Savings, BOP and current Account

According to Soukizis and Cerqueira (2012, p. 59), savings indicate what is left after consumers have made their consumption. The income is either consumed or saved with savings being closely related to the level of investment and the national income. The level of savings in Denmark increased over a period of time as shown in the table below.

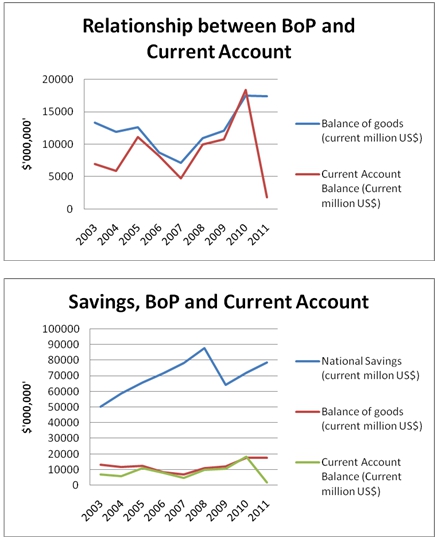

From the above data, it is clear that the level of Denmark’s level of national savings increased since 2003 progressively until 2008 when the figures dropped drastically. The drop in the level of savings in Denmark could be attributed to the uncertainties that surrounded the 2008/2009 global financial crisis. Thereafter, the savings began to rise again in 2009 and they are still rising.

The balance of payments is a national statement that indicates the health of the international business of a country in financial or monetary terms. The statement consists of the capital account, the current account and the financial account that all serve different functions in the economy.

While the capital and financial accounts are responsible for indicating the physical assets of a country and the flow of finances across the globe respectively, the current account is responsible for indicating the nature of goods, services, income and transfers in terms of either a deficit or a surplus. A surplus of Denmark’s current account is an indication of the country’s level of savings as opposed to investment. This implies that Denmark is providing abundant resources to other economies and is in return owed by the economies it provides the funds (Soukizis & Cerqueira 2012, p. 94).

The deficit of the current account of a country does not imply that the BOP is negative because the BOP is determined by other components, the capital and financial accounts. The current account of Denmark fluctuated over the period between 2003 and 2011 by declining in 2003, rising in 2004 and thereafter declining until it began to increase again in 2007. However, it showed a nose dive in 2010 to 2011 (The World Bank, 2013).

Relationship between the Balance of Payments, Current account and Savings of Denmark

The existing relationship among these variables for Denmark can be well captured in a graph that shows how they relate as shown below.

The first graph shows the existing relationship between the balance of payment and the current account of Denmark. It is clear that as the current account has a great impact on the BOP since an increase in the current account leads to an increase in BOP and vice versa. It is only in 2010 that the BOP of Denmark was lower than the current account, though it was not a deficit.

On the contrary, there is no direct relationship between the gross national savings of Denmark with the BOP and the current account. This is because the level of savings in the country was on the increase since 2003 until 2008 when in declined and began to rise again in 2009. However, as the savings were increasing, the BOP and the current account were decreasing and thereafter fluctuating. Despite the relationship among the variables, a surplus of the current account indicates increased savings for the future as noted by Soukizis and Cerqueira (2012, p. 106).

List of References

Soukizis, E & Cerqueira, P 2012, Models of Balance of Payments Constrained Growth: History, Theory and Empirical Evidence, Palgrave Macmillan, Basingstoke.

The World Bank, 2013, “Data: Gross Savings (Current US$)”.