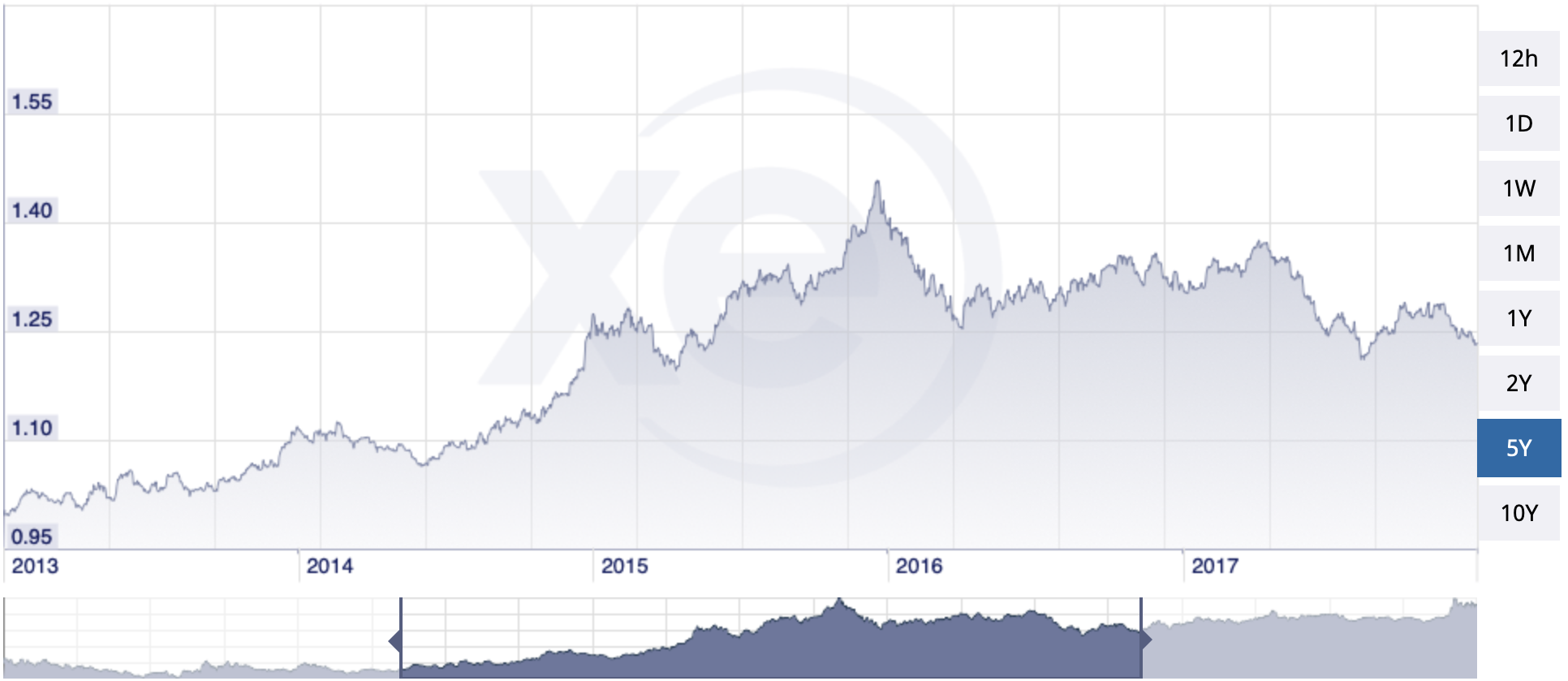

Starting to talk about fluctuations in the exchange rate of the US Dollar to the Canadian Dollar, it is worth referring to the available graphical data for the specified period (CAD – Canadian Dollar rates, news, and tools., n.d.):

As it is possible to estimate the exchange rate using the material provided in Table 1, there is a stable increase in the parameter by the end of 2015. However, there is a fall in the exchange rate, and the events that led to the fall will be discussed later.

Discussing the reasons led to any kind of exchange rate changes, it is necessary to refer to basic categories of influencing factors. Internal factors have been discussed above. External factors include the country’s external trade relations, the political situation in the world, and other events that may affect the economy of the country.

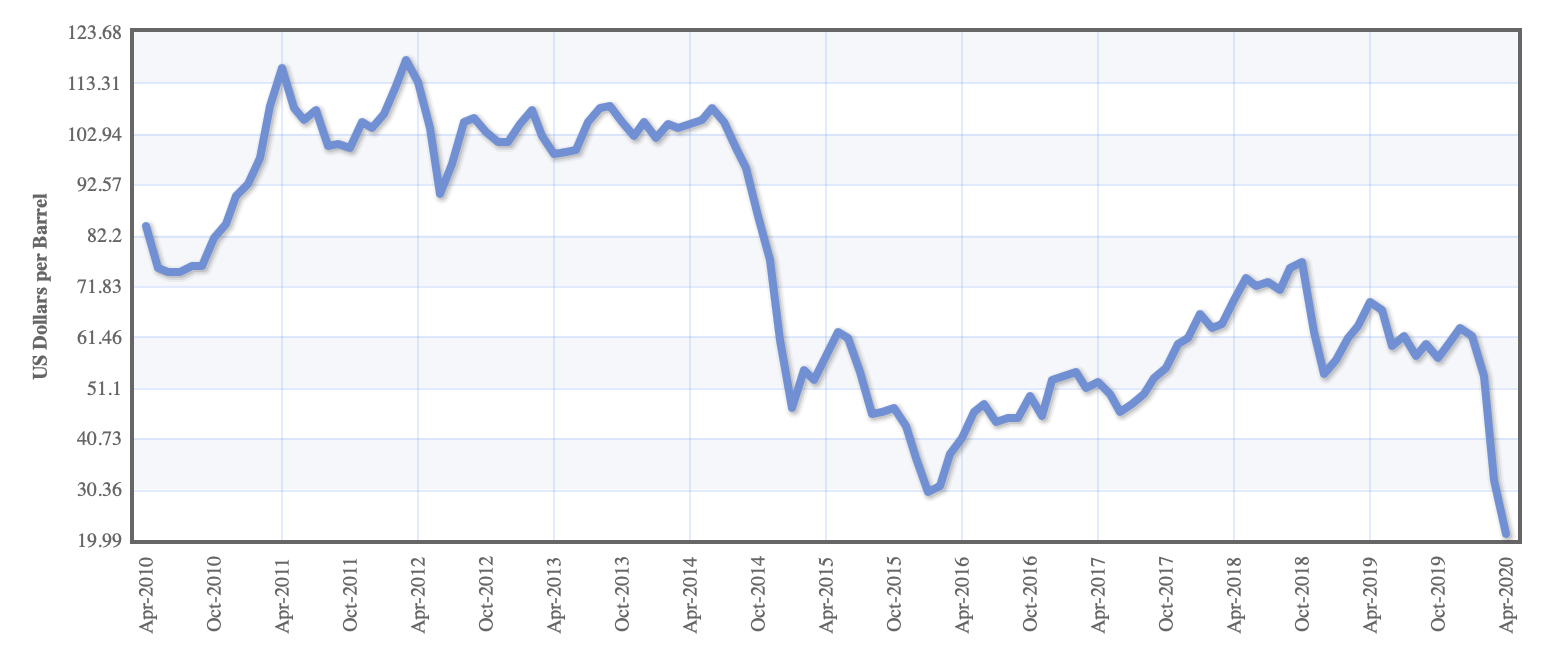

External factors of Canada are determined by the level of oil production, the price of oil and the correlation with the US economy. The Canadian Dollar belongs to a class of commodity currencies, i.e. currencies whose exchange rate is highly dependent on the raw materials produced and sold by the national economy. Country’s geographical location, short transport distance to the USA, and lack of political and military risks make it possible for Canada to become the best oil exporter in the United States. Due to the fact that with the same increase in oil prices, the Canadian Dollar exchange increases, the USD/CAD exchange rate should have a high negative correlation with the price of oil. This happens because Canada is a net oil exporter, and the US Dollar exchange rate falls (because the price of oil is considered in US dollars). However, after oil prices rose to levels close to $100 per barrel, this trend changed significantly. The fact is that previously the US was the largest importer of oil, the high price of oil negatively affected the state of its economy. However, after a certain limit, the increase in shale oil production in 2015 led to the fact that the United States itself began to produce and export oil. The value of this event can be estimated using the graph (Indexmundi. Factbook. Canada, n.d.):

Therefore, the dependence of the Canadian Dollar on the price of oil can be traced quite clearly, as it is seen in Table 1. However, the fall in the exchange rate was not critical, despite the fact that oil production plays a central role in the Canadian economy.

The Canadian economy is also dependent on the state of the US economy, so the Canadian Dollar sometimes reacts to the news on macroeconomic indicators of the US economy and data on the state of the stock market. This dependence is also partially linked with the oil. The stronger the US economy, the more oil it will need and the higher the Canadian Dollar exchange rate.

In addition, a number of countries, including the United States, use the Canadian Dollar to store their foreign exchange reserves which is due to the unique stability of the Canadian economy.

Since China is also a major consumer of Canadian raw materials, the Canadian Dollar rate responds slightly to the news on the Chinese economy. The more China’s economy influences the world economy, the higher this connection will be.

Summary

Making a conclusion about the influence of various factors on the change in the exchange rate, it should be mentioned that initially, the emphasis is on the level of economic development of the country. It is also worth evaluating these changes in terms of the magnitude of the impact of a certain factor on the country’s economy. For example, the Canadian Dollar is almost directly dependent on the price of oil, but has a solid foundation in the form of a stable economy. Among other things, the exchange rate of the Canadian Dollar largely depends on the economic condition of the neighboring United States.

Thereby, despite the sharp drop in oil prices in 2015, the Canadian Dollar managed to maintain its position due to effective domestic policy. This is an example of a decent economic balance that provides a high life standard for country citizens.

References

CAD – Canadian Dollar rates, news, and tools. (n.d.). XE.

Indexmundi. Factbook. Canada. (n.d.) Indexmundi.

International Monetary Fund. (n.d.) IMF.